Ian Tuttle

Roblox Corporation (NYSE:RBLX) fell 21% on Wednesday after the online game platform reported a larger-than-expected loss and continued sales declines.

Roblox’s growth is slowing rapidly, raising concerns about the platform’s ability to generate profits and return to positive free cash flow. With sales growth slowing to just 2% YoY in Q3’22, Roblox’s stock appears to be heading back down.

Because the online gaming platform’s potential is also overpriced based on sales, I believe investors would be wise to avoid the stock.

Concerning Business Trends Continue

First, the bad news: Roblox’s sales likely peaked last year, and the online gaming company appears set to see ongoing sales declines as platform metrics continue to deteriorate.

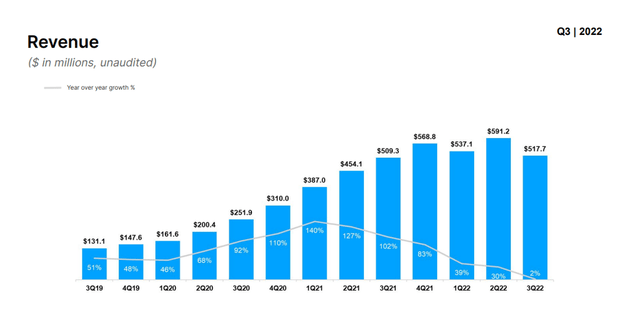

Roblox generated $517.7 million in sales in Q3’22, representing a meager 2% YoY growth rate. Roblox’s sales growth peaked in Q1’21 at 140% YoY, but has since slowed significantly. The third quarter was the sixth consecutive quarter of declining sales growth, and Q3’22 was by far the slowest in years.

Given current sales trends and declining platform metrics, it is not unreasonable to expect Roblox to experience negative sales growth in the fourth quarter.

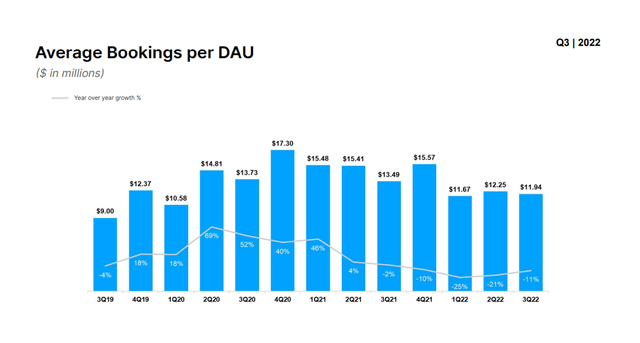

While Roblox’s sales are declining, the trend in average bookings per daily active user is inconclusive. Average bookings for Roblox have stabilized in the third quarter, but this does not mean that average bookings, which are an indicator of sales, are about to skyrocket.

Roblox’s average bookings per daily active user fell 11% YoY to $11.94, but they have stabilized between $11 and $12 and are no longer declining as quickly as they did in Q1’22 and Q2’22, when they fell 25% and 21% YoY, respectively. Roblox’s average bookings per daily active user have dropped 31% since peaking at $17.30.

Q3’22 Average Bookings Per DAU (Roblox Corp)

Where Are The Profits?

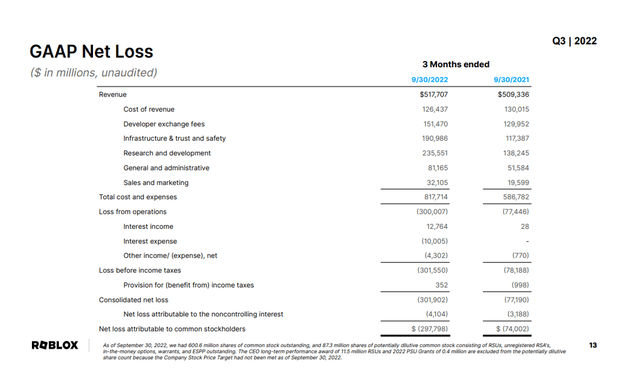

Roblox, like most pandemic high-fliers, is not profitable. In Q3’22, the gaming company lost $300 million on an operating income level, which equates to a loss of 58 cents on every dollar of sales.

Roblox does not have a clearly defined path to long-term profitability, and the declining sales trend suggests that profits will be difficult to come by for a long time.

Q3’22 GAAP Net Loss (Roblox Corp)

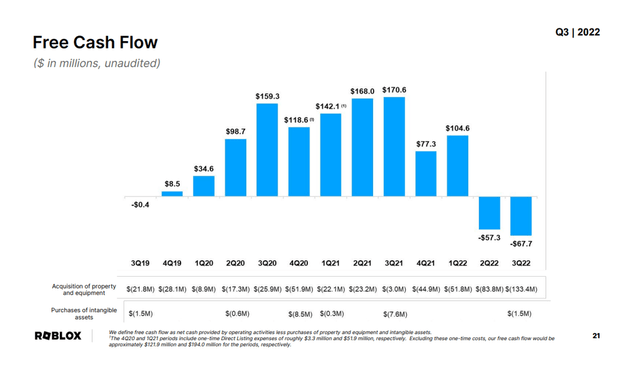

Roblox also lost $67.7 million in free cash flow in Q3’22, up from $57.3 million the previous quarter. It was the second quarter in a row that free cash flow losses increased, reflecting declining user engagement.

Q3’22 Free Cash Flow (Roblox Corp)

Why Pay A Premium?

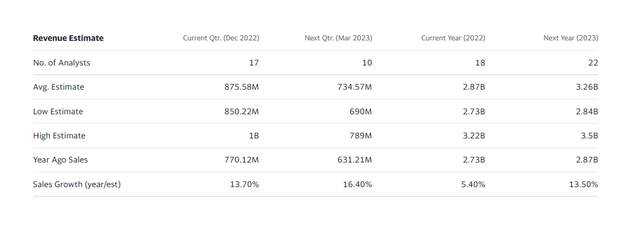

Roblox sales are expected to grow slowly, as online gaming is no longer as popular as it was during the Covid-19 pandemic. The market expects only 5% and 14% sales growth this year and next year, which isn’t much for a company with a sales multiple of 9x.

Revenue Estimate (Yahoo Finance)

Roblox is still trading at a very high price, and the online gaming company has a market value of $20 billion. In my opinion, the sales multiple is completely indefensible, and I believe Roblox’s valuation will continue to fall in the long run due to its complete lack of profitability. Roblox’s stock price has dropped 67% year to date, and more pain may be in store for shareholders.

Why Roblox Could See A Lower/Higher Valuation

Not all engagement trends are negative. Roblox’s ‘hours engaged’ increased 20% YoY to 13.4 billion, but this does not always translate into higher sales for the company.

Roblox has a chance at increasing sales and profit only if users spend money on the platform, and there is evidence that users are cutting back on spending.

For better or worse, a recession could be a catalyst for Roblox’s sales growth and improved performance metrics such as average bookings per daily active user. As people spend more time online during a recession, Roblox’s platform engagement and bookings may increase.

My Conclusion

Roblox is still losing enormous sums of money. Roblox lost approximately $300 million in Q3’22, and its sales are declining.

Average bookings for daily active users, a sales indicator, have fallen 31% from their peak, and the company has now experienced two consecutive quarters of negative free cash flow.

The fundamentals do not match Roblox’s exorbitant valuation, so I believe the stock should be avoided. Roblox’s valuation multiple appears to be set for compression, with a 9x sales multiple and no clear path to profitable growth.

Be the first to comment