hapabapa

Though no bond or equity fund has weathered this bear market, there are some equity CEFs that I believe are now at excellent risk/reward levels.

What I was looking for was an all-US equity stock fund that used a high option-write strategy that could offer a high current yield as well as tax-benefits for my taxable account clients.

There are several CEFs and even ETFs that fall into this option-write category but the one I like best here is the Eaton Vance Tax-Advantaged Buy-Write Strategy Fund (NYSE:EXD), $8.86 current market price.

EXD is a very interesting fund because when it came public in June of 2010, it was a 100% municipal bond fund that wrote equity options for added income. This was a very unusual strategy, not at all correlated and I’m guessing Eaton Vance thought this might make for a good strategy after the financial crisis of 2008.

Well, it didn’t and EXD underperformed mightily as the bull stock market over the next decade meant all those written equity options became mostly realized losses for the fund when they had to close out (buy back) the options at a higher price.

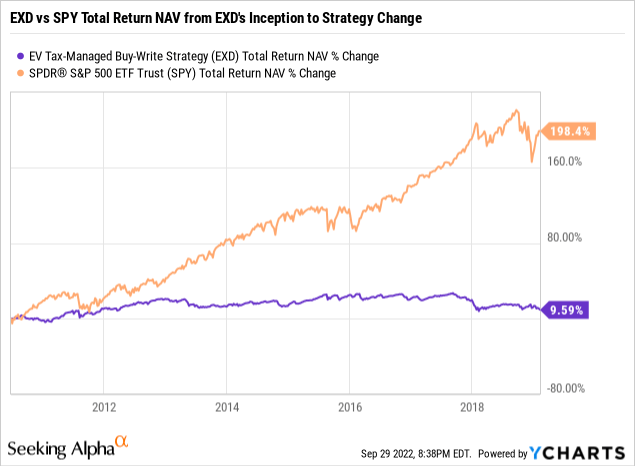

Here’s roughly a nine-year period from EXD’s inception on 6/25/2010 to EXD’s Strategy Change on 2/8/2019 (more on that in a moment):

As you can see, over that roughly nine-year period, EXD’s NAV only returned 9.6% on a total return basis (all distributions included) compared to the S&P 500 (SPY), $362.79 current market price, which gained 198.4% over the same period.

Note: SPY is used as a benchmark for EXD today but also because that was the index EXD was writing options against from 2010 to 2019 when it was a municipal bond fund.

Clearly, EXD’s strategy was not working and on a market price basis, EXD’s total return over this period was an even worse 4.6% as the fund fell to a wide discount.

So it was on Feb. 8, 2019, Eaton Vance announced that EXD was changing its strategy as outlined in this release:

Important Notice Regarding Changes To EXD Effective 2-8-19

And with that, a new fund was born.

The New and Improved EXD

The reason why I go in depth as to EXD’s history is because it’s the primary reason why the fund is able to offer the tax-advantages it can today. More on that in a minute.

The other primary reason for EXD’s appeal is that the new adopted strategy essentially replicated what had worked so well for another Eaton Vance option-income CEF, the Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV), $12.98 current market price.

Heck, they even almost have the same fund name! ETV is one of Eaton Vance’s largest and most successful option-income CEFs. ETV is a goliath at $1.3 billion in total assets compared to EXD, which only has $88 million in total assets managed.

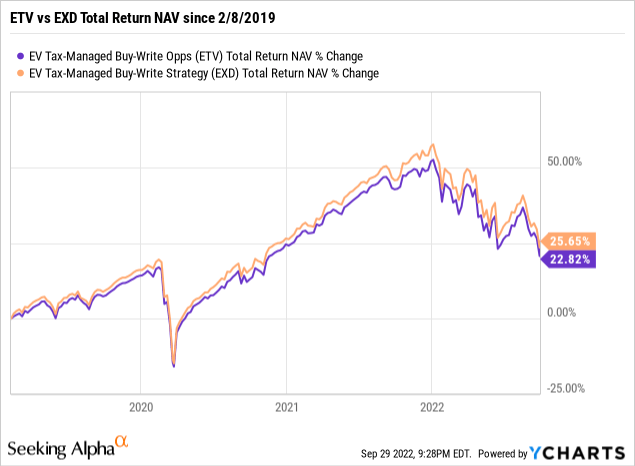

But other than that, EXD is pretty much a clone of ETV and utilizes a very similar portfolio and the same option-income strategy. In fact, if you graphed the NAV total returns of EXD and ETV since the strategy changeover on 2-8-2019, you could almost overlay them:

And since the strategy change, EXD’s NAV has actually outperformed ETV’s by a bit.

Note: NAV performance is the true apples-to-apples comparison whereas market price performance can be influenced by shareholder attitudes and emotions towards the funds.

So what are EXD and ETV and what is their strategy? They are both option-income funds that write (sell) S&P 500 and Nasdaq-100 options against a very high 96% of their all-US stock portfolio.

96% is a very high percentage which makes both funds very defensive. That has certainly helped the funds this year but their relatively high exposure to the information technology sector, has also contributed to a relative underperformance at NAV this year, even though they are still both outperforming the S&P 500 (SPY) this year, which is down -22.7% YTD.

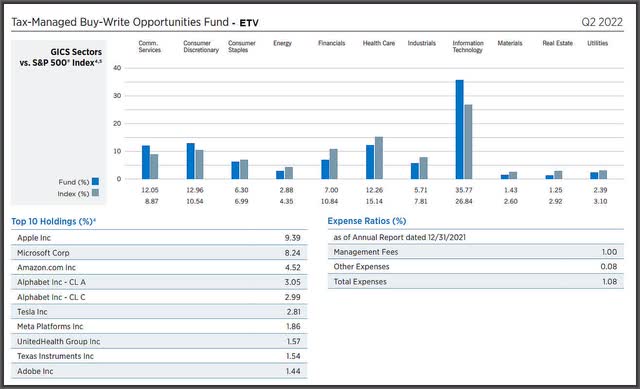

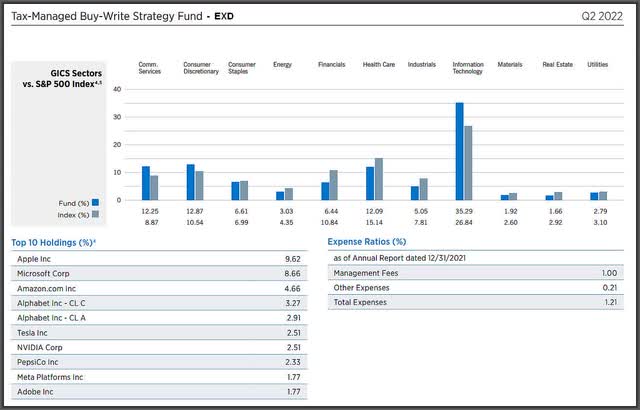

Here’s ETV’s Fact Sheet as of 6/30/22 showing the funds top holdings, sector exposure and expense ratios:

And here is EXD’s:

This should give you a pretty good idea of how similar the two funds really are though currently ETV is at a 9% market price premium while EXD is now at a slight -1% discount.

So Why EXD

Remember I said I’d get back to you on why EXD’s strategy change from a municipal bond fund to an all-equity fund was so important? It’s because all of those accumulated losses it had during the period when it was a municipal bond fund and writing S&P 500 options means that virtually all of its distributions today can be designated as Return of Capital.

And though Return of Capital is widely assumed to be a negative feature of CEF distributions, it can actually be a benefit in option-income funds and is the reason why many have “Tax-Advantaged” in their titles, since portfolio managers try and maximize realized losses when they can.

In fact, Eaton Vance wrote a white sheet explaining how Return of Capital can be of benefit to shareholders:

Return Of Capital Distributions Demystified

So the real benefit of being a shareholder of EXD today is that all of those losses generated from years ago can be carried forward and distributed as virtually 100% Return of Capital to shareholders.

And the benefit from a tax perspective is that Return of Capital is shown as Non-Dividend distributions on 1099s and are not reportable, though you are supposed to reduce your cost basis in the fund by the Return of Capital amount, thus deferring the tax until you actually sell the fund.

A lot of CEFs have some percentage of Return of Capital in their distributions currently but the good news for EXD’s shareholders is that Return of Capital should be making up most of EXD’s distributions for quite some time. As of Dec. 31, 2021, EXD had ($32,082,491) in realized losses, and since the fund distributes $8,285,000 to shareholders each year (9,752,000 shares outstanding X $0.85/share annualized), you’re looking at least four more years of this.

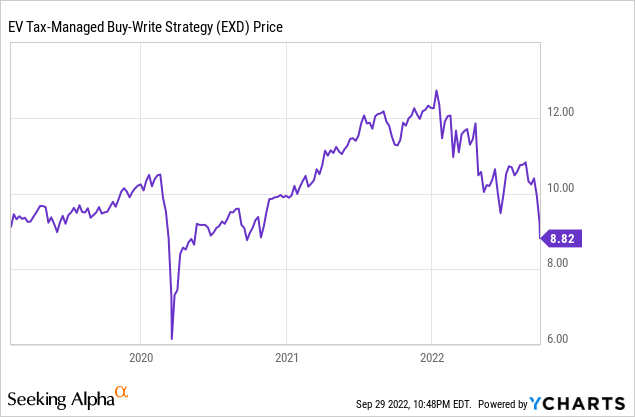

Then consider that with EXD’s current market price of $8.86, a low not seen since post COVID-19 in 2020, that has brought up EXD’s current market yield to essentially a non-taxable 9.6%.

This should, by the way, be sustainable too since the high 96% option write strategy would more than cover EXD’s monthly distributions.

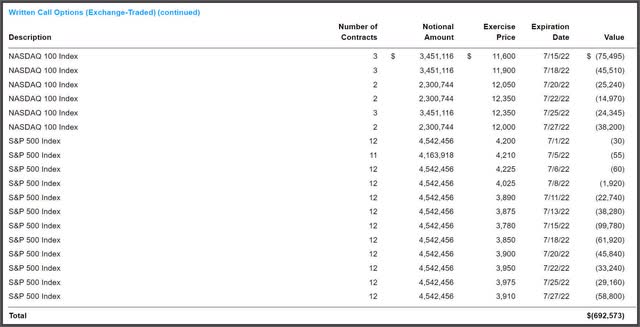

Finally, Eaton Vance uses a rolling index option expiration for most of its option-income funds and this is important because, unlike option-income funds that use monthly expirations, having shorter expirations, in this case every few days (see below), avoids having all of its option contracts put on at a market low.

This has been a huge Achilles heel for CEFs and even ETFs like the Global X family of funds, (QYLD), (RYLD) and (XYLD), which write monthly options against 100% of the value of their portfolios At-The-Money.

This makes these funds very defensive like ETV and EXD but it also exposes them to minimal upside capture if their monthly options go on (3rd Friday of each month) at an interim market low.

But because Eaton Vance’s option income funds use rolling expirations in which a position is initiated every few days when one expires, this largely gets around this potential timing problem. Eaton Vance is the only fund sponsor that I know of that uses this rolling expiration strategy.

Here is EXD’s S&P 500 and NASDAQ-100 option overlay taken from the Semi-Annual report as of 6/30/22:

Conclusion

EXD is not a municipal bond fund anymore, but in some ways, the fund has not left its tax-free distribution status behind! That’s just a bonus for any shareholder who can use “tax-advantaged” income. And it doesn’t get any more tax-advantaged than having almost all of a 9.6% distribution being non-taxable.

Finally, I should say that part of the appeal of EXD and ETV is that I believe the fund’s exposure in information technology, with their #1 position Apple (AAPL), $142.48 current market price, finally getting hit hard too, may end up being good timing considering the Nasdaq-100 (QQQ), $271.87 current market price, is down a breathtaking -31.3% YTD.

I’m starting to see institutional investors finally warming up to the large cap Nasdaq-100 stocks and the trigger may finally have been the last of the generals to fall as Apple finally gets its haircut too.

But even if the timing is not yet optimal, EXD will still have its very defensive option strategy and 9.6% current market yield to fall back on.

Be the first to comment