Extreme Media

Here at the Lab, we recently analyzed Roche Holding AG (OTCQX:RHHBY) (OTCQX:RHHBF) with a publication called new drugs will outpace biosimilar competition. In our last article, we answered the following questions:

- Is Roche’s dividend at risk? We are very confident in the company’s ability to increase its DPS in line with its EPS growth; so rather than a dividend cut, we are forecasting a dividend increase;

- Is Roche losing a moment on turnover? Partially yes, the reason was the positive effect related to COVID-19 sales. As explained in our recent analysis, we deep-dive into Roche’s promising portfolio which has the top-line sales potential of outpacing biosimilar competition with a 5% CAGR growth over the next few years;

- Is Roche fairly valued? Yes, here at the Lab, we reiterate our neutral rating, but we are optimistic for the long run company’s development.

Q3 Results comment

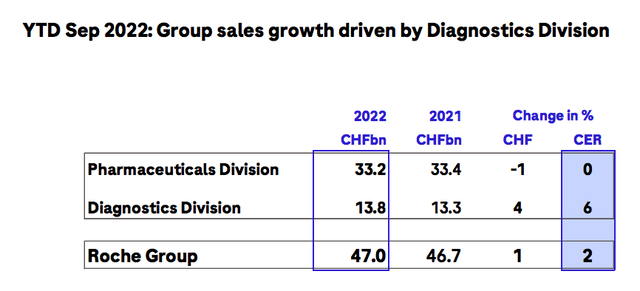

The Swiss pharmaceutical giant delivered a turnover of CHF 47 billion in the first nine months. However, the beneficiary sales recorded during the COVID-19 pandemic are easing. Despite that, turnover rose by 2%. A large portion comes from the Pharmaceuticals division, which is confirmed at the levels of the previous year, with revenues at CHF 33.2 billion. Also, the Diagnostics branch division is still paying off. Indeed, revenues increased by 6% and reached CHF 13.8 billion. The division’s business was mainly driven by Europe, the Middle East, Africa and Asia-Pacific.

Cross-checking Wall Street consensus estimate, Roche missed turnover expectations by 4% on average. At the divisional level, the Pharmaceutical division was particularly weak with the only exception of Vabysmo which was above consensus by almost 20%. The division was also impacted by lower COVID-19 sales mainly due to lower sales of Ronapreve and Actemra drugs. In the Diagnostic division, Q3 2021 sales were considerably down for the same reason – lower sales on the diagnostic for COVID-19. Looking at the details, Roche achieved CHF 600 million in sales against last year’s quarterly results of CHF 1 billion. Important to consider was also the FX implication at Roche’s latest 3-month accounts, in Europe, Japan, and the US, the company recorded a -7%, -12% and +4% respectively on the currency evolution. To sum up, here at the Lab, we are forecasting a miss of CHF 250 million in sales for the whole of 2022.

Conclusion and Valuation

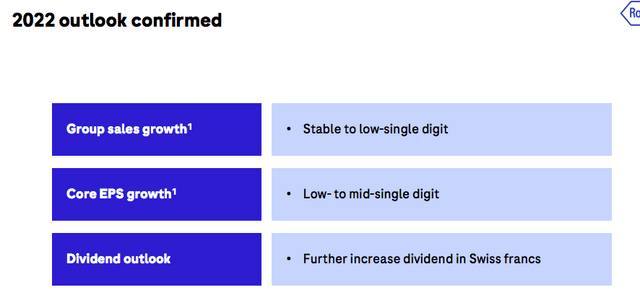

To move on with our first three questions, Roche confirmed its sales target as well as an optimistic outlook on a growing dividend per share. Regarding the valuation, we positively view the latest company news and its recent update on Roche’s new drug pipeline. All are in line with our estimates and expectations. Therefore, in light of our recent publication, we maintain our neutral rating with a price target of CHF 350 per share.

Source: Roche Q3 results presentation

Be the first to comment