ipopba/iStock via Getty Images

Investment thesis

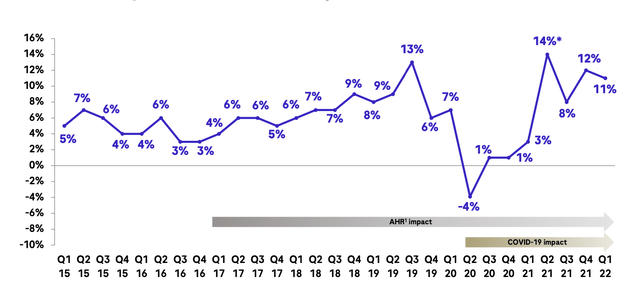

Roche Holding AG (RHHBF, RHHBY) has an interesting setup for both dividend-driven as well as stock price performance-driven investors. The Swiss pharmaceutical giant has a long history of revolutionary innovations in pharmaceutical products and a solid business in diagnostics. While the first division has recently shown some weakness, Roche has a significant pipeline with future-oriented growth drivers. The diagnostics division was positively impacted during the Covid-19 pandemic and has further potential to drive the company’s growth in the coming years. Although my valuation model is based on rather cautious assumptions, I see the company as undervalued with over 33% of upside potential, valuing the ADR at $55.67.

A quick introduction to Roche

Roche Holding is a leading pharmaceutical company that researches, develops, manufactures, and markets prescription pharmaceuticals and engages in the diagnostic businesses worldwide. The company operates through two divisions, Pharmaceuticals, and Diagnostics. The pharmaceutical division offers products for treating anemia, cancer, cardiovascular, central nervous system, dermatology, hepatitis B and C, HIV/AIDS, inflammatory and autoimmune, intensive care medicine, leukemia, lymphoma, metabolic disorders, ophthalmology, respiratory disorders, rheumatoid arthritis, skin cancer, and transplantation. The diagnostics division offers in vitro diagnostics solutions for indications such as blood donor screening, cardiology, coagulation, gynecology, hematology, infectious disease, oncology, and women’s health. In addition, it supplies diagnostic instruments, reagents, consumables, and test kits for use in the diverse research market. The company was incorporated in 1896, is headquartered in Basel, Switzerland, and employs over 100,000 employees worldwide. Its most important geographical regions in terms of revenue are the United States, followed by Europe, and Japan. In the U.S., the company is listed with an American Depositary Receipt (ADR) at the OTCQX, while its primary exchange is at the SIX Swiss Exchange under the symbol ROG, where it’s part of the blue-chip index SMI.

Actual and future growth drivers

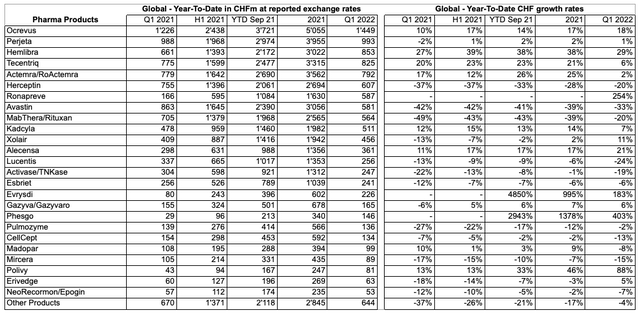

Roche had a mixed start in 2022, with the company’s top-selling product Ocrevus, for the treatment of multiple sclerosis (MS), reaching an all-time high of CHF 1.45B in revenue, an 18% increase on a Year-over-Year ((YoY)) basis. It now holds 20% of the global market share even though the pandemic is still affecting the broader MS market. Regeneron-partnered COVID antibody Ronapreve and COVID diagnostics, and anti-inflammatory med Actemra, together generated CHF 2.82B in sales in Q1. However, for 2022, the company only expects CHF 5B in revenue from these products, a CHF 2B decline YoY.

Roche’s pipeline is progressing well despite its long-term clinical trials in neuroscience being impacted by the war between Russia and Ukraine, since 20% to 30% of patients in MS trials are coming from those countries. Roche had to open additional sites in other countries to perform its phase 3b trials for a higher dosage of Ocrevus.

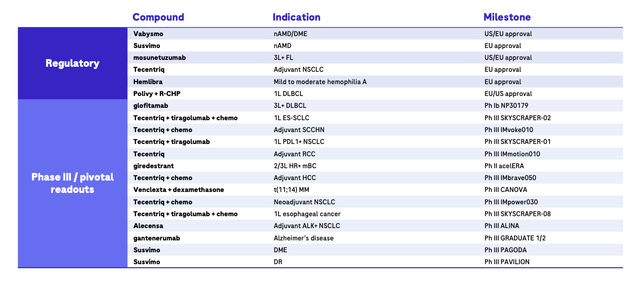

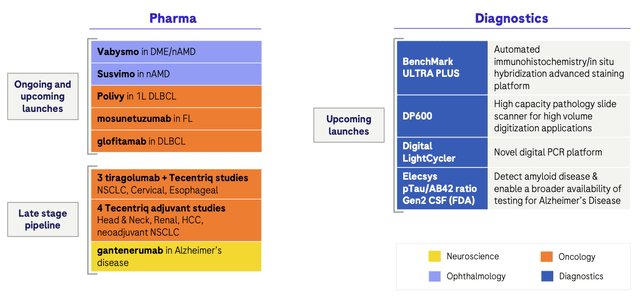

Roche has an innovative late-stage pipeline with strong potential for future growth. The company is expecting significant news flow in terms of milestones during 2022. Recently, on June 9, Roche’s Tecentriq received its sixth lung cancer indication approval from the European Commission, for a subset of people with early-stage non-small cell lung cancer. On June 8, the company saw its first-in-class bispecific antibody Lunsumio, for people with relapsed or refractory follicular lymphoma, approved in Europe. Other important milestones were set in Q1, e.g., Vabysmo for treatment of neovascular age-related macular degeneration ((nAMD)) and diabetic macular edema (DME), approved by the FDA. On May 11, 2022, Roche reported negative interim results for its phase 3 study about Tiragolumab combined with Tecentriq for lung cancer, where the co-primary endpoint of progression-free survival was not met. The study will continue for the other co-primary endpoint of overall survival.

The group confirmed its outlook for 2022, despite the ongoing negative impact of biosimilars for the established cancer drugs Avastin, MabThera/Rituxan, and Herceptin, with a combined CHF 568M in reduced sales.

An insight into the industry

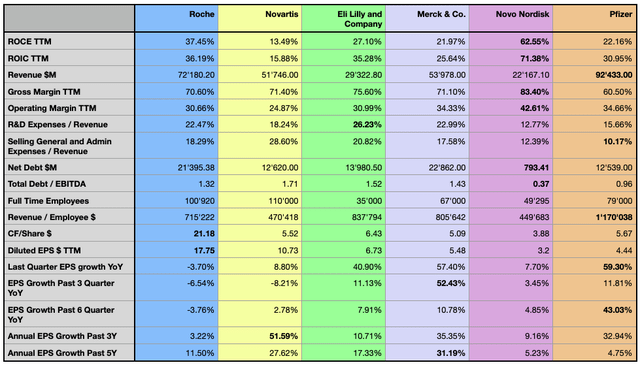

The company reported a slightly increasing gross margin, with a 4.49% CAGR over the past 5 years, standing at 70.60% Trailing Twelve Months (TTM). Its actual gross margin is below the average of the analyzed peers, with Novo Nordisk A/S (NVO) leading the peer group in terms of gross margins with a stellar 83.40%.

In terms of operating profitability, Roche reported a rather stagnant margin with only 0.60% CAGR over the past 3 years, decelerating from 4.50% CAGR over the past 5 years, and standing at 30.66% TTM. Although some of its peers reported higher profitability in the last 12 months, Roche is forecasted to continue to improve its operating margin more significantly in the coming years.

In terms of capital allocation efficiency, the company is standing out from some of its peers, with only Novo Nordisk reporting even higher metrics, Roche reported a Return on Invested Capital (ROIC) of 36.19% in the past 12 months, while the peers’ average stood at 35.83%, and excluding Novo Nordisk just at 26.94%. Swiss competitor Novartis (NVS) has a significantly lower capital allocation efficiency, but as I describe in my article Novartis Is Awakening From Lethargy, the company has doubled its ROIC since 2017 and is poised to perform better in the coming years. I consider this metric a very important element when pondering an investment decision, a company must be able to consistently create value to be a sustainable investment. In this sense, also Eli Lilly and Company (NYSE:LLY) reported a solid performance. Roche’s higher ROCE ratio indicates that the company could employ better its idling cash position at the end of 2021.

Investments in Research and Development ((R&D)) are of primary importance for companies in the pharmaceutical industry, Roche is spending a relatively higher amount of 22.47%, with only Eli Lilly and Merck (MRK) investing even more, and the average standing at 19.73%. The company reported a relatively fair leverage of 1.32, a metric which significantly increased in the past year due to the company more than doubling its debt-reliance, as a consequence of the issuance of $11B and $3B in bonds and the consequent repurchase of its bearer shares from Novartis, in a deal valued at $20.7B.

Roche can historically count on a very cash-rich business, and also in the last twelve months, the company reported significantly higher cash flow per share, compared to Earnings Per Share (EPS), clearly leading the peer group in those terms.

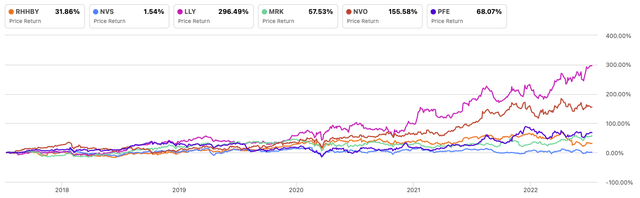

Considering the stock performance of the past 5 years, only Swiss-peer Novartis performed worse than Roche, while most of the analyzed peers reported a significant share-price increase. Eli Lilly outperformed the group with a stellar performance of 296.49%, followed by Novo Nordisk with 155.58%. Pfizer (PFE) performed well during the last two years, clearly positively impacted by its sales during the recent Covid-19 pandemic.

Author, using SeekingAlpha.com

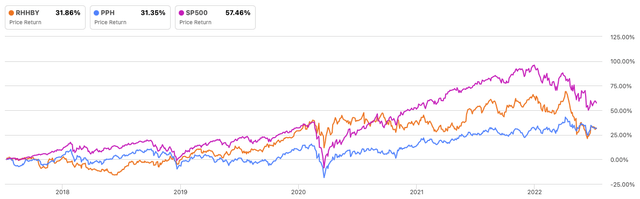

Roche underperformed significantly the S&P500 over the last five years, while showing some sporadic periods of relative strength when compared to the VanEck Vectors Pharmaceutical ETF (PPH), but generally performing worse than the industry reference.

Author, using SeekingAlpha.com

Valuation

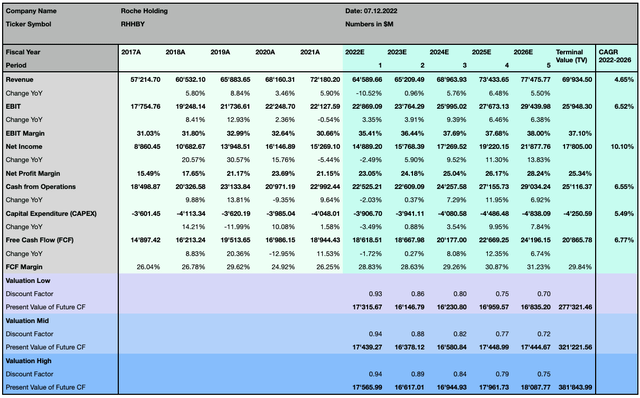

To determine the actual fair value for Roche’s stock price, I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. As forecasted by the street consensus, the company is anticipated to generate a significant 6.77% Free Cash Flow (FCF) CAGR over the coming 5 years, while its revenue is forecasted to grow slower, at 4.65% CAGR. The consensus is that Roche will be able to increase its profitability at a faster pace, with its net profit forecasted to grow at a 10.10% CAGR.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital. As a well-established and stable company with relatively low growth margins, I chose a cautious approach when considering the perpetual growth rate in my DCF model.

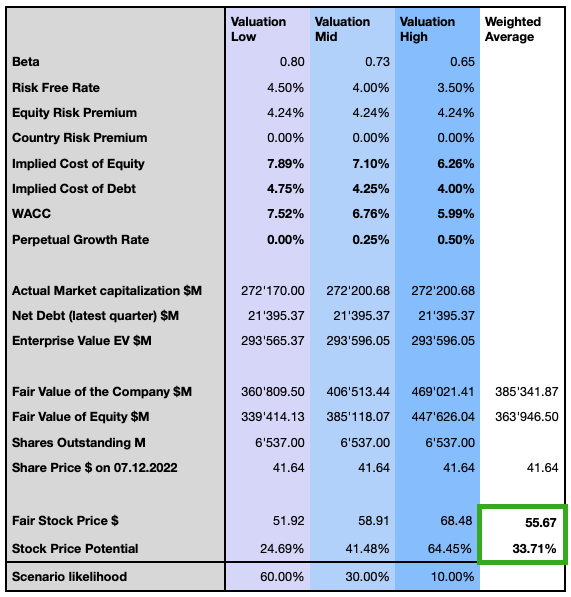

Author

I compute my opinion in terms of likelihood of the three different scenarios. I, therefore, consider RHHBY to be significantly undervalued, with a weighted average price target with 33.71% upside potential at $55.67.

Risk discussion

Events like the Covid-19 pandemic can impact Roche’s business in multiple ways. On one hand, the clinical trials can be delayed due to mobility restrictions and health protocols. The production and sourcing of important components can also be impacted due to difficulties in the supply chain. Last but not least, the sales force is restricted by limited face-to-face interactions with physicians and customers in the pharmaceutical industry. As a pharmaceutical company, Roche is subject to the risk of failure of one or more of its products, or risks that candidates in the pipeline don’t reach the market as may be expected. Competitive pressure is another risk factor to evaluate, especially in products and therapies where a generic or a biosimilar can significantly decrease the cost for the patient, and healthcare insurance may reach out to those products first to lower their costs. The company is also considerably exposed to fluctuations in foreign exchange rates and interest rates. Last but not least, the company reported a notable dependency on single customers, as its three most important wholesale distributors accounted for 23%, or CHF 2.8B, of the group’s consolidated trade receivables in 2021.

Market timing

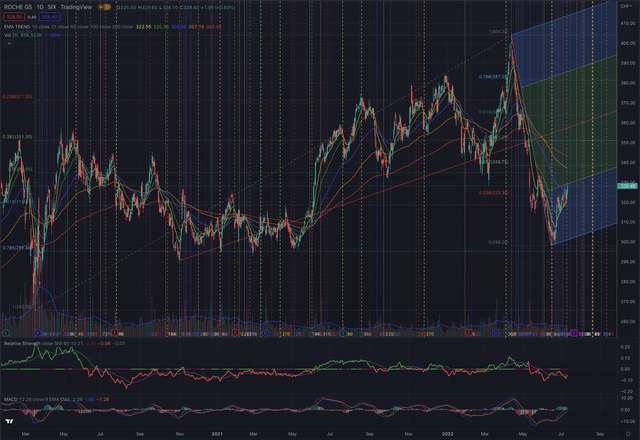

The primary exchange for Roche is at the SIX, and I always perform technical analysis at the main listing of a company’s stock. During the Covid-19 pandemic, the stock reached a low at CHF 265.75 on March 16, 2020 (respectively at $35.04 on March 23 for the ADR) and quickly recovered and reached its All-Time High (ATH) at CHF 404.20 or respectively at $53.86 on April 11, 2022, before crashing 26% the months after until CHF 298.30 on June 16, or $37.88 on June 14, for the ADR.

The price partially retraced the recent losses until the EMA50, which since acted as resistance. During this period the stock showed some relative strength when compared to the SMI, as it is considered to be one of the rather defensive stocks listed on the SIX. From a technical analysis point of view, the stock is still in a side movement with a slight upside tendency; a great setup for momentum and swing traders since the recent closure of the stock price over its EMA50. The market is waiting for further positive catalysts, while the strong setup of the company, and the dividend yield of 3.00%, give the stock strong support, reducing the risk of further losses.

Roche can count on solid institutional support among its shareholders, with 35.38% of the outstanding shares owned by institutions. The company has a particular capital structure, with only 13.20% of the capital controlling 100% of the voting rights, 86.80% being non-voting equity securities. The street consensus for the ADR given by 4 analysts prices the ADR on average at $51.83 with a strong buy rating, with the lowest estimation at $44.50 and the highest at $58. The Seeking Alpha Quant Rating instead qualifies the stock consistently for over three years as a hold position. When considering the stock at the SIX, the consensus given by 26 analysts is on average at CHF 387.44, with the lowest rating at CHF 330.00 and the highest rating at CHF 454.00.

The stock has without surprise shown to be more defensive and less affected by the recent market turmoil and has formed a quite strong bottom. Although the EMA50 now limits the upside at CHF 326.50 or around $42.30, I see the stock overcoming this resistance level if the last closing price is confirmed and the general sell-pressure on the markets is reduced. The stock could attempt to reach the resistance around CHF 335 or $45 and further reach the EMA200, which would then act as the next important resistance. Technically, the stock is in my opinion in a comfortable setup for both long-term investors as well as more short-term traders who can set their stop-loss to limit the downside risk.

The bottom line

Roche is a very solid, innovative pharmaceutical company with promising growth drivers in its product portfolio and its pipeline. The disentanglement from its competitor Novartis after 20 years is a positive strategic milestone. Despite some headwinds mostly caused by competitive biosimilars, this pharmaceutical giant offers an attractive setup for both long-term investors as well as short-term traders. My valuation model prices the ADR at $55.67 and rates the stock as being undervalued by over 33%, with relatively low downside risk and technically on an important pivot point.

Be the first to comment