Michael M. Santiago

Just days after I worked on Rivian Automotive (NASDAQ:RIVN) discussing the EV maker’s production and delivery ramp in the second-quarter, the company suffered another major blow: Rivian announced that it will recall more than 12,000 of its electric vehicles due to a technical issue with its fasteners. The recall led to an 8% price drop for Rivian’s shares on Friday. While the fix for loose fasteners is expected to last only a couple of minutes and won’t cost the company a lot of money, the event highlights the risk of investing in electric vehicle start-ups with limited manufacturing experience!

Rivian’s latest problem: Another recall

This year was not a year short of disappointments for electric vehicle start-up Rivian: The company, already plagued by production delays for its electric pick-up and sport utility vehicles, stepped into a public relations disaster earlier this year when it raised prices for its EVs by 20% due to higher material costs and said that price hikes would also apply to existing reservation-holders.

Although Rivian later apologized and backtracked, the company did some damage to its brand. Additionally, Rivian cut its production target for FY 2022 from 50 thousand electric vehicles to 25 thousand electric vehicles, meaning its expected factory output this year is equal to just 17% of Rivian’s 150-thousand-unit annual production capacity at its Illinois factory.

Now a major recall is set to damage Rivian’s reputation as a reliable EV car brand even more. The company said on Friday that it has to recall 12,212 of its electric vehicles because of a loose seat fastener. According to safety recall report filed with the National Highway Traffic Safety Administration, Rivian described the problem as affecting the front upper control arm and the steering knuckle retention fastener which are not properly torqued. The recall affects the R1T, the R1S and a subset of EDVs. Rivian produced a total of 14,317 electric vehicles this year, so the recall will affect 85% of its 2022 production volume.

Rivian also said that the fix won’t take a long time, but the recall adds to a growing number of problems that highlight the risk of investing in an electric vehicle start-up with limited manufacturing experience. Investors so far have gotten used to Rivian’s production delays, but recalls can be especially damaging to a company’s brand and may have a negative effect on future revenues.

This is especially the case with new electric vehicle brands which compete against established car brands that have already built trust with consumers for many years. Electric vehicle brands like Rivian or Lucid (LCID), as start-ups, have to start from scratch by building trust with consumers since their products haven’t been around very long and buyers haven’t had a lot of contact with their brands.

This also isn’t the first recall for Rivian, which I believe makes the situation worse. Earlier this year, in May, Rivian was forced to recall 500 R1T pick-up trucks because of faulty airbags which didn’t deflate when a child is seated in the front seat. More recalls could cause serious brand damage before Rivian even had the opportunity to establish trust with consumers and prospective buyers.

Revenues

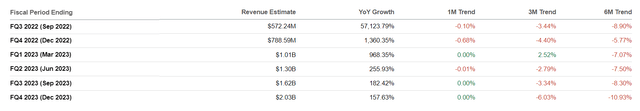

Rivian’s revenues are expected to ramp up nicely going forward, and so far, safety and recall issues have not had a measurable effect on the company’s reservations and revenue expectations. However, this may change going forward as problems are clearly accumulating and quarterly revenue estimates have started to drop off for next year. Estimates now call for Rivian to achieve $6.2B in revenues in FY 2023 and I believe the estimate is on the optimistic site.

Seeking Alpha: Rivian Quarterly Revenue Estimates

Risks with Rivian

There are plenty of risks with Rivian and most of the article already discussed the most important ones. The biggest risks, I believe, is Rivian’s production ramp which is not helped by the most recent safety recall. I also see risks related to Rivian’s very high valuation (P-S ratio of 5.0 X) which exposes investors to more down-side risk in case there is yet another production delay or another safety recall.

Final thoughts

Rivian’s latest recall highlights the risk of investing in electric vehicle start-ups that don’t have established manufacturing histories and are in the early stages of ramping up production. Rivian’s share price plunged 8% on Friday and shares are now trading 81% below their peak. The recall also added to a number of headaches at Rivian that include previous safety recalls, production delays, higher material costs, public relation disasters and, possibly, weaker than expected reservation/revenue growth going forward as a result of these developments. With the latest recall, I believe Rivian made it harder for investors to invest in the company and the risk profile remains skewed to the downside!

Be the first to comment