da-kuk

It’s been about 9 months since I declared that shares of New Jersey Resources Corporation (NYSE:NJR) were overpriced, and, wouldn’t ya know it, at that moment, they started rising in price as the overall market fell. Specifically, they’re up about 18.3% against a loss of about 15% for the S&P 500.

In this piece, I want to revisit that painful trade to see if it’s time to bite the bullet and buy. I’m going to make that determination by looking at the latest financial reports and comparing these to the stock. I’m also going to look at the options market as is my wont.

Welcome to the thesis statement portion of the article. This is what I call the “goldilocks” portion of the piece, where I give people not too much, not too little. It may or may not be just right. That’ll be for all of you to judge. Anyway, I think the most recent financial performance has been poor, except for the increase in revenue. I had the view previously that dividend growth must slow and nothing that’s happened since has changed that view. Revenue has grown dramatically, but input costs have grown more dramatically. In spite of this, the valuation is nearly twice what it was. In my view, this won’t end well for people who buy today.

In this piece I want to address a wider philosophical question that’s pertinent to all investments, beyond this one. I want to work out whether I was mistaken in eschewing the shares earlier. Just because the stock price has moved against me over the past several months doesn’t mean that my initial impressions were incorrect. After reviewing the name, I’m doubling down in my skepticism. I think things were bad before, and I think they’re very bad today. You may suggest that my culture makes me stubborn, and I won’t get offended by that stereotype because we’re not the type of culture to get offended by such trivial nonsense. After reviewing this piece, though, you may conclude that you, too, want to avoid this name until price falls to match value. I’m very, very comfortable taking a victory lap or 50 when a call works out well, and I’m comfortable writing about it when I make a mistake. Although it seems that my call was incorrect because the price has moved against me, I’m not so sure. I’m comfortable writing that I got things terribly wrong with Bed, Bath & Beyond, for instance, but I’m still firm in my convictions here.

Financial Snapshot

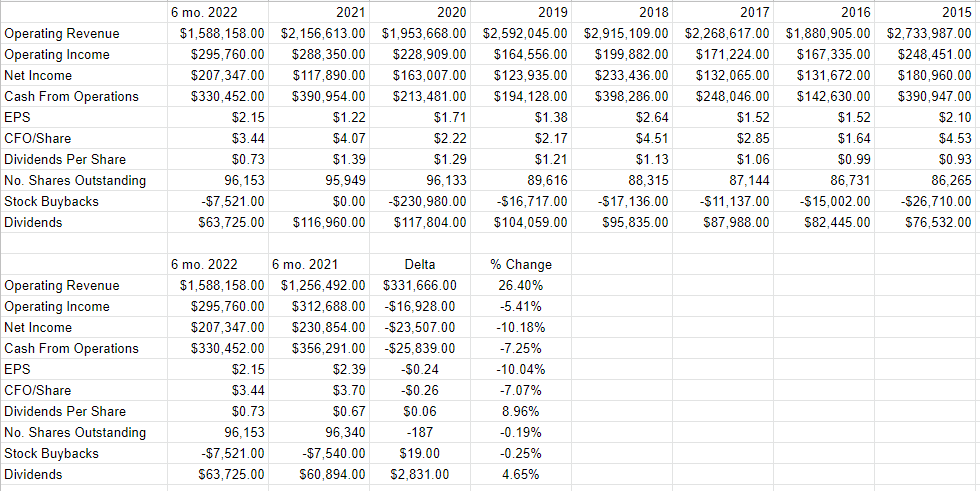

I think the recent financial performance has been impressive in exactly one way. Revenue for the first six months of the current year is about 26.4% higher than it was during the same period a year ago. That’s impressive. The problem is that net income and cash from operations have declined by 10.2%, and 7.25% respectively. The reason for this is the fact that input costs increased at a faster rate. For instance, natural gas purchase expenses increased by 98% in the case of utility and 37% in the case of non-utility. In addition, regulatory expenses increased by 64%. So, in my estimation, looking only at increased revenue misses the point that investors are compensated for whatever’s left over after expenses like taxes, maintenance etc. have been satisfied.

Turning to the capital structure, it’s time to write about debt levels. To get a good sense of the level of relative indebtedness here, I want to look at the cash flow statement. According to this document, the company paid down just over $225 million of short-term debt and $10 million of long-term debt, while taking in proceeds of $150 million from the term loan, and an additional $100 million from long term debt. In other words, according to the cash flow statement, overall indebtedness increased by about $15 million for the six months ended March 31, 2022.

I don’t want to trod over old ground, but in my previous missive on this name, I concluded that dividend growth must slow in future, and nothing I’ve seen since has changed my perspective here. Given all of this, the financial performance for the first six months of this year has been unimpressive in my estimation. That said, I’d be comfortable buying the shares at the right price.

New Jersey Resources Financials (New Jersey Resources investor relations)

The Stock

Anyone who’s had the misfortune of spending too much time in my presence is eventually exposed to one of my “big ideas”, namely that a great business can be a terrible investment at the wrong price, and that a relatively mediocre business can be a good business if you get it for a song. If I haven’t had the opportunity to blare this truth at someone, I will eventually do it, no matter the current topic of conversation. If you were looking for another insight into why my social life is so poor, you now have it. I consider New Jersey Resources to be a mediocre business, but it may be a great investment at the right price.

Underlying this idea is the fact that I think the business and the stock are quite distinct things. Every business is similar in that they all buy a number of inputs, add value to those, and then sell the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company. The crowd changes its views about the company relatively frequently which is what drives the share price up and down. Added to that is the volatility induced by the crowd’s views about stocks in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. The fact that I write articles on this topic, and the fact that you read them indicates to me that we sometimes (often) don’t trust that the crowd’s current view is correct.

In my view, the only way to earn a sustainable profit in the stock market is by finding where the market is incorrect about a company’s long-term future prospects and exploiting that inaccuracy by buying or selling. I’m also of the view that there’s a strong negative correlation between price paid and subsequent returns. The higher the price paid, the lower will be the subsequent returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

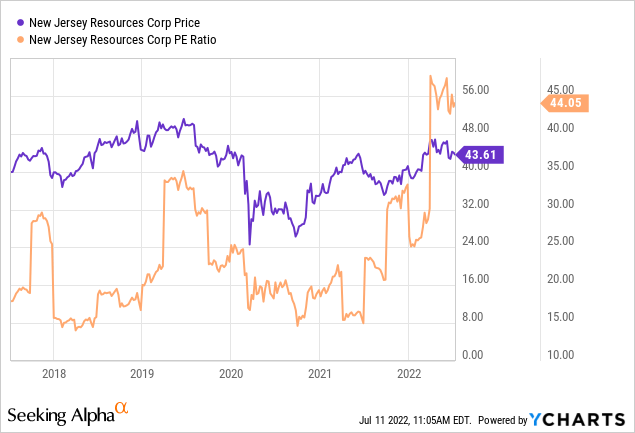

As my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both the overall market, and the company’s own history. In the previous article on this name, I stated that I was unimpressed by the fact that the PE ratio was floating around 22.6 times. Fast forward, and we see that the shares are trading very near a multi-year high, per the following:

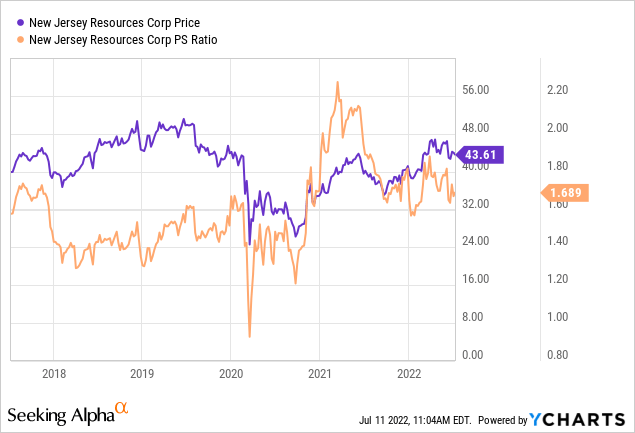

At the same time that investors are paying more for $1 of earnings than they have in many years, they’re paying less for $1 of sales relative to the recent past, but this measure is still elevated relative to the longer-term trend, per the following:

If I didn’t like the shares when they were trading at 22.6, I really don’t like them now that they’re changing hands at nearly twice that valuation.

Options As Alternative?

In my previous missive, I bragged about earlier making money by selling much lower risk put options on this name previously. The problem was that the premia on offer for puts wasn’t high enough then, so I eschewed them. I used the example of May 2022 puts with a strike of $25 being bid at $0. When I review options today, the same situation lingers, because shares are even more overpriced in my estimation. For instance, I’d be willing to buy this stock at $30, and the February 2023 puts of that strike price are currently bid at $0. For that reason, I must continue to sit on the sidelines here, and wait for what I think will be an inevitable fall in price.

Conclusion

Although I wrote it earlier in this article, I think the point bears repeating. The reason we’re all here is because we are of the view that the current stock price proves nothing. We all believe that we can “seek alpha” by spotting the disconnect between the crowd’s current price and subsequent reality. With that said, I think the recent rise in price is unwarranted here, and those who participated will eventually give back their gains. This is because the shares are now trading at multi-year highs, and because I’ve seen nothing to change my view that the dividend growth must slow. While I would normally recommend investors try to earn some sort of return by writing put options, I can’t do so in this case because the market price is so far above what I consider to be reasonable strike prices.

Be the first to comment