Ian Tuttle/Getty Images Entertainment

Elevator Pitch

My investment rating for Roblox Corporation (NYSE:RBLX) is a Sell. I highlighted in my earlier update for RBLX published on March 4, 2022 that a meaningful stock price recovery for Roblox to above $70 is unlikely. In the current article, I offer an update of my views on Roblox’s outlook considering RBLX’s continued stock price decline which has occurred in tandem with the sell-off in technology names.

My prediction is that Roblox’s share price will continue to drop going forward based on the company’s outlook. RBLX hasn’t set out a clear path to achieve profitability, and its bookings growth might not have troughed yet looking at its May 2022 metrics. Moreover, RBLX’s current valuations are still rich, and a further valuation derating is likely.

RBLX Stock Basics

It is important to have a good understanding of the basics for RBLX stock, before I touch on Roblox’s recent developments. I am referring to what Roblox does and why it is attractive as an investment candidate, when I use the term “basics”.

In the “corporate overview” section of the company’s investor relations website, RBLX describes itself as “a human co-experience platform” and “one of the top online entertainment platforms for audiences under the age of 18” which is supported by “developers who produce their own immersive multiplayer experiences.”

In a nutshell, Roblox makes money by monetizing the content on its platform with the sale of its virtual currency known as Robux. There are network effects at play here. An increase in the number of users provides incentives for more developers to create new content on the RBLX platform, and this in turn helps to make the platform more appealing for new users. More significantly, Roblox is a unique combination of a social media platform operator focused on relatively young users and a gaming company that doesn’t have to develop its own games.

Why Has Roblox Stock Dropped?

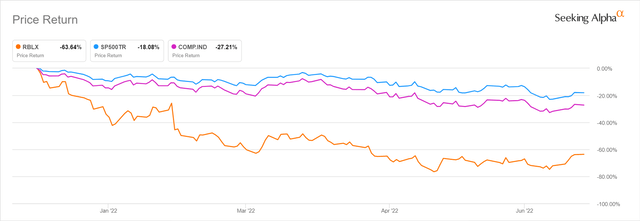

Roblox’s stock price has declined by -22% from $46.03 at the time of publication for my previous early-March 2022 article to $35.93 as of June 27. Year-to-date, RBLX’s shares have dropped by -63%, which is attributable to both market-specific and company-specific issues.

Roblox’s 2022 Year-to-date Share Price Chart

As per the chart presented above, the NASDAQ Composite Index, a proxy for the technology sector, has fallen by -27% in 2022 thus far which underperformed the S&P 500’s -18% correction over the same period. Roblox is a technology company as described in the preceding section of the article, and it is no surprise that RBLX’s year-to-date share price performance has been poor as well. To make things worse, loss-making companies have fallen out of favor with investors. Roblox is expected to stay loss-making at the EBIT level until FY 2026 (as far as consensus numbers are available) as per the sell-side analysts’ consensus financial forecasts obtained from S&P Capital IQ.

Nevertheless, it is noteworthy that Roblox’s shares have done much worse (-63%) than both the NASDAQ Composite Index and the S&P 500 in 2022 year-to-date, and it is reasonable to conclude that company-specific headwinds (apart from the fact that loss-making technology companies are not in favor) are also responsible for RBLX’s stock price weakness.

On June 15, 2022, RBLX disclosed the company’s metrics for May 2022, and the company’s bookings were in the spotlight. Roblox’s total bookings and average bookings per daily active users contracted by 9%-11% and 23%-24% YoY, respectively in May. A June 16, 2022 Seeking Alpha News article citing a Morgan Stanley (MS) research report highlighted that RBLX’s May 2022 “bookings growth deceleration was the slowest year-to-date, confounding investor expectations of a rebound from March’s low of -9%.”

Prior to this, Roblox’s key financial and operating metrics revealed as part of the company’s Q1 2022 results released on May 10, 2022 were also disappointing. The company’s Q1 2022 average bookings per daily active users of $11.67 fell short of the market’s consensus estimate of $12.16 (as per S&P Capital IQ) by -4%. RBLX’s YoY revenue growth decelerated from +84% in Q4 2021 to +39% in Q1 2022. Roblox’s non-GAAP adjusted EBITDA decreased by -64% YoY to $68 million in the most recent quarter, and this was -35% lower as compared to Wall Street’s consensus EBITDA forecast of $104 million according to S&P Capital IQ data.

The easing of Work-From-Home tailwinds and elevated investments were the key drivers of RBLX’s weaker-than-expected operating and financial performance for the first quarter of 2022.

In the subsequent section, I review Roblox’s current consensus price target.

What Is The Target Price For Roblox Stock?

The median sell-side target price for Roblox is $40.00 at the time of writing as per S&P Capital IQ. This is equivalent to a modest +11% upside as compared to RBLX’s last done share price of $35.93 as of June 27. In other words, the $40 median price target seems to suggest that RBLX isn’t a Buy based on its upside potential.

I discuss RBLX’s stock price outlook in the next section.

Is Roblox Stock Expected To Rise?

It is easy to understand why the capital appreciation potential for RBLX is limited as seen with its median Wall Street analyst price target highlighted in the previous section.

Even though Roblox’s shares have dropped by -63% in 2022 thus far, RBLX’s valuations aren’t really cheap. Based on valuation data obtained from S&P Capital IQ, Roblox currently trades at consensus forward next twelve months’ price-to-sales and EV/EBITDA multiples of 7.5 times and 48.3 times, respectively.

With respect to the company’s business outlook, RBLX had noted at its Q1 2022 earnings briefing that “our year-over-year growth rates (for bookings) in April (2022) were better than they were in March”, and it guided for that “on a year-over-year basis, I expect that to be true in May and again in June.” In other words, Roblox had expected the YoY growth in bookings to improve from month to month in May. But this has failed to materialize as seen with the 9%-11% YoY decline in bookings for May 2022 as touched on earlier in this article.

At the same time, it seems unlikely that Roblox will be able to become profitable (bottom line) anytime soon or see an improvement in its EBITDA margins. At the company’s Q1 2022 investor call, RBLX stressed that “in the short run, I don’t think we’re that focused on trying to maintain very high P&L margins”, and it emphasized that “the investments that we’re making, we see very high returns on in the long run.” Roblox’s stance on profitability and investments are reflected in the sell-side’s consensus financial projections as per S&P Capital IQ. RBLX is forecasted to remain loss-making between FY 2022 and FY 2026 with EBITDA margins staying in the low-to-mid teens percentage range (as compared to as high as 30% during the pandemic) over this period.

In summary, I am of the view that Roblox’s share price could continue to trend downwards, taking into account weaker-than-expected May 2022 bookings growth and the lack of a clear timeline to achieve profitability.

Is RBLX Stock A Buy, Sell, Or Hold?

RBLX stock is a Sell. This is justified based on Roblox’s poor outlook in terms of expected bookings growth and profitability, and its demanding valuations.

Be the first to comment