Justin Sullivan/Getty Images News

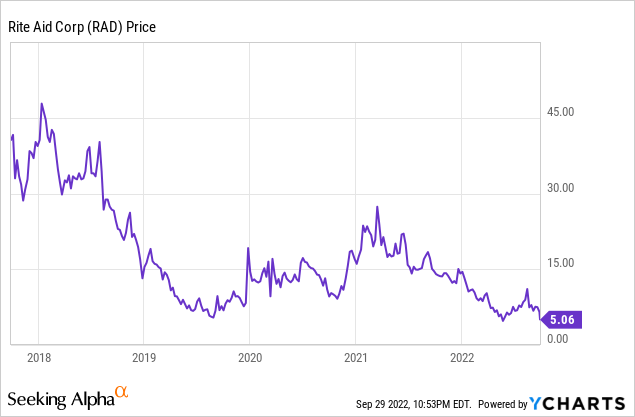

While there were a few bright spots in their latest quarterly report, investors in Rite Aid (NYSE:RAD) were very disappointed with current results and downward revised guidance. The stock price plunged 28% on Thursday to $5.08. Their debt securities also dropped, and I would not be surprised if S&P lowers their debt rating from the current CCC-. Unless management can find some medicine in one of their store’s pharmacies that cures their poor managerial skills or they can get help from some outside investor, Rite Aid most likely will have to do some major restructuring either out of court or in Ch.11. Remember the stock is currently selling at only about $0.25 per share after factoring in their 2019 1-20 reverse stock split.

The latest results are more like their operations before the pandemic. Many Seeking Alpha readers were very upset that I used too many “old” pre-pandemic numbers in my February 2021 article because they were expecting that the more positive pandemic results were indicative of the future. Often investors in other companies that were negatively impacted by the pandemic used “old” numbers for establishing current stock values. So, I thought that using that same logic it would be appropriate to use “old” numbers to establish values for Rite Aid and not their results during the pandemic that were helped by vaccines and testing. I think the financial results during the pandemic gave a “false positive” indication of Rite Aid’s future. My values indicated RAD was a sell and it has dropped about 75% since that report.

Second Quarter Results

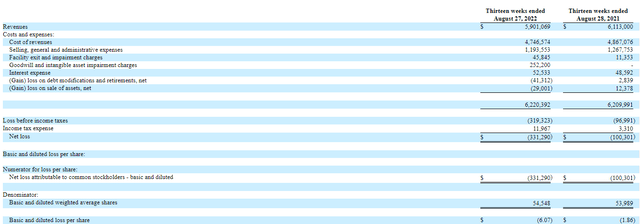

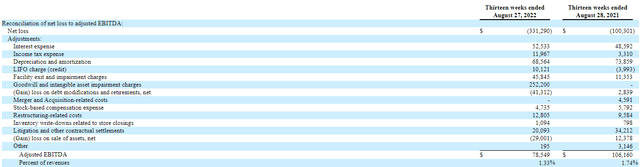

The 2Q results included many special items. There was a $252 million Elixir goodwill impairment charge, a $41.3 million gain on their debt repurchases, $29 million gain on sale leaseback deals, and a $45.8 million facility exit/impairment charge. Their GAAP EPS was a loss of $6.07 per share and adjusted EBITDA was $78.5 million. The reported revenue numbers are worse than they look because there were significant price increases since last year.

2Q GAAP Income Statements (2022 and 2021)

2Q Income Statement (2022 and 2021) (sec.gov)

2Q Adjusted EBITDA (2022 and 2021)

2Q Adjusted EBITDA (2022 and 2021) (sec.gov)

The results in 2021 included a high level of vaccines and testing. This increased foot traffic in their store, which also benefitted front of the store general merchandise sales. With increased inflation, some customers have become more price sensitive and buy more items at discount stores instead of buying them at Rite Aid even if it might be less convenient. This price sensitivity could get worse if the U.S. gets into a deeper recession. Supply chain problems continued their negative impact on results this quarter. There was also an additional $5 million “shrinkage” in New York, which is a nice way of stating that many of their New York City stores had massive theft by “shoppers”.

Elixir May Not Save Rite Aid

I think many investors were really disappointed that Elixir, which some considered their crown jewel, had a $252 million goodwill impairment charge or $4.62 per share in the quarter based on “a change in our estimate of lives for next year”. In my prior articles I have really not covered Elixir, their PBM-pharmacy benefits manager. First, the problem with Elixir is what approach do you take estimating its value. Do you value it as it currently is as part of Rite Aid, or do you estimate the value that a potential buyer may assign to it based upon that buyer’s ability to integrate Elixir into their operations at a much higher level of profitability? I think most investors assert the second approach, which most likely results in a much higher value, but that raises some serious technical legal issues.

I frequently see statements that Rite Aid can always sell Elixir to raise cash and stay out of bankruptcy. That is not as easy as it seems. If Rite Aid continues to slide down hill and continues to report massive losses, it may not be able to find a buyer for Elixir because a potential buyer’s bankers might not be so eager to finance the deal. Many bankers are not willing to finance purchases from severely distressed companies because of section 548 worries.

If the seller eventually files for bankruptcy within two years of the asset sale closing, the seller’s creditors may litigate to reverse the sale under section 548. The creditors need to convince the bankruptcy court that the seller was insolvent at the time of the asset sale closing and that the amount received was “less than a reasonably equivalent value”. The buyer can’t get a bargain price and many buyers don’t want to pay full value when buying any asset. It often becomes a fight in court between each side’s expert financial witnesses over insolvency and value of asset sold. This is a problem some buyers and their bankers would just prefer not to become involved in.

Therefore, in my opinion, Rite Aid needs to sell Elixir in the immediate future before their results worsen, or any potential buyer might just wait until they can attempt to buy it in bankruptcy court at a price approved by the court without section 548 worries.

The revenue for Elixir decreased $171 million (9%) to $1.73 billion while EBITDA increased to $47.1 million from $36.8 million on improved operating expenses in the quarter. You can’t, however, just cut expenses, you really need top-line growth. Since they are expecting a “step down” in the 600,000 current lives next year, it does not seem like they can get the operations growth that many investors were hoping to see. This is also why they took the goodwill impairment charge this quarter.

Revised Guidance – Not Good

After decades of listening/talking to management of various companies and now listening to conference calls, I think I am able to get sort of a “feel” for the abilities of executives running companies. Some are/were excellent. Rite Aids’ executives, however, just do not impress me at all. They just try to put Band-Aids on their problems without any internally developed dynamic ways to solve the problems and grow top/bottom lines.

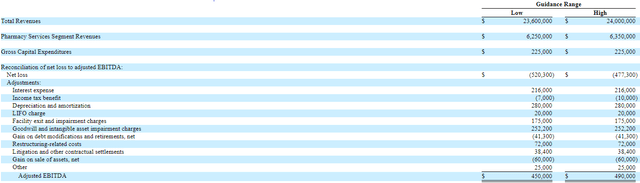

While they did slightly reduce their guidance, I think it is still too optimistic. I expect much higher interest rates, which will mean even higher interest expenses because their credit facility is based on LIBOR, which I expect to increase significantly going forward. I also think the front of the house sales will be negatively impacted by higher prices and a deep recession as consumers become even more price sensitive and place value over convenience. Rite Aid merchandise, in my opinion, is not cheap even with their new loyalty program.

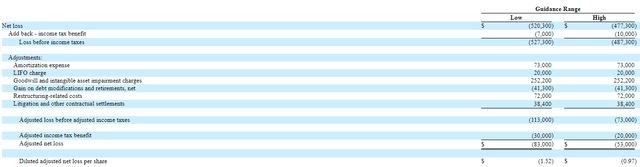

Revised 2023 Fiscal Year Guidance

Revised Fiscal 2023 Guidance Range (sec,gov) Revised 2023 Fiscal Year Guidance (sec.gov)

They plan to securitize their CMS receivables later this year, which is part of their normal financing program. Given interest rates are higher, the cash received should be lower than when rates are low. Management claims their leverage ratio will “be in the lower five times range by the end of the (2023) fiscal year and to generate positive free cash flow for the year”. I have my doubts given I am expecting much higher interest rates and a fairly deep recession.

Their next major debt maturity is their 7.5% 2nd lien notes due July 1, 2025, but I would expect there will be some repurchases or exchanges long before 2025. Management, however, did not give any specific guidance about how they are planning to deal with the debt maturities of their various secured and unsecured notes.

Management did not give any guidance for fiscal 2024 and they stated in their conference call: “we have much work to do to build out our detailed plan for fiscal 2024 and are not prepared to give any additional color on the fiscal 2024 outlook at this time.” That fiscal year starts in only about five months.

Conclusion

Rite Aid is on my list of companies that I don’t think will survive a deep recession and will be in bankruptcy court. That list includes Pennsylvania Real Estate Investment Trust (PEI), Express Inc. (EXPR), and Bed Bath & Beyond (BBBY). Rite Aid was saved from bankruptcy by the pandemic, in my opinion, but was not able to take advantage of the additional time to get their act together. Their poor management shares much of that failure to create a new dynamic Rite Aid.

Because Rite Aid does have some desirable assets, a potential investor coming in can’t be ignored, but once the company gets too far below water, an investor might be more likely to wait until they might get a better deal during a Ch.11 process. Secured lenders may also be interested in making credit bids for certain assets under a Ch.11 plan.

For the above reasons, I Rate RAD a sell for investors and a hold for speculative traders.

Be the first to comment