ClaudineVM/iStock Editorial via Getty Images

DBS logo (DBS Group)

Investment thesis

In August this year, we downgraded DBS Group (OTCPK:DBSDY) from a Buy to a Hold as we felt that the share price left little margin of safety now that there are risks of a weaker economy in the medium term.

Financials have been a good place to be in an environment of rising interest rates.

Ownership in DBS shares has proved to be a safe harbor in this stormy market. Year to date, the share price has gone up 4.7% while the broader market in Singapore is down only 0.6%.

The S&P 500 is down by 21%.

DBS share price is up this year (Yahoo Finance)

Let us look at how South East Asia’s largest bank did in its recent quarter.

Q3 Financial Results

As we expected, DBS had another record quarter in the third quarter of 2022.

Their net profit was SGD 2.24 billion, up 32% from a year ago or 23% higher when we compare it to the second quarter net results.

This translates to an EPS of Singapore cents 87 from which they have decided to pay out a dividend for the quarter of 36 cents. This is in line with the earlier dividends this year. A payout ratio of 41% is quite acceptable.

Based on the present share price of SGD 34.21 we get a dividend yield of 4.21%

DBS is not buying back any of its own shares. We do take this as a sign that they too think that the share is priced fully and fortunately they do not buy back shares at this time.

Their ROE in the last quarter was as high as 16.3%, but it is better we use the ROE for the first nine months which was 14.3%. That is pretty good.

The two main generators of income for a bank are the net interest income and secondly the fee income.

Over the last couple of quarters, we have kept our readers up to date on what the increasing interest rate environment will do for the banks.

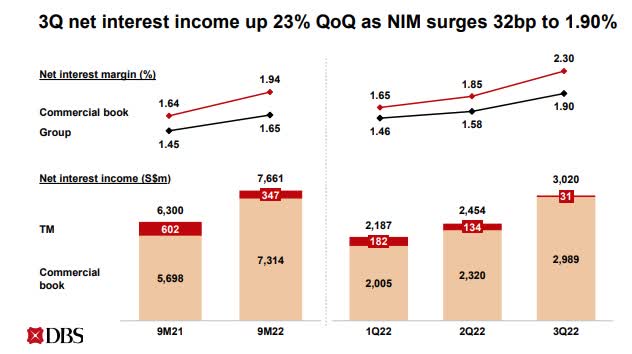

DBS Net Interest Income (DBS CFO Presentation slides – Q3 of 2022)

Their CEO Piyush Gupta expects that the bank’s NIM will continue to increase to around 2.25% by the middle of next year. That bodes well for a further increase in net interest income in the medium term.

Fee income was stable at SGD 923 million. With Singapore opening up its borders, we finally saw people taking to the skies. This resulted in 10% more fees from their card income which was up from SGD 203 million in Q2 to SGD 223 million in Q3.

With inflation biting into the economy, the bank’s expenses also have increased. They rose 10% in the third quarter. The good thing is that income is increasing faster than expenses so we do get a positive jaw. This results in a cost-to-income ratio dropping from 47% in Q3 last year to 40% in this year’s Q3.

NPL, which is Non Performing Loans, is actually improving slightly with a reduction from SGD 5.91 billion to SGD 5.60 billion quarter over quarter. This is an NPL ratio of 1.2%

General provision reserves stand at SGD 3.9 billion, and their Common Equity Tier 1 ratio is 13.8%.

Valuation

In terms of valuation, there are a few things we want to look at when we value a company.

How much do we have to pay now in relation to what they have earned in the past and what I can reasonably expect them to earn going forward?

As we all know, forward earnings is crystal ball gazing. Fun to do, but not accurate.

Its trailing twelve months EPS of SGD 3.41 means that the P/E is a reasonable 10

The next thing we look at is the price we have to pay in relation to its net tangible asset value per share.

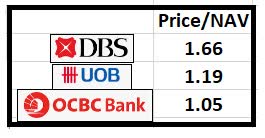

DBS Group’s NAV per share has come down in Q3 this year to SGD 20.66 from SGD 21.43 in Q3 of 2021. This leaves us with a P/NAV of 1.66 That is what we would determine to be a fair value but not particularly attractive.

To put things in some context HSBC (HSBC) has a much more attractive P/NAV of 0.66 and you can buy Bank of China in Hong Kong for just 32 cents on the dollar.

We do understand that these have different risk profiles, so we shall just compare them with their Singapore peers of UOB (OTCPK:UOVEY) and OCBC (OTCPK:OVCHF).

Price to NAV of Singapore banks (Data from DBS, UOB, OCBC)

From this, we cannot say that DBSDY is particularly attractive to buy at this moment.

Singapore and Hong Kong’s economy

Even though there are many uncertainties around the global economy going forward, we can see that at least for now, the tide has turned for Singapore in Q3 of 2022. It registered a GDP growth of 4.4 %

This was on the back of an economy that had contracted marginally by 0.2% on a q-o-q basis in Q2 2022, compared to an expansion of 0.8% in Q1 this year.

The Monetary Authority of Singapore projects that it will register growth in its GDP of about 3 – 4% for the full year.

Importantly, the labor market in Singapore is quite robust as the labor market tightened further in the first half of 2022. Total employment expanded robustly for the third consecutive quarter in Q2. Amid firm labor demand and constrained supply, the resident unemployment rate returned to its pre-COVID level in Q1 2022. The unemployment rate of residents stood at 2.9% as of the end of September and at 3.1% for citizens.

The headline inflation for 2022 is projected to be around 5 – 6%. For those that are not familiar with the difference between core inflation and headline inflation, core inflation excludes items such as energy and food. The headline does not.

Although Singapore is the bank’s core market, the second most important market is Hong Kong. I covered the economic development in Hong Kong in the middle of October here.

At that time. I extrapolated past trends of an improving quarter-by-quarter GDP and was expecting to see a slight improvement in Q3 too.

However, the office of the Hong Kong Government Financial Secretary office has just published their November 2022 report which showed that on a quarterly basis, the economy shrank a seasonally adjusted 2.6% in the July-September period, as compared with the 2.9% decline in the first quarter and a 1% growth in the second quarter.

Conclusion

From a valuation point of view, DBSDY is trading at a fair price.

However, what we as value investors are looking for is to invest in companies that offer us solid fundamentals and are priced at levels that offer us a margin of safety. We do not see this at the moment.

We are long DBS in Singapore and are happy to stay invested. We wish the price would go down below SGD 30 so we could add more to the position. This seems unlikely since the market expects the bank to continue to churn out record after record in terms of earnings.

Based on our average cost and the present dividends we get a 6.9% yield on our money.

Be the first to comment