Anna Richard

Introduction

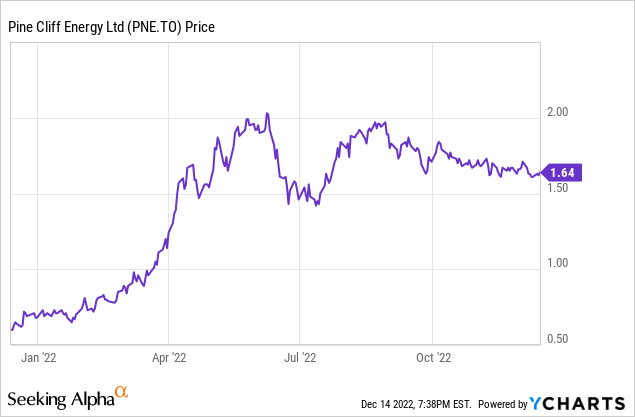

As I like the smaller Canadian natural gas produces, I try to stay up-to-date on the stories I track. Pine Cliff Energy (OTCPK:PIFYF) (TSX:PNE:CA) is one of those smaller producers with an average production rate of just over 20,000 boe/day. The company has a net cash balance and pays an attractive dividend which has helped to keep the share price pretty stable although the third quarter was a bit weaker than the previous two quarters this year.

The third quarter was slightly weaker – as expected

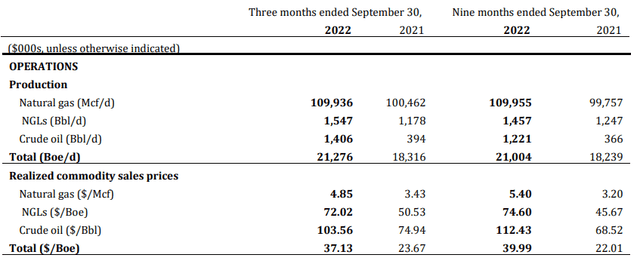

In my previous article, I argued the third quarter would be worse than the first two quarters of the year as the natural gas price was anticipated to be lower. That’s exactly what happened and while Pine Cliff was able to record an average sales price of in excess of C$5.6/Mcf for its natural gas in the first six months of the year, the average realized natural gas price decreased to just C$4.68 in the third quarter. That’s approximately 20% lower but fortunately the attributable production of both NGL and crude oil increased which helped to soften the blow (although those commodities were also sold at a 10-20% lower average price.

Pine Cliff Energy Production Overview

Despite this, the ‘damage’ to the revenue remained acceptable and pretty much in line with my expectations.

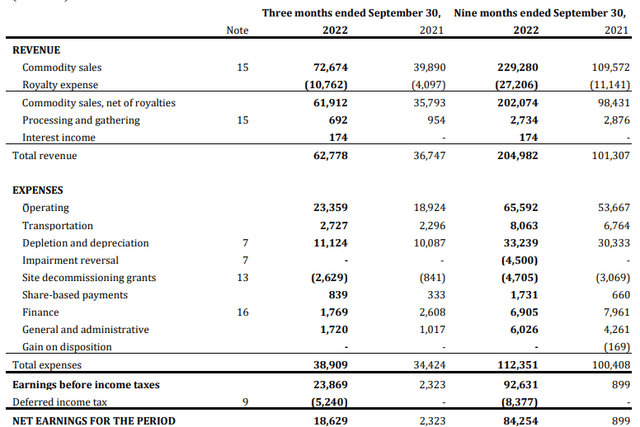

The total revenue in the third quarter came in at just under C$73M with natural gas accounting for in excess of two thirds of the revenue. After deducting the royalty expenses and adding the impact of the other revenue streams, the total reported net revenue was a little bit less than C$63M. The total amount of operating expenses was C$39M and this includes a C$2.6M grant for decommissioning purposes. And as you can see below, just over a quarter of the total operating expenses consisted of depletion and depreciation expenses.

Pine Cliff Energy Investor Relations

The math is pretty simple: Pine Cliff Energy reported a pre-tax income of C$23.8M which resulted in a net income of C$18.6M for an EPS of C$0.05. While that is indeed substantially lower than the reported net income in the previous few quarters, the company clearly remained profitable despite the 20% lower realized prices for its natural gas and oil products.

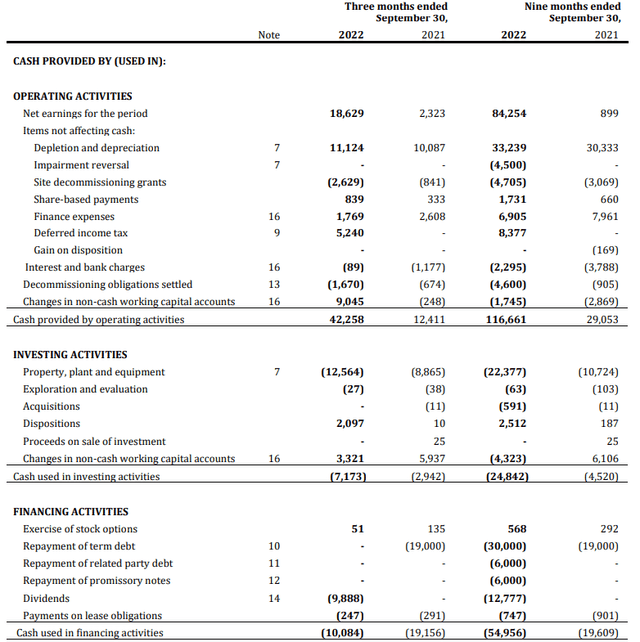

In Pine Cliff’s case, the cash flows are even more important as that’s what will ultimately drive the company’s capex-plans and the dividend payments. Looking at the cash flow statement (as seen below), the reported operating cash flow was C$42.3M, but this included a C$9M contribution from changes in the working capital position and excluded the C$0.25M in lease payments. On an adjusted basis, the operating cash flow was C$33M. Again, a decent result but obviously lower than the C$42M (on average) generated in the first two quarters of this year.

Pine Cliff Energy Investor Relations

The total capex was relatively high – not unexpected as the first semester was pretty capex-light, but despite this high capex level, Pine Cliff’s underlying free cash flow result was still approximately C$20.5M during the third quarter. Divided over the current share count of 350M shares, the free cash flow result was approximately C$0.058/share.

A large portion was spent on the dividend which is costing the company approximately C$10M per quarter. That dividend was originally C$0.01 per share per month but was recently hiked to C$0.0183 per share on a monthly basis, resulting in an annualized dividend of C$0.13 per share. Given the current share price of C$1.65, the dividend yield is a very attractive 7.9%.

The dividend and capital program are fully covered by the cash flows

Needless to say the dividend is fully covered by the company’s free cash flow result. The full-year capex guidance was increased to C$31.5M for the entire financial year, and considering the company has already spent C$22.4M in the first nine months of the year, the Q4 capex will be just C$9M. This also means the average capex is estimated at just C$8M per quarter which means the underlying sustaining free cash flow based on the Q3 natural gas price is approximately C$25M for C$100M on an annualized basis. Again divided by the 350 million shares outstanding, this represents just under C$0.29 per share and will likely exceed C$0.29 per share as Pine Cliff will start to earn interest on its net cash position of C$44M (excluding lease liabilities).

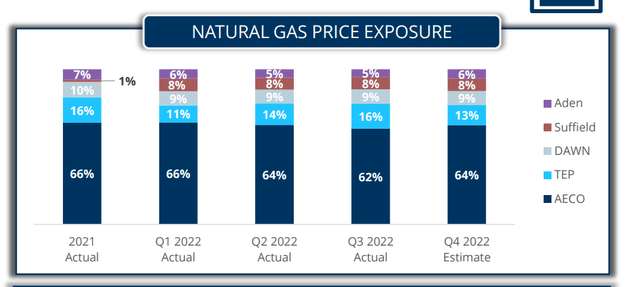

The natural gas prices in the fourth quarter will likely be higher than in the third quarter and this should provide a welcome boost to the cash flow. It’s also important Pine Cliff only sells about 65% of its natural gas into the AECO market. This diversification has traditionally allowed Pine Cliff to generate a higher average price than the AECO natgas price.

Pine Cliff Energy Investor Relations

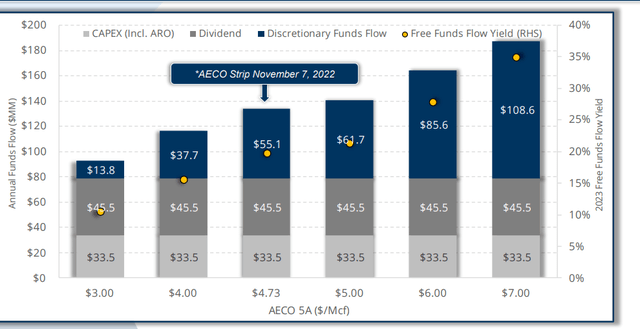

The image below summarizes what really matters for Pine Cliff heading into 2023. Thanks to its very low base decline rate of just 6%, the required sustaining capex to keep the production rate at the same level is pretty low, and the company expects to spend C$33.5M on capex in 2023. This means that even at an AECO natgas price of C$3 (about half the current spot price), the dividend will still be fully covered and Pine Cliff will be able to add an additional C$14M to its treasury.

Pine Cliff Energy Investor Relations

While the AECO futures for delivery in 2023 appear to be pretty weal (with an average of C$4 despite dropping to around C$3.5 during the summer), the Henry Hub prices remain strong throughout the year with an average price exceeding C$6. This means the C$4.73 ‘AECO STRIP’ scenario is realistic, but even if you’d use an average realized price of C$4, Pine Cliff would generate about C$83M or C0.24 per share in free cash flow.

Investment thesis

One of my main issues with Pine Cliff, and the main reason why I currently don’t have a position in the stock despite its attractive FCF yield and dividend yield, is the relatively short Reserve Life Index. I hope to see a boost in the 2022 reserve update. I’m not sure what to expect as Pine Cliff really focuses on spending as little on capital expenditures as possible but if there is a noticeable improvement, I will likely start building a long position as the short reserve life is the only deterrent for me.

Be the first to comment