bjdlzx

(Note: This is a Canadian company that reports in Canadian dollars unless otherwise noted.)

Timing can be everything in the oil and gas business. In this case Headwater Exploration Inc. (OTCPK:CDDRF) is doing far better than originally planned to the point that production can grow fast, and the company now will be paying a dividend. This is clearly the best of both worlds. It was made possible by the unusually profitable Clearwater Play location. This is the kind of investment that is likely to pay some relatively large dividends in the future for an investment made now as well as showing capital appreciation.

Management announced a dividend of C$.10 per share paid quarterly. Even if United States shareholders end up paying the withholding (and cannot find an offsetting tax credit), the rapid growth may make this an adequate income vehicle despite “taxes and all other hassles.” That is a rare result. But then again, this particular basin seems to have profitability levels seldom seen overall in other basins.

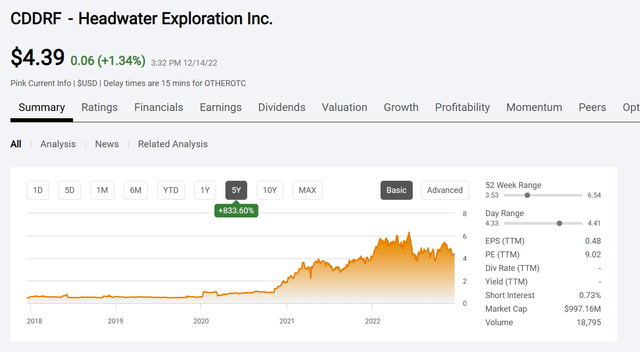

Stock Price Record

You can see from the chart below exactly when the current management took over through a reverse merger (or read it from my older articles on the company). It is just that obvious.

Headwater Exploration Common Stock Price History And Key Valuation Measures (Seeking Alpha Website December 14, 2022)

Headwater Exploration management has already engineered a great return for shareholders in the time they have been in control of the company. But clearly there is a whole lot more growth to add to the stock price appreciation since this management took control back in fiscal year 2020.

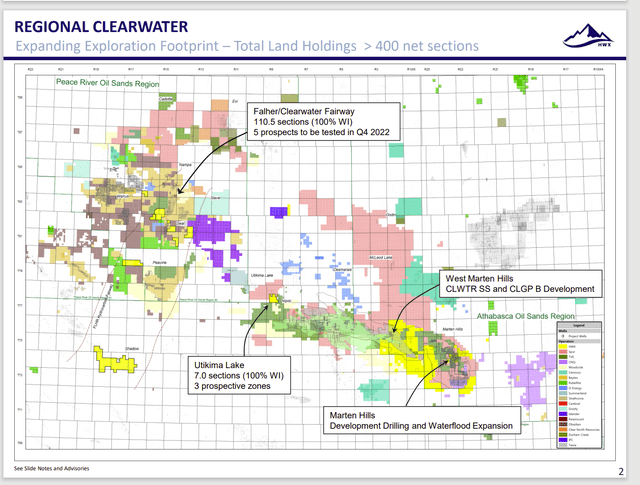

Headwater Exploration Map Of Operations and Key Well Results Highlighted (Headwater Exploration November 2022, Corporate Presentation)

Management has been slowly adding to leases controlled ever since the company began operations in the Clearwater area. The result is all the land shown above.

Robust commodity prices have enabled a growth pace that could hardly have been imagined back when management first began exploring and developing leases in the Clearwater area. Those prices have enabled a faster pace of development and exploration that has clearly made this stock a market darling.

The resulting short payback period has allowed management to run five rigs, with one of those rigs devoted to exploration full time. Even with that level of activity, the cash balance has been building and the company is debt free. Needless to say, production has climbed ahead of original guidance as a result. So, guidance has been periodically raised.

This brings up the need to discuss the long-term effect on the final value of the investment. More money immediately from robust commodity prices raises the long-term return on a buy-and-hold investment. The ability to get off to a faster start is an advantage that just the final result in amazing ways. That means that the potential returns from the present are still pretty good in addition to the returns “already in the bank.”

A low-cost play like Clearwater which has a breakeven point in the WTI $30’s range, even though the heavy oil produce has a price that is discounted from that WTI, is generally going to do a lot better in a cyclical downturn than higher cost basins. That is likely every other basin in North America.

Growth Predictability

The growth of business in this day and age is far more predictable than was the case when I was growing up. In many cases, including this one, the industry knows where the oil is. All that was needed was for technology to advance to the point where the play became competitive. So now the Clearwater Play is emerging as “the” low-cost basin due to technology advances.

Interestingly, exploration wells are not exploration wells to find oil in the sense they once were. Now they are exploration wells to confirm the profitability that has been modeled by management prior to drilling the well. Finding oil is far more certain. The risk is whether more work needs to be done to make the given set of leases cost-compatible under current industry conditions. As a result, this management has been drilling one successful exploration well after another in this basin. Since this is an emerging basin, chances are excellent that the limits of the basin will not be reached for a few years. That is excellent for growth prospects.

The risk, of course, is that the good news ends “tomorrow” with no more successful exploration wells. Even if that were to happen and there is no sign of that, this management has plenty of de-risked acreage to keep them busy for a long time to come.

Future Growth

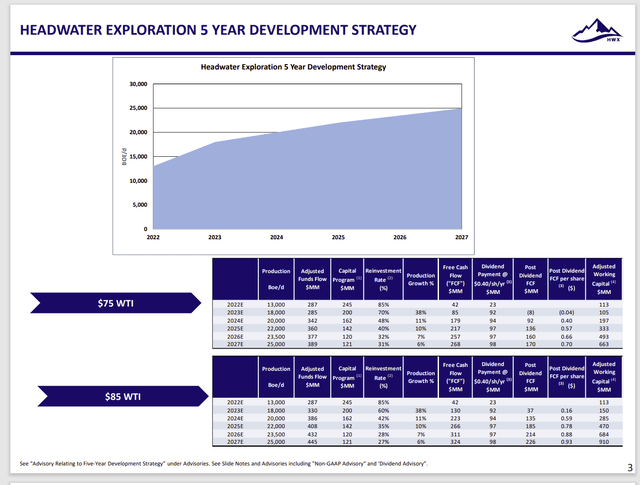

This management has kept a conservative five-year plan as shown below:

Clearwater 5 Year Production Growth And Cash Flow Plan (Headwater Exploration November 2022, Corporate Presentation)

Management raised the next fiscal year growth to a very high rate. That rate is made possible by the extreme profitability of this play. Yet the five-year development plan has overall not changed.

The reason for that is the very low future visibility of this industry. There could easily be a cyclical downturn at any time between now and the end of that forecast. It appears to me that management planned one. They just do not know when it will be and how severe it would be. So, they picked a number they could get to even under some unexpectedly challenging circumstances. Growth in the “good times” is far more likely to be rapid similar to next year than what is shown for later years.

The Future

This company is likely to grow rapidly. A cyclical downturn is just as likely to interrupt that fast growth if it is severe enough. But the low breakeven of the wells drilled should allow this company to outperform the industry throughout the cycle. This is a rare growth story that exists in a cyclical industry due to an unusually profitable situation.

Those looking for an eventual income story can consider Headwater Exploration stock because that initial dividend is likely to grow as fast as the production. That will provide a fair amount of income as well as capital gains potential. This is the kind of income story I like because management does all the work for the investor. The investor can just buy and hold while collecting increasing dividends that often become generous for the original amount invested.

Management is minimizing the risk of focusing on a discounted product by maintaining a generous cash balance with a debt free balance sheet. That will enable management to wait out any severe cyclical downturns without worrying about debt servicing. Management can also shut-in production to wait for that inevitable cyclical recovery.

Headwater Exploration management has built and sold companies before. That minimizes the new-company risk inherent in a growth story like this. A basket of companies with this kind of Headwater Exploration management experience should far outperform the industry (especially given the high cash balance and the no-debt strategy). This issue will interest a wide variety of investors due to the conservative Headwater Exploration management and the unusual profitability of Clearwater.

Be the first to comment