Jose Luis Pelaez Inc/DigitalVision via Getty Images

At one point, investors were still Bullish on Big 5 Sporting Goods (NASDAQ:BGFV) when the stock soared to $46. As the story has changed this year, the major investor base isn’t even able to provide much support for the stock near $10. My investment thesis is far more Bullish on the stock after the annihilation of Big 5 in the last year.

Ahead Of Normal

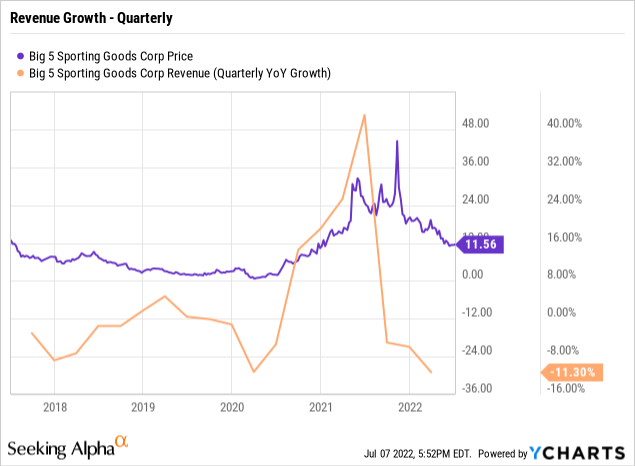

The surge in sporting goods demand mid-2020 made investors far too bullish on retail names. Even the view here turned too bullish on Big 5 in January after the stock had fallen back below $20.

Big 5 meandered around flat growth for years prior to 2020. The company saw revenues surge over 40% with quarterly sales peaking at $326 million in Q2’21.

Remember, Big 5 doesn’t have the e-commerce platform necessary for the big portion of revenue gains during COVID shutdowns. As well, the company doesn’t face the same revenue losses going forward.

The recent Nike (NKE) report should provide a solid indication that demand for athletic apparel remains solid. The company saw revenue flatline with the major issue coming from the 19% dip in Chinese sales.

Big 5 is a West coast retailer with no sales in China. Other department store retailers, such as Kohl’s (KSS), have forecasted quarterly revenues to dip up to high single-digits in the quarter in an indication of the tough retail environment in the U.S.

Analysts forecast Big 5 printing a nearly 20% dip in quarterly sales for the June quarter due to internal forecasts from the company of large comp sales losses. If Big 5 can move beyond this hit to print solid quarters similar to the numbers from Nike and Kohl’s, the stock is golden here at $11.

Of course, Nike sells athletic apparel while Big 5 benefitted from the surge in demand for bikes, kayaks and fitness equipment. These purchases won’t repeat in 2022 and probably even 2023 before consumers might return to needing upgraded equipment in out years.

New Company

My long, long, long term view on Big 5 isn’t overly bullish due to the company not being focused enough on e-commerce. The best way to avoid market share losses in the retail space is to offer a competitive online delivery and store pickup option. Using stores as distribution centers provides a major advantage to e-commerce only retailers.

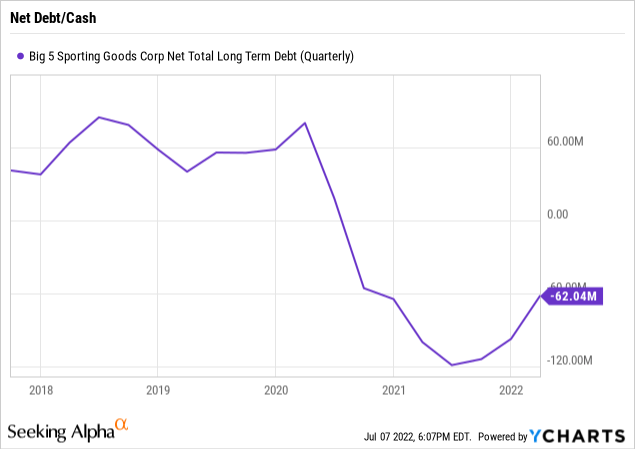

The reason my view is more bullish on Big 5 now is that the balance sheet has switched from the more dire position heading into COVID. The retailer went from a net debt position of over $60 million to net cash now of $62 million.

The company has used the massive cash flows from the last couple of years to repurchase shares and pay dividends. Where the business settles will ultimately determine the stock value, but Big 5 only has a market cap of $260 million now following the collapse of the stock. The stock is difficult to compare to pre-COVID periods due to the dire financial position that doesn’t exist now.

The cash position accounts for nearly 25% of the value of the stock. If the company can earn $2.50 per share, investors could see a double in the stock from here.

Big Five hiked the quarterly dividend to $0.25 to now offer an incredible 9.2% dividend yield. Naturally, the current stock price reflects fears the current business model can’t support such a robust dividend payout.

The retail sector could give up all of the COVID gains leaving Big 5 in a more precarious position where the company previously struggled. The large cash balance provides a lot of cushion for an environment where the sporting goods retailer doesn’t even maintain a $1+ EPS.

With inventories back above $300 million, the biggest risk to the story is the loss of the higher merchandise margins. Big 5 printed Q1’22 merchandise margins up 461 basis points from back in 2019.

Takeaway

The key investor takeaway is that Big 5 is priced for a substantial hit to earnings. The stock is much more appealing here with nearly 25% of the market cap held in cash, though investors must be prepared for some ugly results in the quarters ahead until the U.S. economy starts rebounding and the sales pull forward normalizes. The sporting goods retailer doesn’t need to hold onto much of the COVID earnings boost in order to warrant prices far above $10.

Be the first to comment