dima_zel

Description

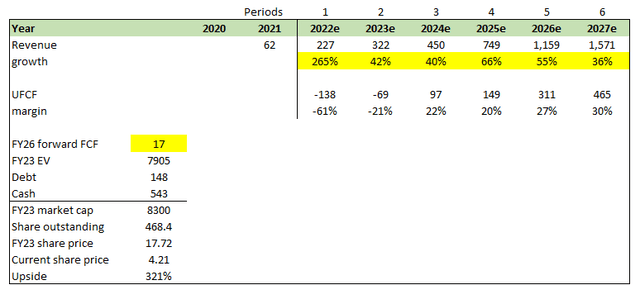

I believe Rocket Lab USA, Inc. (NASDAQ:RKLB) is worth $17.72, representing ~321% upside from the date of writing. RKLB provides solutions to customers that require a dependable and quick method of accessing space services, and this is a very large total addressable market (“TAM”) that RKLB can continue to address and grow within.

Company overview

RKLB offers reliable launch services, spacecraft design services, spacecraft components, spacecraft manufacturing, and other spacecraft and on-orbit management solutions. All these services are geared toward making access to space not just easier and faster but also more affordable. Electron, a fully carbon composite launch vehicle powered by Rutherford and RKLB’s electronic turbo pump 3D printed engines, gives customers access to these services.

Their ingenious manufacturing techniques for electrons have led to RKLB’s frequent launch cadence, including 3D printing and automation. Currently, they operate from a private launch complex in Mahia, New Zealand.

First mover advantage

Electron is the first small launch vehicle to provide frequent and reliable access to space, having completed 21 orbital missions and deployed 110 spacecraft as of March 31, 2022. Electron is a well-tested launch vehicle, and RKLB is a smart team with a strong manufacturing infrastructure and processes. This is shown by the fact that they have been able to reach orbit many times over the past four years.

In my opinion, the best way to learn about this field is through actual practice, rather than by reading about the various theories that have been developed. While RKLB’s rivals may have higher IQs, they can’t compare to the firm’s wealth of practical experience. As RKLB expands, so will its advantage in terms of knowledge and experience.

Vertically integrated model

RKLB is very vertically integrated. This means that they create components and subsystems for their launch vehicles, the photon family of spacecraft, and spacecraft components that they sell into the merchant market, internally with full grasps of all processes. Global extensive supply chain operations have been developed to maintain the vertical integration. These global supply chains are enabled by third-party enterprise resource planning systems and tools. These tools allow RKLB to be involved in every aspect of the design process, manufacturing, and launch operations. The result of this is that launch operations and solutions are delivered to orbit faster.

Rocket Lab manages LC-1 from their base in Mahia, New Zealand. Up to 120 launches per year are possible from this complex, which is significantly more than the current annual launch rate from all U.S. spaceports (based on RKLB’s estimates in S-1). Because RKLB does not share a launch complex with other launch providers, they do not need regulatory approval to launch because they have complete control over the launch schedule and availability. All of these are possible because RKLB has its own private and exclusive launch complex.

Once they get certification from NASA, they will be able to start launching into space from LC-2, since the physical infrastructure is already in place to conduct this launch. Presently, LC-2 is licensed to launch 12 missions every year.

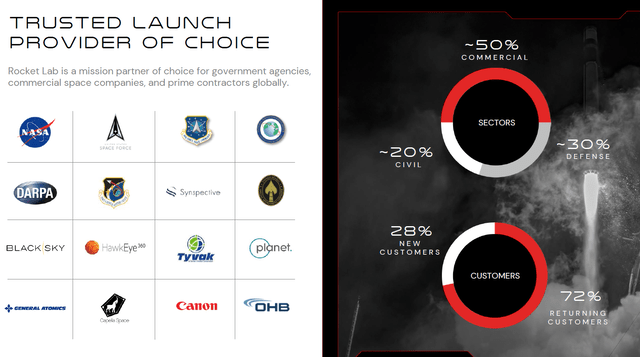

Strong set of customer base that supports RKLB reputation

RKLB continues to offer services to various individuals and agencies, ranging from government customers like DoD, NASA, and other U.S. government agencies. These services are also extended to major domestic and international commercial spacecraft operators. Over 20 organizations have used RKLB’s launch services. Their flight hardware and spacecraft, which are part of their space systems, have been on more than 600 missions, including launches by the company’s previous owners.

Sept 22 investors presentation

Strong sales team with in-depth industry knowledge

The method RKLB uses to bring in revenue is fascinating. Essentially, they have a consolidated global business development team that sells launch services and space solutions. The objective of this group is to increase revenue through cross-selling of launch and space systems as well as make efficient use of administrative, project management, and proposal writing assets. The team is based in the U.S. and they focus on the strong customer base that RKLB has. Together with the engineering team, the business development team works together to identify the needs of customers and look for ways to satisfy these needs.

The business development team is filled with the best of minds. A lot of them, at some point, have worked for government agencies and large institutional space and technology companies. They know the intricacies of the job and they are constantly evolving industry trends, placing RKLB in a strong position where they will always meet the needs of their customers.

Adjacent service modules provide another leg of growth and profits

RKLB’s number one priority is giving their clients easy access to space-based options. With this goal in mind, they have diversified beyond their core competency of launch services to offer low-Earth constellations, deep space, and interplanetary missions, as well as a wide range of spacecraft component solutions, design services, and spacecraft as a service to government and commercial clients. The ability to provide launch services, spacecraft design and manufacture services, amongst others, has enabled RKLB to start having at their disposal strategic keys to space.

Valuation

I believe RKLB is worth USD17.72 in FY26, representing 320% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow consensus’ estimates for the next 2 years until FY23 and management’s long-term guidance until FY27.

- In FY26, I strongly believe RKLB will trade at a higher multiple if revenue grows as planned and margins hit 30%. That said, I choose to be conservative and apply a market multiple (S&P500 10-year average) of 17x.

Now, all these assumptions are very debatable and hard to believe today as it is 5 years into the future. However, we need to make an educated guess as to how much RKLB might be worth if it meets guidance, and my model suggests a huge upside if it does.

Key Risks

Disruption in government budget

The government is one of RKLB’s major customers. Any interruption in the government will have a negative impact on their business. If the disruption is elongated over a period of time, it might cause great damage to the business.

Constant need for innovation

The world is evolving and getting better with each passing day. RKLB might not always be successful in meeting the needs of the changing world. Competitors might develop better technology that better meets the needs of customers. If RKLB does not continue to create ground-breaking masterpieces that meet the needs of customers, the business might suffer.

Competitive market

The industry is a very competitive one. Some of RKLB’s competitors are bigger and have more resources. Competition might also come from emerging low-cost competitors. While the competitors offer different services, in the long run, they might still have to compete to get contracts.

Summary

RKLB is undervalued at its current share price as of the date of this writing. Customers need a reliable and fast way to be able to access space services. RKLB is the best bet for all these services and more. They offer a whole lot of things that should catch the eyes of an investor. To cap it all off, they continue to find ways to make sure that their relevance in the industry does not dwindle.

Be the first to comment