VioletaStoimenova/E+ via Getty Images

In an era with large corporations, many of them with operations spread across the globe, it can be difficult to focus on the core functions that create value for investors without getting bogged down in activities that distract from this objective. This truth has led to a number of companies dedicated not only to providing certain consulting services, but also dedicated to providing specialized staffing. After all, the hiring process is time-consuming, risky, and expensive. So, to mitigate that, one option that many businesses choose, especially if they need short-term work, is to outsource this function to other players. One company dedicated to this kind of work is Robert Half International (NYSE:RHI).

Today, the enterprise is a fairly large player with a market capitalization of $9.2 billion. Even though the business experienced some pain as a result of the COVID-19 pandemic, overall financial performance before and after that time has been positive. This is true for both the top and bottom lines, with performance this year being particularly appealing. Although I do not believe that current market conditions will persist, shares would be cheap if that were the case. If, instead, we assume that financial performance will revert back to what it was in 2021, shares are probably closer to being fairly valued, leading me to rate the enterprise a ‘hold’ at this time.

A play on corporate needs

As I mentioned already, Robert Half International is a staffing and risk consulting services company with a number of different units operating under it. To best understand all that the company offers, we should discuss what these individual divisions are. First, we have Accountemps. Through this division, the company offers its customers staffing services whereby the business serves up a list of temporary employees that can handle functions like accounting, finance, bookkeeping, and more. Next, the company has a division called OfficeTeam. This is a more generalized service that places temporary and full-time office and administrative personnel from all across the corporate spectrum with the company’s customer base. Under the Robert Half Finance & Accounting division, the company focuses on placing full-time accounting, financial, tax, and other related personnel.

The Robert Half Technology division provides information technology contract professionals for the company’s clients, while Robert Half Legal places both temporary and full-time employees in the legal profession. Robert Half Management Resources focuses on providing senior-level project professionals in the financial services space, while The Creative Group division emphasizes those in the creative professions like digital content creation, marketing, advertising, and more. And under the Protiviti division, the company offers consulting services associated with internal audit, technology, risk and compliance consulting, business performance improvement, and more.

Although all of these are vital activities the company engages in, it’s worth noting what the two largest contributors to the company’s top line happen to be. At the top of the list, we have Accountemps. During the company’s 2021 fiscal year, this particular division was responsible for 26.6% of the company’s revenue. This particular division falls under the temporary and consultant staffing operations that, combined, make up 57.4% of the firm’s revenue. However, this unit is responsible for just 46.6% of the company’s profitability. The next largest contributor to the company’s top line is Protiviti. Through this, the company generates 26.3% of sales and 39.8% of profits. Simply put, this is the cash cow of the business. Permanent placement staffing is also profitable. Despite counting for only 8.1% of revenue, the division made up 13.6% of profits last year.

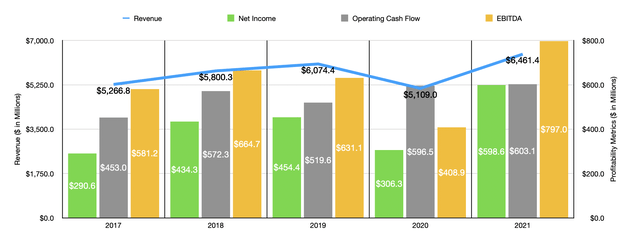

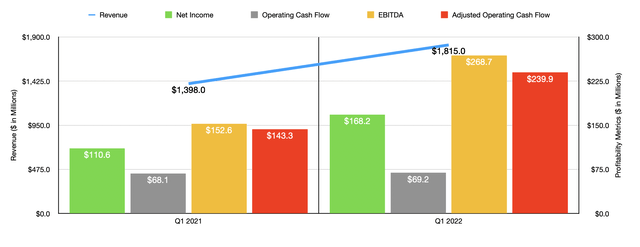

Over the past few years, management has done a pretty good job growing the company. Revenue expanded from $5.27 billion in 2017 to $6.07 billion in 2019. Due to the COVID-19 pandemic, sales plummeted, dropping to $5.11 billion for 2020. Fortunately, this was short-lived, and sales promptly rebounded, skyrocketing to $6.46 billion in 2021. As the economy reopened and demand for workers increased, the company benefited tremendously. That growth has continued into the current fiscal year. During the first quarter of 2022, sales came in at $1.82 billion. That represents an increase of 29.8% over the $1.40 billion generated the same time one year earlier.

When it comes to profitability, the picture has generally been positive as well. Net income rose in each of the three years ending in 2019, with the metric climbing from $290.6 million to $454.4 million. In 2020, the company’s profits narrowed, totaling just $306.3 million for the year. But last year, the company hit a new high in terms of profitability, with net income totaling $598.6 million. Other profitability metrics have followed suit. Over the past five years, operating cash flow expanded from $453 million to $603.1 million. Meanwhile, EBITDA also improved, rising from $581.2 million to $797 million. Just as has been the case with revenue, profitability has also continued to rise this year. Net income of $168.2 million for the first quarter of 2022 dwarfed the $110.6 million recorded one year earlier. Operating cash flow ticked up only modestly, climbing from $68.1 million to $69.2 million. But if we adjust for changes in working capital, it would have risen from $143.3 million to $239.9 million. EBITDA also improved, jumping from $152.6 million to $268.7 million.

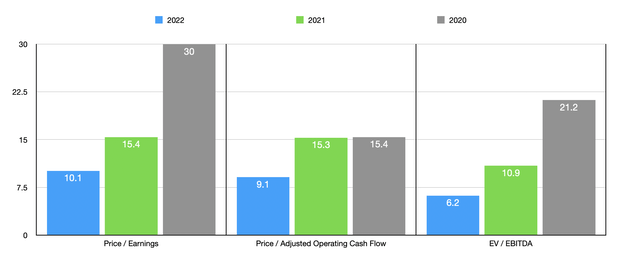

Management has not provided any detailed guidance for the 2022 fiscal year. However, if we annualize results experienced so far for the year, we should anticipate net profits of $910.3 million, operating cash flow of $1.01 billion, and EBITDA of $1.40 billion. If this comes to fruition and, against all odds, represents a new normal for the business, then shares are looking rather cheap. The price to earnings multiple would be 10.1. The price to operating cash flow multiple would be even lower at 9.1, while the EV to EBITDA multiple of the company would be 6.2. Of course, I think investors should be more conservative in their assessments. For instance, if the 2021 fiscal year is more indicative of the company’s long-term potential, something I don’t think is unrealistic at all, then shares are probably closer to being fairly valued. The price-to-earnings multiple is 15.4. The price to operating cash flow multiple would be 15.3, while the EV to EBITDA multiple would come in at 10.9. This disparity in the EV to EBITDA multiple is due to the fact that the company has no debt on hand and has cash and cash equivalents of $550.3 million.

Although shares of the company look fairly valued on an absolute basis, they do look to be on the pricey end of the spectrum relative to similar players. Based on a review of five similar companies, the price to earnings multiple range of the firms in question should be from 9.9 to 27.4. Using the price to operating cash flow approach, the range is from 6.9 to 34.9. And using the EV to EBITDA approach, the range is from 5.1 to 14.7. In all three cases, four of the five companies were cheaper than Robert Half International.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Robert Half International | 15.4 | 15.3 | 10.9 |

| TriNet Group (TNET) | 12.7 | 8.1 | 7.8 |

| ASGN Inc (ASGN) | 10.6 | 34.9 | 10.8 |

| ManpowerGroup (MAN) | 10.5 | 7.6 | 6.4 |

| Insperity (NSP) | 27.4 | 11.4 | 14.7 |

| Korn Ferry (KFY) | 9.9 | 6.9 | 5.1 |

Takeaway

Right now, investors are worried about the broader economy. Short term, we could be in for some pain. In that event, it’s not unthinkable that a company like Robert Half International might suffer because a weak market is not good for staffing demand. But for investors focused on the long run, current prices don’t look unreasonable. They don’t look great either, with shares probably closer to being fairly valued even though they might be a bit pricey relative to similar players. Because of all of this, I have decided to rate the business a ‘hold’ at this time.

Be the first to comment