PonyWang

Tokyo Electron (OTCPK:TOELY) (OTCPK:TOELF) slashed its sales guidance for the second half of FY2023 after memory manufacturers cut CapEx spending and the US ramped up restrictions on cutting-edge chip equipment exports to China.

This cut in guidance is consistent with comments made by some of its main customers such as Micron (MU) and SK Hynix. Some of its US competitors have also warned investors to expect a softening of demand, such as Applied Materials (AMAT) and Lam Research (LRCX).

While we find the guidance cut a little disappointing, this was to be expected to a certain degree, and we believe demand should start growing again in FY2024. One sign that the semiconductor production equipment (SPE) market still has significant growth ahead was ASML (ASML) recently raising its 2025 revenue forecast very significantly. ASML also said that it does not expect the China ban to affect the 2030 outlook very much as “the fabs would be built somewhere else”. We believe the news coming out of ASML helped reverse an initial fall in Tokyo Electron shares after announcing the weak guidance, with shares moving up afterwards. It did not hurt, of course, that shares are relatively cheap at the moment. Despite the weak guidance for H2 FY2023, we continue to believe shares are attractively priced.

Q2 FY2023 Results

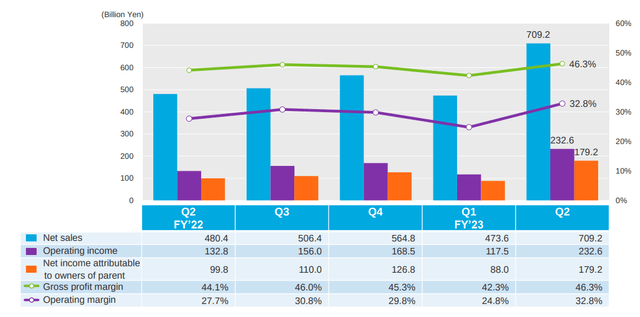

Second quarter revenue was up 48% y/y to 709 billion yen, thanks to improved supply chain conditions and solid demand across its different markets. This means the company delivered record-high quarterly net sales and operating margin, which came in at 32.8%.

The company saw significant sales growth in all products for Logic and NAND. The Field Solutions business also saw an increase in upgrades/modifications towards memory chip scaling and multi-layering.

Logic and foundry sales were up 84% y/y, as customers such as TSMC (TSM) and Intel (INTC) ramped-up investments. DRAM sales fell 17% y/y, but NAND sales were up 113% y/y, as a results of the ongoing transition to 192-layers and above 3D NAND.

Financials

As can be seen in the slide below, gross profit margin and operating margin recovered significantly during Q2 of FY2023. Sales of ~709 billion yen were much higher than previous quarters, which provided operating leverage and allowed the company to post significant profit growth.

Tokyo Electron Investor Presentation

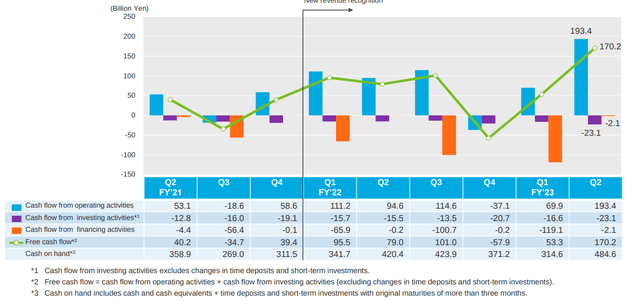

This also resulted in very significant cash flow from operating activities, and free cash flow as well. Free cash flow came in at ~170 billion yen.

Tokyo Electron Investor Presentation

Growth

Tokyo Electron reiterated its belief that the wafer fabrication equipment (WFE) market will continue to grow in the medium to long term.

There are reasons to indeed be optimistic. The global industry association that unites the electronics manufacturing and design supply chain is called SEMI, and they are currently tracking 67 new 300mm fabs, or major additions of new lines, expected to start construction from 2022 to 2025, according to Ajit Manocha, SEMI’s President and CEO.

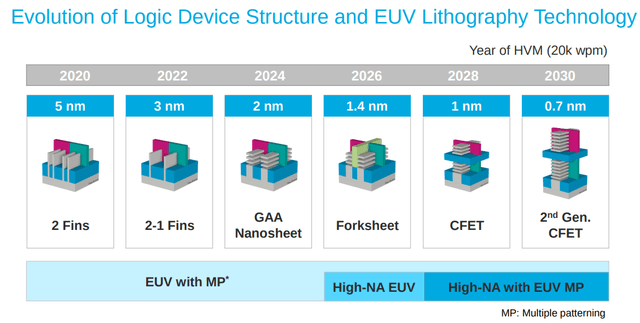

Another reason for optimism about future growth it the exciting technology roadmap for logic device structure evolution. As can be seen below, there are a number of new technologies that should arrive between now and 2030, and which will require more advanced semiconductor manufacturing equipment.

Tokyo Electron Investor Presentation

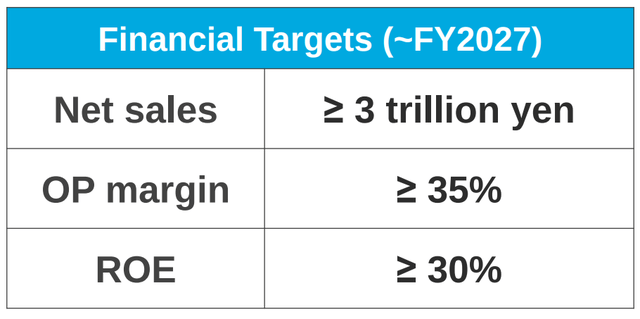

It is thanks to tailwinds like these that Tokyo Electron is reiterating their FY2027 targets of more than 3 trillion yen in net sales, with an operating margin above 35% and return on equity surpassing 30%.

Tokyo Electron Investor Presentation

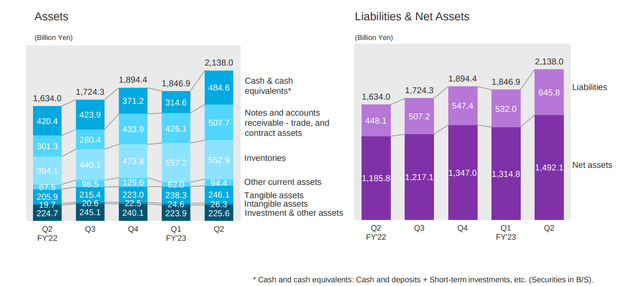

Balance Sheet

As a result of the significant free cash flow generated by the company during the quarter, the balance sheet became even stronger. It now has 484 billion yen in cash and cash equivalents, which is about $3 billion. The company has basically no long-term debt, and its assets are significantly more than its liabilities.

Tokyo Electron Investor Presentation

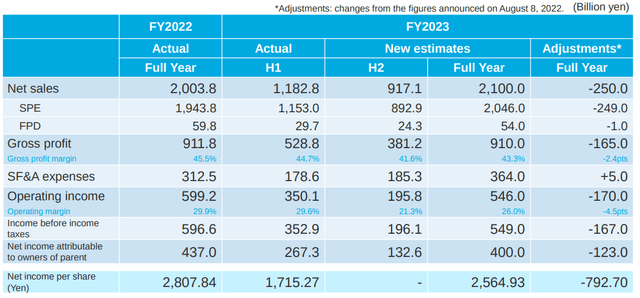

Guidance

Tokyo Electron’s revised financial estimates reflect changes in capex plans of its customers. The new guidance is significantly lower, as can be seen in the table below. For the full fiscal year 2023 net sales are expected to be 2,100 billion yen, which is just a little higher than the fiscal year 2022 net sales of 2,003 billion yen. Net income per share for fiscal year 2023 is expected to be about 10% lower compared to fiscal year 2022. While we are disappointed by the guidance cut, it is completely understandable given the capex reductions announced by its customers and the weakening economy. Our expectation is that net sales and earnings should be in growth mode once again in fiscal year 2024.

Tokyo Electron Investor Presentation

Valuation

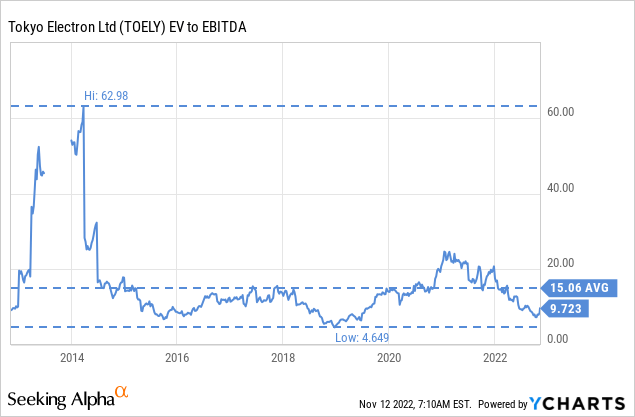

Based on its revised guidance for FY2023, the forward p/e is ~17.3x. We view this as a very reasonable valuation given the quality of the business and the potential for growth to resume in fiscal year 2024. Shares also look attractive when looking at the EV/EBITDA multiple, which is currently below the ten year average by a significant margin.

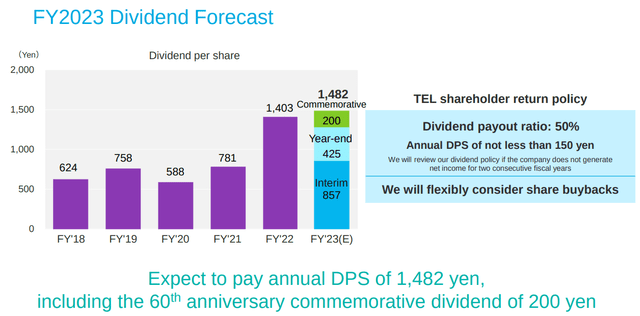

As a reminder, Tokyo Electron has a policy of paying ~50% of its earnings as dividends. For fiscal year 2023 it will also pay a commemorative 60th anniversary dividend. The forward dividend yield is therefore ~3.3% at current prices.

Tokyo Electron Investor Presentation

Risks

In the short-term the biggest risk we see is that this down cycle could turn out to be more severe than it currently seems it will be. The company already reduced guidance, and if things get worse in the economy, it could make further reductions. In the long-term the biggest risk we believe is that of technological disruption. We believe this risk is mitigated by the significant amounts the company spends in R&D to make sure it stays at the cutting-edge of technology for semiconductor manufacturing equipment.

Conclusion

Tokyo Electron delivered very strong Q2 2023 results, but guidance for the second half of the fiscal year was disappointing. Still, we continue to find shares attractive at current prices, and believe that the company can continue to grow longer-term. The company also pays an attractive dividend, which at current prices results in a forward dividend yield of ~3.3%, when including the anniversary commemorative dividend. In summary, we are a little bit less optimistic about the company in the short term, but continue it will do well in the long-term once growth resumes.

Be the first to comment