ijeab

“The ability to distinguish between volatility and loss is the first casualty of a bear market.” – Nick Murray, Author of Simple Wealth, Inevitable Wealth

|

Portfolio Returns[1] |

Q1 2022 |

Q2 2022 |

2022 YTD |

FY 2021 |

FY2020 |

|

RCG Long Only |

(-8.4%) |

(-14.0%) |

(-21.2%) |

2.5% |

40.3% |

|

RCG Long Short |

(-8.2%) |

(-1.9%) |

(-10.0%) |

(-14.3%) |

10.0% |

|

RCG Top 10 |

(-6.9%) |

(-14.0%) |

(-20.0%) |

18.6% |

16.4% |

|

Benchmark Returns |

|||||

|

Russell 2500 Index |

(-5.8%) |

(-17.0%) |

(-21.8%) |

18.2% |

20.0% |

|

Equity Long/Short Index[2] |

(-0.93%) |

(-2.3%) |

(-3.2%) |

10.7% |

9.4% |

|

S&P 500 (large cap) |

(-5.0%) |

(-16.4%) |

(-20.6%) |

28.7% |

18.4% |

Dear Partner,

US Stocks officially entered a bear market on June 13th when the S&P 500 closed 22% below its January 3rd high. We’ve been here before. Only two years ago, Covid-19 caused a panic in equity markets which led to a more than 30% market decline. Those losses were (relatively) quickly reversed as investors realized that both Congress and the Federal Reserve were quickly acting in their favor. Easy monetary policy supported what we can now clearly see, in hindsight, was a speculative market bubble that continued for another two years.

We enter the summer with the Fed taking strong action to temper rampant inflation. On June 15th, the Fed surprised the market by raising interest rates by 75bps instead of the expected 50bps. Markets are in the red as investors consider the longer-term economic impacts of rising interest rates. There is no more “buy the dip”, and there is no longer a certainty that the Fed will rescue equity markets as it has in every other downturn since the 2008 Global Financial Crisis. In the recent past, investors have remained confident that the Fed would either lower interest rates or pause plans to raise if stocks declined too much. There is no such confidence now as Fed Chairman Powell is determined to keep raising rates until inflation is tamed. This is the right strategy. In our view, the Fed is “letting the air out of the tires” to keep our economy from skidding off the runway.

Many investors are still hopeful that the Fed can engineer a soft landing. I don’t believe that outcome is likely, nor do I believe it to be the right focus. As noted by former U.S. Treasury Secretary Larry Summers, anytime we have had unemployment below 4% (currently 3.6%) and inflation above 4% (currently 8.6%), a recession always follows within 2 years. There is an air of inevitability that a recession is pending. When inflation is significant, so is the following downturn. For overheated markets, overcooling is eventually required.

A slowdown in the economy (and stock market decline) is part of the Fed’s plan as it is a backdoor method of reducing consumer’s incomes and spending via the “wealth effect”[3]. When investment portfolios are down 25%, consumers begin to reconsider discretionary and luxury purchases. What we are beginning to see now – falling share prices, asset prices, mortgage applications, and housing demand are all helpful to the Fed as long as markets don’t fall too much and damage the real economy. Falling markets make people feel poorer, encouraging them to save more and spend less.

Another “positive” sign that we are heading in the right direction is rising unemployment. The only scenario in which inflation will drop from 8.6% to the targeted 2% range is if unemployment is higher. When there are too many jobs (more job openings than people to fill them), consumers feel confident about job hopping and asking for more money. No one is hoping for higher unemployment, a 2% rise in unemployment would mean job losses for 3 million Americans. But it is a sobering requirement for us to cure our current ailment. As more people become unemployed or there are fewer jobs available (job market tightening), consumers focus on saving for a rainy day. When we all save (vs. spend) and refuse to pay prices That. Just. Seem. To. Keep. Rising. inflation eases and prices stabilize.

The Fed is taking the right steps, and we are actually entering the recession on strong footing.

The one topic which, in my view, is not covered enough is the concept of “deglobalization”. Deglobalization is the process by which countries around the world begin to depend on each other less, and trade and investment between partner countries begins to decline. A key measure of globalization — trade’s share of global GDP — peaked in 2008 at the start of the Great Recession.

For the past 40+ years, globalization has been a strong counterbalance to inflation. Global trade increased competition and added hundreds of millions of low-paid employees to the global workforce. It increased the efficiency of product development through market specialization – portions of the manufacturing process for goods could be outsourced to countries most specialized to deliver in the most cost-effective manner. Those goods could then be delivered through a highly efficient global supply chain. Interdependence kept a lid on prices for goods. Interdependence brought the world’s best minds together to address pressing global problems such as energy, disease, famine, and climate change. In recent years, this behavior has changed. A geopolitical cold war with both China and Russia created protectionist pressures (Tariffs and a Trade War) while the self-interested behavior during the Covid-19 pandemic made global leaders question the wisdom of relying on other countries for key goods and services. And of course, the pandemic itself made cross border traffic more challenging. Countries are now more concerned with closing their borders to immigrants lest they take the jobs of more deserving natives. And, as the war in Ukraine drags on, and multi-national companies withdraw permanently from Russia, leaders wonder whether future conflicts will impact their ability to reliably source supplies. Each of these obstacles have led to more nationalistic behavior globally. When countries can’t (and don’t) rely on specialization from partner countries better positioned for those functions, costs …and prices …rise.

The hope is that the globalization phenomenon has merely peaked and isn’t heading towards a permanent retreat. A perfectly commingled world is an impossibility. But we are much better off when can leverage the strengths and specialization of partners to increase our output at home. The implications are that this silent factor could cause inflation to linger despite the Fed’s best efforts.

Selected portfolio discussion

For the second quarter of 2022, the RCG Long Only strategy declined 14% and the RCG Long Short strategy declined 1.9% while their respective benchmarks the Russell 2500 Index and Equity Long Short Index declined 17.0% and 12.3% respectively. Year to date, our strategies are roughly in line with their benchmarks with the Long Short strategy trailing its index.

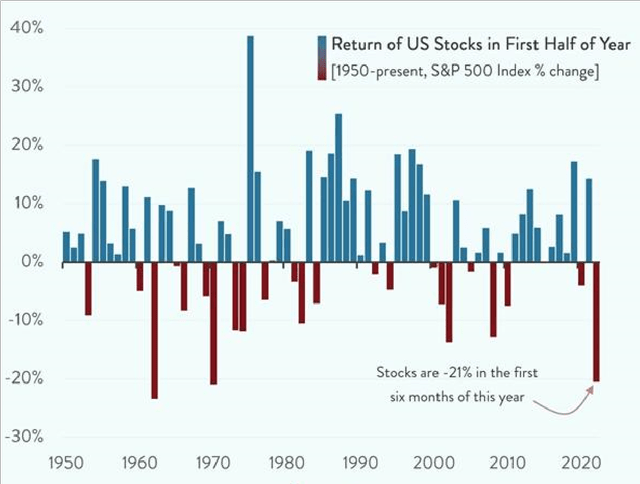

As I was preparing this letter, I came across the following chart which highlights the fact that, in the first six months of 2022, the US Stock market had its worst start to the year in over 50 years:

I had two initial thoughts. The first was that the chart presents a bit of cherry picking. Market downturns don’t typically align perfectly with the start of calendar years as this one seemingly did. And second, I noted that in almost every year (~74% of the time) where we had a dip in the first 6 months of the year, the following year began with a strong rebound. And of the 23 times that stocks have fallen in the first half of the year, more than half the time (52%), they have risen in the second half of the same year.

All the above is just numbers and patterns. And there are obviously no guarantees. But I am reminded that the market moves in cycles. And what is more likely? – That this downward trend continues for years, and the market never recovers? Or that in a few years, we look back on this period as a great buying opportunity for wonderful companies on sale? I strongly believe the latter.

Every cycle is different. But the S&P, on average (considering the 12 previous bear markets since 1945), has fallen an additional 14% after entering a bear market and taken 102 more days to find the bottom. This timeline would take us into the fall. But markets don’t typically bottom near “historical averages” and we are in an unusual environment with the economy showing more strength than we would expect ahead of a recession.

We often feel losses more intensely than we perceive gains. These emotions can easily affect our investing behavior. After seeing our strategy deliver roughly flat returns in 2021 and then decline 20% in the first half of this year, the gut reaction may be to run for the exits, put all your assets in cash, and lie in the fetal position until the queasiness subsides. Changing our strategy is the worst decision that we could make. The best decision is to counter emotions and consider that many of the wonderful businesses we hold in our strategy (that has delivered 240% net returns since inception[4]) are now on sale. We are continuing to invest through the downturn seeking companies with differentiated and profitable business models poised to thrive despite current economic headwinds. We believe that now is a great time to add to equity portfolios.

Our biggest detractors for the quarter

We had numerous detractors during the quarter as the market left few places to hide. The majority of the positions in our portfolios were down 10% or more, and so I won’t discuss them all. One notable exception was The Trade Desk (TTD) which declined 40.0%. At the end of 2021, TTD had grown to one of the largest positions in our portfolio. However, as we entered 2022, I reduced our position to one of the smallest in the portfolio due to valuation concerns. But we have many reasons to remain invested in this wonderful company. The Trade Desk is the leading Demand Side Platform (DSP) for digital programmatic advertising. Their customers are the advertisers and agencies seeking to manage complex marketing campaigns which TTD enables through real-time auctions, AI, and analytical tools placing client’s ads in the best context at the lowest price. Advertisers love programmatic ads because they know exactly who they are reaching and can maximize the effectiveness of their marketing budget. Publishers love programmatic advertising because they can sell the exact spaces they need to fill. Over the past two years, the advertising space has shifted:

- With the advent of streaming platforms (Netflix, Hulu, etc.), and the changes that both Apple (AAPL) and Google (GOOG, GOOGL) have implemented to their ad tracking models, advertisers have scrambled to find ways to effectively reach their target customers.

- And as ad spending continues to shift away from social medial platforms (Facebook/Meta, Snap, etc.), marketers are seeking more effective and targeted channels outside of walled gardens.

TTD is well positioned for this shift. In partnership with the advertising community, TTD has built a unique and effective solution to counteract these changes in the form of UID 2.0. The market has discounted the entire ad tech sector due to concerns that advertisers will significantly reduce their advertising budget during a recession. We believe that a recession is pending, if not already here. But even if we do have a deeper recession, advertisers will reduce their marketing budgets but not eliminate them. Marketing will still be critical to pursue consumer spend. Marketing teams will want to partner with the platform providing the best solution. That is TTD and their Solimar platform which provides marketers with a rich measurement marketplace. The ad tech sector will be a “winner take most” race and TTD will continue to thrive despite challenges amongst their peer group. As Netflix (NFLX) begins their journey towards offering an ad supported subscription tier, they have no choice but to include The Trade Desk in their decision process because they have the best solutions. At their annual meeting in May, TTD management reaffirmed Q2 guidance and CEO Jeff Green reiterated that they expect to continue growth in excess of their market’s projected growth rate (8% to 16%) while maintaining a 90%+ retention rate for their existing customers.

Our biggest contributors for the quarter

The portfolio positions that increased during the quarter likely did so because of the sectors in which they are categorized as opposed to any company specific news. American Tower (AMT up 2.9%) is one of the largest global REITs. The company owns and operates multi-tenant cell towers globally. Our long tenured investment is based on their impenetrable business model and the long tail of the current 5G investment cycle that will extend over the next decade. Carriers are in the early stages of upgrading their cell sites with new equipment to provide contiguous 5G coverage globally. Additionally, since 5G technology requires increased cell site density, cellular carriers will need to invest extensively to ensure strong performance across their networks. Kinsale Capital (KNSL up 0.7%) is a pure-play insurer in the excess and surplus insurance market. KNSL focuses on hard-to assess business risks, and they are the best in their industry as evidenced by their market leading combined ratio. They are the rare insurer that has achieved strong premium growth while maintaining margins.

Business Updates

During the quarter, our extended team has been working hard marketing the firm to raise assets and secure new institutional clients. We recently received some great publicity as the Teacher’s Retirement System of Texas asked us to present at the Texas Alternatives Conference where I competed in the pitch competition. I won the Judge’s Choice and Audience Choice awards based on my recommendation for Nexstar Media Group (NXST). This provided great visibility for the firm. We have held our position in NXST since 2016, and our original thesis is available on our website.

We are still expanding our team. During the quarter, we interviewed numerous outstanding candidates. We are close to making offers, and we will provide updates in our next letter.

Finally, we will be hosting our first (virtual) Limited Partner meeting at the end of July. All LPs will receive an invitation under separate cover. If you are interested in becoming an LP in the management company, please contact us directly.

We understand that our clients have placed their trust in us to protect and manage their valuable assets. And specifically, during periods such as this, we know that we have a very important job to do and we don’t take that lightly.

Khadir Richie

Principal, Richie Capital Group

“It is a privilege to manage money for others.”

[1] All portfolio and index returns mentioned are presented net of expenses and maximum management fees paid by any account within the composite. All performance is estimated pending year-end performance audit. Completed audit numbers available upon request.

[2] BarclayHedge Equity L/S Index

[3] The Wealth Effect Definition

[4] Portfolio returns reflect performance of the RCG Long-Only Strategy from inception through December 2021. Annualized net returns of +14.6%. Comparable return of 218% and comparable IRR of 13.7% for our benchmark the Russell 2500. Performance has been independently verified by a third part GIPS performance provider. Returns are presented net of expenses and maximum management fees paid by any account within the composite.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment