Taiyou Nomachi/DigitalVision via Getty Images

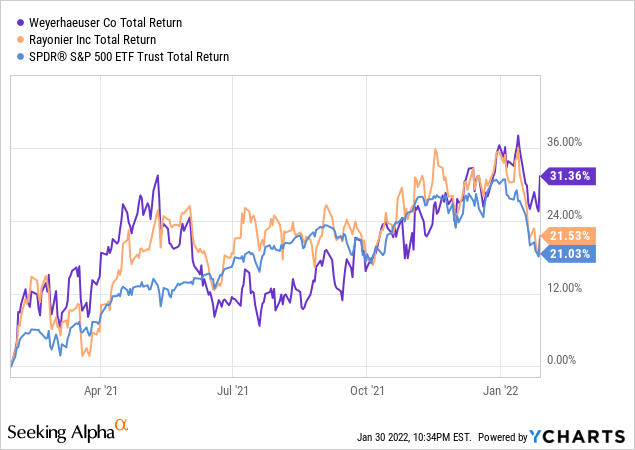

Over the last twelve months, timberland company Weyerhaeuser (NYSE:WY) has outperformed peer Rayonier (NYSE:RYN) with a total return of ~31% vs. ~22%, respectively, as well as the S&P 500’s impressive ~21% return. The outperformance was driven by better-than-expected performance due to strong leverage in the residential construction market and a high returning Pacific Northwest timber position. Housing starts are likely to rise with demographic shifts, just as the company is positioned to capitalize off its shift towards a leaner SG&A infrastructure. US homebuilders are already dealing with a massive backlog of construction projects, particularly in multi-family, with December being the highest number of multifamily permits issued for any month since 1985. This strong demand environment is keeping the stock’s momentum biased towards the upside.

According to Seeking Alpha data, the Street is very bullish on the stock. 50% of 10 analysts rate the stock a “strong buy” and another 30% rate it a “buy”. This compares favorably to May 2021, when less than half of analysts rated the stock a “strong” buy” and 1 analyst even had it at a “sell”. The company finished 2021 with a bang and declared a supplemental dividend of $1.45 after returning $2 billion of cash to shareholders-a significant amount given the ~$40 stock price and $28.4 billion market cap. Management remains highly committed to a shareholder-friendly capital allocation policy, as it targets an annual payout of 75-80% and still has nearly $2 billion of cash on the balance sheet. With US housing starts averaging over 1.6 million units on a seasonally adjusted basis (16% over 2020) and total permits at over 1.7 million units, cash flow is surging. At the same time, the repair & remodel market is providing an additional tailwind as spending grew 9% in Q4 and is expected to maintain that pace into 2022. The median price of a house is now over $400K, and homeowners’ record equity expansion will continue to drive demand for remodeling.

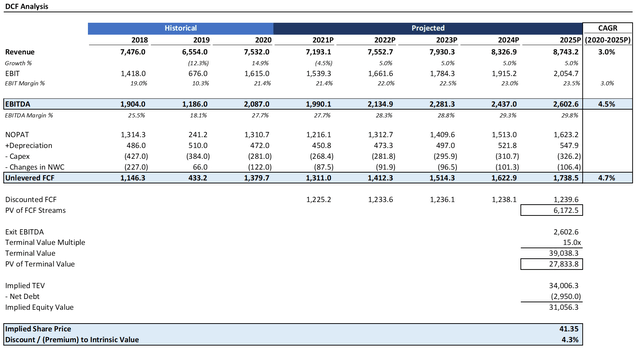

DCF Analysis Indicates Significant Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. In my DCF analysis, I assumed 5% revenue growth after a contracting somewhat in 2021. I also assumed EBIT margins expanding gradually by around just 200 bps heading towards 2025. Capex, increases in net working capital, depreciation, and taxes were flat-lined for simplicity.

Source: Created by author using data from Yahoo! Finance

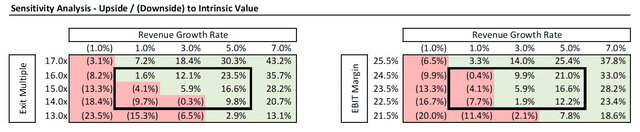

Assuming a terminal EBITDA multiple of 15x and a 7% discount rate, the stock is more or less fairly valued. Historically, the stock has seen its EBITDA multiple generally in the 13-20x range, so there is a high degree of variance. However, for a stock market that already appears substantially undervalued, it’s hard to find any riskless value play out there. Importantly, even if the multiple were to fall to the low end at 13x, at a miniscule 3% growth CAGR, the stock is still only overvalued by 6.5%. This is easily offset by the 7% annual returns inherent in the discount rate and the 1.7% annual dividends. In addition, should the stock see EBIT margins expand to 25.5%, there is 25%+ upside in the stock. Accordingly, at 11.5x earnings, Weyerhaeuser is a compelling opportunity with favorable risk/reward.

Source: Created by author using data from Yahoo! Finance

Catalysts For Continued Outperformance

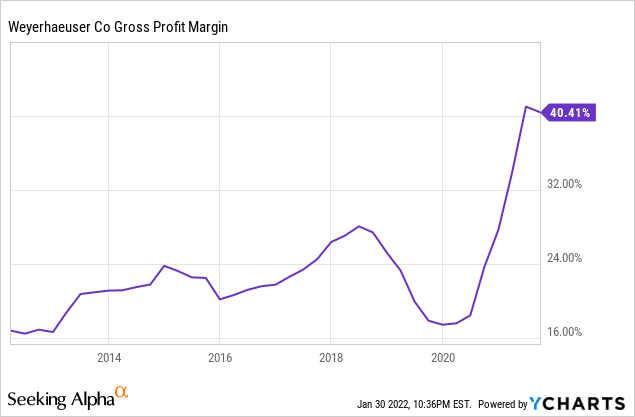

There are several factors that can cause Weyerhaeuser to continue to outperform the broader market. Beyond construction permits exceeding expectations, the company needs to demonstrate that it has room for further margin expansion. Gross margins are at a record high of 40.4%, so a lot depends on price improvement in Southern logs. Persistent wet weather across the South and supply chain issues will drive prices up over the near-term. The mountain pine beetle is wreaking havoc on Canada’s forest and will further benefit Weyerhaeuser’s lumber position. Combined with the Russia log ban and Australian log ban, China is also likely to open up to fiber supply once it inevitably evolves its regulatory process. Longer-term, demand for wood products will be robust, as homebuilders look to build inventories in anticipation of Millennials coming into the market.

I also see significant potential in the company capitalizing off the rapidly growing repair & remodel market. The US home remodeling market is forecasted to grow by a CAGR of 4.1% between 2021 and 2027, and millennial demand for private rented houses is buoying up growth prospects across a broader range of the market.

Lastly, I would be remiss to not mention the company’s upside opportunity in the green economy. Management is targeting $100 million of additional annual EBITDA by the end of 2025 through discussions with developers on carbon capture & storage technology. I believe this target may actually prove to be substantially understated longer-term, as the effects of climate change start to become more apparent to both sides of the political aisle.

Downside Risks

As bullish as I am on Weyerhaeuser, there’s multiple reasons to be hesitant. First, rising mortgage rates give me pause. It seems like the Street is only focused on the upside these days, but the reality is that these rates will stymie income gains and an improved labor environment. Moreover, the inflationary economy poses a significant threat to the company’s ability to remain resilient on cutting costs. Historically, timber has been a good hedge against inflation, but there is no necessary reason why this will continue to be so. In the ongoing saga of COVID, transportation costs are extremely high and are causing safety issues at mills, complicating a labor shortage.

Lastly, I am also concerned about it becoming more apparent that the company probably overpaid for Plum Creek. Plum Creek shareholders got a 35% stake in the combined company, despite providing only ~20% of EBITDA. At this point, another needless M&A play will likely repel investors away from the stock, given the emphasis on a shareholder-friendly capital allocation policy. The 75-80% payout ratio target restricts management’s ability to make growth investments, so any signs of overpaying again are likely to trigger a revaluation by the market. Investors go into REITS with the attitude that they provide stable cash flow streams, but Weyerhaeuser is also pulled in another direction as it faces pressure to upgrade its mills and focus on higher-returning projects.

Conclusion

Weyerhaeuser is a compelling company with a proven history of growing cash flow through difficult macro environments. While it is not without its risks, the 11.5x PE multiple looks appealing at a time when the homebuilding environment looks to continue to go up and to the right. At a 1.69 beta, the stock is highly volatile, especially so for a REIT, but the 1.7% dividend yield plus frequent additional payouts, aggressive share repurchase program, and 1.6x leverage ratio meaningfully offset the risk. Moreover, as a REIT with one of the largest timberland positions, Weyerhaeuser essentially provides a macro bet on the broader economy. If you are bullish on the economy, Weyerhaeuser should provide steady gains, especially at today’s price.

Be the first to comment