kyoshino/E+ via Getty Images

Netflix (NASDAQ:NFLX) shares plunged following disappointing first quarter results. Investors were looking for the company to add more than 2.5 million subscribers in the quarter. Instead, the company saw 200,000 subscribers leave the service. On top of that, the company warned they expect another 2 million subscribers to leave in the second quarter, well below estimates for additions of 2.4 million.

It seems the Netflix growth story may finally be over.

A Product Of Its Own Success

Perhaps the last price hike was too much, or maybe the competition has finally caught up to Netflix. But the biggest problem may have been its success. Netflix set the stage for a mass migration away from linear TV and resulted in a big push for networks to launch their own streaming services.

But the biggest problem is that this is a complex business, with the driving force to gaining and maintaining subscribers being the ability to create compelling new content continually. Series can be watched in a matter of days, and that means to keep your subscribers happy, a new show or series constantly has to be scheduled regularly. It leaves a company like Netflix in positions where they continually need to spend to keep the growth engine running.

YouTube Vs. Netflix

It makes YouTube a superior model to Netflix, a much more sustainable model over the longer run. For YouTube, it costs Alphabet (GOOG) (GOOGL) virtually nothing to create the content since it’s user based, with most of the revenue generated from advertising. Indeed, YouTube doesn’t have hit series, but YouTube has found a robust niche market, and among kids, it’s a growing market.

On the other hand, Netflix has a challenging business model, and in the early years, it didn’t matter. Spending was low, and subscriber growth more than offset that incremental increase in content spending. Now that has changed.

Pull-Forward Excuse By Netflix

The logical explanation is that the pandemic pulled forward years of growth for Netflix and changed the path of the longer-term growth path, and at this point, it isn’t entirely clear just how much of the loss of subscribers is due to this pull-forward. Let us not forget that Netflix saw its subscriber base grow by 36.5 million users in 2020 and another 18.1 million in 2021, increasing to 221.8 million from 167.1 million in 2019. So a loss of 200,000 subscribers in a quarter is a rounding error, while the potential loss of 2 million users in the second quarter is minuscule.

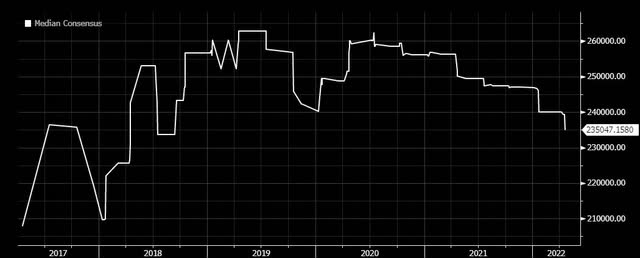

But investing is all about expectations. When looking back at the evolution of total net subscriber estimates over the years, the median forecast for 2022 at one point back in 2019 was for the company to reach 263 million subscribers. That number fell to around 235 million just before the pandemic began. Now estimates are for 233 million subscribers by the end of this year.

While there was a significant growth pull forward in 2020, it seems that Netflix ended up being where it was supposed to be anyway based on 2019 and early 2020 estimates. In a way, Netflix is now trailing those longer-term expectations.

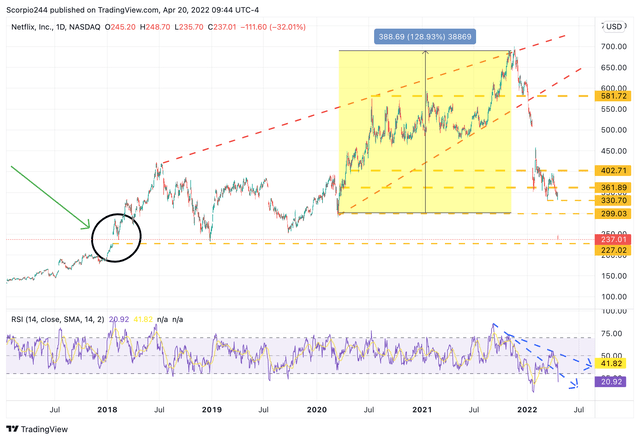

This is all reflected in the stock price, with Netflix peaking in late 2021 around $700 per share and now trading at around $235 on April 20. The stock currently sits on a significant level of support that is likely to lead to a further decline and gap-fill to about $225. That gap was created in January 2018, when the company was growing faster than expected, and the sky was the limit.

If that support level doesn’t hold, there is no support until the stock gets back to $200.

At this point, it seems there’s a very good chance the growth story for Netflix is over, and the path for them will be much more challenging than the path investors have gotten used to.

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment