zoranm/E+ via Getty Images

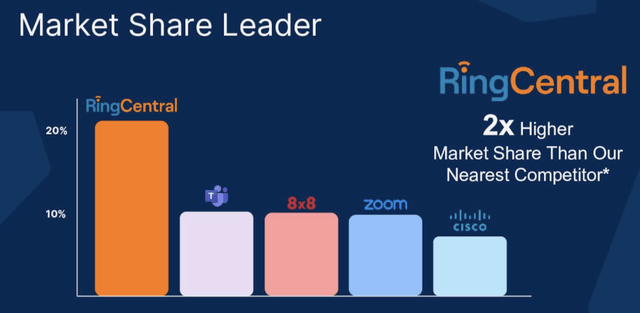

RingCentral, Inc. (NYSE:RNG) considers itself the largest pure-play UCaaS – that’s Unified Communications as a Service – provider in the market, with its main competition coming from Vonage (ERIC), 8×8, Inc. (EGHT), Cisco (CSCO), Nextiva, Zoom (ZM), and Microsoft Teams (MSFT). Started in 1999, the company is still cofounder-led by a pair of Vlads, CEO Vlad Shmunis, and CTO Vlad Vendrow, which can get a bit confusing on earnings calls.

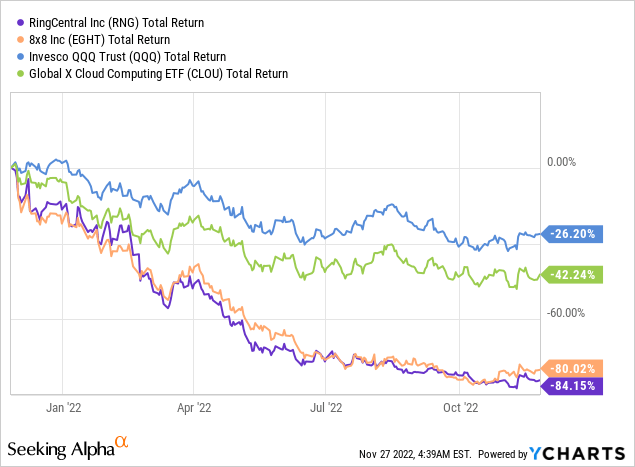

After following RingCentral closely a few years ago, I had forgotten about it until recently, when I noticed that its share price has been decimated over the past year and a half. Given that its subscription business is still growing at over 20% per year and customer retention exceeding 99%, in this article, I’d like to examine whether RNG currently presents a solid turnaround investment opportunity for 2023. I’ll touch on its challenges, its valuation, and its growth potential that might offer an upside should management deliver on its lofty goals for the upcoming year.

A Fast-Growing Market Share Leader

RNG provides a suite of cloud-based VoIP (Voice over IP) communication and collaboration services that integrate with hundreds of essential business applications such as Salesforce, Microsoft, Zendesk, ServiceNow, and HubSpot. Due to its broad product range that includes a full suite of inter-company and customer-facing text, phone, video meeting, and contact center tools, its customer retention has been extremely high, and RingCentral holds a leading 20% market share in its category.

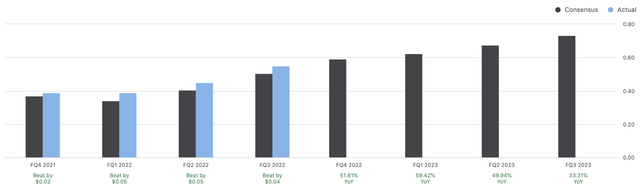

After enjoying a stellar rise from its IPO at $18 per share in 2013 through the beginning of 2021 when shares briefly exceeded $440, RNG has been rightly brought back down to its 2017 levels due to spiraling expenses, long-term debt, and stock-based compensation that make the company’s goal of achieving GAAP profitability seem ever further away. Having only reported a couple of quarters of GAAP profitability since 2013, investors will notice that RingCentral typically only refers to non-GAAP EPS in its press releases to the point that even Seeking Alpha lists non-GAAP EPS figures in its earnings charts for RNG:

RNG Non-GAAP EPS (Seeking Alpha)

A Growing GAAP Earnings Gulf

While non-GAAP earnings can often be useful for providing a more accurate picture of a firm’s operational performance by excluding non-recurring costs, in RingCentral’s case they are quite misleading due to its high SBC (stock-based compensation)-to-revenue ratio, its rapid growth in marketing expenses, and its retrospectively poor capital allocation in the form of its $500 million investment in Avaya Holdings Corp. (AVYA), $375 million of which represented prepaid commissions that may need to be completely written down as Avaya approaches bankruptcy. Note that AVYA traded at $16 per share when the RingCentral partnership was announced in 2021 but now trades at just above $1 per share. Unsurprisingly, RNG’s Q3 earnings saw $125 million of the AVYA investment taken as an impairment charge, with management trying to remain optimistic about their ability to continue shifting AVYA’s customers onto their joint platform Avaya Cloud Office by RingCentral (Q3 earnings call):

So in the quarter, we recorded $125 million non-cash charge related to Avaya prepaid, and that was as a result of their public disclosures and we felt it was prudent to do in the circumstances. It doesn’t, in any way, mean we are stepping away from their commitment to us.

As Vlad just outlined to you, on a commercial basis, we actually saw more — took more seats this quarter versus last quarter and the quarter before. So in terms of the commercial arrangement, we are still transferring seats actually at an accelerated pace.

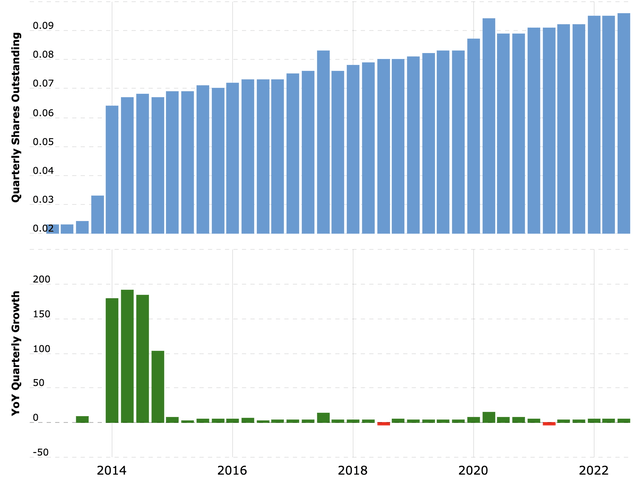

While RNG has started touting share buybacks in its earnings calls, even at an annualized rate of the current $20 million per quarter, or 2% of their current market cap per year, they won’t overcome the company’s average annual share dilution of 4%.

RNG Outstanding Shares (Macrotrends)

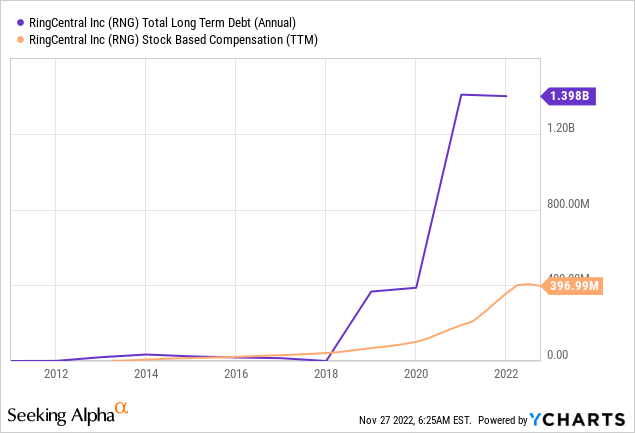

Furthermore, share buybacks seem silly and borderline irresponsible given the company’s negative earnings, dwindling cash reserves of $300MM (down 50% from 2020 levels), and rising debt levels. I’d much rather see the company retiring some of its $1.6B debt load with any extra cash than pretending that a buyback yield of 0.5% per quarter helps to offset the 90% fall in the stock price in any meaningful way, especially given that it increasingly looks like RNG may have to tap equity markets to reduce its debt in the future if it doesn’t get costs under control soon.

That’s to say nothing of its stock-based compensation, which, as we can see above, has reached nearly $400 million in the past 12 months, although as management pointed out in its Q3 earnings call, the current value of that SBC is now much lower given the stock’s 81% slide YTD:

It is something that we have been focused on and if you think about where we are guiding for full year 2022, you should see about a 400 basis point improvement in stock-based comp as a percentage of revenue.

And the reason that the spend was elevated is partly by virtue of — when we gave out those grants, it was at a much higher stock price. It is something that we manage and evaluate as a management team.

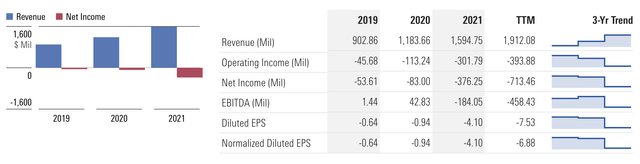

A more accurate picture of RingCentral’s financial position is this:

RNG Financial Overview (Morningstar)

The bottom line is that although RNG boasts $2B in annual recurring revenue, they have lost more than $700MM in the past 12 months and have only $300MM cash on hand. We can see that while RNG’s revenue growth is still strong at 23%, its operating expenses have grown exponentially faster and its net income has cratered. A fast-growing company once on the verge of profitability now seems to be on a dangerous path towards major share dilution or worse, and it must finally reckon with years of downplaying its GAAP EPS in order to get costs and SBC under control.

Reasons For Hope

RingCentral’s drawdown this year has a number of similarities to another high-growth SaaS communications company, Twilio (TWLO), which has fallen by a similar amount. However, whereas I find Twilio’s business model to be inherently flawed due to its profitability problem – i.e., the more its sales grow, the more money it loses – RingCentral has a core business with solid margins that can certainly be profitable if management is willing to dedicate themselves to creating actual shareholder value and focus on GAAP profitability instead of pursuing growth at any cost while touting non-GAAP results as if this is what investors care about.

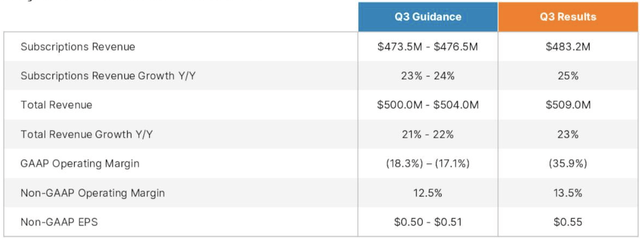

RNG Q3 2022 Overview (RingCentral)

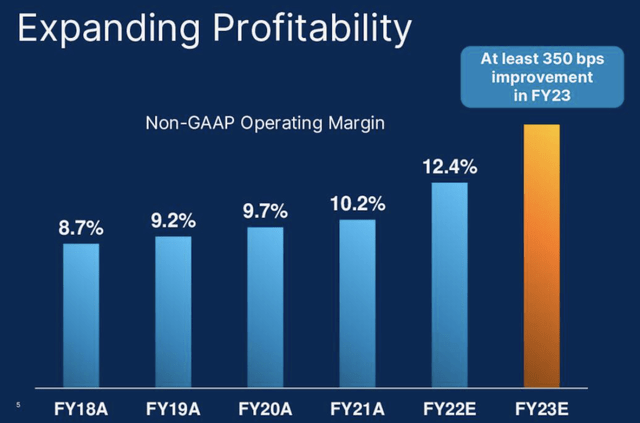

The good news is that management does seem to be turning a corner. RNG has just reduced its full-time workforce by 10% and is aiming to rapidly expand their operating margin from an estimated 12.4% in 2022 to over 15% by the end of 2023 and a long-term target of 20%, as stated in their Q3 earnings call:

We are now guiding to a further 350 basis points year-over-year in Q4. And we have really tried to outline for you an accelerated path of getting to that at least 20% OP margin that we alluded to last time we posted earnings.

So we have now laid out a target really of about 700 basis points of improvement over, say, eight or so quarters and 2023 will be a further 350 basis points on top of where we ended — where we will end 2022.

So I think really, we are getting the benefits of scale and then we are also looking at all aspects of the business and being super disciplined around those margin levers that I called out in my script, obviously, a lot more efficient around labor spend. You did see that today, we made the extremely difficult decision to let 10% of our full-time headcount go, that obviously will have an impact mainly in Q1 of next year.

Achieving its operating margin goals won’t carry RNG to profitability alone, but if the company can do this while sharply cutting SBC and marketing expenses and resolving their remaining $250 million in prepaid commissions to Avaya, they could very well have a clear path to profitability after 2023.

Valuation

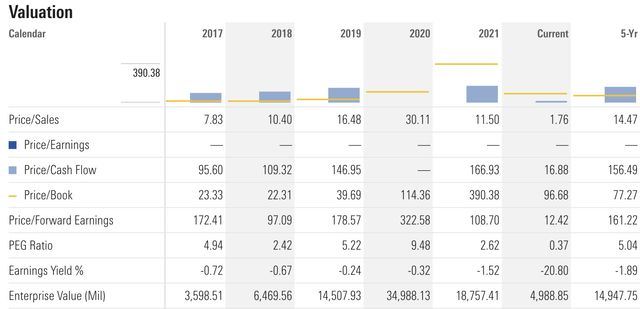

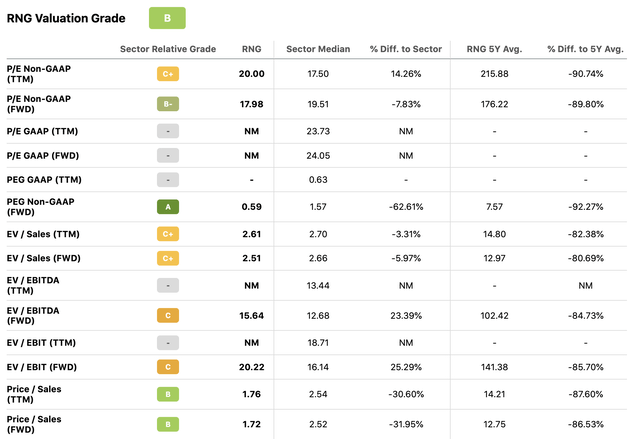

Since RingCentral’s topline growth has remained robust during its share price collapse, it is now trading at a rock-bottom valuation compared to its own historical levels and to the cloud sector in general.

Trading at less than 2x sales and 12x forward non-GAAP earnings with a PEG ratio of 0.36 (and forward PEG of 0.59), RingCentral offers significant potential upside should its profitability start to improve and its valuation starts to revert to historical levels. Of course, in this high-rate macro environment we can assume that even in a best-case scenario a fairly valued RNG deserves a far lower P/S ratio than its 14.5x 5-year average, but even settling at a reasonable 3.5-4x sales would result in more than 100% upside assuming the topline growth holds.

Lastly, since RNG’s share price is now at mid-2017 levels, we can see whether it offers more or less comparative value to buyers now:

RNG Historical Valuation (Morningstar)

While its current P/B is about 75% lower than in 2017 due to far greater debt and operating losses, RNG’s current P/S ratio is over 75% lower and its forward non-GAAP PE is over 90% lower. Looking at it this way, I think its weaker financial position has been accurately priced in, as its loss in book value per share has correspondingly reduced its trading multiple, even though the company’s revenue per share is approximately three times higher now at $20.20 compared to $6.60 in 2017.

Conclusion

Still down nearly 85% over the past year, I think RingCentral’s challenges have been fully priced into the stock at these levels, and between its cash on hand and its 20%+ revenue growth, the company should be able to cover its debt obligations as long as management follows through on reducing costs and increasing operating margins over the next year. I think fundraising via share dilution and economic recession are the largest near-term risks to the share price, however RNG’s products play a vital role in its customers’ workplaces and customer service operations, and its topline growth remains high considering the current macro environment despite falling from past levels.

Based on its low relative valuation and potential for outsized returns if 2023 earnings reports start showing positive impacts from management’s efforts to achieve profitability, I rate RNG a buy at current levels for patient investors who can handle significant volatility. For those who might want to diversify their risk with this strategy, its competitor EGHT is worth similar consideration for the same reasons and reportedly has a takeover interest as well.

Be the first to comment