mi-viri

Investment Summary

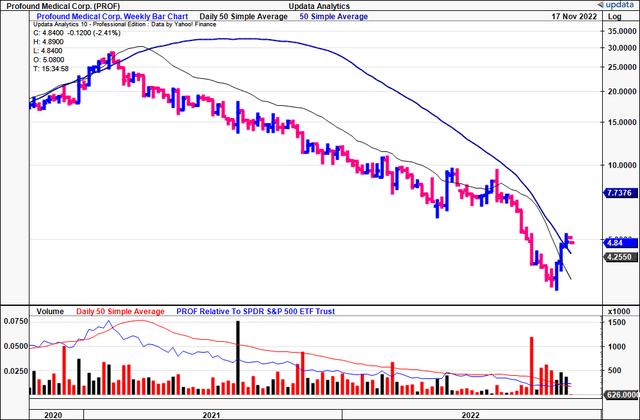

Investors continue to sell Profound Medical Corp. (NASDAQ:NASDAQ:PROF) shares into the final quarter after a mixed set of earnings 2 weeks ago. With the stock trading at our previous price target of $4.91 at the time of writing, I was hoping for greater revenue lift throughout the period, although it didn’t hit my required numbers.

Profound 2-year weekly price evolution with volume, relative strength rating

Chief to the investment debate is the company’s TULSA-PRO® platform. It really must accelerate in user adoption so that PROF can begin driving revenue growth. PROF says that approximately 3,000 patients have been treated with TULSA to date, with a 50/50 mix of whole gland and focal patients. This is on an installed base of 30 systems in the U.S. It says it is on track to do 35 systems by January FY23, calling for another 5 placements in the next 3–4 months. However, it also says that only around 25 sites have completed its pre-assessment for the finalized TULSA placement.

Time will see if it can meet this pace of delivery [in the earnings call, CEO Dr. Arun Menawat said “there have been a lot of supply delays and so on, particularly MR installation, [t]here are at least 4 or 5 sites that we have agreements where the MRs are delayed as much as a year”] and more importantly, what this means for the sock price. Net-net, rate hold.

PROF Third Quarter: In-Line, But More Robust Numbers Are Needed

PROF booked Q3 revenue of $2mm, slightly off revenue of $2.5mm the year prior. Unpacking the top-line see’s 60% or $1.2mm from recurring revenue and a 40%/$800,000 contribution from capital sales.

Key operating highlights in my estimation include:

(1). It now has 30 installed systems in the U.S., and management noted it is on track to achieve an installed base of 35 by January next year. This calls for an additional 5 systems from now until then. At least 4 systems will purportedly come from a HALO Diagnostics agreement consisting of 4 placements – 2 in California, 2 in Florida. The placement at RadNet’s second site in Phoenix is set to go live by FY23 end.

Despite the growth in placements, the company could potentially do better in my opinion. The TULSA-PRO procedure is backed by robust clinical and in-practice data [discussed at lengths in previous analysis], and I’m looking at PROF’s top-line growth as a leading indicator next quarter.

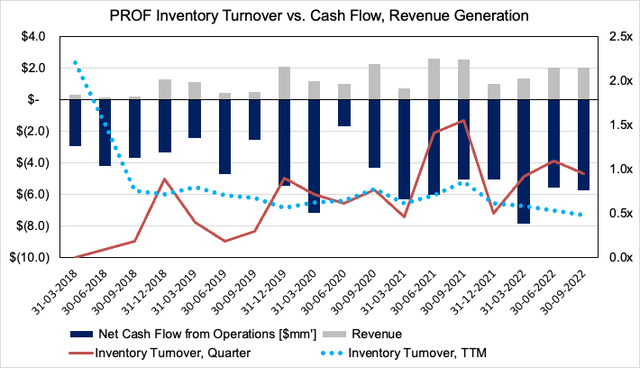

(2). Quarterly inventory turnover is ticking in the right direction, although on a last 12 months basis it pulling down [Exhibit 1]. At the same time, net CFFO remains deep in the red, mirrored in the slow revenue growth from FY18–date.

Given the various placements across teaching facilities, therein lies a headwind for PROF’s revenue upside, as it takes time teach the procedure across a broad cohort and then broaden utilization across surgeons in practice. It currently has “over 15” teaching sites in its base. However, noteworthy is that C-Codes [outpatients] are paying up to $17,000 per patient at its leading teaching sites.

Alas, after the c.3,000 procedures, PROF says it has a better grasp on how to optimize its pipeline [workflow, best practices, standard operating procedures, etc.] for future installations. It will likely have a few reference sites in doing this.

(3). Management didn’t elaborate on guidance in the earnings call, instead opting for 2023 to release forecasts. If all goes according to plan, however, my estimates are that it will do $14.5mm at the top-line in FY23 with a similar 60/40% mix, a growth of roughly 85% YoY.

If it can increase the cadence of procedures and installations throughout the coming 12 months, it’s not unreasonable to expect another doubling of revenue in FY25 to ~$30mm in my opinion. Hence I suggest there’s merit in remaining neutral versus bearish on the stock, as a turnaround in revenue could inflect positively.

Exhibit 1. PROF operating trends trending flat, but needs to improve over the coming periods by my estimation

Data; HB Insights, PROF SEC Filings

Additional forensics

In the absence of earnings, I checked PROF’s balance sheet growth extensively. From observation, the company is well-positioned to sustain operations looking ahead.

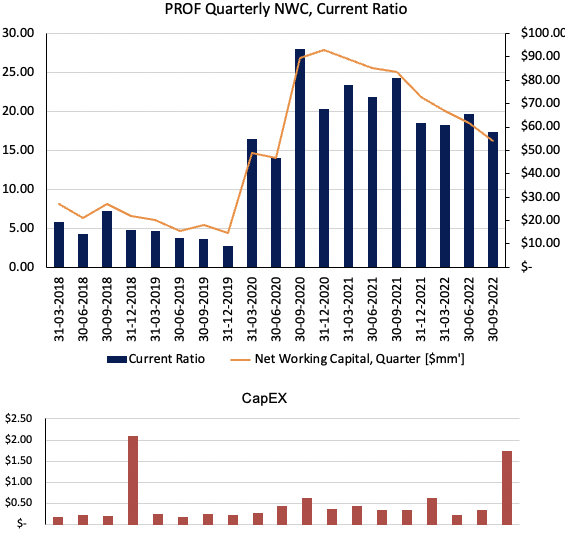

As seen below [Exhibit 2], its has more than 15x cover over its short-term obligations from liquid assets [including cash]. Moreover, it left the third quarter with over $50mm in new working capital (“NWC”), well above long-term ranges.

It has good cover over quarterly CapEx from NWC and continues to reinvest all free operating cash into operations. It grew CapEx to $1.75mm last quarter and this could potentially stem through to a more positive revenue print. Meanwhile, it has $15mm in net book capital and no debt on the balance sheet.

Exhibit 2. PROF Quarterly NWC, Current Ratio and CapEx FY18-date

Data: HB Insights, PROF SEC Filings

Valuation and conclusion

Despite the prospect of strong YoY revenue growth, I can’t get to advocating PROF as a buy just now. At the same time, there’s good reason to stay constructive on the stock from the sidelines.

With lack of earnings we’ve modelled top-line growth as the primary driver for share price appreciation looking ahead. It trades at 16.5x trailing sales, which is pricey in my opinion considering the lack of absolute revenue growth to date.

Bringing our FY22 sales estimates of $7.85mm forward and assigning the GICS Health Care Equipment & Supplies industry multiple of 9.8x [Exhibit 3] derives a price target of $3.54. This falls below with our previous target of $4.91. I believe PROF is likely to trade within this range until Q4 FY22 earnings at least.

Note, Profound Medical Corp. has projected an additional 5 TULSA-PRO placements by January 2023, and hopes to see greater revenue shift to its non-teaching sites. Both could be meaningful growth drivers, but we need more data to evidence the success of management’s strategy. Consequently, rate Profound Medical Corp. hold, price target $3.50–$4.91.

Be the first to comment