Justin Sullivan

Thesis

Tesla (NASDAQ:TSLA) is a high risk/high reward stock, mostly because it doesn’t currently generate enough profit to justify its current valuation. However, the stock could continue to outperform assuming that Tesla can continue to grow profits quickly. Considering potential risks and rewards, I believe that Tesla is near fair value today. But since the stock has often traded above my fair value estimate and is near its lowest level in two years, now may be a good time to buy some shares.

How Much Is Tesla’s Operating Profit?

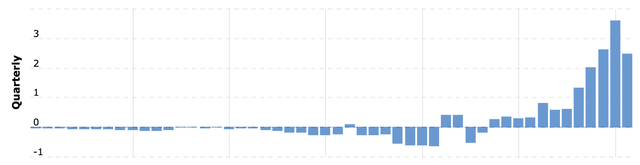

TSLA Quarterly Operating Profit ($B) From MacroTrends

Tesla has a history of profitability going back to the second half of 2019. Since then, profits have grown rapidly. In the most recent quarter, Tesla reported a record $3.688B income from operations, up 88% year over year. Over the past year, Tesla generated $12.37B in operating profit.

Why Does Profit Matter?

The most commonly cited valuation metric is the P/E ratio. The “E” in this ratio refers to earnings, which are largely determined by operating profit. Because of Tesla’s high P/E ratio – 66 at the time of writing – Tesla must grow earnings quickly to justify its current valuation.

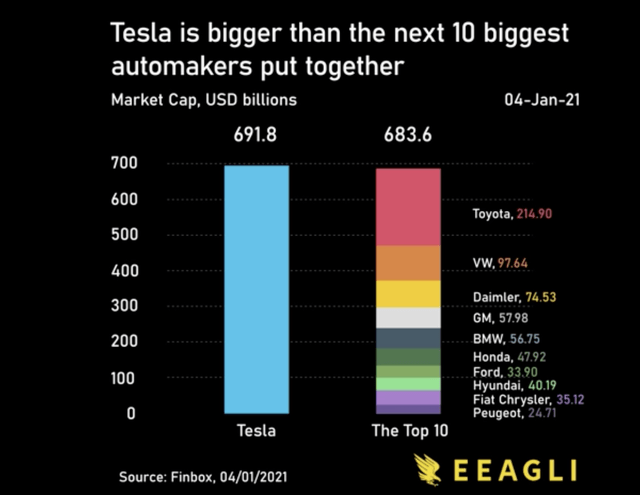

For reference, here is a chart (from last year, but still surprisingly accurate) comparing Tesla’s market cap to that of other automakers.

Many assume based on this chart that Tesla must eventually generate more profit than all other automakers combined to justify its current valuation. Right now, Tesla is nowhere near that level:

| Ticker | Operating Profit ($B) |

| Volkswagen | 19.01 |

| Toyota | 26.22 |

| Daimler | 26.5 |

| GM | 7.72 |

| BMW | 13.6 |

| Honda | 7.8 |

| Ford | 11.67 |

| Hyundai | 4.8 |

| Fiat | 19.01 |

| Peugeot | 4.6 |

| Tesla | 12.37 |

Source: The Author

Note that some of these numbers may be slightly off due to exchange rate fluctuations and other issues, since all but Ford and GM are non-U.S. companies. But the point is that while Tesla compares favorably in terms of operating profit relative to many of its peers, it’s nowhere near having more operating profit than all of them combined.

If Tesla managed to grow its operating profit at the same 88% year over rate that it did this quarter, it would have more operating profit than all these other auto makers combined in four years. That’s actually not very long, but it’s extremely unlikely that Tesla can maintain 88% growth going forward; analysts expect “only” 25% EPS CAGR for Tesla in the next three years.

Is TSLA Stock A Buy, Sell, Or Hold?

It might seem based on the previous section that Tesla stock is a strong sell, considering the unrealistic expectations that appear to be baked into the stock price at first glance, especially relative to other car companies.

However, there’s a lot more going on here. One important consideration is that Tesla has a clean balance sheet, with more assets than liabilities. On the other hand, many legacy automakers are riddled with debt. For example, while Ford (F) has a market cap below $50B, its enterprise value (which accounts for assets/liabilities) is over $140B. General Motors (GM) is in a nearly identical situation. If we take this ~3x enterprise value to market cap ratio and apply it to the overall industry, then Tesla would only need 1/3rd of the rest of the industry’s profits to (arguably) justify its valuation. It could reach this level in a little over 2 years with 88% growth, less than 4 years with 50% growth, and about 6 years with 25% growth.

The other (perhaps far more important) consideration is the future outlook for these companies. Tesla is the undisputed leader in electric vehicles, especially when it comes to manufacturing capability, and electric vehicles are expected to take significant share from ICE in the coming decades. While analysts project a 25% EPS CAGR for Tesla over the next three years, they expect little to no EPS growth for Ford/GM. If Ford was expected to grow at a 25% CAGR and had a fortress balance sheet, a PEG ratio of 2 would give it a >$550B market cap, not that far below Tesla’s current market cap. In that context, Tesla’s valuation looks much more reasonable relative to peers.

The key question for investors to consider is whether Tesla is more likely to grow profits at the 25% CAGR that analysts expect or the 50%+ rate that management has guided for. Based on the valuation model that I shared with Tech Investing Edge members, I believe that a 25% CAGR for the next 10 years would allow Tesla’s stock price to triple from the current valuation, meaning about 12% annual returns. This is likely better than the S&P 500, which is fair since Tesla is riskier than most blue chip stocks.

Fortunately for Tesla investors, I expect Tesla’s CAGR over the next decade to be about 25%, since I expect growth to be much higher than that in the next few years as the company works through its backlog and ramps production capacity. This quarter’s 88% growth only reinforces that thesis. That allows for a 25% CAGR through the decade, even if growth comes in slower than that in the second half of the decade.

If my assumptions about Tesla’s growth are correct, then I believe TSLA stock is a bit below fair value today. However, since the stock has almost always traded above my fair value estimate, I believe that if you want exposure to this company and are okay with the risks, it’s worth buying at fair value.

Although not part of my valuation model at this point, it’s also worth noting that Tesla is considered one of the more innovative car companies around and could eventually boost its growth through autonomous driving/taxi services, solar/battery sales, robotics, and other initiatives which have yet to see much success.

TSLA Stock Risks

Tesla is certainly a high risk stock. The most important risk is that it fails to achieve its expected growth. Right now, Teslas and other electric vehicles are in high demand, and Tesla will have a backlog (i.e. sell every car it makes) for the foreseeable future. Once this is no longer the case, it will become much more clear how much demand there is for Tesla cars and EVs in general. At that point, Tesla investors will either be very happy or very disappointed.

In the short term, it’s also worth noting that CEO Elon Musk owns a large stake in Tesla and may have to sell some of it to acquire Twitter (TWTR). Although Tesla is a large cap with plenty of liquidity, a sale of this size could put short term pressure on the stock, especially if it weighs on sentiment. Sentiment is already burdened due to rising rates, a weak economy, and other often-discussed factors.

Final Thoughts

We can see that Tesla’s stock price has had strong support near $200, bouncing off that level four times since the start of 2021. With shares bottoming at $204 recently and seemingly starting a bounce, it’s possible that history will repeat. Timing the market based on charts is a fool’s game, but this support level makes sense to me from a fundamental perspective, considering that my price target is also near this level.

Tesla is a high risk stock and it’s easy to see the downside. But it’s also worth considering the bull case, where Tesla grows quickly for a long time and eventually becomes the largest company in the world based on market cap. Tesla’s management believes this is possible, and I agree with them even though this result isn’t guaranteed. After all, it wasn’t all that long ago that Ford and GM were the largest companies in the S&P 500 until they made a variety of mistakes that Tesla hasn’t repeated (yet). With shares trading near my fair value estimate, now could be a good time to open a Tesla position or add to it.

Be the first to comment