bfk92

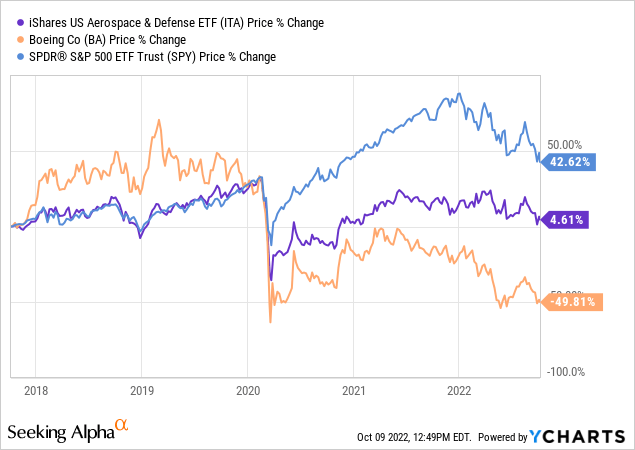

The iShares U.S. Aerospace & Defense ETF (BATS:ITA) has a decent 10-year performance track record (a 12.2% average annualized total return), but has significantly lagged the broad S&P500 over the past 5-years. However, much of ITA’s under-performance is a result of the global pandemic impact on global commercial aviation and the terrible performance by one of its major holdings: Boeing (BA), which is down ~50% over the past 5-years (see graphic below). Generally though, the sector was somewhat out-of-favor during the go-go days of the bull-market, which put higher valuations on more growth-oriented companies. Yet much has changed in the 2022 bear-market – which includes Putin’s horrific war-of-choice on Ukraine that – combined with the sanctions on Russia by the United States and its Democratic & NATO allies – effectively broke the global energy & food supply chains – leading to dramatic increases in inflation and interest rates. Add to that toxic mix the continuing China/Taiwan drama, and there is no doubt that the world has become a much more dangerous place. That being the case, defense spending by the United States and its NATO allies (which buy much of their equipment from US defense companies) is likely to go significantly higher in the years to come.

Investment Thesis

Back in May, the New York Times reported that the U.S. had spent $54 billion on assistance to Ukraine. Of that total (which included economic, humanitarian, and healthcare aid), an estimated $31.3 billion was targeted to military, weapons & defense supplies, and military intelligence related spending. In August, Reuters reported that the U.S. was sending an additional $5.5 billion in aid to Ukraine – $1 billion of which was targeted for military assistance. Last month, The Intercept_ reported that President Biden has asked Congress for an additional $13.7 billion for Ukraine, much of which is very likely to go toward military related weapons, supplies, and intelligence. Clearly, much of the spending for Ukraine’s defense (and more recently, offense…) is going to funnel to the U.S. defense & aerospace companies.

Indeed, in April the Stockholm International Peace Institute reported that global military expenditure recently passed $1 trillion for the first time:

Stockholm Peace Institute

With Putin recently calling up another 300,000 “troops” and threatening to use tactical nuclear weapons, it would appear he is digging in for the long-term and will refuse to admit he made a huge mistake by invading Ukraine – a move that brought NATO back stronger than ever and with two new members (Finland & Sweden), which will only increase total NATO defense spending going forward. That is, I suspect the graphic shown above is likely to see a fairly large increase when the data for full-year 2022 is complete.

That being the case, today I will take a close look at the iShares U.S. D&A ETF to see how it has positioned investors for success going forward.

Top-10 Holdings

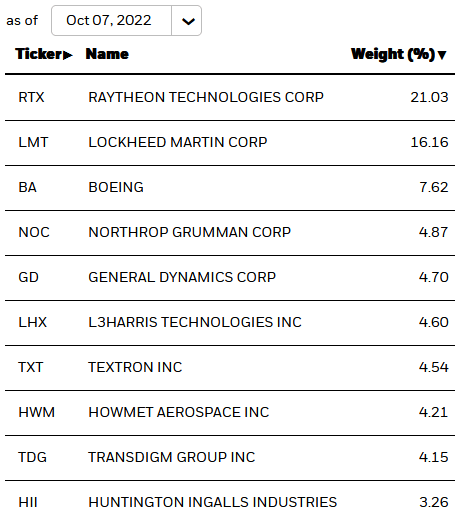

The top-10 holdings in the ITA ETF are shown below and equate to what I consider to be a relatively concentrated 75% of the entire 35 company portfolio:

iShares

Raytheon Technologies (RTX) is the #1 holding with a 21.0% weight. Raytheon has always been a leading defense contractor, and with the addition of United Technologies is now a leading supplier to the commercial aerospace sector as well. RTX’s Pratt & Whitney segment produces jet engines and is a leading supplier for the Airbus A220 and A320 family of aircraft. In addition, RTX’s Collins Aerospace is one of the largest commercial aircraft component suppliers. More to the point with respect to Ukraine is RTX’s significant exposure to missiles, missile defense systems, and IT systems for military supply chain management. RTX is down 6.8% over the past year and yields 2.6%.

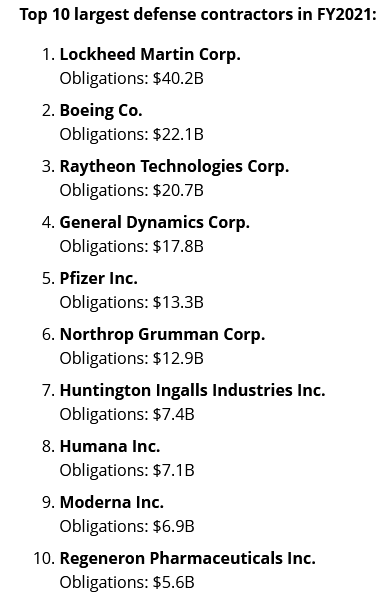

The #2 holding is Lockheed Martin (LMT) with a 16.2% weight. According to Bloomberg Government’s list of top-10 defense contractors, Lockheed was far-and-away the largest in FY2021 with $40+ billion in contractual defense related obligations:

Bloomberg Government

(Author Note: the list above was dramatically influenced by the global pandemic and the related heavy government spending on vaccines.)

Lockheed is up 14.8% over the past year, trades at a forward P/E of 15x, and yields 3.0%. LMT should be a primary benefactor of increased spending on U.S. defensive and offensive military systems.

As noted earlier, the ill-fated Boeing Company (BA), beset by crashes and government investigations and increased regulatory oversight, has been a disaster for investors over the past 5-years (down ~50%). Boeing was typically the #1 holding in many D&A funds prior to its downfall. Now, it is the #3 holding in the ITA ETF with only a 7.6% weight despite being the #2 largest defense contractor (as shown in the graphic above). However, last month Boeing received an order for up to 64 737 MAX jets from Canada’s WestJet and the worst may well be behind the company.

General Dynamics (GD) is the #5 holding with a 4.7% weight. GD recently landed a $532 million contract of Naval Sea Systems. Various options and add-ons could bring the total value of that contract to $800+ million. GD is up nearly 11% over the past year and yields 2.3%.

Howmet Aerospace (HWM) has a 4.2% weight in the ITA ETF and is the #8 holding. Seeking Alpha reported that Truist analyst Michael Ciarmoli said Howmet is:

… a unique and differentiated asset in the aerospace supply chain that should be in position to benefit from increasing aircraft production rates, share gains in the titanium aerospace market, an easing supply chain in the transportation market, and an operational playbook that should enable continued margin expansion in the coming years.

The #10 holding in the ITA ETF is Huntington Ingalls (HII) with a 3.3% weight. Huntington designs, builds, and repair military ships. In August, HII received an $826 million order from the U.S. DoD. The stock is up 14.8% over the past year.

Overall, the ITA portfolio has a 30-day SEC yield of only 0.96%. That being the case, the primary investment opportunity here is capital appreciation, not income.

ITA currently trades with a price-to-book ratio of only 2.9x, a deep-discount to the S&P 500’s current 3.6x price-to-book multiple. The forward P/E = 23.9x.

Performance

As mentioned earlier, the ITA ETF has a solid 10-year average annual return of 12.2%, but has been a laggard over the past 5-years (1.6% average annual return).

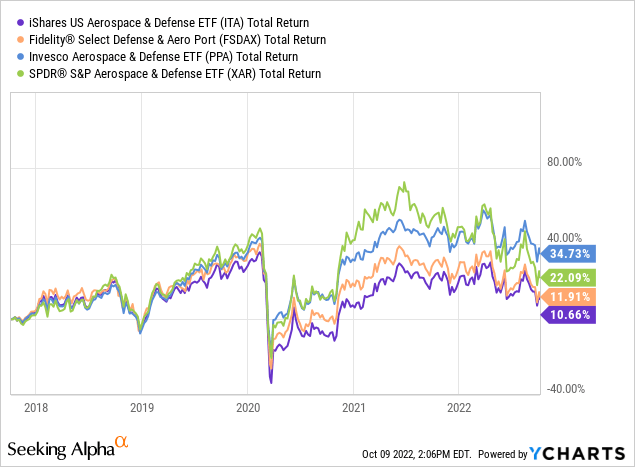

The graphic below compares the five-year total returns of the ITA ETF with several of its peers: the Fidelity Select Defense & Aerospace Fund (FSDAX), the Invesco A&D ETF (PPA), and the SPDR S&P A&D ETF (XAR):

Note the Invesco PPA ETF has been, far-and-away, the best performer, with the ITA coming in dead last. The PPA ETF has a more diversified portfolio and a lower weight in Boeing as compared to the ITA ETF. Interestingly enough, PPA has a higher expense fee (0.58%) as compared to the ITA ETF (0.39%).

Risks

The major risks to the defense spending thesis are that Democratic & NATO countries are generally suffering high-inflation due to the high energy & food prices as a result of Putin’s war. That being the case, interest rates are on the rise and government debt is expanding – not a good combination. Since governments are the primary spenders for the defense side of the equation, that could – eventually – lead to a reduction in military spending. Meantime, the other side of the equation – commercial aviation – continues to recover from the global pandemic, which is another reason the D&A outlook moving forward should be improved over the recent past.

Commercial aviation could be negatively affected by high-inflation and slower economic growth, which could reduce consumer travel demand. In addition, continued covid-19 lock-downs and restrictions in China could dampen commercial airline demand from the planet’s second largest economy.

Summary & Conclusion

The recent 5-year performance of the D&A sector has been pretty awful. However, prior to the global pandemic and the meltdown in Boeing, it was a very high-performing sector. For instance, the FSDAX ETF was up 200% in the 10-years between 2010 and 2020. I would expect a general recovery in the sector going forward with the development of covid-19 vaccines, increasing global travel, and significantly increased military spending. That said, based on recent performance and despite the high expense ratio, the PPA ETF appears to be one of the leading ETFs in the D&A space and superior to the ITA ETF. As a result, I rate ITA a HOLD and PPA a BUY.

Be the first to comment