Angel Di Bilio

As we already performed in Q2 (and also in Q1), today we comment on Rio Tinto’s Q3 operational performance (RIO, OTCPK:RTPPF, OTCPK:RTNTF), which was just released by the company. Here at the Lab, we recently published an analysis called M&A optionality that also emphasized the company’s ability to generate FCF, its compelling valuation, and Rio Tinto’s tasty DPS. Following the company release, today we provide our first takeaway.

Q3 Production Results

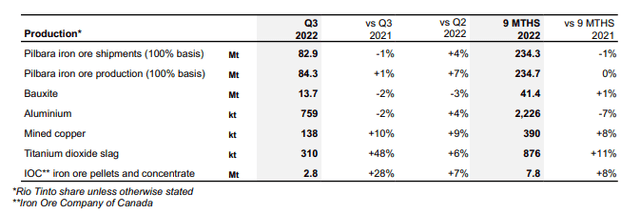

The company’s production in Q3 was softer than expected, cross-checking the consensus estimate, Rio Tinto’s output was above expectations with aluminum and iron ore production, whereas as already happened during the Q2 results, the company missed production results on copper by 11%.

Rio Tinto Third Quarter Production Results

Looking at the specific commodity output below is presented our first impression:

- Iron ore production was ahead of the consensus estimates by 3% on a quarterly basis; however, to confirm Rio Tinto’s 2022 target, the company should improve its production by an additional 4.5% in Q4. Reading the press release on the Iron Ore section, the company expects to “be at the low end of the original 320 to 335 million tonne range”. It is important to note that Q3 iron ore production was achieved despite the rail outages on Gudai-Darri and Yandicoogina lines (there is an ongoing investigation). In the Q2 comment, we emphasized how Gudai-Darri and Robe Valley were supportive catalysts in the second half of the year, today we are more cautious.

- Against the Q2 performance, Aluminum production was significantly above consensus expectations. This was due to Kitimat’s restarts with no union strike. There was also no COVID-19 restriction or outbreaks in Boyne mine.

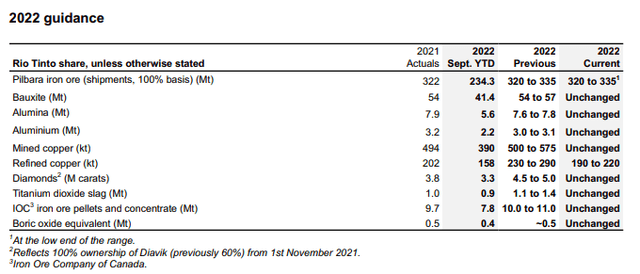

- As already emphasized, Copper production missed Wall Street consensus estimates, the company outlook was cut by 21%, and we should also mention 14% more in production cost. Last time, we were already pricing in some near-term issues with a forecast of lower selling prices and a minor provisional pricing effect. Despite that, copper production improved on a quarterly basis in Oyu Tolgoi and Kennecott (where there are works in progress to rebuild the smelter). For the above reason, as we can see below, refined copper was the only commodity output with lower guidance for 2022.

Conclusion and Valuation

Numbers in hand, 2022 CAPEX guidance was also cut by $0.5 billion due to AUD FX evolution and lower decarbonization investment. Despite the lower guidance on copper, we are confident that Rio Tinto’s production output for the full year is reachable. Important to include in our analysis are the following:

- Rio Tinto’s proposal to acquire THR was unanimously “supported by the Turquoise Hill Board, who have recommended shareholders vote in favor of the transaction“. This goes in line with our latest article on Rio Tinto and more importantly offers the ability to diversify the company’s commodity mix exposure (now with almost 3/4 of the total group EBITDA coming from a single output, i.e., iron ore).

- Secondly, in the press release, Rio Tinto supports new “action to transform our culture and rebuild trust, our second progress report on our Communities and Social Performance practices, which includes increased feedback from Traditional Owner groups, with responses from seven groups compared to four in 2021.” There is a new full presentation that tackles one of the investor’s concerns on the ESG side.

Even if there is no upside on the financial side, we positively view Rio Tinto’s ESG commitment and this might support the stock price evolution. Last time, we already lowered our target price to £58 per share, today we reaffirm our valuation.

Be the first to comment