Gold, XAU/USD, US Dollar, Non-Farm Payrolls, Technical Analysis – Briefing:

- Gold prices await Friday’s US non-farm payrolls report

- A rosier outcome may boost the US Dollar, sink XAU/USD

- Retail traders boost upside gold bets, hinting more pain

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold prices aimed cautiously lower over the past 24 hours, continuing to digest the aftermath of Wednesday’s Federal Reserve monetary policy announcement. There, Chair Jerome Powell inspired markets to add about a 25-basis point rate hike to the projected path for tightening by the middle of 2023. This helped push up Treasury yields and the US Dollar.

XAU/USD can be quite sensitive to situations when both bond yields and the Greenback move in the same direction, whether it is up or down. That is because the yellow metal bears no inherent yield for an investor who holds the asset. When the rate of return on cash rises, as it has been this year, that tends to bode poorly for gold.

With that in mind, all eyes now turn to Friday’s US non-farm payrolls report. The country is seen adding about 200k positions, down from 263k in September. The unemployment rate is seen ticking higher to 3.6% from 3.5%. Meanwhile, average hourly earnings are set to weaken slightly to 4.7% y/y from 5.0% prior.

The Citi Economic Surprise Index tracking the US remains in an uptrend since the summer. This means that overall, economists have been underestimating the health and vigor of the economy. That may open the door to a rosier outcome for NFPs. If such is the case, bond yields and the US Dollar may rise, placing the yellow metal at risk.

Gold Technical Analysis

From a technical standpoint, gold is consolidating just above the September low at 1614. Prices are also contained under the long-term falling trendline from March. Breaking lower opens the door to perhaps testing the 123.6% Fibonacci extension at 1562. Otherwise, breaking above the trendline exposes the 100-day Simple Moving Average. The latter may hold as resistance.

Recommended by Daniel Dubrovsky

How to Trade Gold

XAU/USD Daily Chart

Chart Created Using TradingView

Gold Sentiment Analysis – Bearish

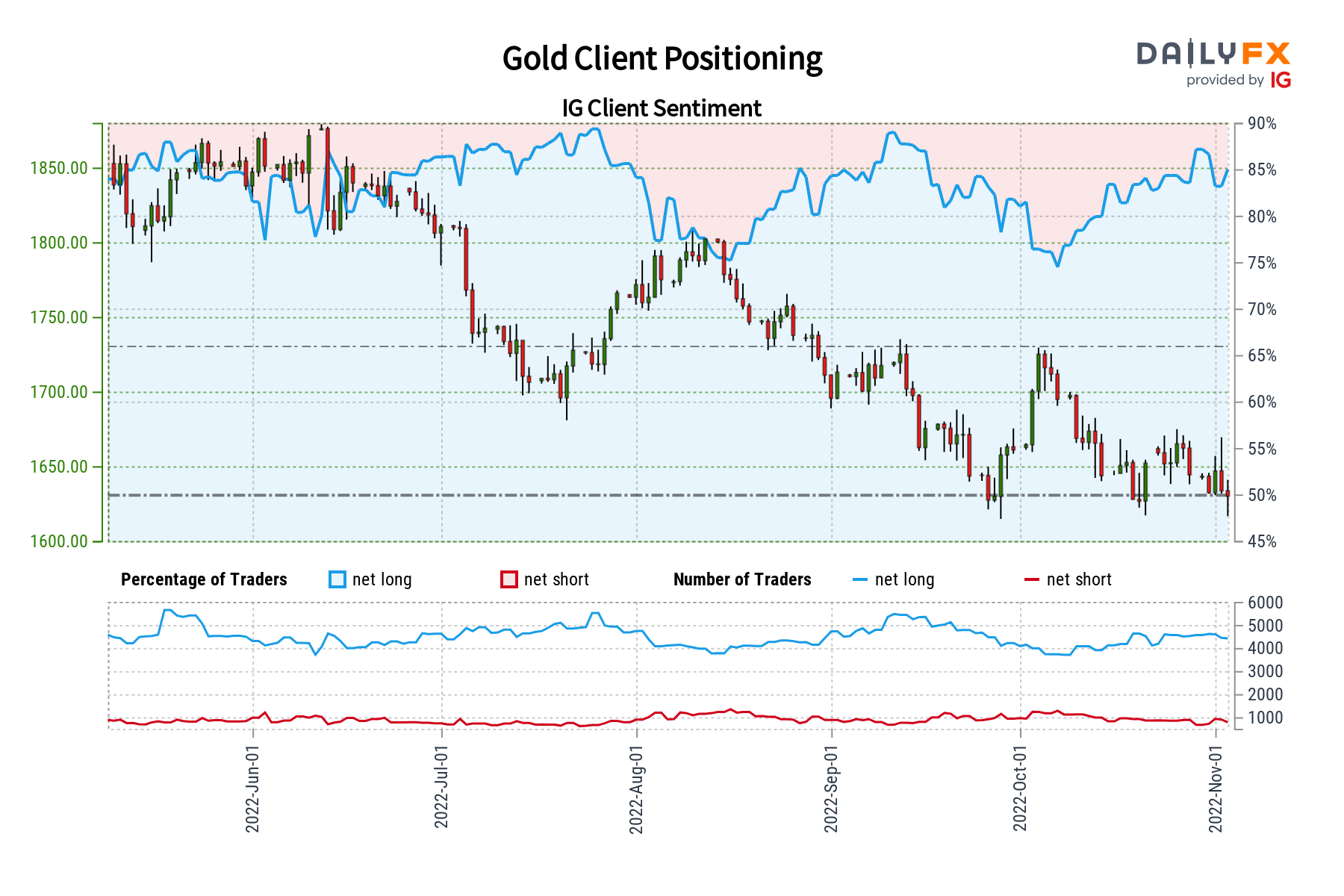

IG Client Sentiment (IGCS) shows that about 86% of retail traders are net-long gold. IGCS tends to behave as a contrarian indicator. Since most traders are biased to the upside, this hints that prices may continue falling. This is as upside exposure increased by 10.37% and 7.45% compared to yesterday and last week, respectively. With that in mind, the combination of current sentiment and recent changes offers a stronger bearish contrarian trading bias.

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Be the first to comment