Kimberly White

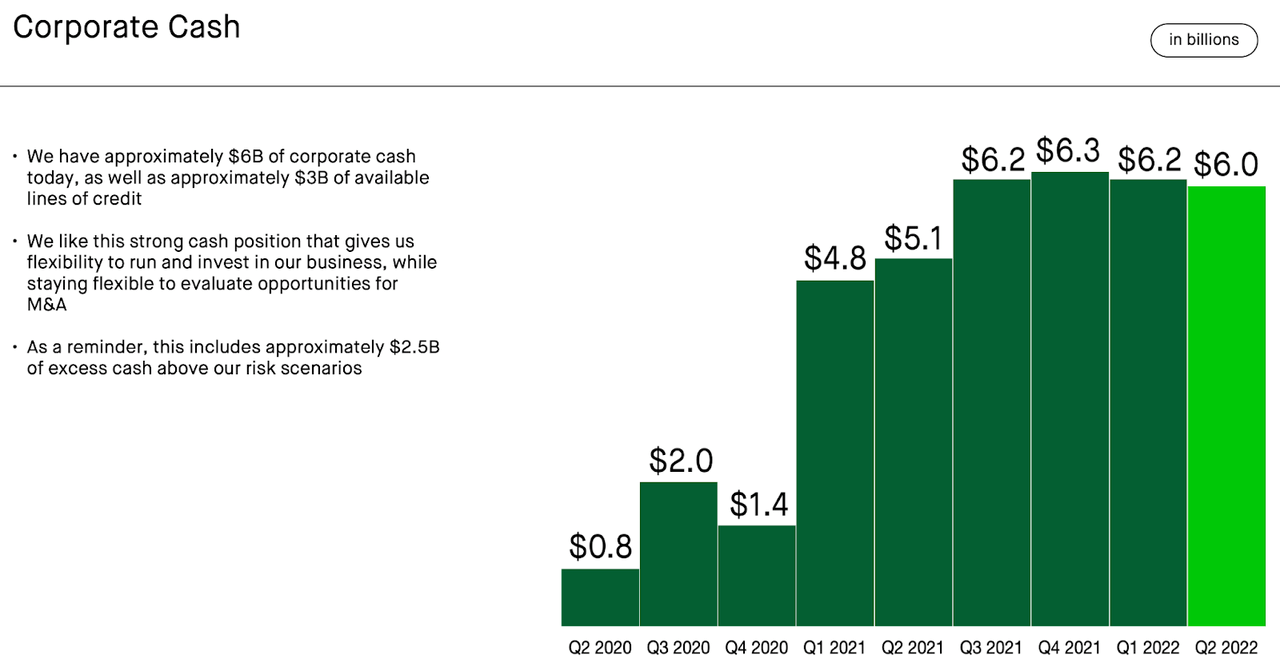

Robinhood (NASDAQ:HOOD) jumped after reporting second quarter earnings results which were just “good enough.” While HOOD continues to struggle with declines in monthly active users, it is making progress on reducing its cost structure. The company still has $6 billion of net cash on its balance sheet, making up 70% of the market cap. This is a name which has seen investors flee on account of deteriorating fundamentals – but can soar higher if the company can fix its issues and return to growth. I continue to rate HOOD a buy on account of the low valuation.

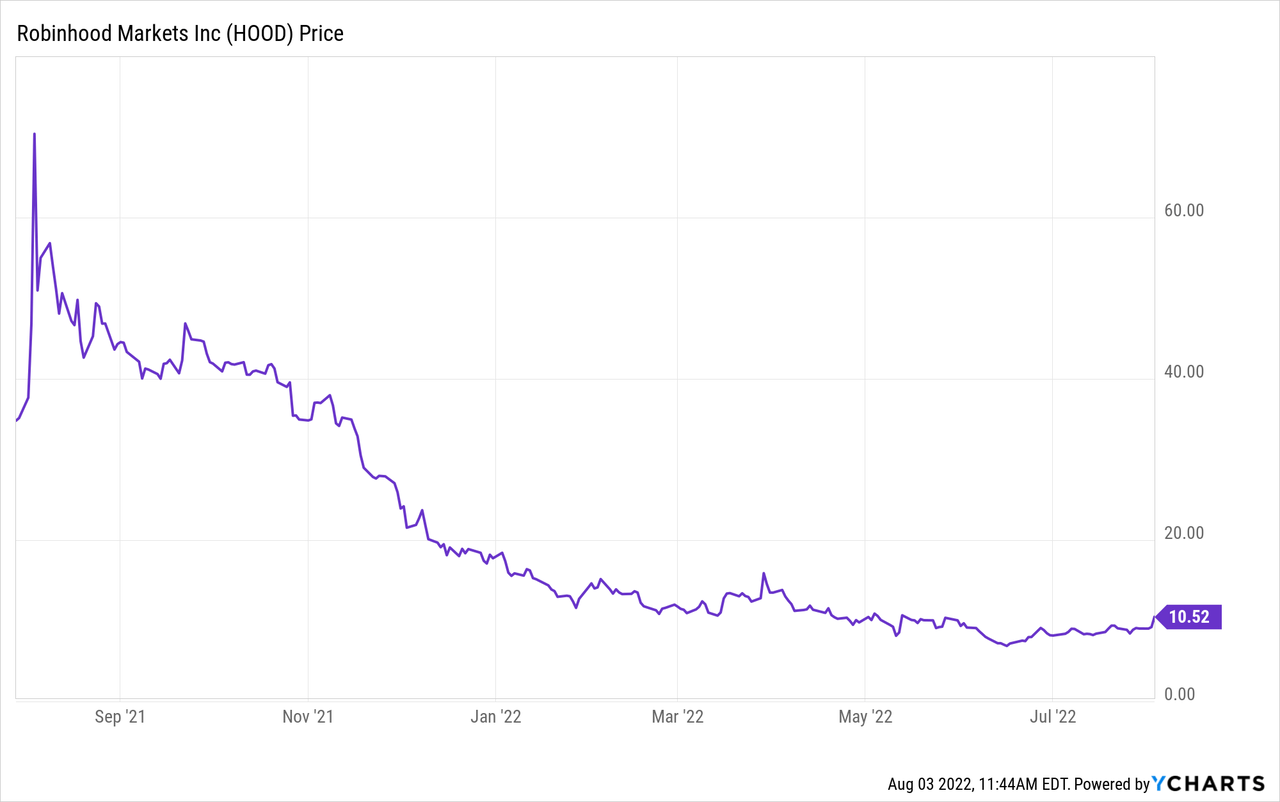

HOOD Stock Price

HOOD continues to trade near $10 per share – a far cry from the $40s range that it traded at when it first came public.

I last covered HOOD in June where I discussed its potential to return to $20 per share. HOOD has not yet stopped its financial bleeding, but the stock is still trading at compelling valuations.

Robinhood Stock Key Metrics

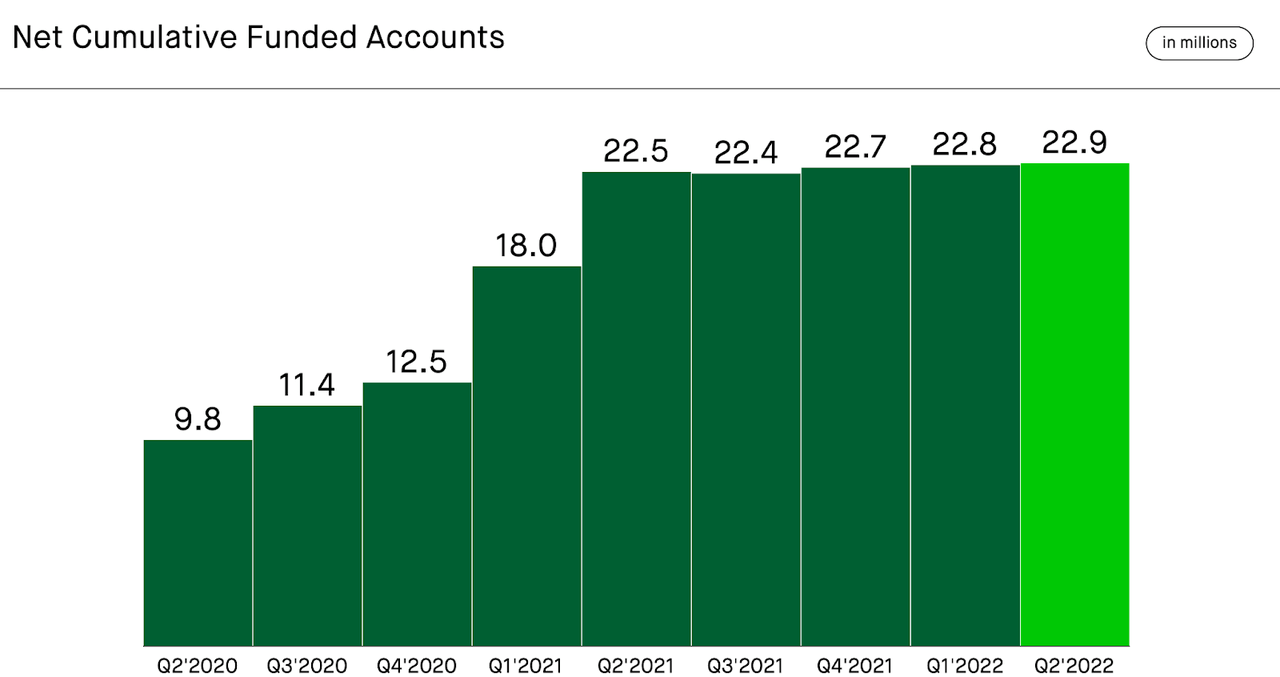

HOOD saw a mild increase in net funded accounts.

2022 Q2 Slides

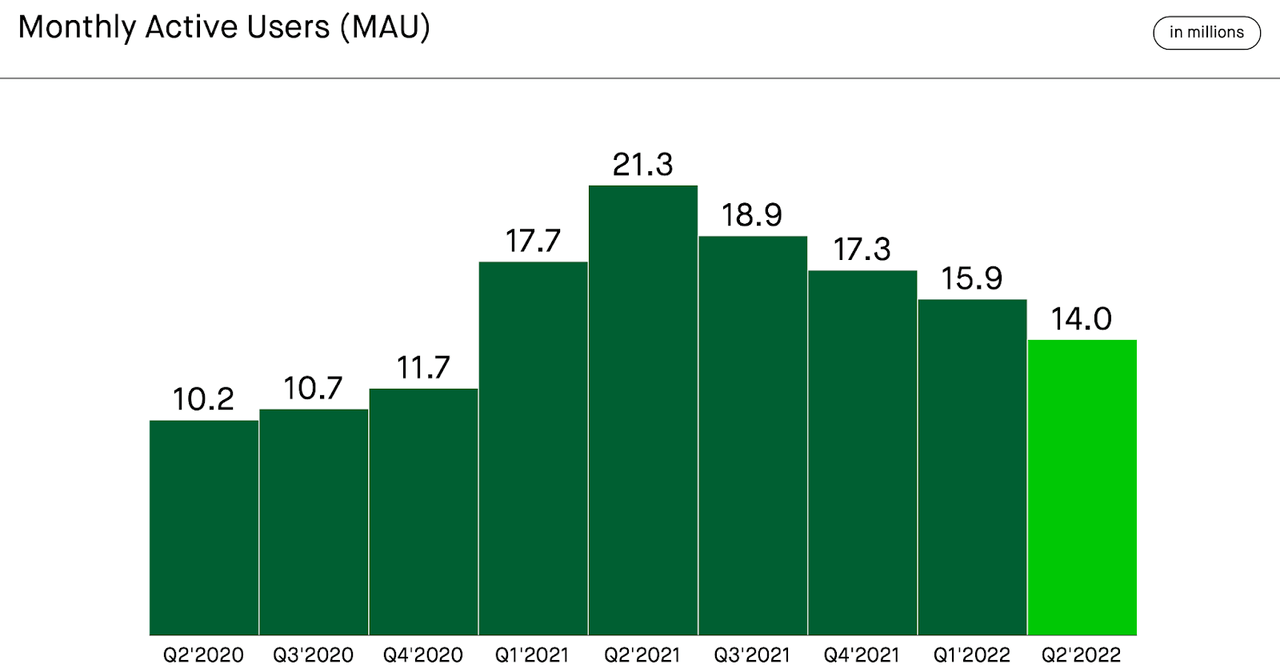

But that metric is arguably not the right one to judge the company by, as the company earns revenues primarily based on customer transactions. Instead, monthly active users (‘MAUs’) continued to decline down to 14 million.

2022 Q2 Slides

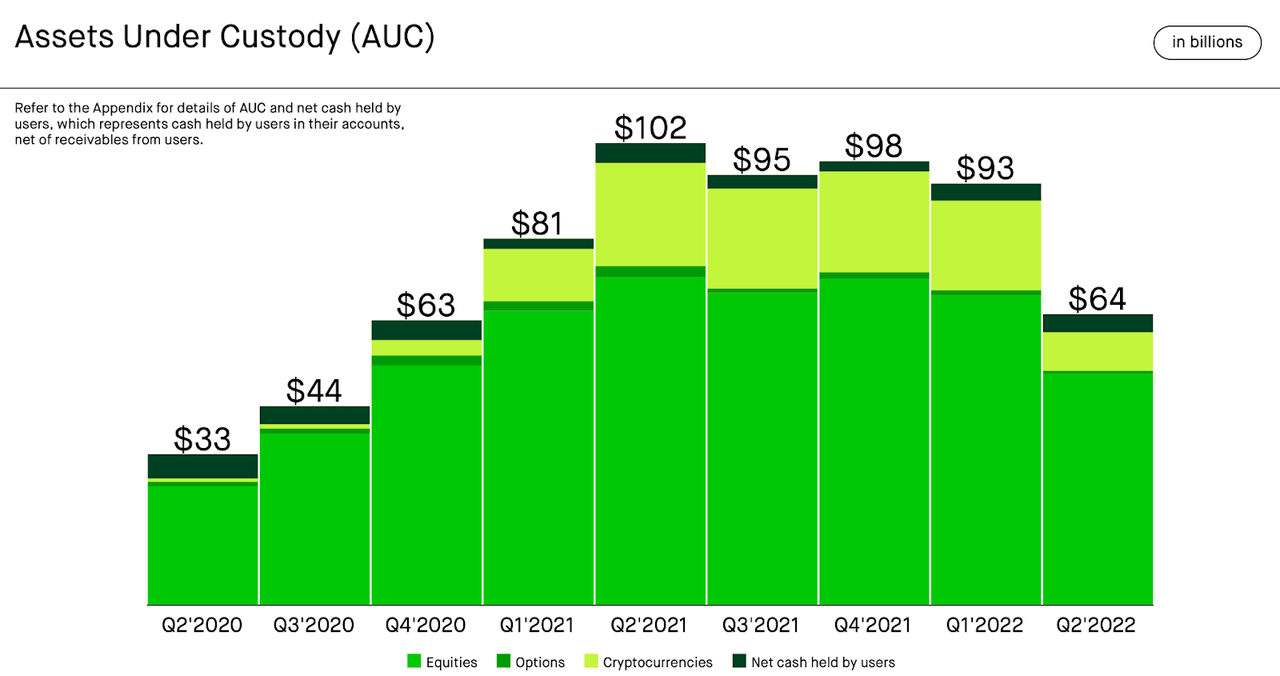

I suspect that this is largely due to the company’s retail investor base – perhaps these customers have lost interest in the markets amidst the market turmoil. Assets under custody declined sizably in the quarter – largely due to declines in cryptocurrency and equity valuations.

2022 Q2 Slides

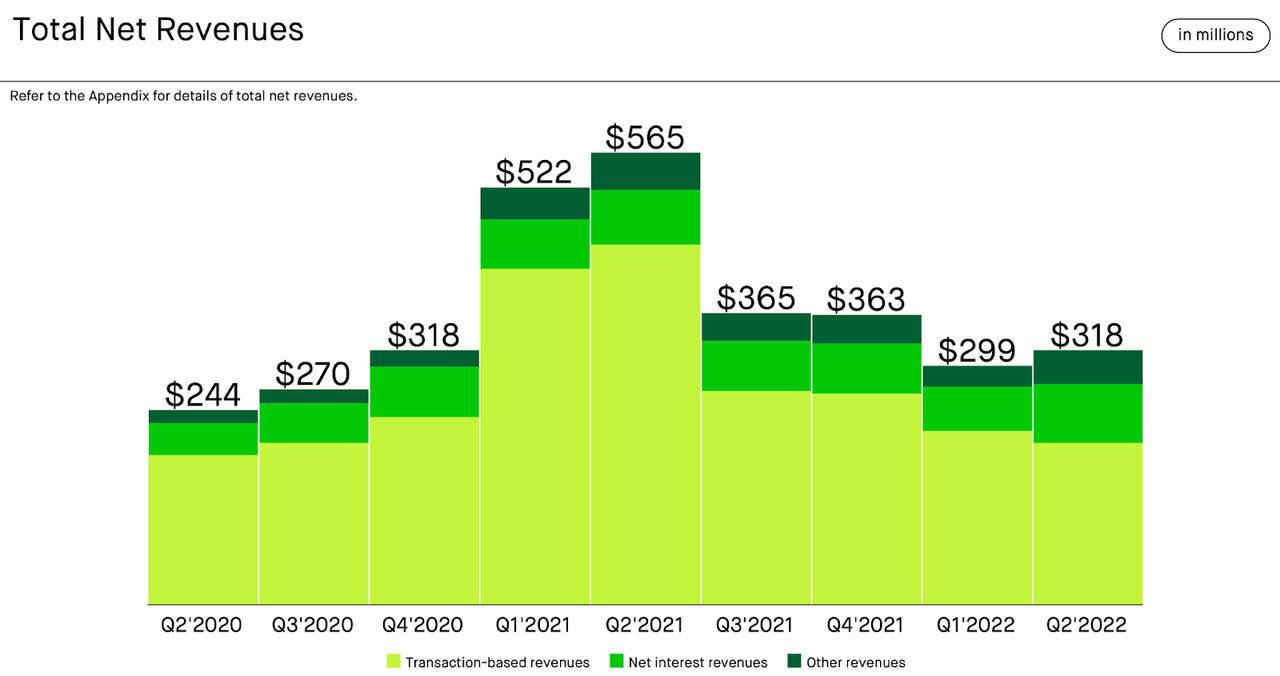

These all led to net revenues to decline 44% year over year to $318 million.

2022 Q2 Slides

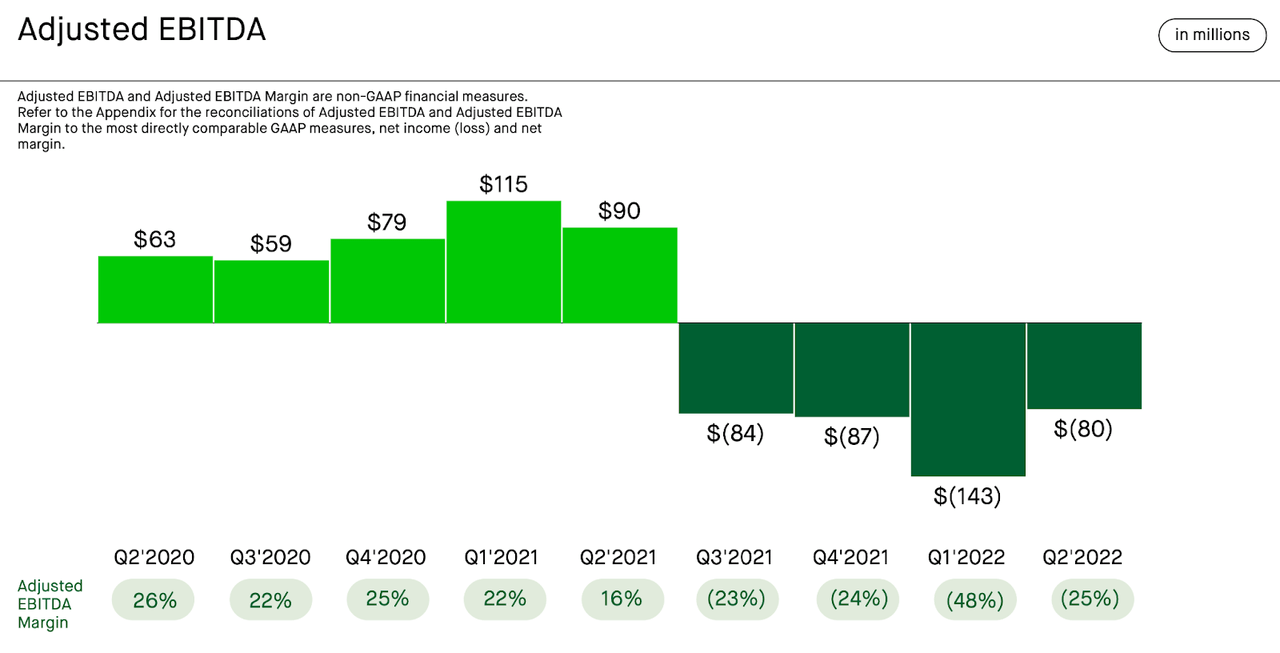

Whereas HOOD was highly profitable on an adjusted EBITDA basis when it first came public, this is now the fourth straight quarter of adjusted EBITDA losses. On the bright side, the adjusted EBITDA loss improved significantly sequentially to $80 million.

2022 Q2 Slides

HOOD aims to reduce operating expenses even further, planning to reduce 23% of its workforce. The company ended the quarter with $6 billion of net cash which should be more than enough to sustain near term operating losses and, potentially, draw the interest of value investors.

2022 Q2 Slides

Is HOOD Stock A Buy, Sell, or Hold?

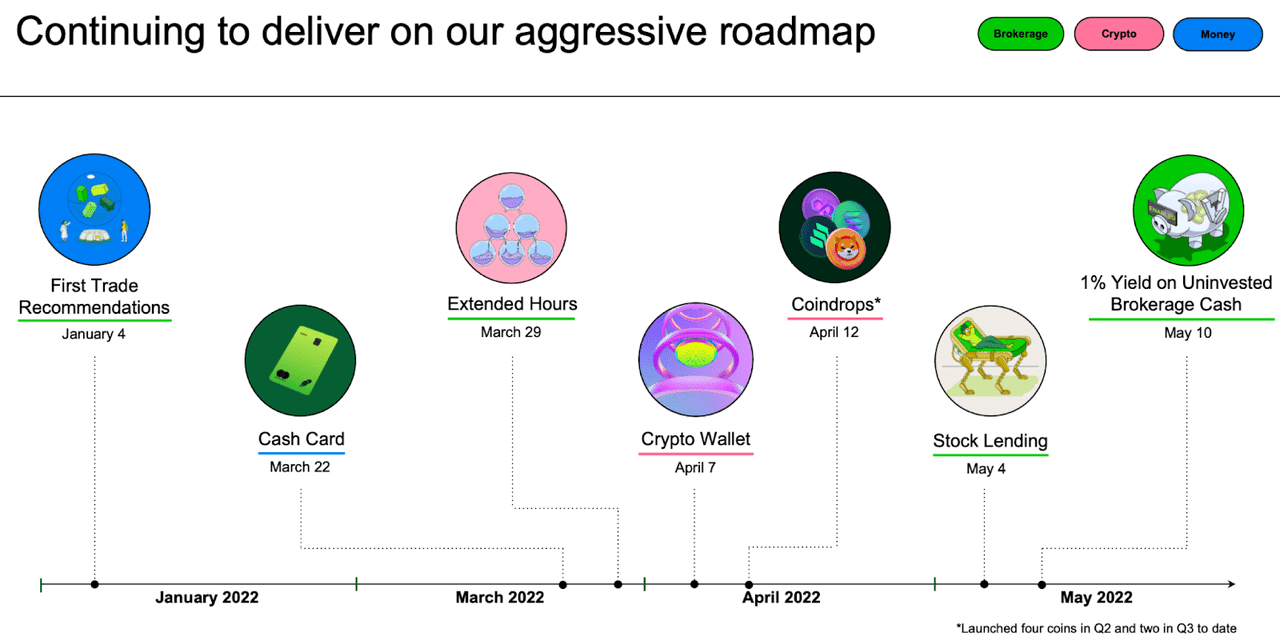

It is not easy to continue recommending the stock here – but that is typical when valuation is the main thing driving the thesis. HOOD continues to bleed users – an unsustainable trend. I do not see any path to profitability that does not involve a return to aggressive user growth. While the fundamentals may not show it, HOOD continues to innovate and improve its platform – just this year the company has rolled out many new features.

2022 Q2 Slides

One also shouldn’t forget that HOOD arguably did something that no other brokerage firm could do: make investing fun for the broader masses. While it isn’t clear if HOOD is still benefiting from that distinction, my point is that one shouldn’t be so quick to write this name off.

The stock is trading at 6x 2022e sales. Net of cash, the stock is trading at less than 2x sales. To be conservative, we can ignore the net cash on the balance sheet – which for now may be reasonable due to the company’s ongoing operating losses. In a bullish scenario, I can see the company returning to 20% growth. Assuming 30% long term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), the stock might trade at 9x sales or around $15 per share, implying 50% potential upside over the next 12 months. That target may prove to be too conservative as any return to growth may be sustained with the greatest value to be accumulated through long term compounding periods. The downside risk is if the company never stops the bleeding and continues to lose users. I estimate that the company has enough cash to last as many as four years based on the current operating loss projections, but the degree of operating cash burn will only accelerate if the user declines are not contained and reversed. This should be considered an “all or nothing” type of investment.

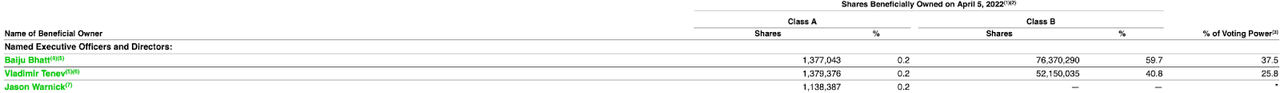

It is worth noting that co-founders CCO Baiju Bhatt and CEO Vladimir Tenev own cumulatively more than a billion dollars worth of the company.

2022 DEF 14A

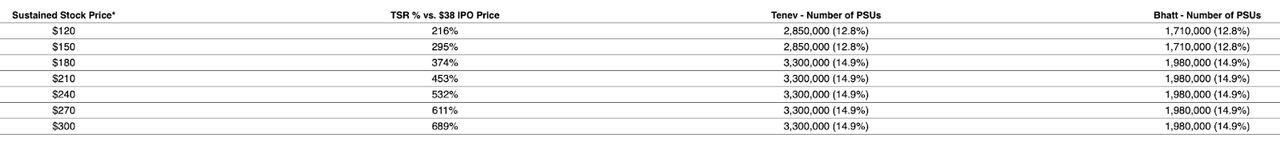

What’s more, these two executives have an aggressive long term equity incentive program in place which has hurdle prices on average 20x higher than the current price (there’s also another 4 million shares vesting at $50.75 per share and 6.9 million shares vesting at $101.50 per share):

2022 DEF 14A

While the large insider ownership and equity incentive program are no guarantees of future success, it potentially indicates that the management team is highly incentivized to drive long-term shareholder value.

There are many risks here. The most important risk is that of execution – this is clearly a turnaround story, as the company needs to stop the bleeding in MAUs and return to growing MAUs. That may not be an easy task, as it is possible that the company has suffered permanent reputational damage amidst the meme-stock bubbles during the pandemic. Another key risk is that of valuation – as long as users and revenues continue to decline, there may be little valuation support for the stock price. Perhaps the net cash per share of around $7.50 may provide some support, but that support may gradually disappear as operating losses persist. Investors should be prepared for volatility. HOOD is one of the stocks named in my 2022 Tech Stock Crash List provided for subscribers and I own a small position. I expect a basket of undervalued tech stocks to perform phenomenally from here – HOOD remains very cheap at current prices.

Be the first to comment