10’000 Hours

People like games, there’s no question about that. Roblox (NYSE:RBLX) is a $19 Bn market cap company, so that’s not nothing – they must be doing something right. Let’s dive in before we dive in, in case you’ve never heard of it – what is Roblox? Roblox is a game platform that not only allows users to play games, but using their graphics engine – players can build their own games and play them. From Crunchbase:

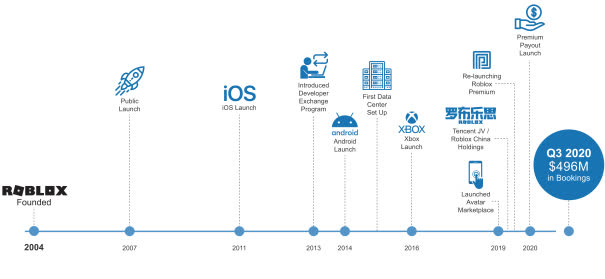

Roblox is an online gaming and entertainment platform for a shared digital experience that brings people together through play. It enables anyone to imagine, create, and have fun with friends as they explore interactive 3D experiences produced by developers using their desktop design tool, Roblox Studio. The company is backed by Altimeter Capital, Dragoneer Investment Group, Investment Group of Santa Barbara, and Warner Music Group. The San Mateo, California-based company was established by Erik Cassel and David Baszucki in 2004.

Roblox uses the freemium model, meaning it’s free to play, and then you can choose to pay money and buy Roblox money for in-game benefits.

Fundamentals

The fundamentals for Roblox are not great, especially compared with their peers. That’s not why we like this stock, but let’s get the negativity out of the way. This was covered in depth on Seeking Alpha previously:

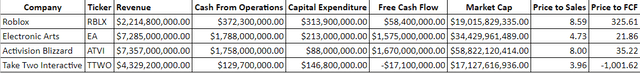

Before going through RBLX’s financials, I wanted to see how Mr. Market valued the company compared to other video game makers. I compared RBLX against Electronic Arts (EA), Activision Blizzard (ATVI), and Take-Two Interactive (TTWO). These companies are responsible for video game franchises, including John Madden Football, Call of Duty, World of Warcraft, Red Dead Redemption, and Grand Theft Auto. Since RBLX is a much younger company, I will look at its price-to-sales ratio in addition to the free cash flow (or FCF) multiple that has been placed on it. I am not a fan of P/S, but there are many investors who are, so I wanted to see how this metric correlated to what could be considered its peers.

RBLX has a market cap of $19.02 billion compared to $17.13 billion for TTWO, $34.43 billion for EA, and $58.82 billion for ATVI. In the table above, I have listed revenue, cash from operations, capital expenditure, and FCF, which I will use a trailing twelve-month (or TTM) number for.

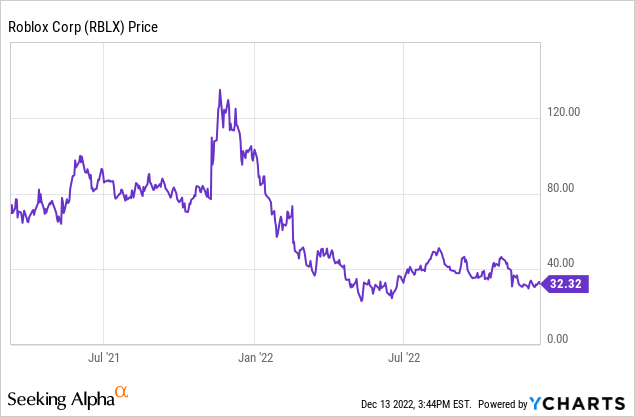

Now, let’s look at the chart:

The stock was above 120 in 2021 before the public markets downturn. Some believe the valuation to be still high, but we think Roblox is going to pick up steam in the long term.

Roblox is operating at a loss, so what can we possibly say positive about the financials? Well, for one thing, the revenues are growing. In 2018 revenues were 325 Million and in 2021 they were 1.9 Billion. That’s a positive upward trajectory, even if the costs have kept up the same pace or greater.

According to analytics provided by Seeking Alpha, Roblox has a D- growth grade, which is not super. However, year-over-year (YOY) revenue growth is 33.39% or B+ (Compared to an average of 7.35% for the sector).

The thesis here is that a strong fundamental base is forming, and while the numbers as they are do not warrant a strong buy, our thesis is that it will form in the next few quarters to a year (or two, worst case).

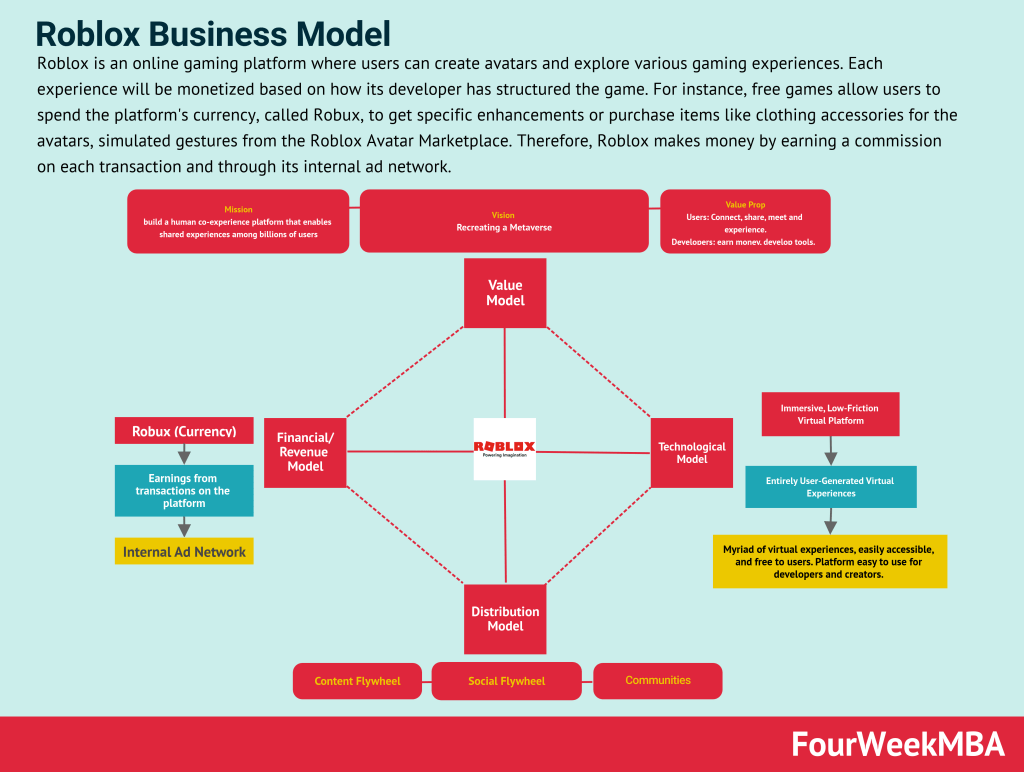

The Roblox business model

Roblox is not just a gaming platform, it’s a virtual world – similar to Meta (META).

Roblox Financial Prospectus

Here’s a good explanation of what that virtual world really is:

Roblox has, over the years, championed a new virtual reality category; they called “human co-experience,” a form of social interaction that combines gaming, entertainment, social media, and even toys. This category, called metaverse, is a virtual universe of 3D virtual spaces.

FourWeekMBA

One could say that Roblox is the Web 3.0 that combines multiple features beyond just your traditional online portal/gaming system. It’s an entire economy, but unlike the multiplayer role-playing games, Roblox allows users to build their own games and essentially create their own content.

Value in gaming platforms

You have to be a gamer to understand this, but gamers are very territorial. Gamers who play on Nintendo Switch are likely to use it 90% of the time, and the same applies to PC games, and game platforms like Roblox. What Roblox has is unique compared to other platforms, and their user base is huge. Let’s look at some of the numbers here:

1.) Roblox has more than 58.8 million daily active users as of Q3 2022.

2.) Roblox recorded 13.4 billion hours in user engagement in Q3 2022.

2.) Roblox crossed the 200 million monthly active users mark in April 2021. Currently, Roblox has 202 million MAUs.

3.) Robux is the in-game money of Roblox.

4.) Roblox is expected to cross the 3 billion mark of accounts created.

5.) Roblox has had over 12,000 billion hours of user involvement to date. Out of those 12k hours, 13.4 billion hours of engagement came in Q3 2022.

6.) Roblox presently hosts over 24 million “experiences.”

58.8 Million active daily users is a huge amount of users. I think that Management knows what they are doing, which means they should monetize that in better ways. Of course, that’s just my opinion – I could be wrong. I believe that if you have built a company up to the size of Roblox, you have to have a combination of book smarts and street smarts.

If you look at the rise of various PC and console gaming platforms, it takes time to grow. Many people have still never heard of Roblox (our family only learned about it because of our 6-year-old, and I’m not sure where a 6-year-old learns about such things). It will continue to spread and gain adoption, and meanwhile, the management will tweak the model to further optimize their ability to monetize.

Our own experience

Our kid grew up playing simulation games on the PC like Sim City when he was 3. He just liked to make tornadoes and zombies destroy a city, but we felt it was better than other games, and he learned a lot playing Sim City. When he got bored with that we got Steam which is an Epic Games product (privately traded), and you can buy games, and they are all run on Steam engine in one account – it’s a great system.

But Roblox is something totally different, maybe because players can make their own games. Our son begs us to play, and we even had to set a 1-hour timer on it. Some of his favorite games include soup factory, where you make soup by choosing ingredients, and then you have to sell it. We have watched him playing to make sure there are no bad things and the games are all simple for his age and other players are there in real-time (real people, not bots). He loves it, and we have avoided buying anything as yet. But the point of sharing is that we have used multiple gaming platforms with our child and something about Roblox is very addictive, and it’s not just shooting and kicking.

Of course, Roblox is a great babysitter – when he’s playing, he’s totally engaged.

The long play

Epic Games has a similar valuation, although it’s hard to compare market cap to market cap because Epic Games is private. Epic Games was founded in 1991 which is more than 30 years ago. Roblox was founded in 2004 but not released until 2006 – so it still has a long way to go in order to move forward.

One huge demographic that is beneficial for Roblox is the post-pandemic work/school from home movement. Families are spending more time at home in general, and that’s going to allow more gameplay time. Compared to other platforms, Roblox has an engaging interaction that is addictive and interactive – both kids and parents like that.

We feel that, overall, Roblox is a buy-and-hold for the long term – but it may take a while for this demographic trend to percolate.

Be the first to comment