piranka

Globant S.A. (NYSE:GLOB) is set to expand its business outside of the United States, and it has adopted acquisition as the strategy to achieve this objective. In this thesis, I will be talking about these acquisitions by GLOB and how they will not only help the company expand but also diversify its risk. I will also be analyzing the company’s financial performance in the recent quarter and its future targets.

Expansion through continuous acquisitions

GLOB has been on a continuous acquisition spree to expand its operations in different geographies and target broader markets outside of the United States. The company currently derives 65% of its revenues from North America, the majority of it being from the United States. It generates just 3% of its revenue from the Asia Pacific region and 10% from the EMEA countries. With the recent acquisitions, the company plans on boosting its revenues and market share by tapping into the developing markets in the Asia Pacific region and expanding operations even further in the EMEA countries.

eWave Acquisition

eWave is a leading digital commerce consultancy with the majority of its operations in Asia and Australia. eWave primarily specializes in adobe and salesforce commerce solutions. It has offices in major cities across China, Singapore, the Philippines, Australia, India, France, and England. Some of its clientele includes big companies like L’Óreal, Nike, Coca-Cola, and Cochlear. I believe the acquisition of eWave will open the doors for GLOB in the Asia Pacific region, where it has a relatively lower market share. With the majority of GLOB’s revenue coming from the United States, the company is now looking to diversify its risk and reduce its dependency on one particular market. The acquisition is expected to drive significant revenue for the company in the coming quarters. eWave has a significant technological edge in terms of technological advancement in the digital commerce space, which I believe will play a significant role in improving and enhancing GLOB’s services, and the expertise in adobe and salesforce will complement the existing services provided by GLOB to its clientele.

Martín Umaran, Globant’s Co-Founder, commented,

eWave joins Globant with perfect timing when we are expanding and solidifying our portfolio and reaching new markets. Both company cultures fit seamlessly, and we are looking forward to continuing growing together with such a talented team.

Sysdata Acquisition

Sysdata is a business and technology consultancy based in Bologna, Italy. It specializes in the digital transformation space and has clients spread all across Europe. Sysdata provides advisory services and digital transformation services to multinational companies from different industries, including banking, automobile, energy, etc. GLOB generates just around 10% of its revenues from the EMEA countries, and with this acquisition, the company aims to expand its revenue share significantly over the next five years. I believe this acquisition is crucial in the company’s expansion strategy as it will help GLOB access the wider European market and build upon its existing client base in the EMEA region. I think the company could see a material impact of this acquisition in the coming quarters, with improved profit margins and revenue boost provided by Sysdata.

Martin Umaran, Co-Founder of Globant and President of EMEA, said,

Sysdata joins Globant to consolidate our expansion in Europe. We were impressed by their long-standing portfolio of customers in some of Italy’s more significant industries, such as Banking, Insurance, and Automotive. Globant will complement these and other offerings to keep on supporting successful digital transformations.

Financial Analysis

GLOB recently announced its Q3 2022 results. The results were in line with the market’s expectations with respect to the EPS and revenue targets. The company saw significant improvement across segments, including revenue and EPS. However, the profit and operating margins remained flat compared to Q3 2021. I believe the company is on a significant growth trajectory with continuous acquisitions, and maintaining profitability while expanding operations is a positive sign from the financial standpoint.

GLOB reported Q3 2022 revenue at $459 million, a significant 34% jump compared to the corresponding quarter last year. This increase can mainly be attributed to the increased revenues from the United States and an increase in the USD price compared to other currencies. The company earns 81% of its revenues in USD. GLOB saw a significant rise in the cost of revenue, up 36% from $210 million in Q3 2021 to $286 in Q3 2022. As per my analysis, the rising inflation resulted in this increase. The company reported profits from operations of $52 million, a 30% jump compared to the same quarter last year. The company increased its employee headcount from 21,850 during Q3 2021 to 26,500 during Q3 2022. The increased human resource is a part of the company’s expansion strategy, but it also has resulted in increased costs for the company. The company, however, has managed to maintain its gross profit margins around 37.5% despite increased costs mainly due to higher revenues. GLOB reported diluted EPS of $0.84, a 40% increase compared to $0.60 EPS in the same quarter last year.

As per my analysis, the company performed exceedingly well despite the global recession and high inflationary headwinds. With the global markets getting back on track and in view of recent acquisitions by the company, I believe the company’s financial performance will see significant improvement in the coming quarters. The company has provided the outlook for FY22 with revenues estimated to be in the range of $1.75-$1.85 billion, giving us the Q4 2022 estimated revenue in the range of $485-$490 million. I think the company should easily achieve these targets with a strong financial performance by far in FY2022. The company estimates FY22 adjusted diluted EPS to be a minimum of $5.06, giving us the Q4 2022 EPS estimate of $1.37. I believe the company is a great buying opportunity for investors looking for a growth company with improving financial performance.

Martín Migoya, Globant’s CEO and Co-founder, commented,

We continue to be a leader in the broader technology market. Globant is fully committed to delivering 360-degree digital transformations with consumer-centric solutions. We execute our strategy through smart process optimization, which helps our clients streamline their operations and achieve maximum efficiency. Our end-to-end capabilities help organizations deliver innovative experiences for their customers, leading to better performance and stronger returns. Our unique approach differentiates us from other players in the industry. Just recently, Frost & Sullivan awarded Globant the 2022 Company of the Year Award in the Global Digital Transformation Services Industry. We look forward to continuing to extend our reach to additional regions and industries.

Technical Analysis

GLOB has positive technical indicators, suggesting a buying opportunity at current price levels. The company has made a double bottom pattern at $160 price levels which is considered a bullish technical pattern, and the stock could see a breakout from current price levels for a 15-20% upside. The $160 price level is also a very strong support zone for the stock, as the stock has tested $160 price levels multiple times and rebounded from there. This provides investors with limited risk exposure from current price levels. The stock is trading near its 200-day EMA, and once the stock crosses the 200-day EMA, we can see a fresh upside momentum in the stock price. The RSI indicator suggests that the stock is in the buying zone. The stock is trading between the 40-50 RSI band zone, which is considered a good buying zone for the stocks. Overall, my technical analysis indicates a good buying opportunity in the stock at current price levels.

Main risk faced by GLOB

High dependence on fewer clients

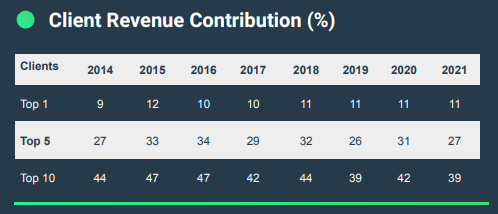

Investor Presentation GLOB

GLOB served around 1114 clients during Q3 2022; out of these clients, the top client accounted for about 11% of the total revenue, and the top five and top ten clients accounted for 27% and 39%, respectively. This reflects the company’s dependency on its top clients. High dependency on fewer clients is generally considered a risk for a business organization. The company, however, is continuously expanding and addressing this risk by increasing its client base globally.

Is GLOB worth buying?

GLOB is currently trading at the share price of $175, down 44% from the year-ago period. GLOB is trading at a P/E multiple of 35x with forward EPS estimate of $5.06. When compared to its peers like DCX technology and Amdocs Limited, with P/E ratios of 8.5x and 15x, respectively, the stock might seem overvalued. However, for growth companies like GLOB, PEG ratio analysis is a better tool to measure the company’s valuation. GLOB currently has a PEG ratio of 0.87x with an EPS growth rate estimated to be around 40%, a PEG ratio below 1x is considered good for growth companies. I believe the company is on the right growth trajectory, and even with the higher P/E multiple, the company is undervalued in terms of the PEG multiple.

Bottom Line

GLOB is on an acquisition spree with the aim of expanding its operations in different geographies and building a sustainable and diversified client base. I believe the recent acquisition of eWave and Sysdata will boost the company’s growth in the near future and will help it expand globally. The company also has positive technical indicators suggesting a buying opportunity at current price levels. The company is also undervalued as per my PEG ratio analysis, and I would recommend investors buy GLOB at current price levels.

Be the first to comment