Putting all your eggs in one basket witsanu singkaew/iStock via Getty Images

Author’s note: All figures listed in Canadian dollars unless otherwise noted.

ETF Style

My personal investing style is “core and explore”. I hold a core of high-quality blue-chip companies in my portfolio and look to supplement with exchange-traded funds. I like ETFs for the convenience and easy diversification. However, not all ETFs are made equal and not all match individual investing goals.

Regular readers will know that I am a fan of high-quality companies with long histories of dividend growth. I believe that patient investors who build a core portfolio of dividend paying equities can achieve their income goals without taking on unnecessary risk. Holding dividend ETFs such as the FTSE Canadian High Dividend Yield Index ETF (TSX:VDY:CA) can support this strategy, provided the fund is properly diversified, have low fees, and are comprised of companies with clear visibility towards consistent and growing dividends.

Who is VDY For?

Through passive management, VDY aims to replicate the TSE Canada High Dividend Yield Index. To achieve this, VDY invests primarily in common stocks of dividend paying Canadian companies.

VDY is a useful investment vehicle for investors looking for growing dividend income who may not have the capital or the inclination to manage their own diversified dividend portfolios. For a hands-off investor, or someone looking to supplement another income strategy, VDY offers a low-cost option for monthly income.

Fees & Liquidity

VDY trades on the Toronto Stock Exchange with an average volume of 297,836 units daily. As of September 2022, VDY has a market capitalization of $1.7B, providing ample liquidity.

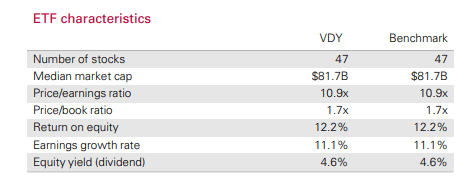

VDY Characteristics (Vanguard)

VDY carries a management fee of 0.20% and a MER of 0.22%. This compares favourably to peers such as iShares Canadian Select Dividend Index ETF (XDV:CA) and BMO Canadian Dividend ETF (ZDV:CA), which carry management fees of 0.50% and 0.39% respectively.

Holdings Analysis

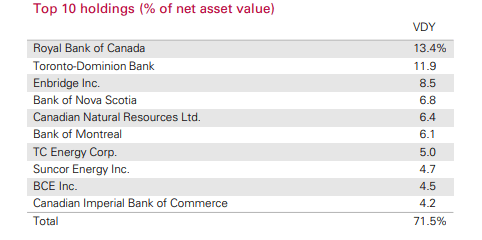

VDY consists of 47 holdings, of which the top ten account for 71.5% of the total NAV. At face value, 47 holdings sound reasonably diversified, however the smallest 25 holdings by weight on the list account for just 6% of NAV. While just two companies, Royal Bank of Canada (RY) and Toronto-Dominion Bank (TD) represent more than one quarter of VDY’s net assets.

The market weighting approach to this ETF has the result of concentrating the funds underlying assets to a small number of holdings with significant weightings. While an equal weighted ETF would lead to higher management costs due to the need for more rebalancing, Vanguard could employ a capped framework to limit the weighting of some of Canada’s large financial stocks. This would offer a little more diversification without changing the ETF’s parameters significantly.

VDY Holdings (Vanguard)

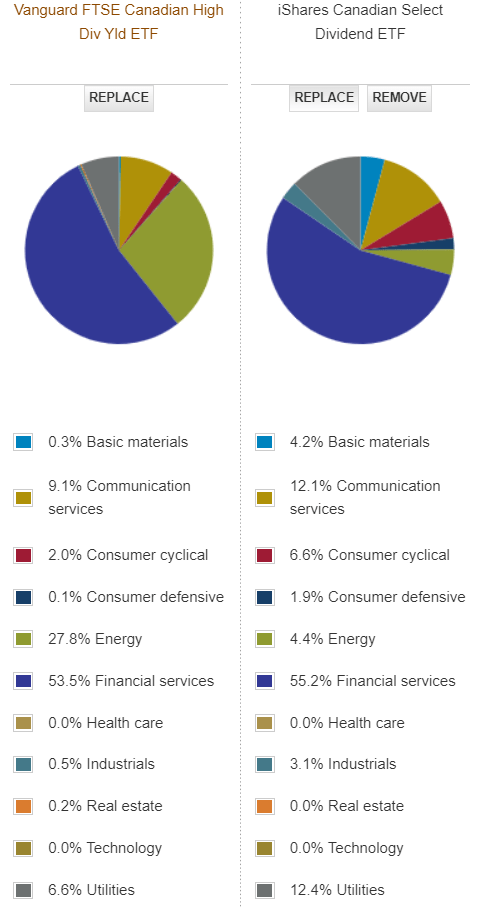

VDY is especially heavily weighted towards the two segments that already dominate the Canadian stock market: Financials and Energy. For most Canadian investors at the stage in life where seeking income in their primary investing goal, they will need to be mindful of their exposure to these two sectors already.

Sectors usually rich in dividend paying companies such as healthcare, consumer discretionary, real estate and utilities are either absent or under-represented in VDY, relative to other high dividend funds such as iShares Canadian Select Dividend Index ETF. XDV has a greater representation in consumer cyclicals and almost twice the exposure to utilities.

The ETF’s geographic constraints to Canada limit the availability of healthcare and consumer discretionary names. Canada does however have a number of high-quality utility and REITs and utilities with above average yields which could be employed to address some of the sector concentration in this fund.

In terms of optimal sector diversification, VDY falls far short of U.S. dividend ETFs in more diversified markets such as Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (SCHD), in which no one sector accounts for more than 21% of NAV.

Sector Allocation Comparison (Vanguard)

Dividend Income

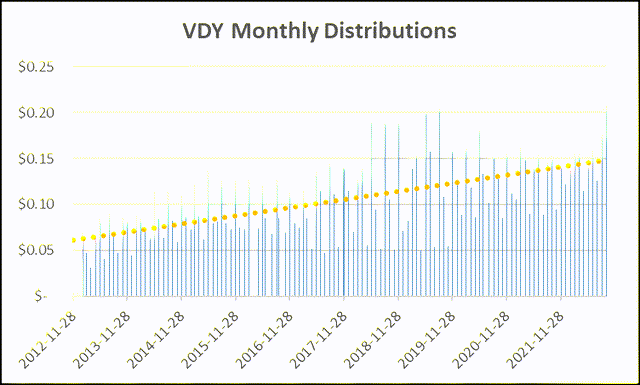

VDY pays a monthly distribution, which has grown steadily since the fund’s inception. In 2013, VDY paid out $0.74, in 2021, this had more than doubled to $1.54 per unit. With most of the fund’s underlying holdings paying dividends quarterly, the month-to-month distributions can be somewhat choppy. The long-term trend and stability of dividend income however has been positive. VDY has a forward distribution yield of 5.01% as of its most recent distribution and a trailing 12-month yield of 3.99%.

VDY Monthly Distribution (Data Source: Vanguard, Graph Source: Author)

The vast majority of VDY’s income is considered eligible dividend income with occasional disbursements of capital gains and return of capital. For investors holding VDY outside of a tax-sheltered investment account, VDY may be tax-advantaged given the lower marginal tax rate for eligible dividend income.

Dividend Growth

VDY’s top ten holdings are comprised of mature companies with established market positions. For the majority of these companies, including the financials, pipelines and telecoms, the incumbents enjoy protected market positions in highly regulated industries where the threat of new entrants is minimal. Some of these sectors, such as banking and telecommunications are de facto oligopolies providing these companies with pricing power and the visibility to fund future dividend growth.

|

Holding Name |

Portfolio Weighting |

5-Year Dividend Growth Rate |

|

Royal Bank of Canada |

13.33% |

5.9% |

|

Toronto-Dominion Bank |

11.83% |

7.9% |

|

Enbridge Inc. |

8.44% |

9.5% |

|

Bank of Nova Scotia |

6.73% |

4.6% |

|

Canadian Natural Resources Ltd. |

6.33% |

16.3% |

|

Bank of Montreal |

6.05% |

4.5% |

|

TC Energy Corp. |

4.92% |

6.9% |

|

Suncor Energy Inc. |

4.70% |

7.9%* |

|

BCE Inc. |

4.44% |

5.1% |

|

Canadian Imperial Bank of Commerce |

4.22% |

4.4% |

|

Average 5-Year Dividend Growth |

7.2% |

|

Table Source: Author, Data Source: Data Source: Canadian Dividend All-Star List

VDY’s underlying holdings have enjoyed strong dividend growth despite market maturity. The average 5-year dividend growth rate for VDY’s top ten holdings is over 7%. Strong dividend growth with reinvested dividends is a recipe for outperformance.

While these underlying companies have had strong dividend growth in recent years, there is reason to expect that for some it may be slowing. For Enbridge Inc. (ENB) and TC Energy Corp (TRP) the most recent dividend increases were 3.0% and 3.4% respectively; well below their 5-year averages. Even for banks such as the Bank of Nova Scotia (BNS) and Bank of Montreal (BMO) recent increases were 3.0% and 3.1% respectively; down by approximately 1/3 from their 5-year averages.

Another red flag in the top ten here is Suncor Energy Inc. (SU), which accounts for 4.7% of VDY’s NAV. In 2020, Suncor cut its dividend in half after approximately two decades of continuous dividend growth. The firm has since reinstated its prior dividend amount; however, the cut highlights the precariousness of individual underlying securities and the need for diversification.

Total Return

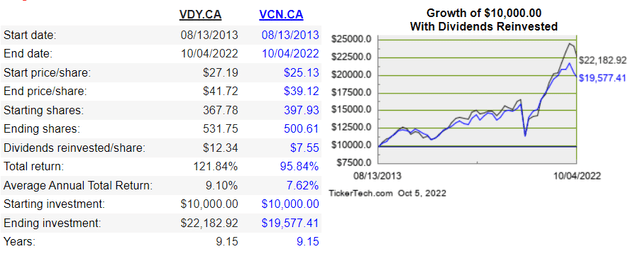

Despite concerns around portfolio composition and diversification, VDY has achieved a respectable average annual total return of 9.10% since inception, outperforming the broader Canadian stock index. To put the total return of VDY in context, I have compared it to Vanguard FTSE Canada All Cap Index ETF (VCN:CA), a good proxy for the entire Canadian stock market. The total return is calculated with dividends reinvested. I have used a start date of August 2013, shortly after the funds launched.

VDY Total Return (Canada Stock Channel)

Conclusion

VDY is a concentrated bet on the continued outperformance of Financials and Energy. This exposure to big banks and big oil could prove a drag on the portfolio in certain market conditions. Despite VDY’s over-concentration in a handful of large dividend-paying companies, the fund has achieved its objective of providing a steady stream of growing dividend income. Investors who are mindful of overall portfolio diversification can tap VDY as an easy and inexpensive way to add some dividend growth to a portfolio.

Be the first to comment