Pgiam/iStock via Getty Images

Almost three months ago, I recommended purchasing RLJ Lodging Trust (NYSE:RLJ) for its markedly cheap valuation and its expected recovery from the pandemic. Since my article, the stock has remained essentially flat but the company has greatly improved its business performance, as its recovery has progressed. The primary reasons behind the poor performance of the stock this year (-23%) are the impact of the pandemic on its business and fears of an imminent recession. However, as the business prospects have improved and the stock is trading at an exceptionally cheap valuation level, patient investors should purchase the stock around its current price and wait for the recovery to play out.

Business overview

RLJ is a REIT that owns 95 luxurious, high-margin hotels, with 21,113 rooms in 22 states. Due to the luxurious character of its hotels and their reliance on tourism, RLJ was especially hit by the coronavirus crisis in 2020-2021. Due to the social distancing measures taken in response to the pandemic and the reluctance of people to travel, RLJ incurred losses in 2020, for the first time in more than a decade. It also slashed its quarterly dividend by 97%, from $0.33 to $0.01, in early 2020 in order to preserve funds amid an unprecedented downturn.

On the bright side, thanks to the massive vaccine rollout worldwide, the pandemic has begun to subside. As a result, leisure travel has almost recovered to pre-pandemic levels while business travel has begun to recover.

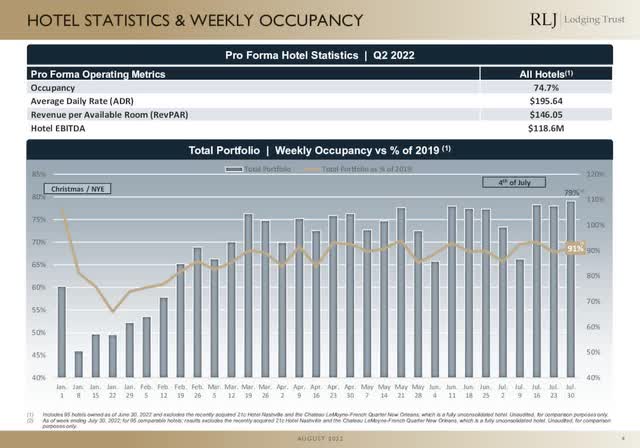

The improving business trends were clearly reflected in the latest earnings report of RLJ. In the second quarter, the trust grew its revenue per available room 36% sequentially and thus this metric reached 92% of its pre-pandemic level, in 2019. The ongoing recovery is also evident from the positive trend in the occupancy of the REIT.

RLJ business performance (Investor Presentation)

As shown in the above chart, occupancy has reached 91% of its pre-pandemic level. The recovery has resulted from the rebound of leisure travel, strong citywide attendance and the early phases of a recovery in business travel. Thanks to all these drivers, RLJ more than tripled its funds from operations [FFO] per unit sequentially, from $0.14 to $0.49, and exceeded the analysts’ estimates by $0.05.

Even better, the recovery has continued in the running quarter and hence RLJ is on track to approach its pre-pandemic performance. Analysts seem to agree on the sustained recovery of the REIT. They expect RLJ to grow its FFO per unit from $0.19 in 2021 to $1.43 this year and $1.88 in 2023. If they prove correct, the FFO per unit in 2023 will be only 7% lower than the FFO per unit of $2.03, which were posted in 2019. To cut a long story short, RLJ is recovering from the pandemic at a fast pace, as people are claiming their normal lifestyle back.

The solid recovery and the confidence of management in the positive outlook of its business is evident from many recent decisions of management. RLJ recently raised its quarterly dividend from $0.01 to $0.05. While it still has a long way to restore its dividend to the pre-pandemic level of $0.33, the stock is not offering a negligible yield anymore; it is offering a 1.8% yield.

Moreover, thanks to its strong recovery, RLJ exited its covenant waivers in the second quarter. In simple words, its lenders (banks) stopped posing strict financial limits on RLJ, as they do not consider them necessary anymore. This is a vote of confidence from bankers, who are well known for their conservatism.

Furthermore, RLJ repurchased 2.5% of its shares during the second quarter. This is a remarkable share buyback rate for a single quarter. This move is a testament to the confidence of management in the bright outlook of the company, as it signals that RLJ does not need to preserve excessive funds anymore. In addition, management should be praised for repurchasing shares at depressed stock prices, thus enhancing shareholder value.

Overall, the exit from covenant waivers, the meaningful dividend hike and the share repurchases are testaments to the confidence of management in a sustained recovery. If management considered the business environment fragile, it would not take all these decisions in a single quarter.

Apart from the coronavirus crisis, the other reason behind the decline of the stock is the risk of an upcoming recession. The Fed is raising interest rates aggressively in an effort to restore inflation from its current 40-year high to its normal level, around 2%. As higher interest rates reduce the total investment in the economy, they take their toll on economic growth and hence the risk of an upcoming recession has increased.

Due to the luxurious nature of its hotels, RLJ is especially vulnerable to recessions. During rough economic periods, the demand for luxurious hotels significantly decreases and thus RLJ is especially hit. On the contrary, when the economy recovers, RLJ usually outperforms the broad market thanks to its leverage to economic growth. This is why RLJ is a high-beta stock. It has a beta of 1.75, which means that the moves of the stock are 75% greater on average than those of the S&P 500.

If a recession shows up, RLJ will probably experience a decrease in the demand for its hotels. However, the company has proved that it can endure recessions and emerge stronger from them. It also has the financial power (more on this below) to endure such a downturn and wait patiently for the subsequent recovery. If a recession materializes, the resultant downturn will almost certainly be milder than the fierce downturn caused by the pandemic in 2020. As RLJ endured that unprecedented downturn, it will also endure a potential recession.

Balance sheet

The resilience of RLJ to downturns should be attributed, at least in part, to its balance sheet, which is one of the strongest in the REIT universe. The net debt of the REIT (as per Buffett, net debt = total liabilities – cash – receivables) stands at $2.0 billion, which is equal to the market capitalization of the stock and about nine times the expected FFO this year. Therefore, the debt of RLJ is manageable, particularly given the absence of meaningful debt maturities until 2024.

It is also remarkable that management has done a great job protecting the REIT from rising interest rates, as the whole amount of debt is either fixed or hedged. Therefore, RLJ is resilient to the current environment of rising interest rates. Overall, thanks to its healthy financial position, RLJ will almost certainly endure a potential recession and emerge stronger during the subsequent recovery.

Valuation

As mentioned above, analysts expect RLJ to post FFO per unit of $1.43 this year and $1.88 next year. As the REIT has exceeded the analysts’ consensus in 6 of the last 8 quarters, it has good chances of meeting or exceeding the above estimates, particularly given its ongoing strong recovery. Therefore, RLJ is trading at a price-to-FFO ratio of 8.0 while it is also trading at only 6.1 times its expected FFO in 2023. This is an exceptionally cheap valuation level, especially for a REIT with a strong balance sheet.

The exceptionally cheap valuation of RLJ has resulted mostly from fears of an imminent recession, but the REIT is likely to be able to navigate through a recession without any problem thanks to its healthy financial position. Whenever the economy accelerates again, the stock of RLJ will probably be rewarded with a much higher price-to-FFO ratio, in line with its historical average. RLJ has traded at an average price-to-FFO ratio of 10.0 over the last decade. Therefore, the REIT is exceptionally attractive from a long-term point of view right now.

Dividend

RLJ is currently offering a dividend yield of 1.8%. This yield is much lower than the median dividend yield of 4.6% of the REIT sector. While RLJ recently raised its quarterly dividend from $0.01 to $0.05, its annualized dividend of $0.20 is still 85% lower than its pre-pandemic dividend of $1.32.

However, it is important to realize that the REIT can gradually restore its dividend in the upcoming years. First of all, it currently has an exceptionally low FFO payout ratio of 11%, which provides the company with ample room for future dividend hikes. Investors should also note that RLJ was offering its pre-pandemic dividend of $1.32 when its FFO per unit were standing at $2.03. As the REIT is expected by analysts to achieve FFO per unit of $1.88 in 2023 and $2.28 in 2024, it will probably be able to restore its dividend at approximately $1.32 in the upcoming years. If this proves correct, the stock will be offering an 11.6% yield at its current price. This is just another illustration of the exceptionally cheap valuation of the stock right now.

Risk

A potential risk for RLJ is the unlikely event of a prolonged recession. Due to the luxurious nature of its hotels, RLJ will be highly vulnerable in such a scenario. If a prolonged recession materializes, RLJ is likely to exhibit poor business performance for an extended period and hence great patience will be required for the aforementioned investment thesis to play out. Therefore, only those who can withstand stock price pressure and volatility for a long period and remain focused on the long-term potential of RLJ should consider purchasing the stock.

Final thoughts

The stock of RLJ is in a strong downtrend right now, mostly due to its high sensitivity to economic growth and the ongoing bear market of the S&P 500. The stock is likely to remain under pressure in the short run but it has become exceptionally cheap from a long-term perspective. Those who can wait patiently for a recovery of the economy are likely to be highly rewarded by this high-quality REIT.

Be the first to comment