Ian Tuttle

Thesis

Roblox Corporation (NYSE:RBLX) stock has surged as much as 20% since the metaverse gaming company reported key metrics for September. Arguably the most important reference point “bookings” was up 11% – 15% year over year, increasing to $212 million and $219 million for September.

Although the numbers were not stellar, investors cheered the better-than expected net bookings – which absent any FX headwinds would have increased as much as 17% – 21% year over year.

Reflecting on Roblox’ September metrics, paired with an oddly bullish price action, I continue to like Roblox as a speculative stock-pick. Reiterate “Buy” rating.

Roblox’ September Key Metrics

Although there is no obligation for social media, gaming, or entertainment companies (however you like to define Roblox’ market focus) to publish monthly business and engagement data, Roblox has since the company’s IPO nurtured a habit to regularly share updates with investors.

During the September month, Roblox’ Daily active users (“DAUs”) were 57.8 million, up 23% year over year, but down 3.5% as compared to 59.9 million in August. Hours engaged were 4.0 billion, up 16% year over year, but down 17.5% quarter over quarter respectively.

Similarly, Roblox’ estimated bookings for September were between $212 million and $219 million, up 11% – 15% year over year. August bookings were between $233 million and $237 million.

Although the market celebrated Roblox preliminary results, the engagement and business data for September was clearly worse than the respective data from August. But investors should consider that August usually is a very strong month for gaming engagement – while September engagement is pressured by “school reopening” trends.

Moreover, Roblox has highlighted that the financial data for September would be much better, if the strong dollar would not have distorted exchange rates. In fact, without the FX headwinds, net-bookings would be higher by about $15 million (about $180 million annualized). The company said (emphasis added):

The strengthening of the US Dollar against the Euro, British Pound, and other foreign currencies during 2022 has had an adverse impact on bookings.

We estimate that the impact of foreign currency fluctuations led to a reduction of approximately 6% in the year-over-year growth rate for September bookings.

On a constant currency basis, we estimate bookings growth would have been 17% – 21% year-over-year and ABPDAU would have been down 2-5% year-over-year.

What To Expect For Q3

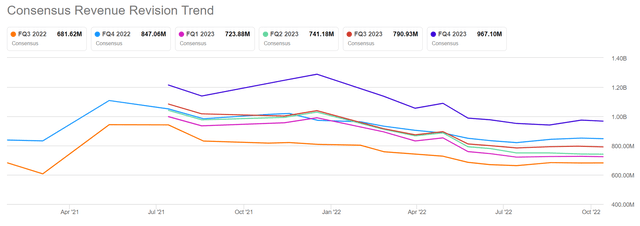

According to data compiled by Seeking Alpha, as of October 17th, 10 analysts have submitted their estimates for RBLX’s Q3 results, which are expected to be announced on November 9th. Total sales are expected to be between $605.5 million and $721.0 billion, with the average estimate being $681.6 million.

If an investor would assume the consensus average as the anchor, Roblox’ Q3 sales are estimated to grow by about 6.8% as compared to the same quarter in 2021. Such a growth rate is not particularly amazing. And as highlighted below, revenue expectations have sharply fallen since mid/late 2021. But still, Roblox might fail to meet expectations. Adding the monthly revenue data provided for July ($171 million and $180 million), August ($208 million and $211 million) and September ($205 million and $208 million), Roblox might even miss the lower revenue estimate of $605.5 million.

But will the market care?

Has Sentiment Bottomed?

Admittedly, Roblox September data was much less positive than what the stock price action would reasonably imply. But this might be a bullish signal: it highlights that market participants have excessively priced in any potential negativity, making the stock vulnerable to a “mild” upside surprise.

After a more than 70% sell-off from all-time highs, sentiment around Roblox stock was clearly bad – and certainly not supported by the deteriorating outlook for Zuckerberg’s metaverse strategy. Only recently, two authors on Seeking Alpha published reports with a sell rating. See here and here. For reference, the average short-interest as a percentage of float for RBLX in September was higher than 10%.

But negative sentiment might be good. In fact, reflecting on bearish sentiment data paired with a sharp upside price action on muted September metrics, makes me believe that the negativity surrounding Roblox stock might have bottomed.

And accordingly, even if Roblox would miss Q3 estimates as argued in the previous section, the stock might not react to the downside. If this were the case, then a “Strong Buy” signal would be implied.

Conclusion

Roblox’ September metrics, both with regards to engagement and monetization were not spectacular. But the stock price rallied. This, I argue, is a strong signal that bearish sentiment surrounding RBLX stock might have bottomed – negative financials do not impact the stock price anymore.

If a similar price action will be confirmed after (presumably) bad Q3 results, then investors will know that sentiment has shifted: investors are once again focused on Roblox’ secular growth story and fantastic business model. I remain Buy-rated.

Be the first to comment