With the recent coronavirus pullback in global markets, one name that has been hit harder than the major averages has been technology giant Apple (AAPL). At one point last Friday, shares were nearly 22% off their 52-week high, as investors continue to digest the ongoing news cycle. Today, I’d like to examine 4 key items I’m watching for the company as it regards to the coronavirus situation.

What does the analyst community do?

In this market, sentiment can change quickly. Just two months ago, I was talking about how most analysts on the street had price targets on Apple that represented considerable downside from current levels. Some of these firms even had Buy ratings on a stock that they thought could lose 20%, which didn’t make any sense. Well, with the recent fall in Apple shares, despite the $17 rebound from Friday’s lows, it now appears that every analyst sees the stock going higher from here.

(Source: Apple 3.0 article, seen here)

When it comes to the coronavirus, Apple has noted that its supply chain was impacted a little, and it remains to be seen how long it will be before things return to normal. We don’t know if future products and or services will see their potential upcoming launches delayed, and how economic slowdowns will result in a revenue and earnings hit for the firm. In my most recent article, I explained why I wasn’t a big fan of the delayed versus lost notion regarding overall sales.

Now that the stock has come back down, and there will be at least one quarter of a negative impact from the coronavirus, will we start to see price target cuts come? So far, the street average for fiscal Q2 (the March period) revenues has come down by more than $4 billion to around $61 billion, but most future periods haven’t seen such dramatic estimate cuts. Even if overall markets start to rebound a little, a wave of negative analyst notes could limit the potential rebound we see in Apple shares. It wouldn’t be surprising to see some of those high 3 handle price targets come down a bit to reflect some increased risk in the stock.

Does the company borrow debt with negative rates?

Apple’s balance sheet is regarded as one of, if not the, best corporate ones out there today. The company produces roughly $60 billion in free cash flow each fiscal year currently, and that’s allowed a massive capital return plan primarily through stock buybacks. Until the US tax cut plan was enacted a few years ago, the company was borrowing a lot of money instead of repatriating funds and paying a much larger tax bill.

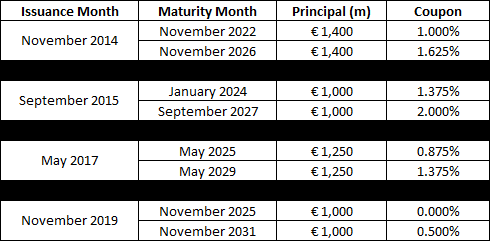

Debt issuances have slowed dramatically in the past year or two, but the company does occasionally hit the market. Back in November, I detailed how management was able to borrow some money in the Eurozone at a zero percent coupon for a six-year term. The table below shows the four most recent Euro denominated bond issues and how rates came down.

(Source: Prospectuses for each set of bonds: November 2014, September 2015, May 2017, November 2019)

A couple of key countries in Europe have seen their 5 or 10-year bond rates drop by around 20 basis points since early November, while US interest rates have also dropped a bit as well. While Apple doesn’t need any extra money, as it still had nearly $100 billion in net cash at the end of its most recent quarter, it would be pretty tempting to float some debt if it would result in negative interest rates now.

The one area that may be helped by virus fears:

We could call this scenario either the Netflix (NFLX) or the Zoom Video Communications (ZM) effect. On the consumer side, those stuck at home might increase their streaming habits, which could boost numbers for streaming names like Netflix. On the business side, instead of traveling, there likely will be an increase in videoconferencing that favors Zoom.

Last year, Apple launched two new services, TV+ and Arcade. You could make the argument that these services, as well as others like Apple Music, could benefit from the coronavirus, and potentially offset some revenue losses from other business segments. It will be interesting to see what management says at the next conference call about this, as the growing services portfolio is one of the key parts of the Apple bull case for the next decade.

Looking at the technicals:

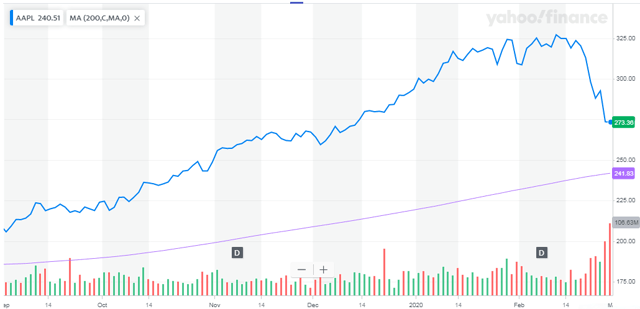

Apple shares had a tremendous rally during 2019 and into the start of this year. Through Friday’s close, the stock was about 16.6% off its all-time high, compared to a 12.9% drop for the NASDAQ composite. Apple shares fell below their 50 and 100-day moving averages in the pullback, but they still remain well above their longer-term trend line as seen below.

(Source: Yahoo! Finance)

Even at Friday’s low, the stock was nearly $15 above the 200-day moving average. If we get another leg down in the markets in the coming days and weeks, I will be watching to see if Apple loses this longer term trend line. The next major point I would look for on the downside would be about $226.67. At that point, Apple shares would yield 1.50% on an annual basis if you assume this year’s dividend raise goes to $0.85 per share per quarter, a little more than a 10% increase. I’ll have more on the dividend as we get closer to the next earnings report which is where management will update investors on the capital return plan.

Final thoughts:

Coronavirus fears have resulted in a major market pullback, and technology giant Apple has certainly felt the pain. How much more of a decline we’ll see is anyone’s guess, and I’ll be watching to see if the street starts cutting price targets with the stock under $275. Estimates are likely to continue lower the longer these fears drag on, but we might see a boost to the services business from those who are stuck home. Management might also use this panic to borrow debt with negative rates, and I’d expect the buyback to be cranked up at these lower levels. Major support remains a bit below where we are now, but a repeat of last week could easily put us there.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Be the first to comment