APeriamPhotography/iStock via Getty Images

Devon Energy Corporation (NYSE:DVN) is a hydrocarbon energy corporation with a market capitalization of less than $45 billion after its double-digit share price decline on Wednesday. The company’s price decline was caused by a cut in its dividend along with rising capital expenses. However, despite that weakness, we expect Devon Energy to continue generating substantial returns.

Devon Energy Performance Overview

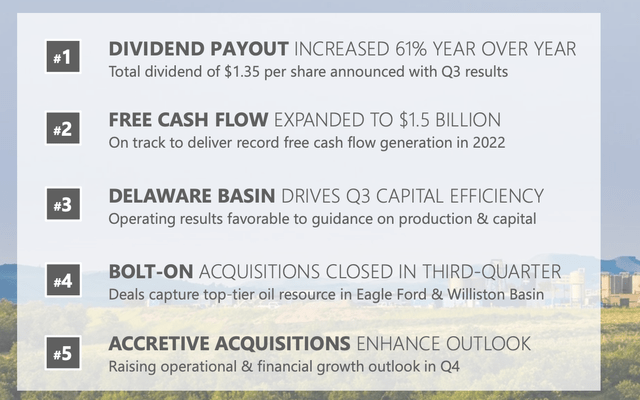

Devon Energy had a reasonably strong quarter despite the dividend decline that resulted in market unhappiness.

Devon Energy Investor Presentation

Devon Energy announced a $1.35 / share dividend, a slight decline in the company’s dividend, taking its yield to roughly 8% with its price decline. However, the company set a new quarterly free cash flow (“FCF”) record of $1.5 billion, taking the FCF yield of the company to almost 14%, and showing the company’s overall financial strength.

The company is continuing to opportunistically add bolt-on acquisitions while looking at other opportunities to increase margins and performance.

Devon Energy Portfolio

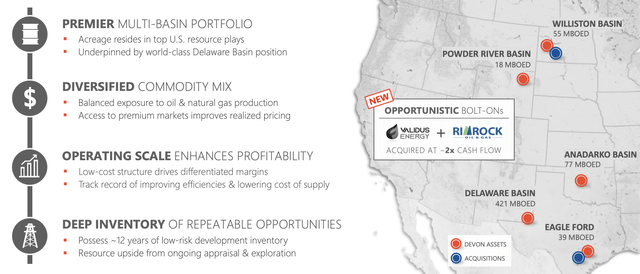

The company has an impressive overall portfolio that it is continuing to utilize to increase production.

Devon Energy Investor Presentation

The company has a well distributed portfolio, with acreage across top U.S. resource plays. The company has spent more than $2 billion in cash with opportunistic bolt-on acquisitions at a 2x margin. However, its largest asset by far continues to be the Delaware Basin, where the company’s daily production is more than 400 thousand barrels / day.

As the company scales, we expect margins to improve and the company’s recent acquisitions support a total development inventory of more than a decade. The company is continuing to focus on not only access to markets but premium access to the markets, with 3Q 2022 price realizations at 101% of the WTI prices.

Devon Energy Financial Performance

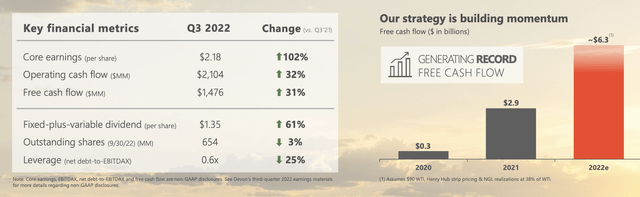

Financially, putting all of this together, we expect continued strong performance for Devon Energy.

Devon Energy Investor Presentation

Devon Energy has managed to improve its portfolio substantially QoQ. The company earned almost $1.5 billion in FCF, a 31% QoQ increase. The company’s forecast for 2022e FCF is expected to be substantial, with an almost 15% FCF yield for the company. From 2021 to 2022, the company’s FCF has more than doubled.

The company has continued to reduce both its outstanding shares and its leverage substantially. With its current debt positioning, the company can afford to increasingly use its cash for share repurchases and dividends highlighting the company’s ability to continue its financial performance.

Devon Energy Shareholder Return Potential

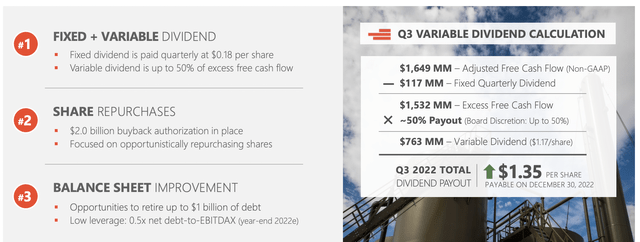

The company’s shareholder return potential is clearly evident from its impressive portfolio of assets.

Devon Energy Investor Presentation

The unfortunate part of a variable dividend is that it is, well, variable. However, the company’s payout with the weakness is still an 8% yield. The company has the ability to continue paying out this dividend even with quarter-to-quarter share price volatility or an increase in the company’s capital spending obligations.

The company is continuing to spend a modest amount on share repurchases, an investment it can continue. We expect the company to continue generating double-digit shareholder returns.

Thesis Risk

The largest risk to the thesis is crude oil price. WTI prices are currently at roughly $90 / barrel, a level where traditionally significant investment is warranted. However, at the same time, due to concerns over long-term oil prices, it’s likely for investment to remain lower for longer. That makes it tougher to determine what’ll happen, however, oil prices remain a long-term risk for Devon Energy.

Conclusion

Devon Energy has a unique and impressive portfolio of assets. The company has made several opportunistic acquisitions to expand its portfolio, acquisitions that it can both comfortably afford and acquisitions that will help the company to substantially expand its cash flow. The company has managed to do all of this while continuing to reduce its debt.

The company has more than a decade of high-quality assets. It has a reliable 8% dividend yield and is continuing to opportunistically repurchase shares with an average payment price well below current prices. The company’s debt has declined substantially, making it more manageable. Putting all of this together makes Devon Energy a valuable long-term investment.

Be the first to comment