Adam Berry/Getty Images News

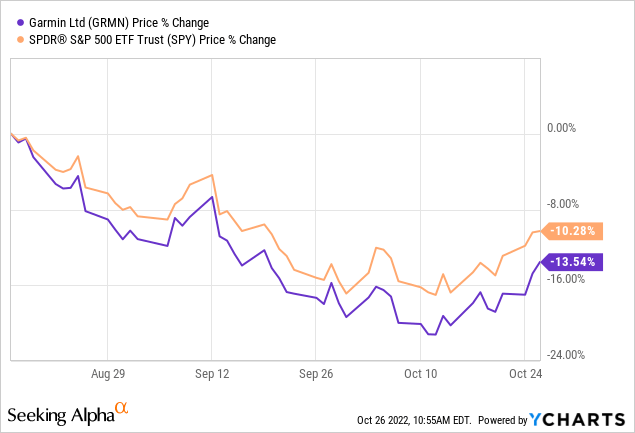

In August 2022, we published an article on Seeking Alpha about Garmin (NYSE:GRMN), titled: “Despite The Sell-Off, Garmin Is Still Overvalued“, In that article, we rated Garmin’s stock as “sell” for the following reasons:

- Declining revenue and contracting margins in the second quarter.

- Macroeconomic factors, including low consumer confidence and high inflation, are likely to continue creating headwinds for Garmin in the next quarters.

- GRMN’s stock is trading at a substantial premium compared to its peers, according to a set of traditional price multiples, which we believe were not justified in the volatile market environment.

Since our previous writing, Garmin’s stock price has fallen by as much as 14%, slightly underperforming the broader market.

Today, we are going to take a look at the Q3 earnings figures and see how are previous thesis has played out so far.

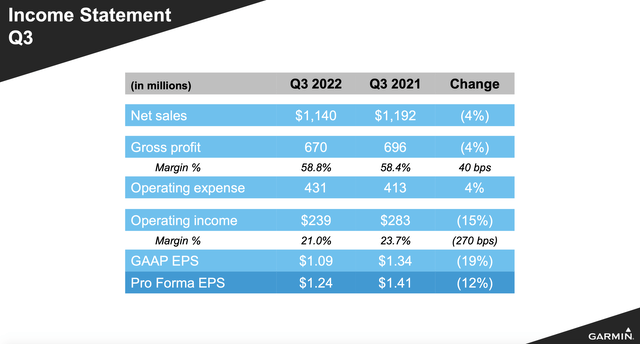

Q3 results

The main financial highlights of the third quarter were summarised by the firm:

- Consolidated revenue of $1.14 billion, a 4% decrease compared to the prior year quarter, was unfavorably impacted by approximately $70 million due to the year-over-year strengthening of the U.S. Dollar relative to other major currencies

- Gross margin expanded to 58.8%, and operating margin was 21.0%

- Operating income was $239 million, a 15% decrease compared to the prior year quarter

- GAAP EPS was $1.09 and pro forma EPS was $1.24

Let us see how the firm has actually achieved these results, and which segments were the main contributors.

Revenue

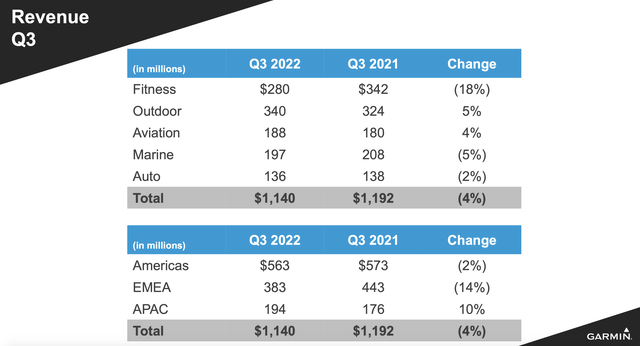

Revenue has declined by as much as 4% year-over-year in the third quarter.

Revenue (Garmin)

Fitness

The largest decrease in revenue has been in Garmin’s Fitness segment, which is also the largest segment of the company. Revenue in fitness has decreased by as much as 18%, compared to the same period in the prior year. This decline has been primarily driven by the lower revenue generated by advanced wellness and indoor cycling products.

In our opinion, this could be a result of two factors:

1.) The impact of Covid-19 induced trends is diminishing. Less and less people are working out at home, which likely has a negative impact on the demand for the above-mentioned products.

2.) Low consumer confidence. People are reluctant to spend on durable, non-essential products, when their financial future and the overall economic outlook is uncertain.

We believe these two factors are likely to keep negatively impacting the firm in the near term. Despite some of the exciting new product releases in Q3, such as the first smart blood pressure monitor, the IndexTM BPM or the Venu® Sq 2, we do not see a rapid improvement of the sales figures in the coming quarters.

Aviation and outdoor

On the other hand, the aviation and outdoor segments have both seen an increase in revenue compared to the third quarter in 2021.

Revenue from the outdoor segment grew 5% in the third quarter primarily due to growth in adventure watches and inReach devices and services, partially offset by declines in other product lines. […] Revenue from the aviation segment grew 4% in the third quarter driven by growth in multiple product lines, primarily in aftermarket.

In our opinion, the outdoor segment has seen an uptick as people started to travel more after the lockdowns. While the aviation segment continued to perform well, because it is not directly related to the consumer sentiment in our view. Going forward, we believe that the demand for outdoor adventure watches may fall in the coming quarters.

Marine and auto

The revenue in the marine and auto segment have declined by 5% and 2%, respectively.

Revenue from the marine segment decreased 5% in the third quarter primarily due to the return of typical seasonality trends. […] Revenue from the auto segment decreased 2% during the third quarter as declines in our consumer products more than offset the growth in OEM programs.

The firm has announced two new products in the marine segment in this quarter:

LiveScope® XR System, bringing revolutionary live- scanning sonar technology to deep water fishing allowing anglers to see real-time images of fish and structure up to 500’ in front of or below the boat. We also launched the LiveScope Plus Ice Fishing Bundle, creating the ultimate portable solution for winter fishing.

While these new products sound exciting, we are not convinced that the demand is going to develop positively for such equipments in the near term, in the current volatile market environment.

International exposure

The firm has a large portion of its revenue generated outside the United States. The relative strength of the USD compared to other currencies has been quite unfavourable for the firm in the latest quarter.

Revenue was unfavourably impacted by approximately $70 million due to the year-over-year strengthening of the U.S. Dollar relative to other major currencies.

Not only the currency headwind creates challenges for the firm, but the ongoing geopolitical tension between Ukraine and Russia, and the uncertain energy supply of Europe may all have negative influence on the firm’s performance in the EMEA region.

Operating expenses

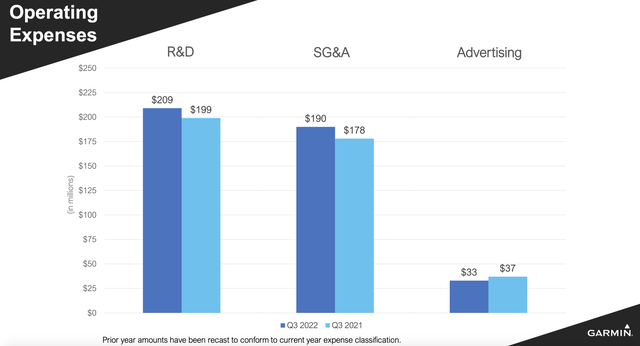

Operating expenses have increase by 4% YoY.

Operating expenses (Garmin )

While the firm has cut its advertisement expenses by more than 5%, it was more than offset by the increase in SG&A and R&D expenses.

We have seen this quarter that not only Garmin, but many other firms are advertising less to reduce their expenses. But in our view, for a company like Garmin, where SG&A makes up a significantly larger portion of the operating expenses, it may not be the most effective measure. With elevated inflation, there is an upward pressure on the wages, which keeps driving SG&A expenses higher. We would like to see Garmin addressing this issue, before we would consider investing in the firm’s stock.

R&D expenses have also increased, however for technology related products R&D and innovation are key. Therefore, we would not like to see the firm cutting on their research and development.

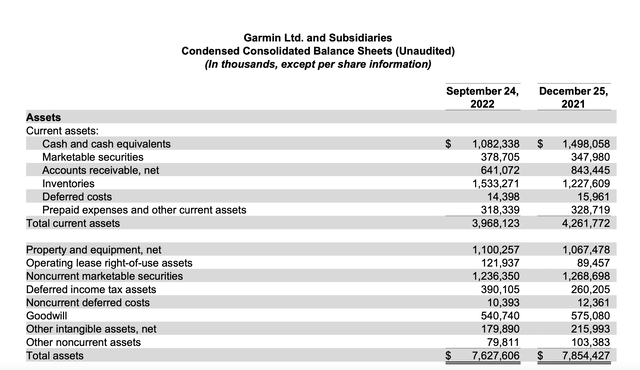

Inventory

Further an other indication that demand has been becoming softer is the rapid increase in the inventories measure.

Assets (Garmin)

We have seen many retailers earlier this year struggling with inventory management. They eventually had to use substantial discounting to get rid of excess, obsolete inventory. Garmin’s inventory grew by more than 20% year-over-year, which is not critically high, but we need to keep in mind that if discounting will be necessary, it may have a negative impact on the margins in the coming months.

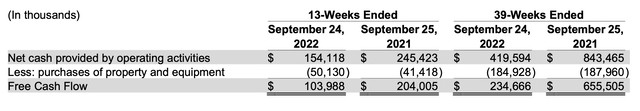

Free cash flow

An important liquidity measure, as defined by the management, free cash flow represents the amount of cash provided by operations that is available for investing and defines it as operating cash flows less capital expenditures for property and equipment.

Free cash flow has declined by almost 50% year-over-year in Q3 and by almost 65% in the first 3 quarter of 2022.

Free cash flow (Garmin)

While we believe that currently the firm has sufficient liquidity and financial flexibility (current ratio: 2.54 and quick ratio: 1.43) to navigate in the uncertain macroeconomic environment, it is crucial to follow the development of the free cash flow in the coming quarters.

To sum up

All in all, in the third quarter, demand has been declining for most of Garmin’s products, resulting in lower revenue. On the other hand, operating expenses have been increasing, primarily driven by SG&A and R&D, leading to lower operating income and lower EPS than in the year ago quarter.

Income statement (Garmin)

Taking these results into account, we believe that in the current market environment, Garmin is still not an attractive investment option. We do not see any catalyst or development in the macroeconomic situation, which would indicate that the demand for the firm’s products and services would rapidly increase in the near future.

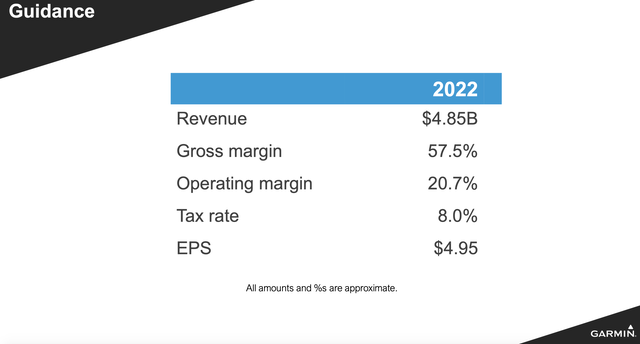

Further, the firm has also provided an updated guidance, which foresees a lower than previously expected revenue for 2022. On the other hand, the firm expects the EPS to be slightly above their previous estimate of $4.9.

Guidance (Garmin)

Be the first to comment