Robert Way/iStock Editorial via Getty Images

Shares in Chinese EV startup XPeng (NYSE:XPEV) have taken a beating since June, falling nearly 70% as the OEM struggled with two sequential declines in revenues amid margin weakness and geopolitical concerns. Deliveries have also slumped, in part due to a resurgence of Covid-19 in major cities and related lockdowns, as well as a power crunch and a weakening economic situation in China. While things may get worse before they get better, XPeng shares look appealing from a speculative, contrarian point of view as shares sit near all-time lows in oversold territory after eight straight weeks of losses.

Deliveries Struggle As G9 Is Launched

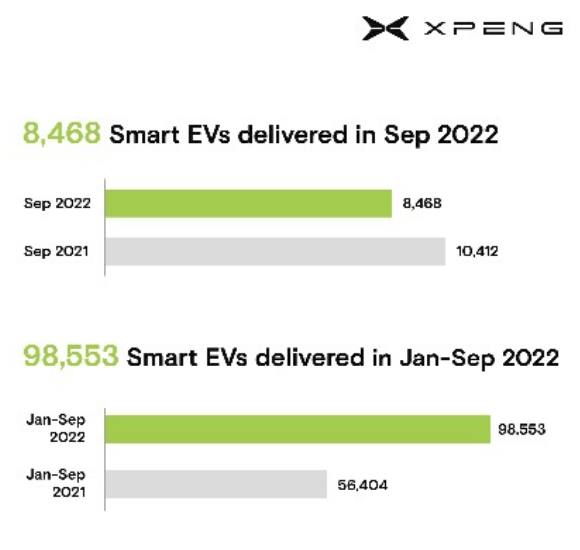

XPeng

XPeng has struggled with deliveries over the past six months, especially in Q3, as September deliveries dipped to the lowest level since March even with the launch of the new G9 SUV. The three-month slump in deliveries throughout Q3 (-14.1% q/q from Q2) raises questions about market share, competition, and production levels, as well as margins from cost pressures.

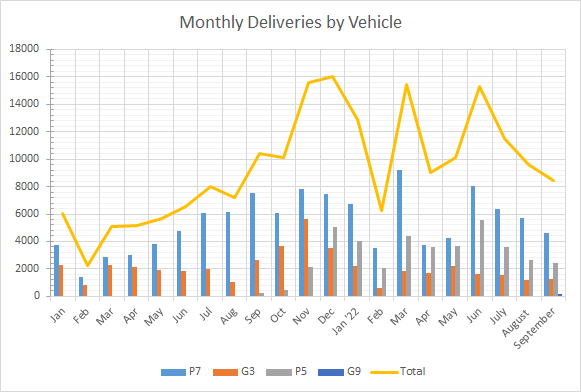

XPeng delivery data

Deliveries have consistently slid since peaking above 15,000 in June for the third time this year. Weakness was evident in all three models, with volume in the P7 sliding over 42% to 4,634 units from June’s 8,045. G3i deliveries dropped by about one-third, while the P5 lost nearly 60%, falling from nearly 5,600 units to over 2,400 in just three months. The P5’s weakness is particularly concerning, given how management was touting high levels of demand prior to the model’s launch last year.

However, the launch of the G9 brings some promise — XPeng President Brian Gu said the OEM thinks “the volume of G9 next year will exceed what we have achieved for P7, which makes it one of our top-selling vehicles.” XPeng has delivered around 128,000 P7s cumulatively, and the idea that the G9 can reach that volume in just one year is a strong sign of optimism, and certainly will prove a significant boost to deliveries and revenues — however, XPeng needs to demonstrate solid levels of demand in Q4 as well as the production capacity to handle four different vehicle models (three at scale). 10,000 vehicles per month for just the G9 is an ambitious plan, but one that would likely aid in a turnaround in shares from the revenue and deliveries boost it would provide.

Although the G9 was just recently released, XPeng has already made modifications to the models’ specs and prices. XPeng added two new trims with revised pricing and the additional of optional packages, including XPILOT, 5D Music Cockpit, and X-NGP. While the company labeled the move as a method to meet customer expectations, it’s yet to be seen how these changes will affect the launch speed and demand, as well as ASP.

Capacity Supports Massive Growth

As Q4 sales kick off, XPeng is in the final stages of expanding its production capacity in Guangzhou and Wuhan. XPeng’s Zhaoqing facility was reportedly retooled and upgraded to 200,000 units in annual production capacity, supporting the OEM’s ramp until the former two are operating. Both factories are expected to be operational at the moment, giving XPeng around 400,000 units in total production capacity (or up to 600,000 in the future under double shifts).

At a projected 400,000 unit run rate, XPeng can support production levels of over 33,000 units per month; up until this point, XPeng’s ~200,000 unit capacity handled over 16,000 units of production, aligning with deliveries peaking in the 15,000 range.

Currently, XPeng has delivered just under 99,000 vehicles YTD, putting it on track to record around 130,000 units in 2022, with expected stronger seasonality partially offsetting economic weakness. Such volumes correlate to approximately +32% y/y growth, a solid figure but far below expectations considering the +75% y/y growth for the YTD period. XPeng’s projected annual delivery growth is about equal to peer NIO (NIO), which is on track for about +33% growth to 121,000 units this year. As such, XPeng looks rather attractive, with shares down over 70% since late June compared to NIO’s 42% decline. Such underperformance appears to stem from weaker margins and expanding losses.

But Strong Demand Is Needed

However, the key for XPeng to turn around from this relative underperformance and significant share price plunge is strong demand correlating to a resumption of sequential (m/m and q/q) sales growth.

In order to record quarterly sales growth in Q4 relative to Q3, XPeng needs to deliver 10,000 vehicles per month on average; to record y/y sales growth, deliveries would need to average 14,000 per month, over 60% growth from September’s tally. While production capacity certainly would support such growth, with Guangzhou and Wuhan both operational, the question boils down to demand.

Gu had said that Q3 reflected a “relatively slow season,” and along with impacts from economic pressure and Covid-related lockdowns, demand already seems to have suffered. Other factors he pointed to for sales weakness included lower foot traffic and hesitant consumers. While some of the factors are simply out of reach and out of XPeng’s control, the company runs the risk of losing customers to rivals and losing market share if it cannot resume delivery growth during Q4.

Moving into 2023, XPeng has the capacity and ability to grow deliveries by triple digits to >250,000 units, but that is entirely dependent on demand. While the OEM is planning to launch at least two new EVs (or up to one each quarter) next year, none of this lineup expansion means anything if deliveries of the P7 and P5 suffer as a result. Aiming to have G9 sales surpass the P7 means XPeng is aiming to reach consistent 10,000 unit volumes monthly, which would impact P7 and P5 sales if the OEM can only average 18,000 units/month with more product launches, or 216,000 units for 2023.

It will be interesting to see the targeted segments for upcoming vehicle launches, as a mass-market approach could be vital in spurring sales and demand for XPeng’s high-tech vehicles, given the inflationary environment and macroeconomic pressures. Targeting a lower-priced segment and forgoing some of the expensive sensor suites for ADAS functions could be a useful approach to keep demand high moving forward over the next four to six quarters.

Leading The Tech Race

Aside from a potential high-volume ramp in 2023 with multiple new vehicles hitting the market, XPeng can also benefit by differentiating itself via a commanding lead in vehicle tech, specifically ADAS (XPILOT, City NGP). XPeng is offering one of the most comprehensive ADAS platforms in China and is continuing to evolve and develop semi-autonomous functions. XPeng also is offering the quickest charging time in the industry for the G9 — its 800V supercharger can charge to 200km range in just 5 minutes. The G9 highlights XPeng’s next-gen software and hardware — XPILOT 4.0, capable of delivering up to level 4 autonomous driving, and X-EEA 3.0, XPeng’s advanced electric and electronic architecture enabling high performance and quick OTA upgrades.

In addition to EVs, XPeng also is foraying into the eVTOL sphere, with the X2 getting a green light to test fly in Dubai this month. While eVTOL are merely a small piece of XPeng’s overall e-mobility push, it’s another outlet of future growth potential should future tests successfully pave the way for mass commercialization.

A Contrarian Opportunity

While shares in XPeng have plunged due to fears of market share losses and slumping deliveries, other key risks are in play: geopolitical risks manifesting in the US implementing chip bans with China, macroeconomic risks in the domestic scene, and market share risks as peers like NIO, BYD (OTCPK:BYDDY), Tesla (TSLA), Geely (OTCPK:GELYY), and others ramp up deliveries.

However, XPeng has multiple catalysts that are expected to surface moving into 2023. These include a resumption to delivery growth from expanded capacity and a growing vehicle lineup, revenue growth matching a growth in deliveries, and a technical-focused bounce from oversold levels after four months of selling pressure.

XPeng’s deliveries are still on track for >30% annual growth this year, on par with peer NIO, but shares have fallen over 70% compared to NIO’s 42%, as XPeng has felt more significant selling pressure, pushing the stock to extremely oversold levels. China has indicated that it will continue to support the broader EV industry, as the nation announced in August “it would extend its tax exemption for new energy vehicle purchases until the end of 2023.” With policy support, delivery growth is probable, especially with the launch of a more mass-market vehicle expected.

Although expanding net losses are also a concern, the majority of the widening loss stemmed from adverse forex impacts. XPeng noted that Q2 non-GAAP net loss expanded to RMB2,464 million, from RMB1,528 million in Q1. However, XPeng recorded RMB938 million in exchange loss from foreign currencies, suggesting that with a stable yuan, losses would not have widened at all. Q3 is expected to feel a similar, if not worse, impact from forex as the yuan weakened a further 3.7% on average during the quarter.

Even so, XPeng’s capacity supporting up to 33,000 units per month can support significant delivery growth depending on demand. A more reasonable forecast for 18,000 units per month on average throughout the year, for 216,000 total units, would represent nearly 60% y/y growth, a level that can drive revenues towards $9.0 billion. At such a level, XPeng trades at nearly 0.7x EV/revenues for 2023, while peer NIO trades at nearly 1.8x. Valuing XPeng at 1.4x EV/revenues, a reasonable multiple given the weaker margin profile alongside ~60% growth in deliveries, would value the company at an EV of $12.6 billion, or ~115% upside to current levels.

Although the risk profile remains cloudy, with multiple key risks that may keep shares depressed, the upside potential to bounce from extremely oversold levels on a technical basis combined with ~60% growth potential next year provides an attractive opportunity to scale into a speculative bet in the single digits. Shares could quickly recapture $13 to $15 given that China has shown a willingness to support the industry, especially if XPeng can push deliveries past 10,000 per month throughout Q4.

Be the first to comment