MarioGuti/E+ via Getty Images

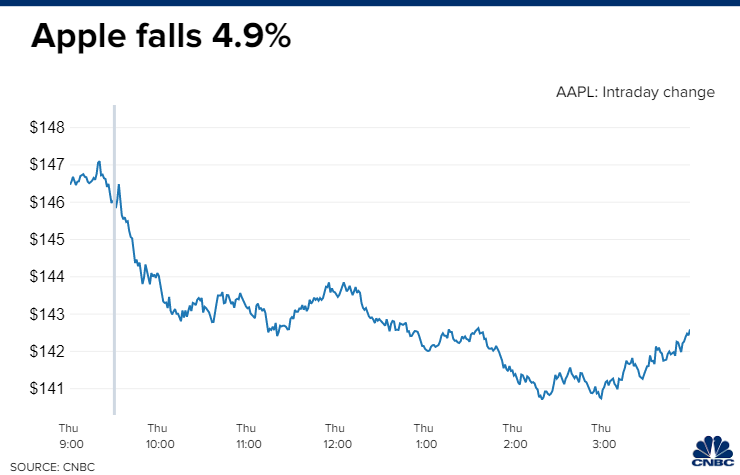

Stocks gave back the previous day’s enormous gains, but interest rates were not the culprit in the sell off. To the contrary, both short- and long-term rates were relatively stable after the plunge that occurred the day before. Instead, investors agonized over more hawkish commentary from misguided Fed officials, and the continued strength of the labor market with unemployment claims falling when they were expected to rise. There was also a headline-grabbing downgrade of Apple from Bank of America analyst Wamsi Mohan, who suspects that iPhone sales will slow as consumer spending weakens. Most of his peers disagree, but that didn’t stop a rush for the exits from the most valuable company in the marketplace.

Finviz

The bottoming process for a bear market is an ugly experience, as the pendulum swings from excessive greed to extreme fear, which is where we have been in recent days. Good news is swept under the rug to make more room for bad news that fuels even more fear. This process has been going on gradually all year long, starting in the most speculative corners of the market and working its way up to the highest quality and most valuable names. The good news is that when the generals finally fall, like Apple (AAPL), it means that the process is nearing its end. That is also when the bears’ confidence peaks, and the bulls finally cower, but there will be no cowering here.

CNBC

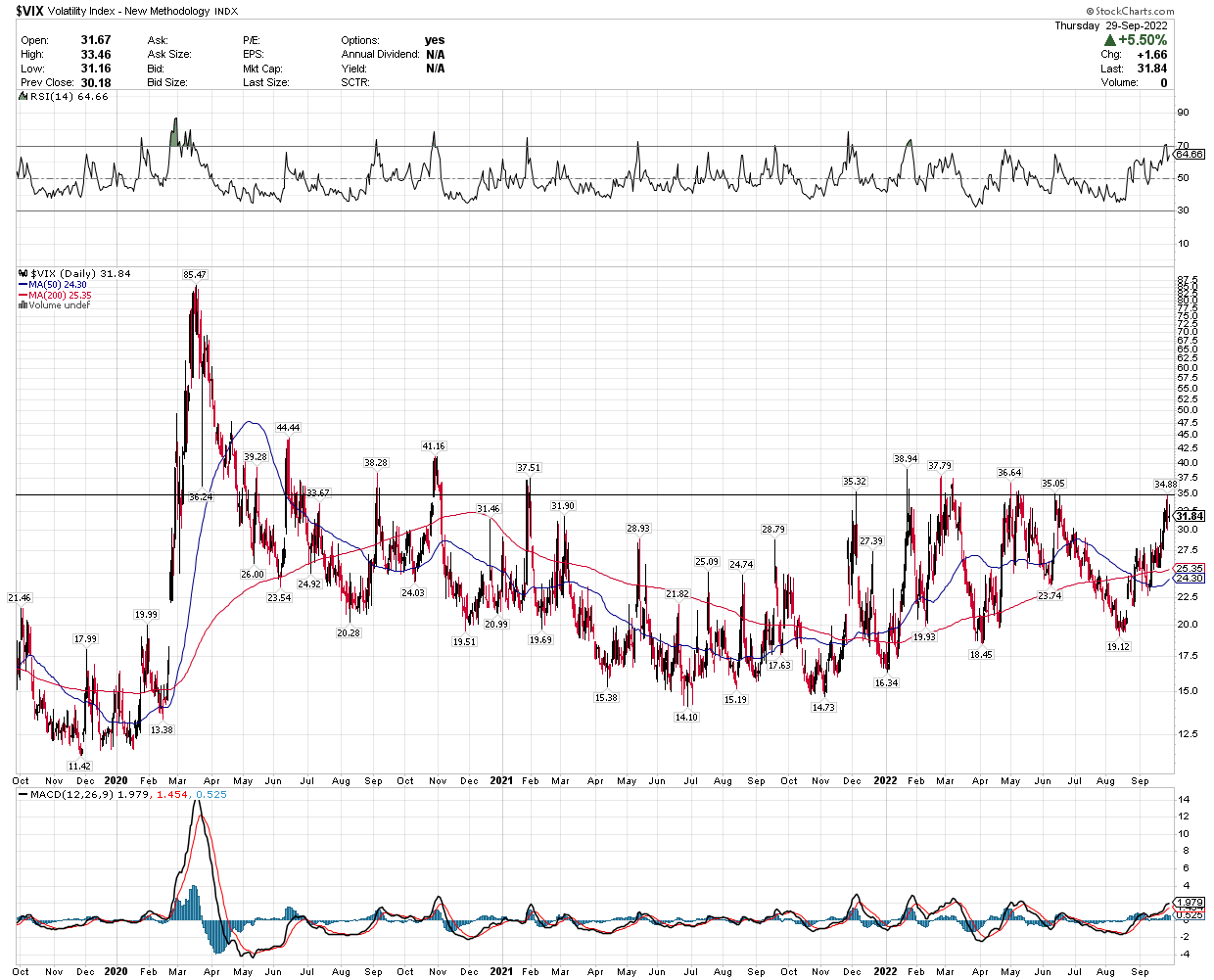

What will keep investors from profiting during this process is making emotional decisions, which is what many of the wealthiest and most successful investors hope they do. Wall Street loves a good panic that leads to capitulation, so that the investment firms with a well-informed understanding of the true value of the risk assets they follow can swoop in and buy them on the cheap. The billionaires who have made their fortunes in the marketplace are no different. That’s why I always take what they say with a grain of salt. They will warn of pending doom in one hand, while buying hand over first with the other. You only learn about what they were doing after the fact. These warnings are contributing to what look to be peak levels of volatility in the market.

Note that the Volatility Index has now climbed above 30 for a fifth day in a row, which is positive from a bottoming standpoint. It is also very close to where fear has peaked in the upper 30s over the past three years, as indicated by the horizontal line below. The only move higher occurred during the panic of the pandemic in March 2020.

Stockcharts

The best time to buy risk assets has been during peaks in volatility, which are associated with peak levels of fear and troughs in investor sentiment. We can’t be certain of the day or week when these peaks are behind us, but history suggests we are close. Fed officials are helping us get there.

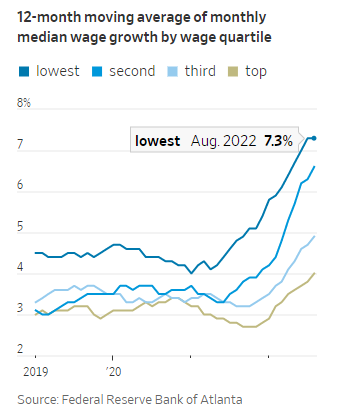

The stupidity behind some of the Fed’s rhetoric in recent days is mindboggling. When you have had a huge spike in inflation over a short period of time caused largely by supply issues, you don’t resolve them by trying to stifle demand. You resolve them by increasing supply, which the Fed’s tools are not designed to do. Therefore, leave it alone. Instead, the Fed seems hell-bent on trying to crush demand by raising the unemployment rate to cap wage growth. Meanwhile, it is the strength of the labor market and wages that is keeping our economy afloat during this inflationary period.

The unemployment rate is as lagging an indicator as the rate of inflation itself, while increasing short-term interest rates works with an extremely long lag time. Therefore, to suggest that the Fed will raise rates until the unemployment rate has reached a specified level and the rate of inflation has fallen close to the Fed’s target is literally like trying to drive a car looking through the rear-view mirror. It is doomed to failure. I still believe that today’s hawkish rhetoric is intended to suppress any enthusiasm for risk assets until a downtrend in the rate of inflation is firmly established and keep inflation expectations contained, which has already been accomplished.

While the bears view economic strength as a headwind, I see it as a positive from the standpoint of prolonging this expansion while we wait for price increases to abate over the coming 6-12 months. For the first time in my 30-year career, our economy is strengthening from the bottom up. Wage gains have been the strongest for the lowest quartile of workers. In fact, the lowest paid are seeing real wages increase, despite the current rate of inflation. This is why consumer spending has been able to eke out small inflation-adjusted gains over the past year.

Wall Street Journal

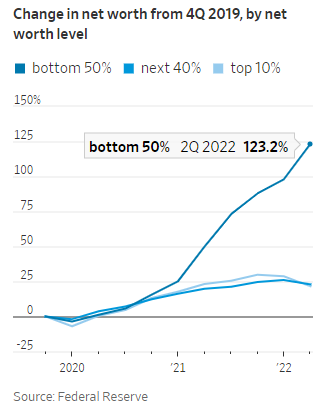

The wage gains in combination with the fiscal stimulus deployed after the pandemic has resulted in a dramatic improvement in net worth for Main Street in comparison to Wall Street. This has strengthened the foundation of our economy. It is the primary reason I think this expansion can absorb the ongoing tightening of monetary policy and avert a recession. Granted, we may see segments of our economy contract with housing at the top of the list, but consumer spending is what fuels 70% of our growth.

Wall Street Journal

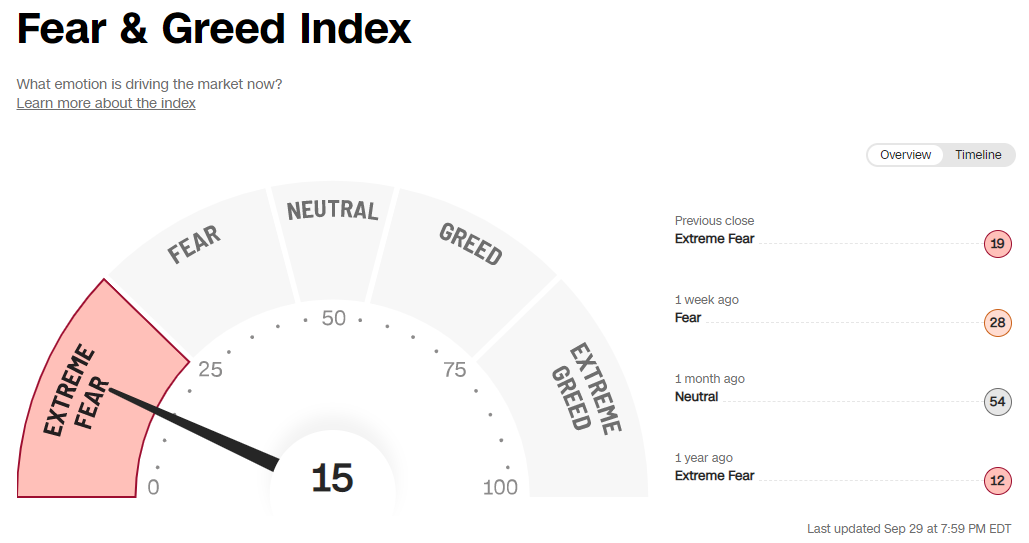

This stronger foundation I speak of is lost on most investors who live closer to the top floor and for good reason. We have never seen an economic cycle where the bottom strengthens at a faster rate than the top. It isn’t supposed to work that way. Over the past year it is the wealthiest 10% who have taken the brunt of the hit from tightening financial conditions, due to the fact that they own the vast majority of financial assets. On that front, I still think the majority of the damage has already been done, opening the door for outcomes not as bad as expected, which should bring better days ahead for markets. Markets bottom when fear reaches a fever pitch, which seem to be awfully close based on the CNN Fear & Greed Index below.

CNN

Be the first to comment