Anucha Tiemsom/iStock via Getty Images

Investment Thesis

When I last covered Bristol-Myers Squibb for Seeking Alpha back in mid March I suggested that the company may be the momentum stock to watch in the “Big 8” US Pharmaceutical sector.

This sector consists of – in order of market cap valuation – Johnson & Johnson (JNJ), Eli Lilly (LLY), Pfizer (PFE), AbbVie (ABBV), Merck (MRK), Bristol-Myers Squibb (NYSE:BMY), Amgen (AMGN) and Gilead Sciences (GILD).

Since my last post BMY stock is up 17%, and across the past 6 months it is up by 29%, making it the best performer in the US Big Pharma sector, with Merck – the other stock I suggested had the most short term upside potential – the second best performer at 25%.

Although the “Big 8” Pharmaceuticals in the US all have a similar business model – develop or acquire drug products, bring them to market via the clinical trial process, and try to dominate the markets in which the drugs are approved using its marketing and sales funnels – they are all very different companies with unique strengths and weaknesses.

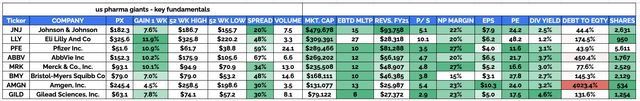

The below chart gathers together some fundamental analysis for investors to consider:

Investment fundamental of “Big 8” US Pharmaceuticals. (my table)

Source: my table using data from TradingView, Google Finance.

Studying this, we can quickly see which company pays the highest yielding dividend – Gilead Sciences – which drives the highest profit margin – Merck, with a 27% NPM – which has the lowest (and therefore best) price to earnings (“P/E”) ratio – Pfizer’s 11.6x – and whose stock is the most volatile – AbbVie, whose spread between 52 week high and low is 67%.

Using this type of financial/performance analysis can be a useful guide to help decide which Pharmaceutical to back – all are profitable, blue chip dividend payers, but some are more profitable than others, some more indebted, etc.

Above and beyond fundamentals and performance, it is also important to have good knowledge of what fields of medicine companies are specialists in. AbbVie, for example, derives most of its revenue from auto-immune/anti-inflammatory markets, Eli Lilly is most active in diabetes, Gilead in HIV, and BMY in oncology, for example.

It’s also good to know how a Pharma’s revenues are likely to change over time, and we can do this by studying their product portfolios and pipelines – which contain all of the assets they hope to launch commercially.

As I discussed in a recent note, despite generating only $28.3bn revenue last year, and guiding for a similar figure this year, Eli Lilly is a more valuable company by market cap than Pfizer – whose revenues in 2021 was $81.2bn in FY21, and which is guiding for ~$100bn in revenues in FY22.

To get the full picture, it’s important to know any given Pharma’s product portfolio and pipeline well, understand which drugs will lose their patent exclusivity – meaning other pharmaceuticals can develop and sell cheaper generic versions of the drug and sales will plummet – and most importantly, what management is doing to grow the company.

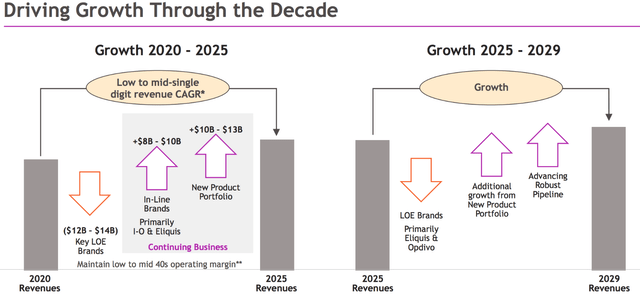

The main reason I would give for Bristol-Myers Squibb’s recent share price spurt is that management has been able to provide clear guidance as to how it is going to deal with the patent expiry of its best-selling asset – the blood cancer drug Revlimid, which generated $12.8bn of sales in FY21 – and other drugs losing exclusivity such as chemotherapy Abraxane and blood cancer therapy Pomalyst, whilst at the same time driving top line revenue in the mid single digits until the end of the decade, as illustrated by a slide from the Q122 earnings presentation.

BMY management’s growth plan. (earnings presentation)

Source: BMY Q421 earnings presentation.

Of course, any management team can put together a similar slide, but thankfully, it is relatively straightforward to plot how BMY can succeed in this ambition, and as the company has been consistently ticking off the achievements necessary, its stock has been climbing. The long term target is to generate $45 – $50bn in free cash flow between 2022 and 2024, and BMY’s rising share price is proof that the market trusts that the Pharma will succeed.

The challenges will continue to come thick and fast – BMY took on massive debt when agreeing to buy Celgene in a $74bn deal in 2019, not just to gain access to Revlimid and Pomalyst, but also due to its exciting late stage pipeline – 5 late stage assets that BMY has successfully brought to market – and $37.5bn of long term debt remains.

BMY’s net profit margin in 2021 of 15% is the lowest of the “Big 8” and its dividend yield of 2.7% is the second lowest behind Eli Lilly, whilst its price-to-earnings ratio is the second highest in the sector behind Lilly’s.

The question for investors to answer is whether, after 5 years of stagnant growth which saw BMY shares trade no higher than $69, and touch lows of $43, the incredible gains made over the past 6 months are sustainable.

In the rest of this article, I will discuss BMY’s performance to date in 2022, its progress towards its stated ambition of driving annual low-to-mid single digit topline growth, and whether, from an analytical perspective, the current company valuation of $171bn undervalues or overvalues the company.

Q122 Performance & FY22 Guidance

BMY is guiding for $47bn of revenues in FY22, according to its Q1 22 earnings presentation, which represents a ~1.33% year-on-year uplift – probably not quite as high as management would have liked.

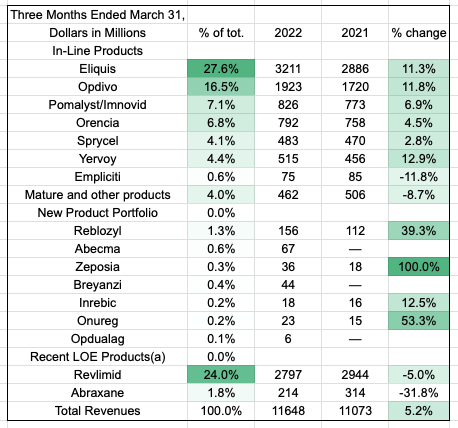

BMY total revenues breakdown by drug Q122 vs Q121. (my table)

Source: my table using data from BMY 10Q submission.

Total revenue in Q1 22 was actually up 5.2%, so we can presumably expect performance to be less impressive across the next 3 quarters, and that will be due to falling sales of Revlimid, which has lost its patent exclusivity in both the US and Europe.

In terms of profitability, GAAP EPS slipped from $0.89 in Q1 21, to $0.59 in Q1 22, although on a non-GAAP basis, EPS rose by 13%, from $1.74, to $1.96. Management is guiding for non-GAAP EPS of $7.44 – $7.74 in FY22 – revised down slightly after Q1 22 earnings were announced – giving a forward P/E of ~10.5x, but the GAAP EPS forecast is for $2.92 – $3.22, and a forward P/E of 26x.

In Q122, BMY generated $3.8bn of cash from operations, which is impressive, although it will need to continue to be so since the company reported $45bn of debt versus $15bn cash, and faces $12bn of maturing debt positions between 2022 and 2024. That hasn’t stopped management from taking care of its shareholders however, with a $5bn share buyback program announced in Q1 22, and a dividend raise announced in Q4 21.

BMY Delivers On New Product Launches As Patent Expiries Loom

As discussed, BMY management’s growth strategy is built upon new product launches, to compensate for falling sales of its LOE assets Revlimid, Pomalyst and Abraxane, and looking further ahead, Eliquis, sometime between 2027 – 2029, and Opdivo, likely around the same time.

These assets currently make up ~77% of BMY’s sales, so we can see the kind of pressure management is under, although it should be noted that patent expiries are not written in stone – AbbVie, for example, successfully delayed the patent expiry for Humira from 2017 to 2023, through negotiation with generic drug manufacturers and filing for new patents. It is therefore likely that Eliquis and Opdivo will continue to make multi-billion dollar revenue contributions well into the 2030’s.

BMY investors can be highly encouraged by the new wave of BMY products that have found their way to market however. In a November 2021 post, I discussed 5 new products as follows:

The five assets earmarked to replace the likes of Revlimid and Eliquis when patent issues finally catch up with them are blood cancer therapy Reblozyl (peak sales estimate >$2bn), CAR-T cell therapy Abecma (p/s estimate >$1bn), Leukemia therapy Onureg (p/s >$1.5bn), auto-immune treatment Zeposia (p/s >$5bn), and lymphoma cell-therapy Breyanzi (p/s >$1bn).

All 5 assets have now been approved, and although their contribution in Q1 22 was just ~$325m, there is a potential $10bn in peak sales available for these therapies.

Joining them on the market in the last quarter are 2 more products which BMY believes can make sales of ~$4bn per annum each. The first is Opdualag, a LAG-3 inhibitor which is approved for use in combination with Opdivo to treat 1st line melanoma – in trials, the combo demonstrated a Progression Free Survival of 10.1 months, versus 4.6 months for Opdivo alone, and cut risk of death by 20%.

Opdualag is expected to take market share away from Merck’s mega-blockbuster immune checkpoint inhibitor (“ICI”) Keytruda, and is also being trialed in colorectal cancer, non-small cell lung cancer (“NSCLC”) and liver cancer. In total, BMY now has 3 ICIs – Opdivo, Yervoy, and now Relatlimab/Opdualag, meaning the company has a strong chance of overhauling Merck in the oncology sector – a long-term ambition.

The second new product approval is CAMZYOS, formerly known as Mavacamtem and acquired by BMY as part of its $13bn takeover of Myokardia. That deal now looks like good value as CAMZYOS now becomes the first drug to treat obstructive hypertrophic cardiomyopathy, having shown in its pivotal clinical trial that 37% of patients showed improvement in exercise capacity and disease symptoms versus 17% in placebo. Analysts are not quite as optimistic as BMY on peak sales – $2.5bn is the consensus analyst view – but it will certainly bolster BMY’s cardiovascular division.

Finally, there is a Prescription Drug User Fee Act (“PDUFA”) date upcoming in September for Deucravacitinib – a selective allosteric TYK-2 inhibitor – with the indication being Psoriasis. An orally available drug, BMY CEO Giovanni Caforio commented on the Q122 earnings call that:

We believe that psoriasis patients need better oral options. And this asset has demonstrated superior efficacy compared to the oral standard of care with a favourable safety and tolerability profile.

BMY also plans to launch a pivotal study of Deucravacitinib in Lupus, based on establishing Proof-of-Concept (“PoC”) in a Phase 2 trial, whilst Inflammatory Bowel Syndrome is another target. Alongside Zeposia and Orencia, BMY is building an autoimmune portfolio that could challenge the supremacy of AbbVie, whose $20bn selling Humira goes off patent in 2023 – although almost every large Pharma has horses in this particular race.

Looking Ahead – Earnings Forecasts And Share Price Target

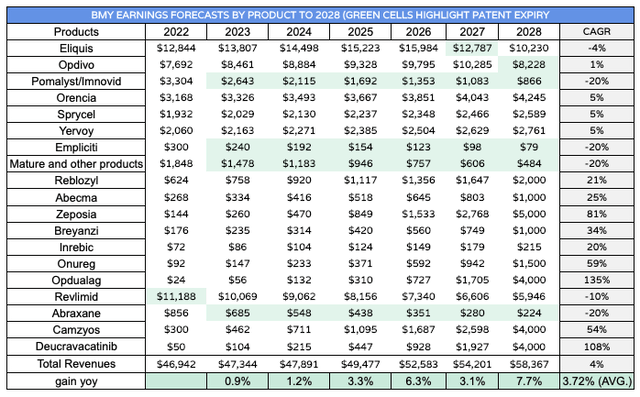

In the below table I have mapped out an arguably optimistic scenario in which management hits its peak sales targets with Camzyos, Deucravacatinib, Zeposia, Abecma, Breyanzi, Zeposia an Opdualag, whilst Revlimid, Pomalyst, Eliquis and Abraxane sales begin to fall after their patents expire.

BMY sales forecasts by product to 2028. (my table)

Source: my table using historical data, management forecasts and my assumptions.

I believe this is a reasonable representation of how management expects to grow top line revenue by an average of ~3.7% per annum, with the different CAGR figures showing how certain product sales ought to rapidly increase over time as markets open up and peak sales targets are reached.

I have taken this data and assumed that total operating expenses continue to be ~59% per annum, similar to the figure I calculate for 2021, falling to ~58% by 2026, and that net profit margin increases from ~13.2% in FY21, to $16.3% in FY26 owing to reduced interest expense as debt is paid off, operating efficiencies post the Celgene buyout, and an increasingly entrenched market position for the newer assets.

The forward P/E for 2026 would therefore be ~20x, which is still relatively high, but importantly, decreasing annually. I then use a weighted average cost of capital of 8.3%, based on a beta of 0.91, expected market return of 10%, and risk-free rate of 1.7%, and complete discounted cash flow analysis over the 5-year period to the end of 2026.

This scenario sees BMY – traditionally an excellent generator of cash flow – grow free cash flow from $12.7bn in FY22, to $15.8bn by 2026, factoring in depreciation and tax, and gives me a fair value price target for BMY shares of $100.50, or a 25% premium to today’s traded price. Completing similar EBITDA multiple analysis, using a multiple of 14.5x, I get a price target of $93, for an average price target of $97.

Conclusion – 25% Upside Opportunity In BMY Stock In Aa Fairweather Market – Headwinds Restrict Growth To 10-15%

BMY shares have experienced a dramatic 6-month bull run unlike anything experienced over the previous 5 years when the stock refused to climb and typically traded in a range of $45 – $65.

Management’s Celgene acquisition has been key to the reversal of fortunes, as not only did Revlimid and Pomalyst add nearly $15bn revenues to the top line, the pipeline assets ensured that their patent expiries would not derail further growth at the company.

I do think the scenario I have highlighted above and which management have also insisted is possible – low to mid-single digit growth until the end of the decade – is achievable, and that opens up the possibility of BMY shares achieving a price of $100 in time. Holding BMY stock is therefore a solid investment, when we also consider the share buybacks and dividend.

With that said, as a recession looms and with bipartisan pressure being put on drug pricing policies, with net debt close to $30bn, and intense competition in all of its markets, I believe these risks ought to reduce the $96 – $100 price target by $5 – $10, so I think investors will do well to realize more than a 10-15% upside from BMY stock if purchasing today.

The path of a major pharmaceutical corporation – develop, test, commercialize – never runs smoothly, and although it looks as though BMY will complete 3 major product launches in 2022, 2023 looks more fallow. It is dangerous to assume products will achieve their peak sales targets when new drugs are released into BMY’s major markets – hematological oncology, cardiovascular, auto-immune – as regularly as every few months by rival firms.

BMY is typically an acquisition hungry company – the last deal was for $4.1bn to acquire Turning Point Therapeutics (TPTX) and its mid-stage 1st line lung cancer drug repotrectinib – which sets up a battle royale against both Roche and Merck for supremacy in solid tumor markets, with BMY having already established a dominant position in blood cancers.

I would not be surprised to see more deals despite the existing debt, and I think management will be rewarded for their ambition in this respect so long as they keep making good buys, such as Myokardia, and of course Celgene, and avoid the kinds of disastrous M&A deals that e.g. Gilead Sciences (my note here) has made in recent years.

I believe it is still a good time to be holding BMY stock although I would not expect BMY stock to outperform all of its “Big 8” US Pharma rivals’ valuation wise over the next 12 months. I don’t think BMY stock has reached its peak, but I do think it may not be far away from it, and I believe $100 is a psychological ceiling at the present time.

Keep performing as they have been, however, and BMY management can set the company up to surpass that figure by demonstrating that their stated goals are achievable, or even beatable. I look forward to studying Q2 22 results when they arrive on July 27th.

Be the first to comment