Coupa headquarters in Silicon Valley Sundry Photography

Coupa Software Incorporated (NASDAQ:COUP) is the leader in the Business Spend Management space (BSM). While it competes with the likes of major ERP (Enterprise Resource Planning) software players such as Oracle (NYSE:ORCL), SAP SE, (NYSE:SAP) and Workday (NASDAQ:WDAY), it is a pure play focusing on Business Spend Management.

BSM includes accounts payable management, supply chain management, sourcing and procurement among other spending and related functions – a comprehensive, outsourced SaaS (Software as a Solution) managed on Coupa’s platform.

The BSM space has a lot of potential to grow – Fortunate Business Insights expects the global market to grow at a CAGR of 11% from $15.7Bn in 2022 to $39Bn by 2029

Strengths

Focus and Leadership

Coupa is the leader in the payment management space and unlike other enterprise software providers with several products, focuses and offers the best solutions in this segment. Unlike the much larger Oracle and SAP with slower growth, it has focused strictly on the spend management space where it has grown revenues at an astounding CAGR of 47% from FY2015 to FY 2022. All additional modules, such as the recently introduced travel expense management and other upsells such as procurement analytics are also focused on BSM.

Network Effect

Coupa has a large network affect. With its more than 8 Mn suppliers, it makes the platform more attractive to suppliers and buyers who benefit from a wider range of purchasing options. As more businesses subscribe to their BSM platform, the collective spend under management on the platform grows. The greater the total amount of spend under management the more attractive the platform is to suppliers. As more suppliers join their platform, their clients benefit from a broader range of purchasing options, which in turn encourages greater use of the platform by existing customers, while also attracting new customers to their platform. This network effect creates tremendous leverage for the company and is a huge competitive advantage.

Cost Saver

Coupa is marketed and branded as a money saver – the first questions CFO’s and Controllers ask…

- How much can I reduce in Accounts Payable/Accounting headcount?

- How can I get the best procurement?

- How can I get the cheapest deals out of my suppliers?

- How can I get my department heads to stay within budget?

- How can we ensure that no payments have been made without the proper approvals?

Coupa’s strength is establishing a process, which ensures that department heads stay within their budgets and approve purchase requisitions, FPA (Financial Planning and Analysis) departments reconcile the requisitions against budgets and Accounting departments processes transactions with controls in place and finally back end transactions are seamless integrated with accounting software and reconciled with minimal manpower.

Switching Costs

Last week, I wrote about switching costs between payroll providers, stating how painful, expensive and time-consuming it was to switch payroll providers and that this was a real moat. I believe in Coupa’s case it is even more of a moat, because this is a company-wide solution, across every department head that approves expenses, to FP&A, which budgets for the same, to accounting that processes the transactions. Coupa has a retention/renewal rate of 94-96%, which bears testimony to the success of its platform. Renewals are key to this business, Coupa routinely loses money in the money with new customers in the first few quarters with expensive onboarding and training/service delivery.

Bundling and Upselling

Besides procurement, supplier management and payments, there have been several strategic complementary offerings for bundling, upselling and cross selling.

These include Supply Chain Design and Planning, Strategic Sourcing, Supplier Risk Management, Treasury, Contract Management, Travel Expenses and Reimbursements, Coupa Pay via virtual cards, and Spend Analysis. All efforts to keep the customer with minimal acquisition costs and provide key benefits at reasonable prices.

Weaknesses

Stock Based Compensation Hurts Margins

While Coupa has shown good operating leverage with high gross contributions of about 75% of on a non GAAP basis, on GAAP basis accounting it has a different story to tell. In FY2021 and FY2022, GAAP based gross contributions dropped to 59 and 57% respectively, as compared to an average of 66% in the preceding four years. The vast majority of the difference was stock based compensation. If you’re paying employees more for onboarding and service delivery, which are the two of the largest components of cost of sales, clearly you’re hurting your leverage to cover fixed expenses.

That is, your contributions are not enough to cover Selling, General and Administrative expenses, which also includes R&D. As a consequence, your road to profitability is going to get much longer. The success of SaaS based companies depends on getting enough gross or variable margins to cover fixed costs, specially R&D, which is their lifeblood – basically their platform or software has to be strong enough to generate enough margins without extra personnel support. And Coupa has not demonstrated that yet.

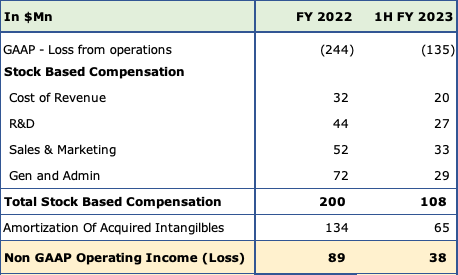

Coupa Stock Based Compensation (Coupa 10K, 10Q)

Stock based compensation at $200Mn was 28% of 2022 revenues of $725Mn, and at $135Mn, 27% of $407Mn in the first half of FY2023. The swing from operating losses to income is quite large and while this is de rigueur in Silicon Valley among tech and other SaaS companies, the size is worth pointing out for those inclined to more conservative valuations.

Longer Sales Cycles

Coupa has an average sales cycle of 6-9 months, which is common for enterprise software companies, but given the slowdown in the tech sector this is likely to get even longer. Coupa’s goal is get larger customers who spend $100,000 a year, and an outlay of this size does require long sales cycles.

Convertible Debt

Coupa carries $1.6Bn of convertible notes maturing in 2023, 2025 and 2026, which is about 50% of their total balance sheet of $3.2Bn. With strong cash flows (more than 20% of revenues) there is no immediate threat and the business is doing very well. However, given the recessionary trends and slowdown in growth there are either possibilities of dilution on conversion or the need to raise cash should the notes not convert.

Dilution

Coupa had 60.4Mn diluted shares outstanding as of FY-2019, which ballooned to 75Mn by FY-2022, a dilution of 25% in three years. This is likely to go up by another 7-8% this year to about 80Mn shares.

There was a recent Downgrade from Piper Sandler citing some of the same issues, that I’ve mentioned here.

Opportunities

Supply chain disruption and or migration out of Asia, could be a huge opportunity – I can see Coupa having an edge for three reasons.

a) They have a large database of 8Mn suppliers all over the world, which they can springboard on.

b) They have a lot of domain expertise in this area, which is a big deal in enterprise software

c) Spending on ERP is not small, you can see that from the 6-9 months sales cycles. Getting a customer to cough up $100,000 each year is not easy. To be sure, if you’re a customer spending 100K a non spending specialist may not cut it, it would make sense to stay with the specialist or go to the specialist.

Coupa rates a very impressive 4.6 in the BSM space according to Gartner. SAP is rated 4.3 and Oracle 4.1 in the same report, with two others getting higher scores at 4.8 and 4.7.

With a recession looming, Coupa’s ability to save clients money should also be a strong tool they can exploit.

Threats

The biggest threat to Coupa is an economic slowdown and in any B2B business this is usually quite pronounced. We’re already seeing this with comparatively slower growth of 18% as compared to 47% in the last seven years. Spending budgets get hit and any non-productive expense is usually cut first!

I had mentioned switching costs as a moat for Coupa, however, conversely this can be a millstone as well – when you’re trying to get a new client to switch business and accounting systems. While integration with accounting is usually seamless for mid size and smaller companies, larger companies with entrenched legacy systems find it much difficult to switch. For example, if you’re using SAP to run all or most of your business processes, you would definitely consider SAP’s ARIBA first for spend management, which is a very strong competitor to Coupa in that space.

I believe obsolescence is a definite threat. Piper Sandler talked about Zip as a credible competitor. Even a relative young Coupa (15 years old) can’t race to make their interface or systems the easiest or most user-friendly. If the decision makers at your potential customers are younger and used to finger swipes to make decisions, you will have trouble selling a system that needs to be installed or onboarded, even with a short learning curve.

Valuation and Investment Case

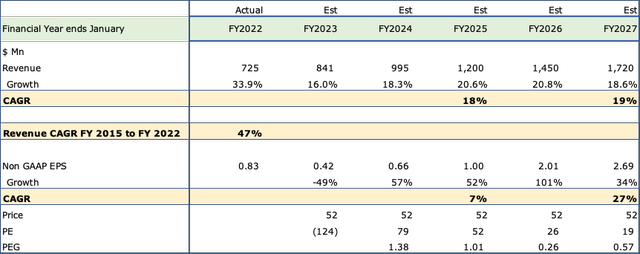

Coupa Investment Case (10K, Seeking Alpha Estimates, Fountainhead)

I expect Coupa’s revenues to grow at a much a lower 18-19% rate over the next 3 to 5 years compared to the heady 47% growth of the last seven. Non GAAP Earnings should grow at 27% over the next five. P/E multiples remain elevated till FY 2026, though, and perhaps will likely keep the stock sideways till other catalysts emerge or we get respite from interest rate hikes.

Coupa’s stock has fallen to 20% of its 52 week high of $250 and to 14% of its all time high of $357! Most of the weaknesses of slower growth, longer sales cycles and economic recession are already in the price. There is a possibility that the stock will go sideways given the current bear market, but I’m willing to accept a 10-20% downside for a much larger potential upside in the next 3 – 5 years.

Coupa’s market cap of $3.9Bn or 4.15X Sales of $841Mn is lower than valuations of other tech and SaaS companies, as the CNBC article on Starboard’s stake in Salesforce suggests.

I’m rating Coupa as a buy for one main reason, it is far more valuable to an acquirer than a stand-alone company. Building a Billion Dollar, B2B successful business with one major focus area (BSM) in the enterprise software arena, with entrenched clients and a switching costs moat, is an extremely difficult, lengthy and expensive endeavor.

Be the first to comment