Bet_Noire/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 27th, 2022.

I’ve covered several inflation-hedge ETFs in the past, including those focused on treasury-inflation protected securities, commodities, global miners, and more. These are all effective inflation hedges and strong investment opportunities, but relatively undiversified, each focusing on one particular asset class. Although there is nothing inherently wrong with this, some investors might prefer a broader, more diversified, multi-asset class inflation-hedge ETF, to simplify their portfolios and minimize fees. The SPDR SSGA Multi-Asset Real Return ETF (NYSEARCA:RLY) is one such fund.

RLY is a fund-of-funds, investing in several broad-based, index ETFs, all of which are effective inflation hedges, and outperform when inflation is high. The fund is a buy, and particularly appropriate for investors looking for a particularly simple, easy, way to hedge their portfolios against rising inflation. More hands-on investors might wish to avoid the fund’s 0.50% in fees, by constructing their own portfolio.

Inflation Analysis

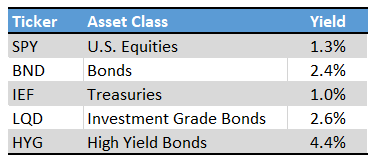

Investors are weary about inflation, and with good reason. Over the past twelve months, prices have increased by 7.9%, the highest inflation rate in forty years. Inflation seems to be accelerating, with monthly inflation doubling since March 2021, and increasing from 0.6% to 0.8% since January. Rising prices hurt everyone, but retirees are hurt more than most, as retirees can’t bargain for a raise, or switch to a higher-paying job. Lots of retirees, especially Seeking Alpha readers, depend on the income of their investment portfolios to make ends meet, but most asset classes simply don’t yield enough to keep up with rising prices. Investors are falling behind, and by a lot.

Seeking Alpha – Chart by author

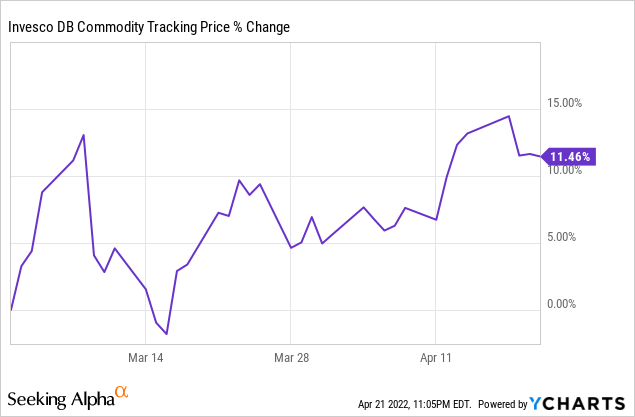

Importantly, inflation will likely remain elevated for at least a couple more months. This is because commodities, which are inputs for most manufacturing processes and consumer goods, are seeing surging prices, mostly due to the ongoing war in Ukraine. Commodity prices have surged more than 10% since March. Commodities are inputs for many industrial goods, so broad-based inflation should be soon forthcoming.

Besides the above, China is seeing significant supply chain disruptions in several major cities, due to government measures to combat surging coronavirus cases. China remains committed to a Zero COVID policy, supply chain disruptions will continue as long as this is the case, putting upwards pressure on prices.

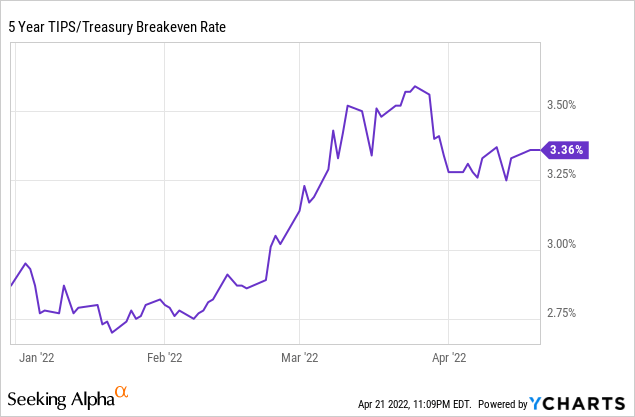

Markets seem to expect elevated inflation for a few years. 5Y breakeven rates, a market measure of inflation expectations, currently stand at 3.4%, and have moderately increased YTD. These are not excessively high inflation rates by any means, mostly because investors seem to believe that inflation will normalize after a year or two.

In my opinion, inflation will almost certainly remain significantly elevated for a few months, and will likely be at above-average levels for a couple of years. This is consistent with market measures of inflation expectations, and, from what I’ve read, the consensus view amongst analysts and regulators.

Considering the above, investing in assets, securities, and funds which outperform when inflation is high seems like a reasonable proposition. Which is where RLY comes in. Let’s have a look.

RLY – Overview

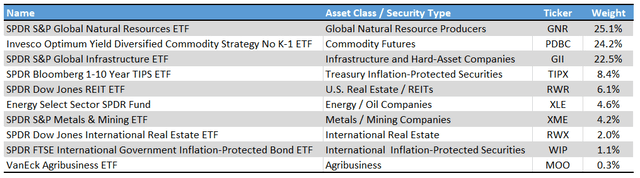

RLY is an inflation-hedge fund-of-funds. It invests in most relevant inflation-hedge asset class, through investments in cheap, simple, broad-based index ETFs. Asset class weights take into consideration a variety of fundamental measures, but are ultimately at the discretion of the fund’s investment management team. RLY’s holdings are as follows.

RLY Corporate Website – Chart by author

As can be seen above, RLY invests in ETFs covering all relevant inflation-hedge asset classes, including natural resource producers, commodities, infrastructure, treasury inflation-protected securities, and more. The fund is tilted towards higher-risk higher-return asset classes, mostly equities and commodities.

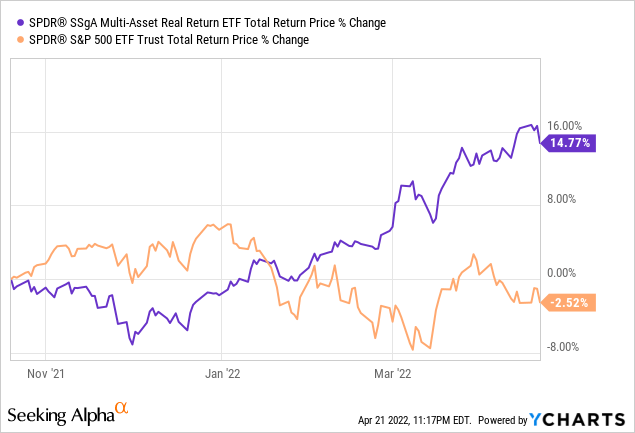

From what I’ve seen, the fund performs particularly well when inflation is high and rising, as expected. That has been the case for the past six months or so, a period of surging inflation.

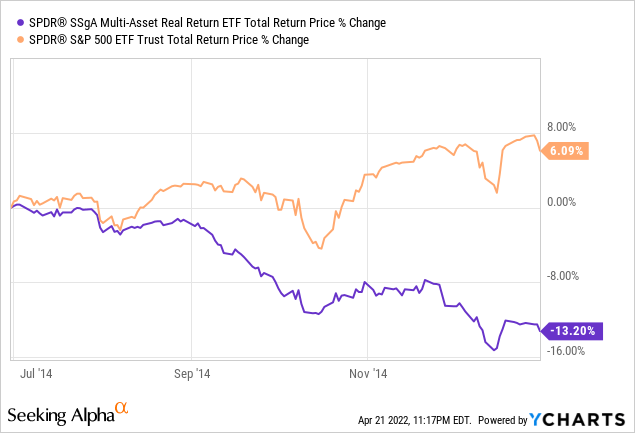

Inflation was generally quite stable in prior years, with few significant movements. Still, from looking at the fund’s performance in relation to past inflation rates, I do think there is a negative relationship there. As an example, inflation plummeted from mid-2014 to early-2015, during which the fund significantly underperformed, as expected.

In my opinion, and considering RLY’s holdings, strategy, and performance, the fund is a reasonably effective inflation hedge, and should outperform as long as inflation remains elevated. As such, the fund is an appropriate investment opportunity for investors concerned about rising inflation.

Relative to its peers, RLY’s key differentiator is the fund’s diversified, multi-asset class holdings. Most inflation-hedge ETFs focus on one particular asset class, while RLY invests in several. Diversification reduces risk and volatility, and ensures strong performance during most relevant inflationary periods. As long as broad-based inflation measures remain elevated the fund should outperform, while this is not necessarily true for other less diversified, concentrated funds, which might underperform due to idiosyncratic factors. As such, and relative to its peers, the fund is particularly appropriate for investors looking for broad-based, diversified inflation-hedge ETFs. Investors looking for more specific, concentrated exposure to a specific asset class or security, say oil or gold, should consider other funds.

RLY – Dividend Analysis

A quick note on the fund’s dividends. RLY sports a trailing twelve-months yield of 10.4%, an extremely high figure. Although the fund’s yield looks attractive, I do not believe that it is indicative of the fund’s current underlying generation of income, or of future / expected dividends. RLY’s yield is mostly the result of certain structural / regulatory issues concerning commodity futures and distributions thereof, explained in more depth here.

In simple terms, RLY distributes any profits from its commodity futures to investors as distributions. These profits are not generated from underlying dividends, interest rate payments, coupons, or similar, and are mostly the result of certain structural features of RLY’s underlying holdings, meant to simplify tax reporting requirements. As such, RLY’s 10.4% yield is not a particularly informative, material figure, and should (mostly) be disregarded by investors.

By my calculations, if one were to exclude commodity futures dividends from RLY’s yield, the fund’s yield would drop to between 2.0% and 3.0%. In my opinion, these figures are more indicative of the fund’s actual underlying generation of income. As such, it seems quite clear that RLY is not a particularly high-yield fund. It is an effective inflation hedge, but it is nothing special income-wise.

RLY – Effectiveness as an Inflation Hedge

RLY focuses on asset classes with indirect exposure to commodity prices, including energy and material equities. These asset classes benefit from rising prices, and so generally outperform when inflation is high, but there are a few, rare, exceptions. Sometimes these asset classes underperform even when prices are moving their way, due to issues with market sentiment, valuations, foreign currency exchange movements, etc. Prices matter, but other factors matter too.

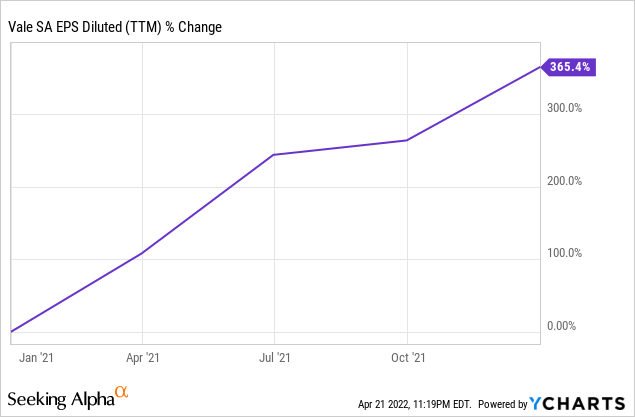

Let’s use Vale (VALE), one of the fund’s larger underlying holdings, as an example. Vale is a global mining company focusing on iron ore mining. Vale has seen skyrocketing earnings during the past year or so, due to rising iron ore prices.

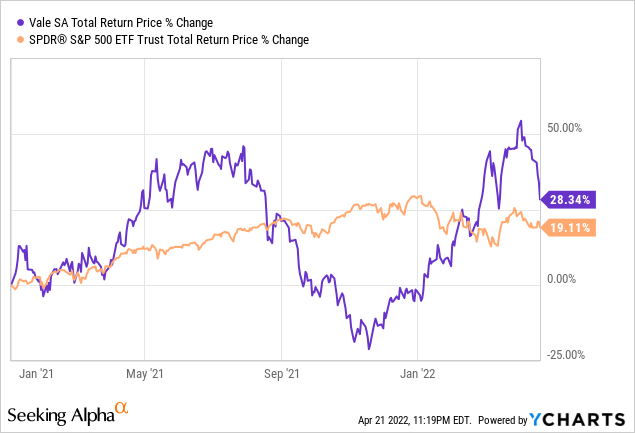

Vale’s returns have been quite good since, with the company significantly outperforming the S&P 500, but quite complicated too. The company suffered losses of about 45%, almost halved, in late 2021, due to weakening economic conditions in China, and sluggish Chinese steel demand / production. These were all bearish indicators for Vale, investors sold the company’s shares in fears, sending its share price tumbling down. Importantly, the market’s reaction was soon proven excessive. Iron ore prices remained elevated and earnings remained high, see above. A drop in Vale’s share price seemed warranted, a collapse did not, and markets soon reversed course.

Vale’s earnings are strongly dependent on iron ore prices. Vale’s share price is moderately dependent on iron ore prices, but also dependent on market sentiment, valuation, investor flows, and the like. These other factors dampen the effectiveness of the company’s shares, and of similar securities, as an inflation hedge. Vale significantly underperformed in late 2021 even as inflation was quite elevated at the time. Underperformance during future periods of elevated inflation is possible. Still, the company only underperformed for a couple of months, and has more than recovered from these losses YTD. Vale and similar companies tend to perform quite well when inflation rises, all things considered.

RLY focuses on asset classes / securities like equities / Vale, and so could plausibly underperform even as inflation remains elevated. I think that this is quite unlikely due to the fund’s significant diversification, but could plausibly happen. From what I’ve seen, this has not really been the case for RLY in the past, although it has been the case for some of the fund’s underlying funds. In any case, the only funds which completely avoid these issues are those focusing on diversified commodity futures, as futures have direct, explicit exposure to (commodity) prices.

Conclusion

RLY is a multi-asset class inflation ETF, providing exposure to most relevant inflation-hedge asset classes. It is a buy, and particularly appropriate for investors concerned about inflation, and looking for diversified inflation-hedge ETFs.

Be the first to comment