ArLawKa AungTun/iStock via Getty Images

Article Thesis

In recent months, investors started to worry more about a downturn in US real estate, especially when it comes to residential real estate. Housing sales are slowing down and rising mortgage rates make homes less affordable. That could mean pressure for housing prices. But that does not necessarily mean that REITs must be bad investments, as we’ll explore in this article.

US Housing Market Is Slowing Down

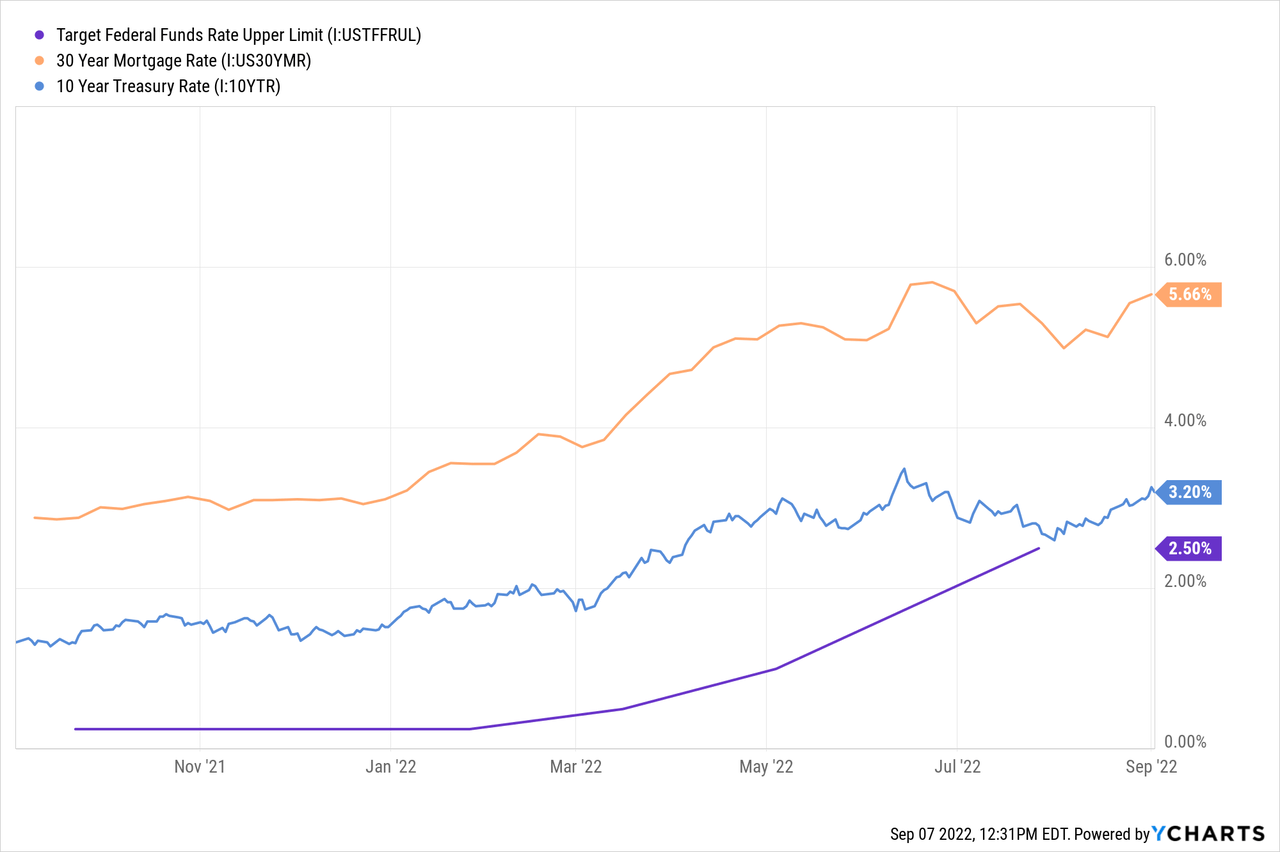

Inflation is running at a multi-decade high, and that has forced the Fed to become more aggressive with rate hikes. The US central bank has increased interest rates several times this year already, and the market is currently expecting another 75 basis point hike with the upcoming announcement. That naturally has had an impact on other interest rates as well, as we can see in the below chart:

The rising Federal Funds rate has pushed the 10-year treasury rate up by around 150 base points over the last year. The impact on 30-year mortgages was even more pronounced, as those are currently yielding around 5.7%, which is close to double the level from a year ago.

Combined with steep increases in house prices over the last couple of years, that has made houses way less affordable for many potential buyers. After all, interest expenses on a $400,000 home have doubled from around $9,000 to around $18,000 over the last year, assuming 80% of the price is financed via a mortgage.

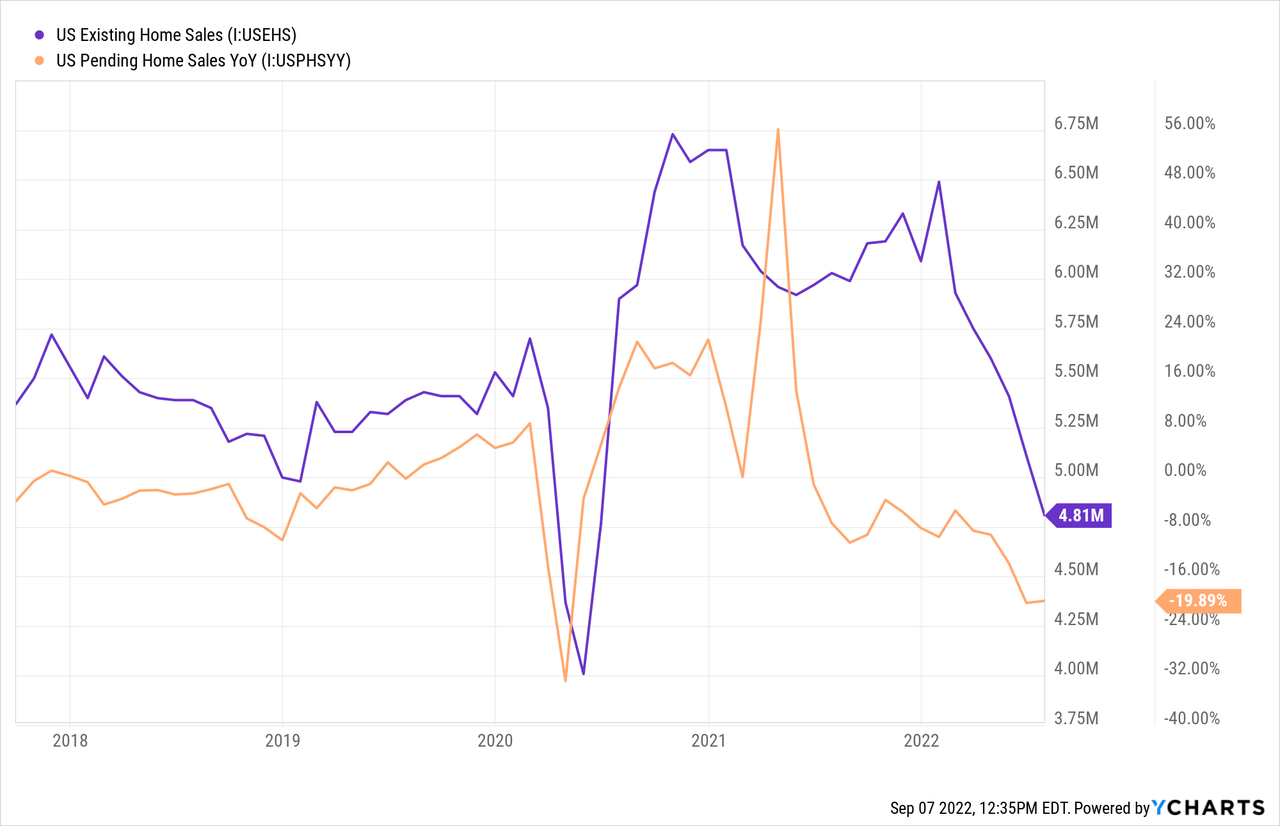

Except for spring 2020, when lockdowns were in place, existing home sales have not been this low over the last couple of years:

US pending home sales are down 20% year over year, and the trajectory makes it seem likely that we might see even bigger declines in the coming months and quarters. Clearly, the fact that homes have become way less affordable is having an impact on the US housing industry.

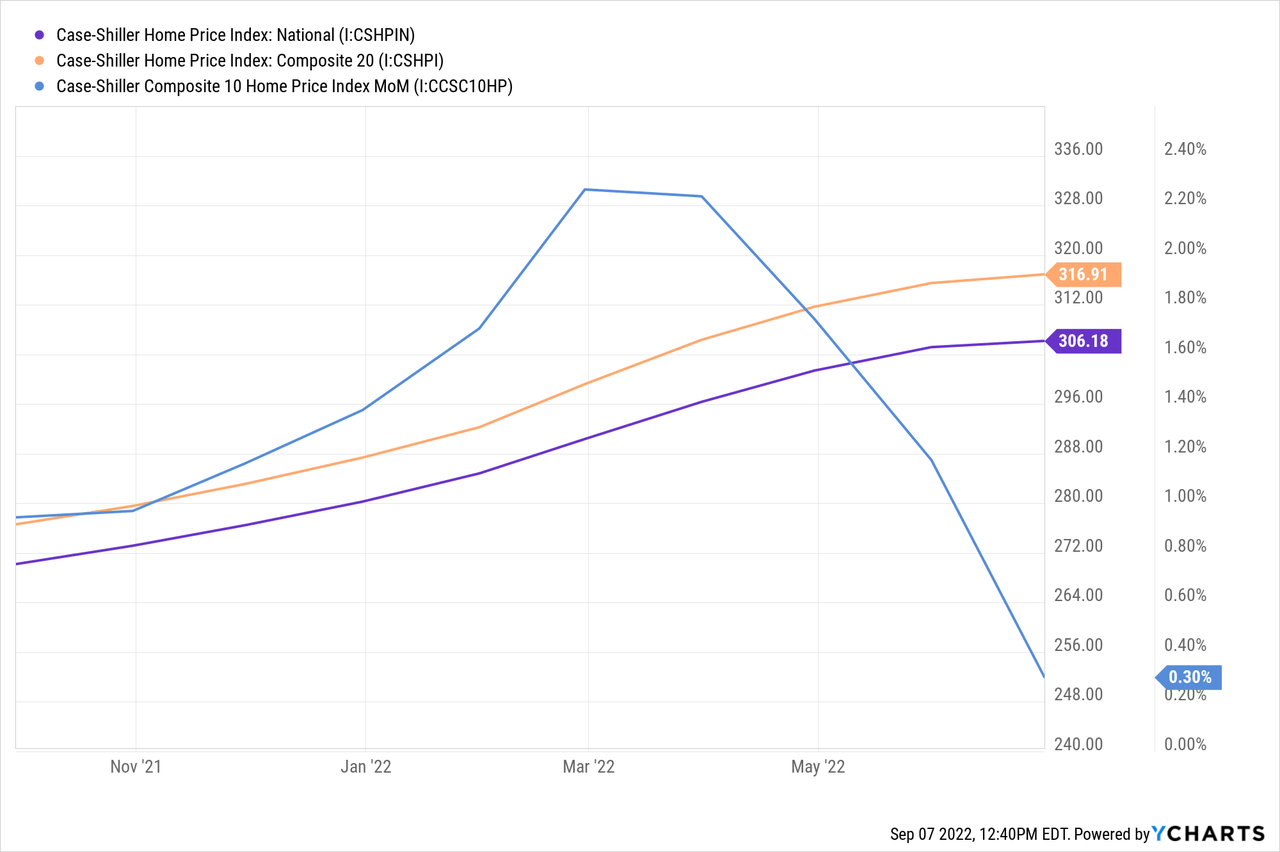

Home prices have rapidly risen during last year and in early 2022, but it looks like they are in the process of topping out:

The Case-Shiller index is not growing meaningfully any longer, and the trajectory is pretty clear: Month-over-month increases have dropped massively, and if that trend continues, home prices will fall. During a recession, forecasts see US home prices drop by up to 10% in most markets, and by up to 20% in the most exposed/overvalued markets, as reported here on Seeking Alpha.

With interest rates at a pretty high level and with house prices looking like they are topping out, it thus doesn’t look like a great time to buy a house today. But things may be different when it comes to REITs.

Why REITs Are Different

First, the above holds true for houses or residential real estate. But that is by far not the only class of real estate that REITs can invest in. Instead, REITs invest in a wide range of properties: Malls, single-tenant retail space, hotels, hospitals, warehouses, apartment buildings, offices, and many more. Home prices have risen quite a lot over the last two years and are thus expensive, but that does not hold true for all types of properties. Many other properties have not experienced the same stimulus-fueled rally over the last two years, and they are thus less likely to be overvalued today, reducing the risk of price declines.

When US home prices fall by 10%, for example, that does not mean that the price of offices owned by Vornado (VNO) or hospitals owned by Medical Properties Trust (MPW) will drop as well. Instead, it’s possible for US home prices to decline while other types of properties remain stable or actually increase in value. Hotels, for example, could benefit from the ongoing travel recovery and might become more valuable even as the US housing market is slowing down at the same time.

Second, even when it comes to residential real estate, REITs are different from direct real estate investments such as homes that were purchased to rent them out. REITs are more diversified and less exposed to single markets that might be overvalued, and they oftentimes trade at substantial discounts relative to how private real estate is valued.

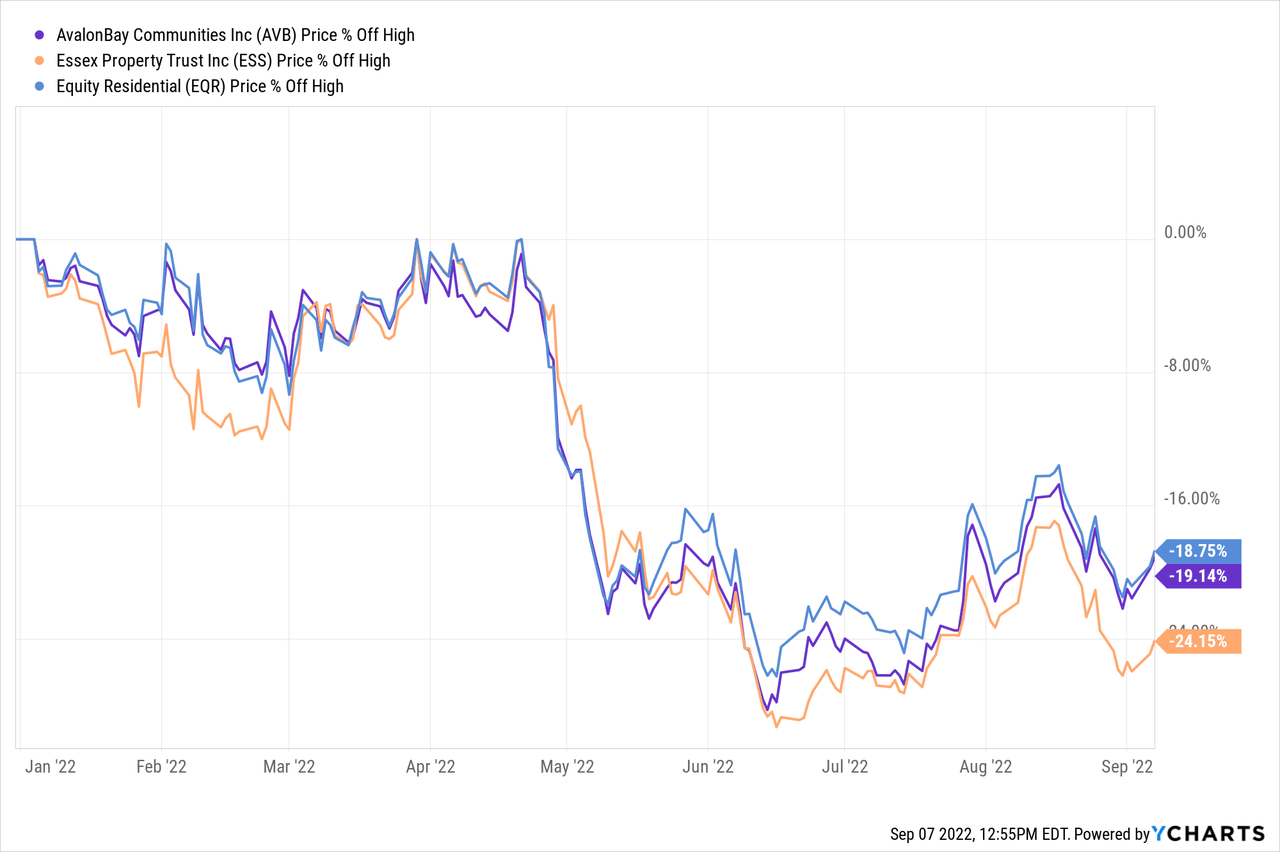

The market has already priced many residential REITs for a slowdown or downturn in the market, while US home prices are still at pretty high levels. Many apartment REITs, for example, trade at meaningful discounts to their net asset value. That means that the same apartments that investors are willing to purchase for $200,000 or $300,000 in private deals are only valued at 90% or 80% of that when owned by a REIT. In other words, even when prices pull back, that does not necessarily impact residential REITs as they are already priced for major price declines. Apartment stocks such as AvalonBay (AVB), Essex Property Trust (ESS) and Equity Residential (EQR) are trading well below their recent highs:

Buying those REITs at their highs from spring 2022 has not been a great idea, but things do look very different now. Following price declines in the 20% range, they have become way more attractive, especially since private property values have continued to climb during the summer months. While these REITs became cheaper, their assets became more valuable. Private market values of residential real estate will likely be declining to some degree over the coming months, but that is already fully accounted for when it comes to the stock prices of these REITs. Buying them today, 20% below their highs, is different than buying a house today that is valued at or very close to all-time highs.

REITs are thus more attractive than private real estate investments in the current environment, I believe. Factors such as better liquidity, less hassle/work, access to foreign markets, and many more, are additional advantages for REITs relative to direct real estate investments.

Attractive REITs To Choose From

Not all real estate investment trusts are attractive, but there is a wide range of REITs that look attractively priced today and that provide considerable dividend yields.

Realty Income (O), for example, is a retail REIT that has proven its excellent recession resilience both during the pandemic and in past downturns. Its FFO will hit a new record high this year, and yet, its shares have dropped by 10% in recent weeks. Today, investors get a dividend yield of 4.4%, and that will likely continue to grow, as it has for decades — recession or not.

Simon Property (SPG) is another attractive retail REIT that primarily owns class A malls. Its dividend yield has grown to 7%, providing excellent income opportunities. At the same time, the company has raised its guidance this summer and trades for just 8x forward FFO, which is a clear discount relative to the mid-to-high-teens FFO multiples SPG has traded at in the past.

STAG Industrial (STAG) is a REIT that owns logistics properties, warehouses, etc. Demand for these is strong thanks to the growth of Amazon (AMZN) and other online retailers, which provides clear growth tailwinds. STAG has seen its shares pull back quite a lot in recent months, which has made its dividend yield rise to 4.7%, and which has made the FFO multiple drop to just 14. With growth tailwinds in place and a starting yield of close to 5%, STAG looks like a compelling buy-and-hold investment at current prices.

Host Hotels (HST) is a hotel REIT that has recovered quite a lot in recent quarters, at least on an operational basis. And yet, its shares are still pretty inexpensive. Based on current forecasts, Host trades at just 9.5x forward FFO, and following the most recent dividend increase, the yield is 2.8%. Since the payout ratio is still very low and since Host should see its FFO grow further next year, there is a lot of room for further dividend increases in the coming years. Investors that want to play the travel recovery could see very compelling longer-term returns here.

Of course, many other REITs are attractively priced as well, including the Dividend Aristocrats such as National Retail Properties (NNN) and Federal Realty Investment Trust (FRT). At current prices, they offer dividend yields of 4.9% and 4.2%, respectively. Like Realty Income, they have proven their resilience and their ability to raise their dividends during good times and bad times, making them suitable for risk-averse investors.

Takeaway

The US Housing market looks toppy. Affordability has worsened quite a bit in recent quarters, sales are falling rapidly, and it looks like prices could start to pull back in the coming months. It thus does not look like it is a great time to buy a home today.

REITs, on the other hand, look more attractive. Their valuations are way lower, they have oftentimes already pulled back considerably this year, many of them trade at discounts to net asset value, and their balance sheets are strong in most cases.

Not all REITs are attractively priced, but income investors have a wide range of suitable REITs to pick from at current prices.

Be the first to comment