imaginima

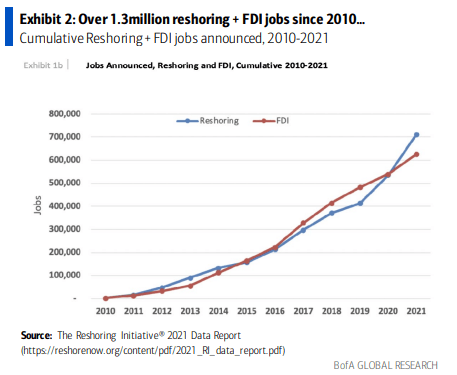

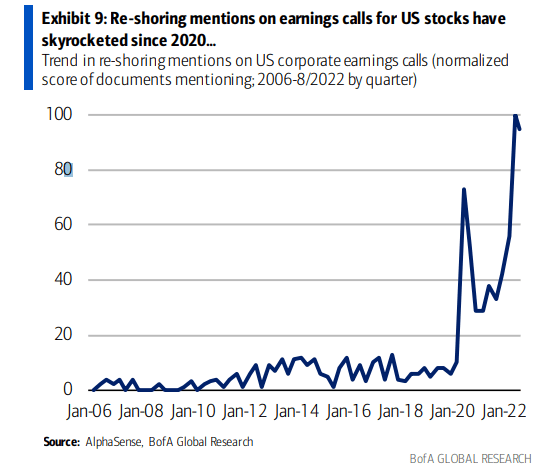

Re-shoring is going to be a hot trend in the coming years if experts’ forecasts are right. According to The Re-shoring Initiative 2021 report, there have been more than 1.3 million re-shoring and foreign direct investment (FDI) announced since 2010. And just recently, the number of “re-shoring” mentions on earnings calls has skyrocketed. The large-cap U.S. company at the heart of it all is Rockwell Automation (NYSE:NYSE:ROK).

Re-shoring Jobs: A Top Trend

BofA Global Research

Corporate America Wakes Up To Re-shoring

BofA Global Research

According to Bank of America Global Research, Rockwell Automation is a global supplier of industrial automation equipment, software, and services and is divided into two segments. The Architecture & Software segment contains integrated control and information architecture that allows the customer to connect its manufacturing enterprise. The Control Products & Solutions segment includes intelligent motor control and industrial control products that allow the customer to implement an automation or information solution on the plant floor.

The Wisconsin-based $24.8 billion market cap Electrical Equipment industry company within the Industrials sector trades at a high 39.3 trailing 12-month GAAP price-to-earnings ratio and pays a near-market dividend yield of 2.0%, according to The Wall Street Journal.

Rockwell is one of the preeminent firms that should benefit from a shift toward domestic operations for U.S. firms through re-shoring in wake of evident supply chain missteps among corporate America in the last several years. Higher labor costs might also be a boon to the Industrials stock as the higher wages go, the more robotics appear attractive. Of course, downside risks include weaker global capital expenditure trends should a protracted recession strike. Moreover, stronger competition could threaten Rockwell’s position.

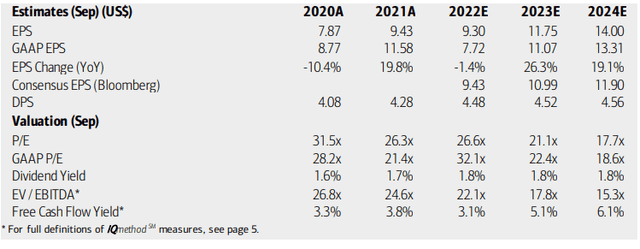

On valuation, BofA analysts see earnings having fallen in the firm’s 2022 FY (which ended in September) while the current fiscal year’s EPS should grow sharply next year, then cool slightly in 2024. The Bloomberg consensus forecast is not as sanguine as BofA, however. Dividends are seen as growing through 2024, too.

Given solid per-share profit growth, the high P/E might be warranted, but its EV/EBITDA multiple definitely prices in optimism while its free cash flow yield is not that strong. Overall, I am worried about ROK’s cyclical operations should a downturn happen. It is a lukewarm valuation to me.

Rockwell Earnings, Valuation, And Dividend Forecasts

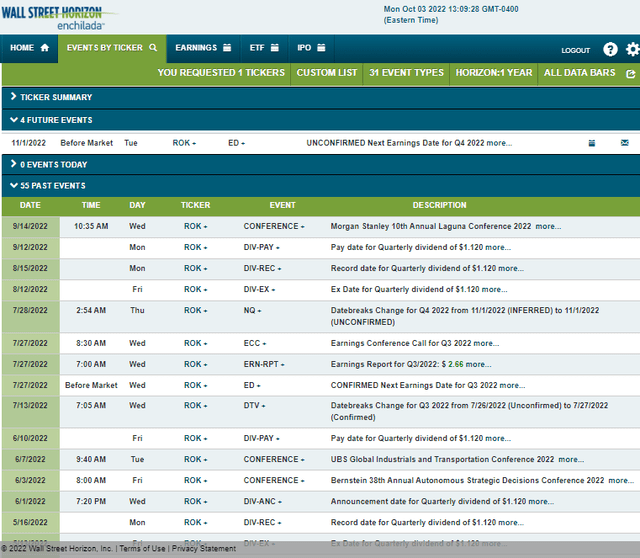

Looking ahead, Rockwell reports its Q4 2022 quarterly results on Tuesday, November 1 before market open (unconfirmed) according to corporate event data provided by Wall Street Horizon. The calendar is light until then.

Corporate Event Calendar

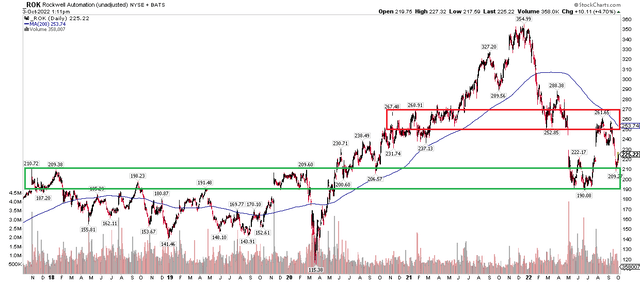

The Technical Take

ROK dropped 46% from its late 2021 high to the low this past June. That whopping correction brought the stock down to key support in the $190 to $210 range. So long as shares remain above that zone, I think being long is a good play. It’s possible that the bear market wrapped up and a new uptrend could be starting. Consider that the stock successfully tested $210 in September and has since shot higher by $15.

I see resistance, though, from $250 to $270. Rockwell’s falling 200-day moving average has been significant support and resistance in the past, and it comes into play in the low $250s, as well. If it hurdles that range, a new uptrend would show strong signs of being confirmed.

ROK Shares Retreat To Support, Bouncing After A Retest

The Bottom Line

Rockwell has robust growth prospects, but it does not come cheap. Price action tells me a new bullish trend could be shaping up, so this Industrials stock could be a good growth company to own in your portfolio.

Be the first to comment