Goodboy Picture Company/E+ via Getty Images

Introduction

Even though Carter’s (NYSE:CRI) is down 34% YTD, in my personal opinion, now is not the best time to buy shares. First, at the macro level, the company faced a decline in demand against the backdrop of declining real consumer incomes. In addition, reduced economies of scale on the back of falling purchases could put pressure on the company’s operating margin, as upside potential for product prices is limited.

Survey of Q3 results

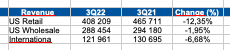

In Q3 2022, the company’s revenue decreased by 8.2% YoY. In terms of business segments, we see the largest decline in the US Retail segment, where revenue decreased by 12% YoY (comparable sales decreased by 11%), while in the US Wholesale segment, revenue decreased by 2%, and in the International segment, revenue decreased by 7%. From a negative point of view, I would also note that revenue continues to decline at the beginning of the year.

Revenue by segment

Company’s presentation

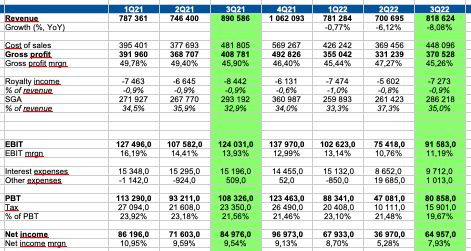

The company was able to keep the gross margin at a stable level despite the decline in comparable sales and the growth of logistics costs. I believe that the company is able to raise prices and pass on high inflation to the end consumer, but the business is facing serious pressure on the number of buyers.

The operating margin of the business decreased from 13.9% in Q3 2021 to 11.2% in Q3 2022 due to the deleverage effect and higher ocean freight rates.

Company’s presentation

Guidance

The company has published weak guidance for 2022. First of all, it is worth noting that the company will continue to face macro pressures, and consumers will continue to cut spending in the discretionary segment.

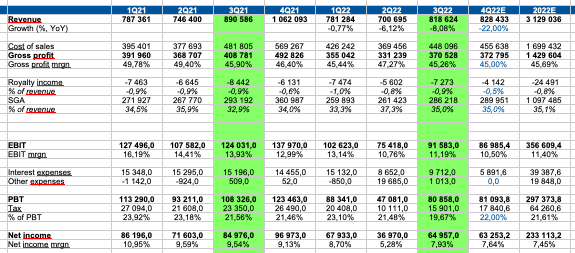

Management expects Q4 revenue to be $845-$885 million, implying a decline of approximately 22%. In my personal opinion, we will see continued pressure on revenue due to last year’s high base when families were supported by stimulus payments during COVID. In addition, management noted that holiday shopping this year may be less robust than in previous periods.

In addition, operating income will be in the order of $85-$115 million. Thus, we may see a continuation of the downward trend in operating margins this year.

Projections

Personal calculations

Valuation

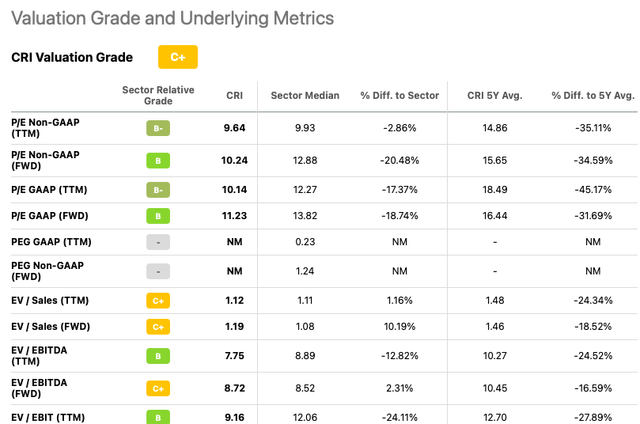

Despite the fact that the company continues to trade lower than the sector average on a P/E (fwd) basis, I personally don’t expect a revaluation any time soon or an increase in the business’ earnings.

SA data

Drivers

Macro: declining inflation, recovery in consumer confidence, growth in real incomes may support the expenses of families with children, which will have a positive impact on business revenue dynamics.

Margin: a decrease in seaport congestion due to a general decline in consumer demand could lead to lower logistics costs next year, which should support operating margins.

Risks

Macro: continued growth of inflation negatively affects real incomes and the level of consumer confidence of the population; as a result, families with children reduce spending on goods for children, which may have a negative impact on business revenue dynamics.

Supply chain: The introduction of new COVID restrictions may have a negative impact on the supply chain, because manufacturers may be forced to temporarily stop production.

Margin: Rising inflation and reduced economies of scale due to lower demand can have a negative impact on the operating profitability of the business, because the share of SGA expenses (% of revenue) will increase.

Conclusion

Despite the fact that I like the company’s business model and the current level of valuation, I don’t think now is the best time to buy, as the company will continue to face financial pressure in the coming quarters. First, based on guidance, we are likely to see a double digit decrease in revenue. Second, the company continues to face pressure on operating margins due to high inflation and declining economies of scale. I guess now is not the best time to buy stock in the company.

Be the first to comment