Andybarisaphotography/iStock via Getty Images

Devon Energy (NYSE:DVN) is a large United States focused energy company with a market capitalization of almost $40 billion. The company recently reported 2Q 2022 results with a blowout quarter, which included incredibly strong results. The company improved its asset position through investing and acreage-trading. As we’ll see throughout this article, that’ll enable the company to drastically increase shareholder returns.

Devon Energy Portfolio

Devon Energy is building up a unique and incredibly strong portfolio of assets.

Devon Energy Investor Presentation

Devon Energy Portfolio – Devon Energy Investor Presentation

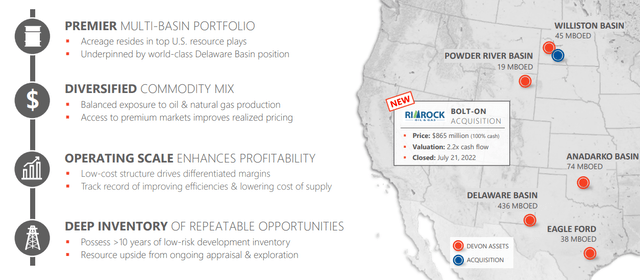

The company’s acreage resides in the top U.S. resource plays in the country. The company’s acreage is focused on the Delaware Basin, which makes up roughly 75% of the company’s production. The company recently made a strong acquisition of RIROCK, for $685 million, at a mere 2.2x cash flow valuation that closed recently.

The company has >10 years of low-risk development inventory, with strong resource upside. The company does have strong commodity price exposure, but it’s focused on a low break-even to continue driving shareholder returns at a variety of price ranges.

Devon Energy Acreage Trading

Among the company’s intelligent moves is its increased focus on acreage trading.

Devon Energy Investor Presentation

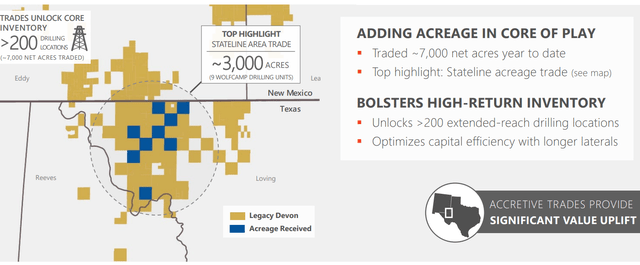

The company has continued to opportunistically “trade” acreage, an intelligent process in the industry that enables operators to better line up their acreage and their operations. The company’s top acreage trade was the “Stateline Area trade” which consisted of 3000 acreage being traded lining up well with the company’s legacy acreage in the region.

The trading doesn’t cost the company anything, but its unlocked the company >200 new extended-reach drilling locations as the acreage has lined up. Longer laterals also lower the company’s cost per barrel produced for its existing wells. That trading is something that most companies take advantage of, but something that Devon Energy has continued to do well.

Devon Energy Acquisitions

The company has also made an intelligent acquisition in the Williston Basin.

Devon Energy Investor Presentation

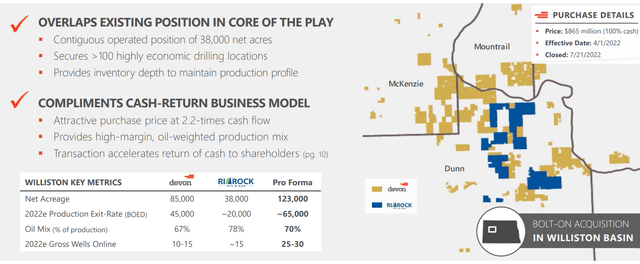

The company’s acquisition here expands its Williston Basin acreage from 85 thousand to 123 thousand. Growth here potentially makes other major plays such as Chord Energy an interesting acquisition proposition. The acquisition adds >100 highly economic drilling location and allows the company’s inventory to expand enough to maintain production.

The company expects the pro forma combination will double the gross wells coming online in 2022e while increasing the oil mix to 70% from 67%. The acquisition price at 2.2x cash flow is an incredibly strong and well timed acquisition for investors.

Devon Energy 2Q 2022 Results

The company generated incredibly strong results which will enable increased shareholder returns.

Devon Energy Investor Presentation

The company increased earnings by 38% YoY to $2.59 / share while EBITDAX increased to more than $10 billion annualized. Leverage dropped by a substantial 37% YoY to 0.4x. The FCF is more than $2 billion per quarter, up a massive 62% YoY. With the company’s payout policy that has enabled more than 200% YoY dividend growth.

Devon Energy Shareholder Return Potential

Devon Energy has the ability to drive massive shareholder returns at the current pricing environment.

Devon Energy Investor Presentation

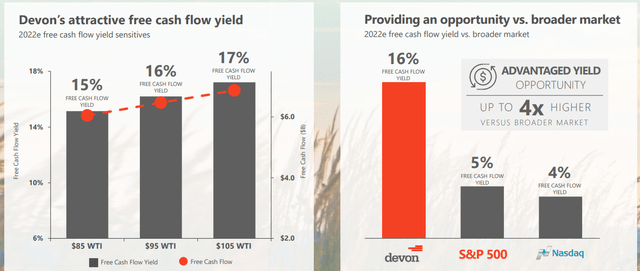

The company has substantial FCF potential in an environment where WTI is almost $94 / share. The company’s FCF yield is roughly 16% at the current time. The company has allocated ~75% to share buybacks, which means it’s going to provide a shareholder yield of roughly 12%. The company’s fixed + variable dividend yield is expected to be more than 8%.

The company has a $2 billion repurchase program underway as well. That’s enough to buyback 5% of its outstanding shares and the average price has been well below the current share price. The company has the authorization through May 2023, but with $8 billion in FCF from 2022e we expect it to more than beat its guidance.

The company’s current debt is ~$4.5 billion, something that it can comfortably afford, with just a few hundred $ million in annual interest payments. It can continue paying down debt, but it has no need to continue doing so.

Devon Energy Thesis Risk

The largest risk to the thesis, as per usual, is oil prices. The company is incredibly profitable at the current time and has the ability to drive substantial shareholder returns. However, that changes in different pricing environments. If prices were to drop significantly, which they have before, that’d hurt the company’s ability to drive returns.

Conclusion

Devon Energy has a unique portfolio of assets and the company has been a 10-bagger since its COVID-19 related lows in March 2020. The company’s dividend yield is more than 8%, counting the special variable dividends that have been added on. Despite the company’s strong returns, it has the ability to continue generating additional returns.

The company has a $2 billion share buyback program underway, which is 6% by the end of year. At the same time, we expect the company to pay a high single digit dividend yield. It’s done intelligent acreage trading and acquisitions to improve its portfolio. Putting all of this together, Devon Energy’s strong financials makes it a valuable investment.

Be the first to comment