HJBC

Introduction

Shareholders of Amazon (NASDAQ:AMZN) stock have had a tough year so far. The stock is down close to 50% so far this year and seems to have lost all near-term upside momentum over the last couple of weeks. There have been a couple of serious hits for investors in Amazon this year with a massive drop after the first quarter results and another one after the third quarter results. Many people would say to you that these drops just offer new buying opportunities, and you should load up some more. As a shareholder of Amazon, I would be urged to say the same. Reading Seeking Alpha, you will come across many different opinions on Amazon. Just by looking at the last 10 articles published there are extremely bullish contributors with strong buy ratings and very bearish contributors with sell ratings (and everything in between). I don’t think this should be surprising as Amazon is a difficult company to judge. With hundreds of billions in revenue, loss-making quarters, a high-growth cloud ecosystem, a struggling eCommerce business, and thriving subscription services, Amazon offers a wide offering of discussible items. So, what should you do with Amazon?

I am investing for the long-term and Amazon’s incredible ecosystem, moat, and exposure to high-growth industries are to my liking. If you are a short-term trader, this article will not be for you. I believe Amazon has several growth drivers that make it a no-brainer investment for the long term. Yet, I believe it is hard to predict whether the current price weakness is a good buying moment as there seems to be more weakness ahead for the economy and Amazon. At the same time I feel like the long term prospects are being underestimated by both investors and analysts.

This is my initial thesis on Amazon. Let’s get to it!

Amazon.com Inc.

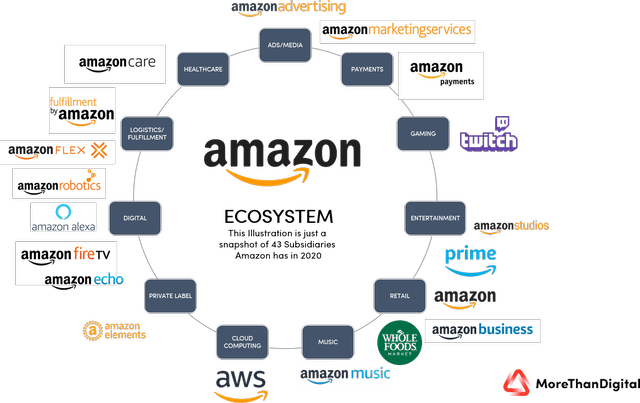

Amazon will probably not need much of an introduction, but I will give a short one anyways. Amazon is an American multinational technology company that focuses primarily on cloud computing, eCommerce, online advertising, and streaming. Besides significant exposure to the above-mentioned industries, it also has highly competitive exposure to E-books, AI, robotics, and smart home products. Amazon is a huge conglomerate with a massive ecosystem of products. To most people, Amazon will be known for its eCommerce segment and through this realizes hundreds of billions in revenue annually.

Besides being exposed to many different industries, it is also the biggest player in many of them. Amazon is the #1 eCommerce platform, smart speaker provider, cloud computing service (AWS), and live streaming service (Twitch). Amazon combines many of its popular services through a subscription plan, Amazon Prime.

One of the most popular parts of the subscription service is Prime Video, the video streaming service owned by Amazon. The company distributes a large number of entertainment forms through services such as Amazon Music, Twitch, and Audible. To fight the competition in the video streaming industry, Amazon created its own film studios through Amazon Studios with the highlight of the studio being the producer of the Lord of the Rings series.

Amazon ecosystem (MoreThanDigital)

What is causing problems for Amazon?

The latest earnings release has been analyzed enough by now, so instead I want to focus on what issues Amazon has been running into in order to define the halving of the share price YTD. In the introduction, I have already mentioned some of these problems.

The biggest one is the profitability problem. While Amazon managed to report sales growth of 15% over the latest quarter, operating margin and free cash flow did not follow this pattern. Where the operating income was $4.9 billion in 3Q21, this decreased to $2.5 billion over the latest quarter. The North America segment operating loss was $0.4 billion compared to $0.9 billion in profit in 3Q21. International saw an even bigger loss of $2.5 billion. This means these two segments lost a total of $3.4 billion. As most of this revenue comes from the eCommerce business these segments already operate with very low margins. With the impact of a sudden growth slowdown, extreme inflation, high fuel costs, and too many people working in distribution centers, Amazon’s operating margin fell. All these factors are pressuring profitability for Amazon, but most of these seem to be temporary. Management is working on improving profitability and has stated that this should be the low point from a profitability standpoint. Still, Amazon has seen an incredible increase in operating expenses as a result of these headwinds which then resulted in negative cashflows. These do not immediately need to be a problem for Amazon as the company still has over $50 billion in cash on the balance sheet, but taking on more debt is not preferred.

AWS operating income was a positive $5.4 billion, which was an increase compared to the $4.9 billion of 3Q23. This kept Amazon’s bottom line in the green.

When considering the very important free cash flow, there is not much room for positivity. Over the last 12 months, free cash flow was a negative $19.7 billion compared to a positive free cash flow of $2.6 billion in the 12 months before.

This all sounds very bad and I am not going to be able to tell you that it is not. Yet, these headwinds are temporary and should dissipate over time and bring up profitability again. In addition to this, I expect Amazon to become much more profitable in the future as business segments with higher growth than retail will become a larger part of revenue and drive up the operating margins.

Overall, current profitability and cash flows are worrying, but with these issues being temporary this should not be of any worry to long-term investors.

A second problem I would like to point out is the forecast given by management for 4Q22. Amazon guided for $140 to $148 billion in sales, meaning growth will slow down significantly to just 2% – 8%. Operating income is expected to be between $0 and $4 billion. This estimate was far below the consensus estimate of over $155 billion in sales. These are the reasons Amazon gave for the lower forecast:

Our results are inherently unpredictable and may be materially affected by many factors, such as uncertainty regarding the impacts of the COVID-19 pandemic, fluctuations in foreign exchange rates, changes in global economic and geopolitical conditions, and customer demand and spending (including the impact of recessionary fears), inflation, interest rates, regional labor market and global supply chain constraints, world events, the rate of growth of the Internet, online commerce, and cloud services, and the various factors detailed below.

I feel like Amazon is being overly conservative with this forecast and with inflation easing over the last couple of months and the dollar losing some strength, this could lower the FX and inflationary impact on the results. In addition to this, consumer spending remains to be relatively strong which could cause a better than expected quarter. While the outlook might be bad, I think this opens up for a significant amount of upside and analyst revisions.

Three main growth drivers

By looking through the near-term headwinds, we can see the amazing long-term potential for Amazon. Amazon is exposed to incredible growth trends and has a strong market position in many industries giving it a strong moat. I continue to see strong growth for Amazon going forward and eventually also margin expansion as other business segments with higher margins increase as a share of revenue.

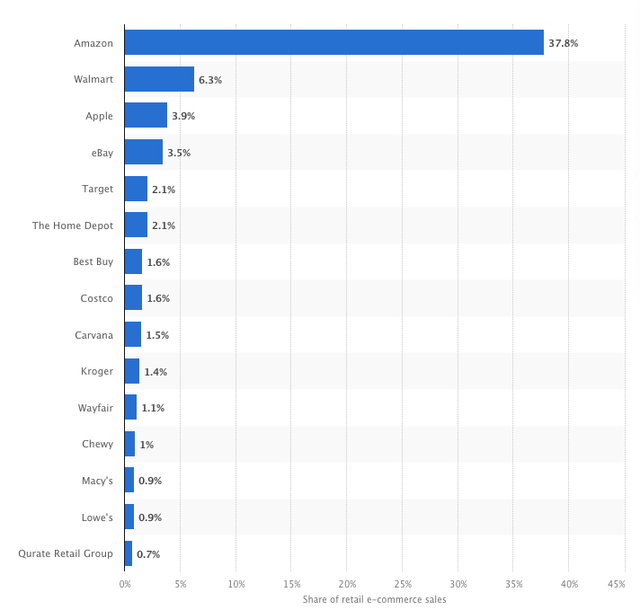

Amazon is in a great position to realize future growth through its eCommerce segment. Amazon has done several things really well in the past that will benefit them in the future. These include investments in its own delivery network and consumer retention by offering many services through its Prime subscription. Amazon has a market-leading 37.8% market share in retail eCommerce in the US as of June 2022. This gives Amazon an incredible moat.

Marketshare eCommerce in the US as of June 2022 (Statista)

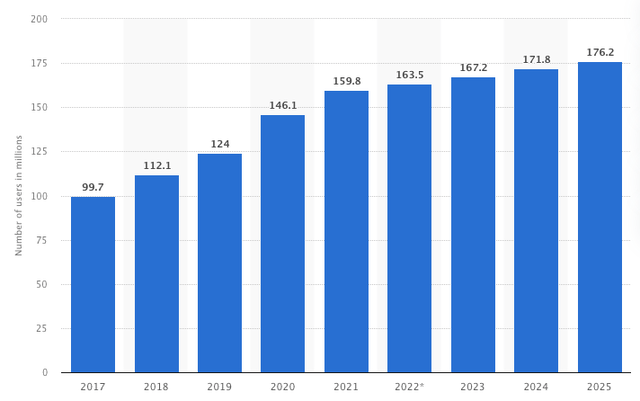

To keep its market share, Amazon can leverage delivery opportunities through its own delivery service (such as same-day delivery) and attract customers by offering attractive upside through its Amazon Prime subscription (such as discounts and other advantages). Amazon Prime offers multiple services such as same-day delivery, streaming through Prime Video, using Prime Music, and much more. Most of all, the subscription offers customers the opportunity to benefit from the best deals offered through Amazon. Amazon Prime subscribers now total more than 165 million. Amazon Prime subscriber numbers are expected to increase to over 176 million by 2025.

Amazon prime subscribers in millions (Statista)

Amazon has been losing market share in the eCommerce market over the last few years with other large retailers such as Walmart (WMT) increasing their focus on the eCommerce market. Still, Amazon remains to be by far the largest eCommerce company and is in the #1 position to benefit from the growing eCommerce market as part of the digitalization trend. The eCommerce market is projected to be worth $904.9 billion today and will continue to grow rapidly to a massive market value of $1.7 trillion by 2027. Even if Amazon’s market share would drop further to just 30%, this still equals over $500 billion.

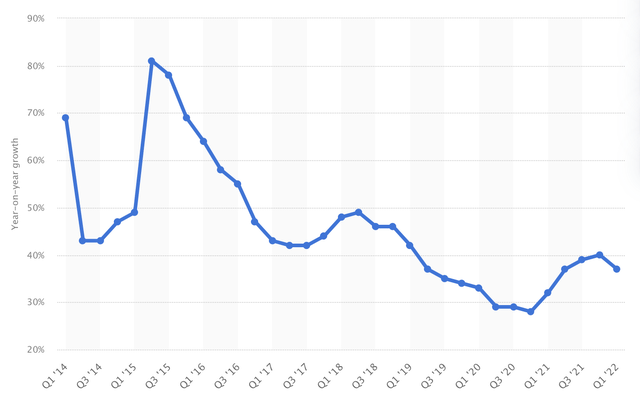

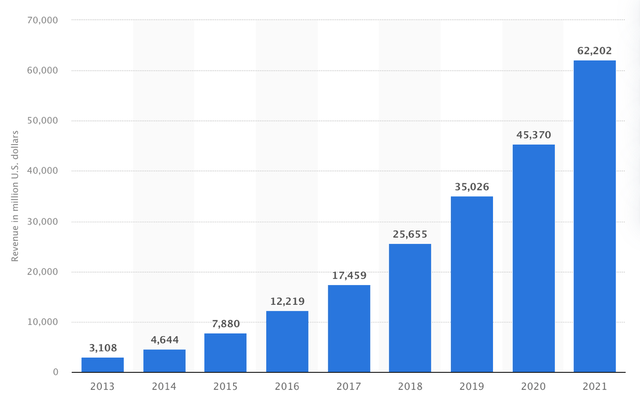

Secondly, AWS has been and increasingly is, the most important growth and profitability driver for Amazon. With AWS becoming a larger part of Amazon, this will have some serious advantages for Amazon’s profitability. Even more, lots of contributors on Seeking Alpha have stated that they think that AWS by itself is worth the current market cap of Amazon with the segment generating $62 billion in revenue in FY21 and growing at close, or over, 30% while maintaining strong margins of around 30%. It is safe to say that based on operating income of 2021, AWS as a separate company could be worth around $740 billion (P/E of 40).

AWS segment growth rate (Statista) AWS segment revenue (Statista)

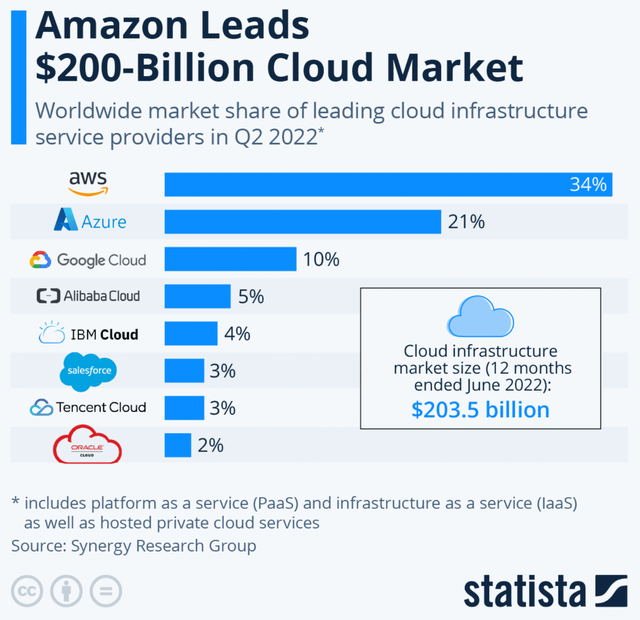

Driving growth for AWS going forward will be its strong market position in a growing industry. The shift towards the cloud is still strongly continuing and is not expected to slow. According to Fortune Business Insights, the global cloud computing market size is expected to grow at a 17.9% CAGR through to 2028. The total market size in 2028 will be $791.48 billion and therefore creating a massive opportunity for AWS. AWS is already the largest cloud platform across the globe with a 34% market share.

AWS has had the first-mover advantage for a long time now, but Azure (MSFT) and Google Cloud (GOOG, GOOGL) are gaining market share. Azure is being a fierce competitor for AWS as the platform offers more possibilities to clients. I expect AWS’ market share to drop slightly over the next couple of years to about 30%. Yet, a 30% market share in an $800 billion market is still offering massive growth potential.

In the end, AWS has a strong market share in one of the most promising industries. With the market expected to grow at close to a 20% CAGR, I believe AWS should be able to keep growing close to 20% until 2028. The recent slowdown seems worrying and looks to be an industry-wide trend with the same happening for Microsoft’s Azure segment. Cloud growth might dip going into 2023 but will definitely rebound over the next couple of years. Eventually, growth in the AWS segment will drive both growth and profitability for Amazon as a whole.

The final growth driver for Amazon I want to point out right now is advertising. This is not something people relate with Amazon, but Amazon is one of the largest advertisers in the world. During the third quarter, Amazon reached $9.5 billion in advertising revenue, growing 25% YoY. This shows advertising growth is more resilient than industry-dominating companies like Meta and Google. Growth even increased compared to the previous quarter. So, what makes Amazon so attractive to advertisers? It is primarily the fact that Amazon does not need to track its customers – the customers simply tell Amazon what they want by typing this into the search bar on the Amazon website/app. Amazon then brings up other relevant products compared to your search as an advertisement. This makes Amazon very attractive to advertisers as the platform attracts way over 2 billion customers every month.

Amazon held a 14.6% market share in the digital advertising market as of late last year. This puts Amazon in a strong position to benefit from yet another strong growth trend. The digital advertising industry is expected to grow at a 13.9% CAGR until 2026 to reach a total market cap of close to $800 billion. Amazon still has great potential to gain market share on Meta and Google as the platform keeps growing and Amazon expands its advertising efforts into Prime Video – another huge advertising growth opportunity.

In addition to a strengthening market position and growing advertising market, this segment also holds very high margins as shown by Google and Meta. Therefore, I believe that a fast-growing advertising segment will be beneficial to Amazon’s bottom line. Advertising will grow faster than Amazon as a whole and therefore become a larger part of total revenue. This will result in margin expansion for Amazon and advertising will be a strong driver of free cash flow as well.

I think we have established now that growth will not be the issue for Amazon, and I think it’s fair to assume that Amazon will continue to grow by solid double digits over the next decade after a possible dip in 2023. Analysts’ expectations are telling us the same story with growth in the low double digits until 2027 and no dip in 2023. I think Amazon will outperform its fourth-quarter expectations and those of analysts which will result in an upwards revision by analysts. I believe Amazon will grow closer to 15% until 2027. Bottom-line growth will be growing at a much faster clip as inflationary impacts disappear and investments drop as a percentage of revenue. Just as I explained above, the revenue mix will be another contributor to higher margins. Analysts project massive bottom-line growth from 2024 onwards as can be seen below.

Valuation & Balance Sheet

From a valuation standpoint, Amazon is a tough one. Amazon is and has been, an expensive stock. Yet, this has never stopped it from generating massive returns in the past. If we look at the current valuation metrics Amazon receives a D- for valuation from Seeking Alpha. EV/sales now stands at 2.05 and is 40% below its 5-year average. Price/Sales is 1.85 and 44% below its 5-year average. From a historical standpoint, Amazon does not look as expensive as it has been. Of course, that does not make it cheap, but considering both top and bottom-line growth prospects it is not that expensive. Fellow contributor Ben Alaimo wrote and calculated in his recent article on Amazon a fair value price of $184 which would make the stock undervalued by over 50%.

Amazon’s balance sheet is also not the prettiest. The company does have a strong cash position of $56.8 billion, but the debt pile is massive at $164 billion. Considering Amazon has not been able to generate decent free cash flow lately, this is a bit of a worrying sight. The cash position has come down in recent years and the debt has been trending in the opposite position (increasing significantly). The large amount of cash does allow Amazon to continue investing in the business without taking on much more debt.

Risks & Conclusion

While I have just laid out the largest growth drivers and believe the company has great long-term growth potential, the stock is not without any risks. The main risk to Amazon at the moment remains to be the economy combined with inflation and rate hikes. As Amazon is highly exposed to consumer spending on its eCommerce platform, a potential recession poses a serious risk. So far unemployment is not becoming a problem yet and let’s hope it won’t at all, but there is a significant chance that unemployment will rise in 2023 when we end up in a recession. This will then have a significant impact on consumer spending and growth potential for Amazon. In addition, there is already a slowdown visible within the cloud computing industry as businesses are postponing IT spending. With continued high inflation and less sales growth, the bottom line for Amazon will not be getting better in the near term. And that is exactly the problem for now. The near-term impact of economic worries is highly unpredictable, and no recession is the same as the one before. I, therefore, find it hard to decide whether you should buy Amazon right now or wait out further downturns. One positive signal are the latest reports on inflation coming down, so this should help Amazon as fuel costs also trend lower.

I do know that from a long-term growth perspective this company is a no-brainer to me, and I see great growth ahead. Whether this is the bottom is not a question I can answer right now, but I do feel like a lot has been priced into the stock already, resulting in a significant drop so far this year. To me, Amazon is a strong buy at prices below $100 per share as I feel like downside risk is limited. I do recommend buying in small bits as there could very well be better entry prices coming.

Long-term, the main focus will be on whether Amazon can significantly improve profitability and free cash flow. Amazon has the levers to increase profitability, but it needs to use them as well.

For now, I rate the stock a Strong buy as I see a strong outperformance for Amazon over the final quarter of the year driven by better economic data, a falling dollar, and low expectations by management. Amazon is close to its yearly low and I feel like reactions have been overdone. For me, a lot will depend on its 4Q22 earnings as these will dictate where the stock will go over the next year.

I rate the stock a Strong buy as I feel like Amazon has strong long-term tailwinds thanks to its exposure to high-growth industries such as cloud computing and advertising. Yet, I do believe there is still a significant risk of more weakness over the next 6 months as we get a better idea of where the economy is headed.

Be the first to comment