da-kuk

~ by Snehasish Chaudhuri, MBA (Finance)

When the world’s fifth largest economy registers a growth of almost 13.5 percent, while all other major economies are fearing recession, investors need to have a look at some of the India focused closed-ended mutual funds (CEFs). Aberdeen Asset Management’s India Fund (NYSE:NYSE:IFN) is one of the best investment options for American investors who wish to capitalize on the world’s fastest-growing major economy. The fund was launched 28 years back, and has generated a strong and steady pay-out, consistently offering double digit yield for the past 10 years. Still, the price growth was extremely poor when I covered this fund last time.

How The Indian Growth Story Is Helping IFN

Despite being the economy with the youngest skilled and unskilled workforce and despite Indians heading various global and multinational companies these days, when it comes to economic growth, the developed world has been quick to dismiss India’s economic performance and growth potential in the pretext of the slightest deviation from their expectations. The reasons could be real; violence, inflation, corruption, ease of doing business, health related issues, unemployment, and even media-managed vote bank politics – or they could be derision stemming from ignorance. What the outside world fails to understand is that India as a nation is a perfectly managed chaos, and it has been managing itself the same way for centuries.

Once a closely held market, the Indian economy was liberalized and privatized in 1991, and three decades of consistent and sincere economic reforms have made it a sought after destination for foreign direct investments (FDI). Moreover, being a democracy with a millennia old civilization, and a highly diverse population and culture, there is no real reason why foreign investments will hesitate to flow in.

India Fund has invested almost 80 percent in 20 blue-chip stocks, primarily dealing in Information Technology, Finance & Banking, Infrastructure, and Fast Moving Consumer Goods (FMCG). Besides being part of a growing economy, these industries have their own growth drivers.

For the Indian economy, the IT sector is what oil and gas is for the Gulf nations. The IT sector is exporting its services all over the world, and has minimal threat of slowing down. The huge unmet demand for infrastructure has generated enormous potential for infrastructure and financial companies. On the other hand, a population of almost 1.4 billion with a savings-oriented mindset makes the banking sector resource rich. The huge population is also composed of a very large middle class with a substantial disposable income, which again increases the demand for the FMCG sector.

While it is easy to forget this when emerging from an Indian airport in the stifling heat and dust, the key to remember is that democracy maybe chaotic, but it is managed chaos.

Indian Stock Market: Slow and Steady Growth

While the impact of covid-19 pandemic and Russia’s war on Ukraine has jeopardized economic activities all over the world, and slowed down the economic growth, Indian economy stood out as an exception. Very recently, India moved to the second spot in the MSCI Emerging Market (EM) Index with a weight of almost 15 percent. MSCI EM Index tracks the performance of companies from emerging (growing at a fast pace) nations. During the past one year, The MSCI India Index has outperformed the MSCI EM Index by 29 percent. This led to a strong inflow of foreign institutional investments (FII) – approximately 12500 crores, only in the month of August. [Note: $1=~80 INR]

During July, 2022, goods and service tax (GST) collections touched a whopping ₹1,48,995 crore and the GDP growth rate has been exceptionally high at 13.5 percent. On the back of such outstanding economic performance, the Indian economy became the world’s fifth largest economy. At the same time, it became the fifth biggest equity market, too. The recent rise of the Indian stock markets helped India reach a global market capitalization share of an all-time high of 3.5 percent, which is a tremendous achievement considering a mere 2.05 percent market capitalization share during May 2020.

While the United States (inflation rate of 8.5 percent), European Union (inflation rate 9.8 percent) and United Kingdom (inflation rate 9.9 percent) are grappling with historically high inflation, India has been able to control it to a large extent. Restricting inflation to 6.7 percent is no mean feat considering almost the entire crude oil and gas is imported from abroad. While Europe struggled with the energy crisis, some bold but opportunistic steps by the Indian government such as keeping strong diplomatic ties with Russia and Iran on the one hand and the Gulf countries and western economies on other, ensured its energy security while keeping inflation under check.

There have been consistent and steady steps by India’s central bank, the Reserve Bank of India (RBI) in controlling inflation, as well as the depreciation of Indian rupee. Amidst uncertainties of food and energy shortages arising out of Russia’s invasion of Ukraine, the dollar has been perceived to be the safest option, and thus has inflated against most world currencies. The Euro dropped to a two decade low (0.99 against a dollar). Yen too has depreciated to 145 per dollar. Considering this, the depreciation of Rupee has been much lower. While the US dollar gained almost 13 percent against all leading world currencies, the value of Indian rupee has depreciated by 6 to 7 percent only.

Strong governance and stable policies during the past decade has transformed the Indian economy and provided much needed confidence to the policy makers, industrialists, as well as investors. Fearing a possible invasion or increased military activities over Taiwan, the multinational companies based in western economies are slowly moving out their manufacturing bases from China. Just recently, Taiwan’s FoxConn and multinational Vedanta announced a $20bn semiconductor development plant in India.

IFN’s Portfolio Has Huge Growth Potential

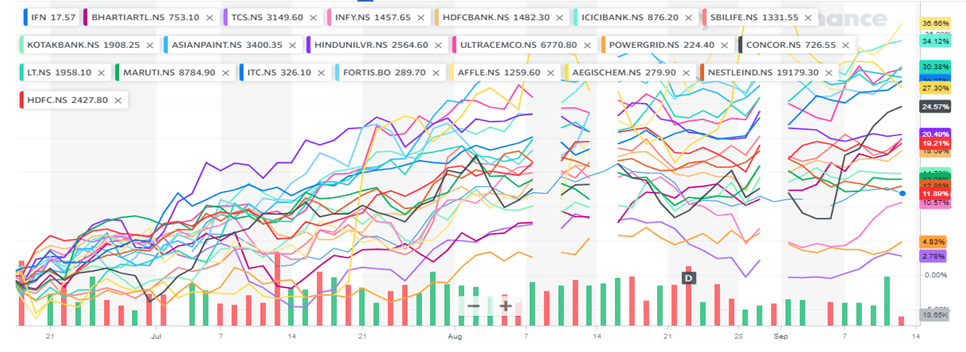

We covered India Fund three months back, when we were optimistic about it despite high inflation and looming global recession. We were optimistic about this fund primarily due to its portfolio, which focused on blue-chip stocks in the Indian market. This time, I tried to find out the price growth of its top 20 holdings, which constitutes almost 80 percent of the entire fund. Financial stocks like Housing Development Finance Corporation Limited (HDFC.NS), HDFC Bank Limited (HDFCBANK.NS), ICICI Bank Limited (ICICIBANK.NS), Kotak Mahindra Bank Limited (KOTAKBANK.NS), and SBI Life Insurance Company Limited (SBILIFE.NS) hold the largest share (27 percent) of IFN’s portfolio of investments.

Companies from consumer cyclical sector, i.e. the FMCG giants, like Hindustan Unilever Limited (HINDUNILVR.NS), ITC Ltd (ITC.NS), Nestle India Ltd (NESTLEIND.NS) and Asian Paints Limited (ASIANPAINT.NS), also constitute a significant portion of IFN’s portfolio. The portfolio also includes infrastructure oriented stocks like Container Corporation of India Ltd. (CONCOR.NS), UltraTech Cement Ltd. (ULTRACHEMCO.NS), Power Grid Corp of India Ltd. (POWERGRID.NS), Aegis Logistics Ltd (AEGISCHEM.NS) and Larsen & Toubro Ltd. (LT.NS).

Surprisingly there are only three technology stocks, namely Infosys Limited (INFY.NS), Tata Consultancy Services Limited (TCS.NS) and Affle (India) Limited (AFFLE.NS). While I agree that the IT sector has faced some headwinds recently, IFN should remember its success with Mphasis, and take another look at this lacunae in its portfolio.

Among other investments, Bharti Airtel Limited (BHARTIARTL.NS), Fortis Healthcare Limited (FORTIS.NS) and Maruti Suzuki India Limited (MARUTI.NS) complete the list. During these past three months, all these 20 stocks generated positive price growth. Barring INFY.NS, TCS.NS and POWERGRID.NS, all other stocks have delivered a double digit growth, recording a growth range between 10 to 40 percent. It reaffirms the fact that despite the record inflation and looming recessions all over the world, there is no real reason to be worried about the future growth prospects of Indian blue-chip stocks.

Indian stock performance (Yahoo)

Changing Perceptions

The last time I covered the India Fund, price growth had been extremely poor, while the individual stocks posted exceptionally high growth. In my last report I found that IFN’s price dropped by 30.75 percent during the past five years, whereas the stocks grew within a range of 30 to 300 percent. It raised a pertinent question why the growth generated by its top holdings was not reflected in the stock’s performance. And the answer was – faulty market perception.

Therefore, I developed an assumption that average US investors lack understanding and knowledge about the Indian stock market, and there lies a perception among many investors that price growth of Indian blue-chip stocks was not purely due to fundamentals. There were also doubts surrounding the risk elements and efficiency of Indian financial markets.

For a change, during the past 3 months, the India Fund has been successful in generating a close to double digit price growth. It seems that the US investment market is slowly realizing the true potential of this India focused CEF.

How did this come about? One reason could be a subtle shift in global recession that we are observing in certain sectors since June. However, the other reason is more fundamental to the India story. Global investors, I am coming to believe, have now noticed that when almost all major economies are slowing down, the Indian economy is posting double digit GDP growth rate.

The money will flow where the return lies. As analyst Anupama Bhargava pointed out in her article in the ‘Financial Express’, “The non-believers can continue to look for negative news and shoot holes in an otherwise stable economic ship and the believers can go out there and grab the opportunity to grow with the economy.” She was talking about the Indian economy.

Be the first to comment