stockcam

Airbnb (NASDAQ:ABNB) is a fantastic business, and we have used Airbnb services several times over the last few years while vacationing in the US, Europe, and South America. Airbnb services benefit both the guest and the host, and we expect the company to gain a significant slice of the hotel and traditional lodging market share. We expect Airbnb revenue continue to grow meaningfully over the next few years, driven by newer offerings such as experiences, etc. While we are bullish on Airbnb’s business prospects, we believe the shares are at risk of a violent sell-off in the near term due to their rich valuation. We also believe the competition continues to intensify for the company, and the market will likely remain highly fragmented. Competition from VRBO, Booking.com, and Expedia (EXPE) continues to heat up as they begin investing resources to build a platform that can take on Airbnb. In addition, there are niche specialist websites that cater to a specific region or interest. For example, Kid & Coe caters to families with kids; Pets Pyjamas cater to dog-friendly travelers. Overall, we expect the market to remain fragmented and owners to list their properties on multiple travel sites.

While we like Airbnb a lot as a business, and it is one of our two favorite travel apps, we do not like the stock at the current levels. We believe the stock is at risk of a pullback from these levels as Airbnb stock is expensive on almost all metrics we look at – P/E, P/S, and EV/Sales. We believe Airbnb stock is at risk of continued sell-off from these levels as the valuation is not supportive. Therefore, we recommend investors sell their shares and look for a pullback before reinvesting in the company in the future.

Benefiting from post-pandemic travel

Airbnb is benefiting from the pent-up demand due to pandemic-induced lockdowns. Airbnb’s gross bookings have already increased 27% Y/Y during 2Q22, and we expect demand to ramp up post-lockdown restrictions ease across the world. Airbnb’s 2Q22 recorded its highest demand for Nights and Experiences Bookings, exceeding pre-pandemic demand levels. We believe Airbnb’s business model makes it well-positioned within the booming vacation rental industry, estimated to grow at 5.3% CARG. We expect the company will become more profitable and expect increased top-line growth to be driven by consumer adoption of Alternative Accommodations. However, there are headwinds to worry about in the near term

More headwinds on the horizon

We believe Airbnb is one of the best vacation travel platforms in the industry. Airbnb allows owners to make revenue on their properties while providing guests with personalized and affordable accommodation. Airbnb is not immune to macro challenges and intensifying competition. The company has faced a bumpy road since going public at the end of 2020, and we believe more challenging times are ahead before good times roll in later.

The vacation rental environment has been challenging during the pandemic due to lockdowns. It is now facing new threats from global unease from the Ukraine-Russia conflict, inflation pressures, spiking interest rates, and currency headwinds. Europe is inching towards recession if it is not already in one. We believe customers are caught between wanting to travel post-lockdowns and a challenging macroeconomic environment. Airbnb stock is trading at a premium multiple now, and we expect the multiple to compress as the markets pull back during recessionary periods.

An adaptable business model

We believe that Airbnb presents a resilient business model because of its adaptability for both host and guest. Airbnb’s advantage lies in its ability to attract customers, as the company does not need aggressive marketing and spending. Instead, the company operates off demand from both host and guest ends. Airbnb’s straightforward formula combines the previously scattered locations to profit hosts and provide affordable and personalized accommodation options for guests. The company’s business model builds on itself – the flywheel: the more individuals demand listings, the more hosts join with more listings, and the cycle renews itself.

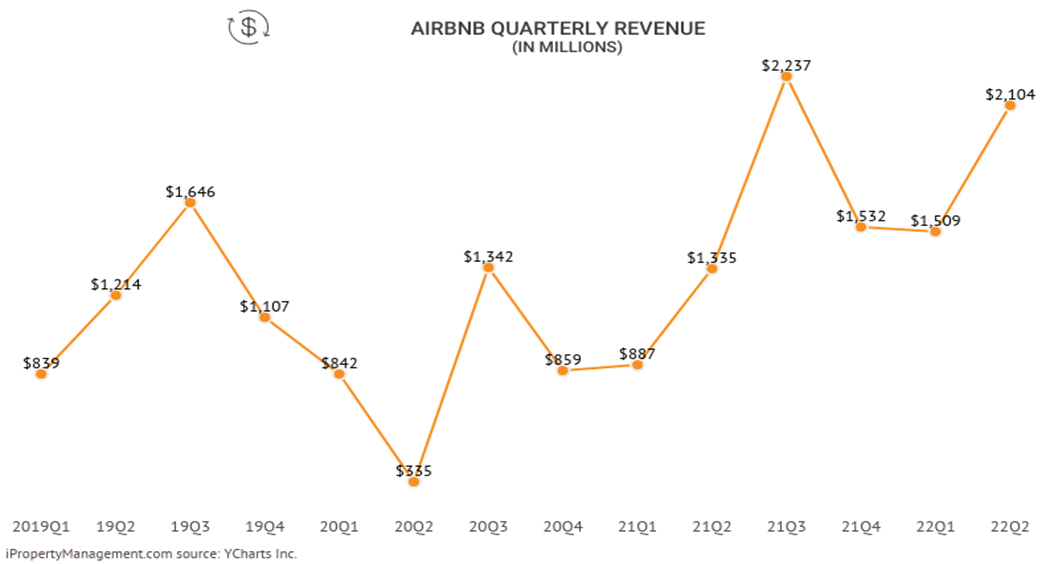

The resilience of Airbnb’s business model showed during the pandemic. When travel restrictions forced many typical accommodations to close, travelers flocked to Airbnb’s alternative accommodations. During the height of the pandemic, Airbnb’s 4Q21 revenue increased 38% from its 4Q19 despite pandemic lockdowns and the emergence of the Omicron variant. We expect demand to ramp up as we leave the pandemic in the past. Airbnb’s most recent August quarter announced a 58% Y/Y increase in revenue. We believe Airbnb’s guests find great value while their hosts earn extra income to travel, cover rent or pay off their debt. We’re excited about Airbnb’s long-term growth and profitability.

The following graph shows Airbnb’s quarterly revenue.

iProperty Managment

iProperty Management

Cutting a bigger slice of the vacation rental industry

Airbnb offers different types of spaces in nearly every location across Europe, the Middle East, and the Americas, among others. We believe Airbnb benefits from its global expansion, technical advancements, and strategic acquisition. In 2019, the company acquired an online marketplace for boutique hotel rentals, HotelTonight. HotelTonight offers heavily discounted room rates, especially for travelers with flexible schedules or looking to book at the last minute. Airbnb is taking a bigger slice of the hotel and traditional accommodation market shares. More and more individuals are renting out their properties. With the help of this acquisition, Airbnb offers guests more choices and supports boutique and independent hotels to connect with its global network of guests seamlessly. We’re excited about Airbnb’s booking numbers. The company reported over 103 million nights and experiences booked, the largest quarter to date.

Post pandemic environment is in favor of Airbnb

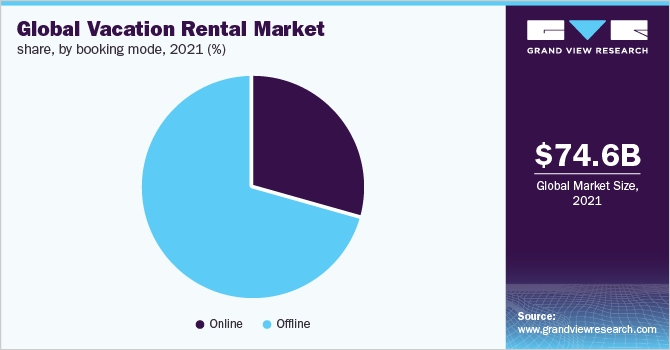

We believe there is a pent-up global demand for travel post-pandemic, and hence we expect Airbnb to enjoy higher demand than it did pre-pandemic. The pandemic has changed how employees work and enabled more individuals to work remotely and from anywhere worldwide. This makes Airbnb a far more robust company than before the pandemic. Post-pandemic, Airbnb’s witnessing an increased demand for its long-term stays of 28 days or more, growing 25% Y/Y and almost 90% compared to pre-pandemic 2Q19. As travel is increasingly digitized, Airbnb is in a great position to grow as an online travel platform. The following graph shows the global vacation rental market for 2021.

Grand View Research

Grand View Research

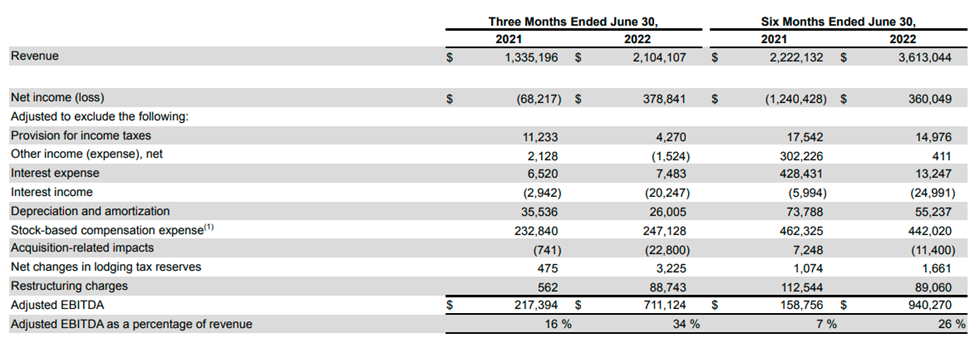

We’re also excited about Airbnb’s finances. Airbnb’s 2Q22 Adjusted EBITDA was $711M, more than tripling compared to 2Q21.

The following table shows Airbnb’s Adjusted EBITDA

Airbnb

Stock Performance

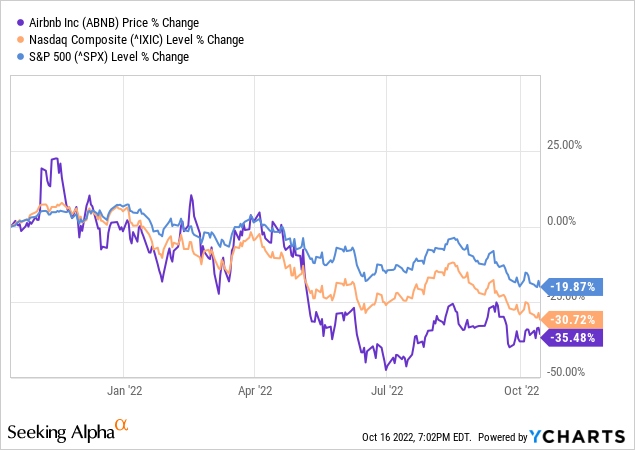

YTD, Airbnb is down around 34%. Over the past twelve months, Airbnb has been down about 35%, underperforming both Nasdaq and S&P indices. While we expect the vacation/rental sector to grow as we leave the pandemic behind, we expect more downside in Airbnb stock over the next few months, as the looming recession may cap the growth in the stock at these levels. We expect multiples to compress further in the next few months as Airbnb continues to trade at a premium to consumer discretionary peer group stocks.

The following graph shows Airbnb’s performance relative to Nasdaq and S&P indices over the past 12 months.

Ycharts

Valuation

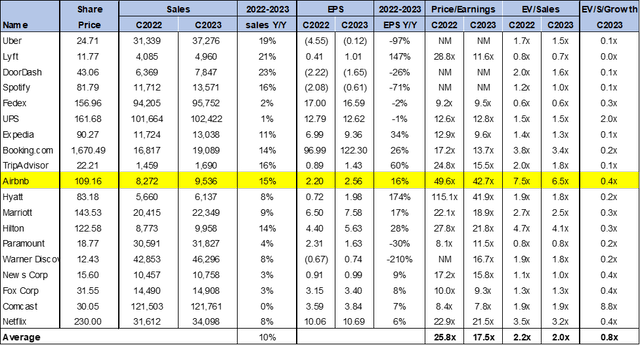

Airbnb stock is expensive by almost all metrics we traditionally use to evaluate the stock. On a P/E basis, Airbnb is currently trading at 43x C2023 EPS of $2.56 compared to the peer group that is trading at 17.5x C2023. On an EV/Sales, Airbnb is trading at 6.5x C2023 sales versus the peer group average of 2.0x. Given this, we recommend investors sell the shares of Airbnb here, as we expect the stock to pull back from these levels as growth slows and multiple compresses across the markets.

The following chart illustrates ABNB’s valuation relative to its peer group.

Refinitiv & Techstockpros

Word On Wall Street

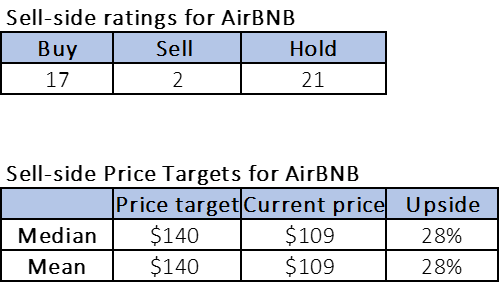

Of the 40 analysts covering the stock, 17 are buy-rated, 21 are hold-rated, and the remaining two are sell-rated. Airbnb is currently trading at around $109. The median and the mean sell-side price targets are $140, with a potential upside of about 28%. The following chart indicates the sell-side ratings and price targets.

Refinitiv & Techstockpros

What to do with the stock

We are SELL-rated on the stock. With a network of individual hosts and guests, Airbnb is a leading global marketplace for Alternative Accommodations (“AA”) and experiences. We anticipate that further consumer adoption of AA will fuel significant top-line growth in the post-pandemic environment. However, the stock is expensive and will likely sell off before it can find momentum. Hence, we recommend investors sell the stock.

Be the first to comment