Marco Di Lauro/Getty Images News

EOG Resources (NYSE:EOG) resources is a large hydrocarbon company, headquartered in Houston, with an almost $75 billion market capitalization. The company has an incredibly strong portfolio of low-risk assets, which, as we’ll see throughout this article, will help the company to drive substantial shareholder returns.

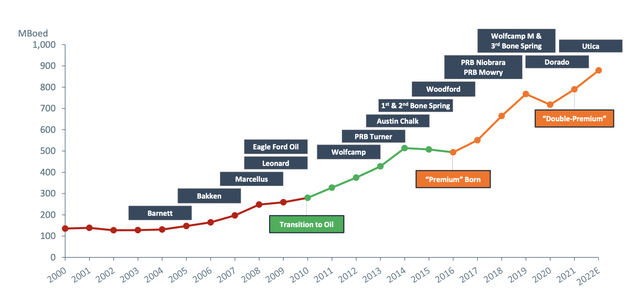

EOG Resources Premium Wells

EOG Resources has worked to diversify its portfolio into premium wells.

EOG Resources Investor Presentation

EOG Resources has worked to increase production while focusing only on high-quality wells, graded through both the resources they own and the company’s technological innovations. These changes have allowed the company to increase production while lowering costs across the board. The company timed the transition to “Premium” with the original oil price collapse.

Since 2018, the company has substantially reduced costs per well, while rapidly improving drilling speeds, enabling much higher profit margins per well. The company has worked to improve margins to more than $35 / barrel at the wellhead, however, revenue still is just over $50 / barrel indicating the continued shipping stresses of the Permian Basin.

It’s worth noting that even in 2020 the company managed to make profits per barrel.

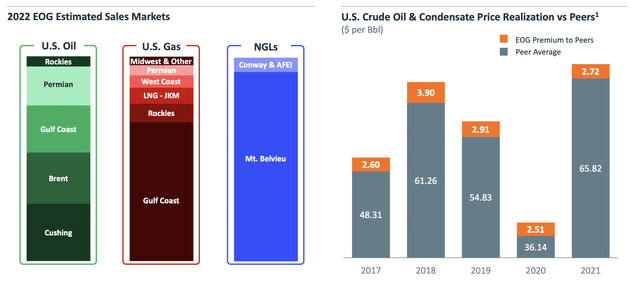

EOG Resources Diversification

The company has worked to diversify its resources with a number of markets.

EOG Resources Investor Presentation

The company sells U.S. oil in a number of major markets including substantial Cushing and Brent exposure. The quality of the company’s oil tends to mean that it can achieve a premium to its peer average of several $ per barrel, however, it’s worth noting that the company continues to struggle to meet market prices.

For U.S. gas the company’s gas markets are more restricted, however, the company has continued to work on deals where it can for example get LNG + JKM pricing exposure without building out, exposure that it has with Cheniere LNG. We’d like to see the company continue to build this out as possible, given the long-term potential of LNG.

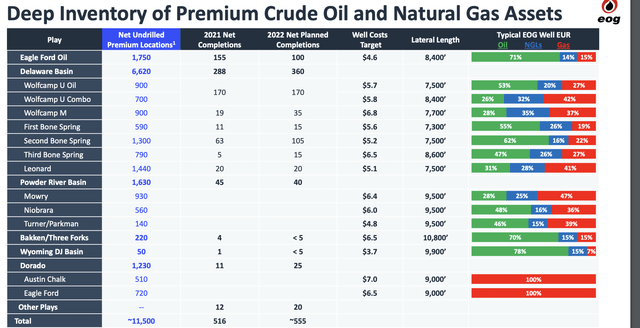

EOG Resources Well Inventory

EOG Resources has a massive well inventory, including the company’s new expansion into the Utica Shale.

EOG Resources Investor Presentation

EOG Resources has 11,500 total premium locations un-drilled. The company has a 20 year reserve life at its current drilling rate, although it’s been working to continue adding locations. Simultaneously, the company has worked to continue reducing its well costs and extending the lateral on its wells, which will help production and margins for the company.

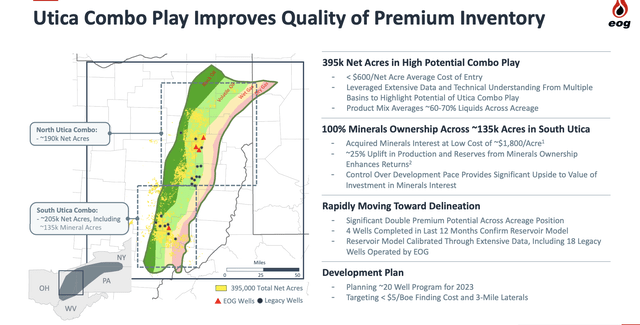

EOG Resources Investor Presentation

The company has built almost 400 thousand net acres at <$600 / acre, an incredibly cheap acquisition from the company’s perspective. The company sees a 60-70% liquids average across the acreage with low cost minerals interest. The company expects to have found a new reservoir play with 4 wells in 2022.

We recommend paying attention to the company’s 20 well program through 2023, which if they confirm the reservoir, could enable strong production growth for the company as it becomes another major basin.

EOG Resources Shareholder Return Potential

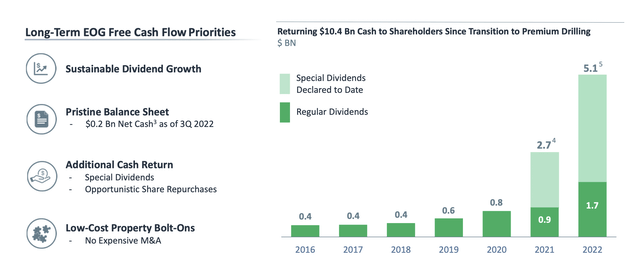

Throwing off a substantial $2.3 billion in FCF in 3Q 2022 (14% annualized) EOG resources has the continued ability to continue driving shareholder returns.

EOG Resources Investor Presentation

The company has declared $5.1 billion in dividends to date, utilizing special dividends. That combination means an annualized high-single digit yield from dividends alone, highlighting the company’s financial positioning. The company has $5 billion in authorized share repurchases, which is a fairly small program, however, with $0.2 billion in net cash it can direct most FCF to returns.

As a result of this, we expect the company to be able to continue driving high-single digit to low double-digit direct shareholder returns, while continuing to opportunistically invest in additional growth.

Thesis Risk

The largest risk to our thesis is crude oil prices. EOG Resources has a proven ability to execute and earn a premium from its peers on realized crude prices. However, there’s no guarantee that prices remain high, and if they don’t that could hurt the company’s ability to continue driving shareholder returns, which is worth paying close attention to.

Conclusion

EOG Resources has used the 2014, 2016, and 2020 oil price collapses to revamp its portfolio. The company is now focusing on double-premium wells which have the ability to generate strong margins. The company’s quality assets continue to generate a margin above peers, however, the company does still have less export price access than it’d like.

The company has built up a substantial position of assets in the Utica Basin. It’s going to be drilling 20 exploratory wells over the next year, so we recommend paying close attention to that. If the company confirms the reservoir, its new acquisitions could pay-off in a substantial way. We expect the company to utilize that to continue driving substantial acquisitions.

Be the first to comment