felixmizioznikov

American luxury furniture retailer RH (NYSE:RH) is seeing near term softness along with slowing housing activity, but their long term strategic efforts are promising. After dropping considerably this year, the stock is quite cheap relative to peers.

Decelerating top line amid industry slowdown

After benefiting handsomely during the pandemic when consumers stuck at home splurged on home furnishings, the tide is now reversing with slowing housing activity as a result of rising interest rates and a weakening economy; the luxury home market in the U.S. posted its biggest decline in a decade, with luxury home sales tumbling 28% YoY during the three months ended August 2022, impacting luxury furniture retailer RH’s performance and market share; sales rose just 0.28% YoY to USD 991 million during the quarter ended July 2022 while net profits declined 46% YoY to USD 122 million.

RH’s stock has dropped 54% over the past year, better than Wayfair (down 88%) but a steeper drop than Williams Sonoma (41%), and Arhaus (9.7%) (Ethan Allen is one of the few furniture players whose stock has increased, up 25% over the past year). RH’s revenue growth has also decelerated sharply relative to furniture rivals as the company’s strategy of limiting promotions despite widespread discounting in the industry resulted in mounting market share losses (with premium furniture retailers such as Arhaus and Wayfair being among those gaining share).

|

Quarterly revenue growth YoY % |

|||

|

RH (quarters ended April, July, September 2022) |

11.2% |

0.28% |

Not released |

|

Arhaus (quarters ended March, June, September 2022) |

43.7% |

66.4% |

57.4% |

|

Williams-Sonoma (quarters ended May, July, October 2022) |

8.1% |

9.7% |

7.1% |

|

Ethan Allen (ETD) (quarters ended March, June, September 2022) |

11.7% |

28.8% |

17.6% |

|

Wayfair (quarters ended March, June, September 2022) |

(13.9%) |

(14.8%) |

(9)% |

Near term, the Fed is expected to continue raising interest rates (albeit likely at a slower pace) suggesting soft housing activity which RH management expects would last several quarters. Additionally, given the company’s reluctance to engage in promotions for fear of destroying brand equity, it is likely that RH may continue to see market share losses in the near term, and possibly revenue and profit declines as well.

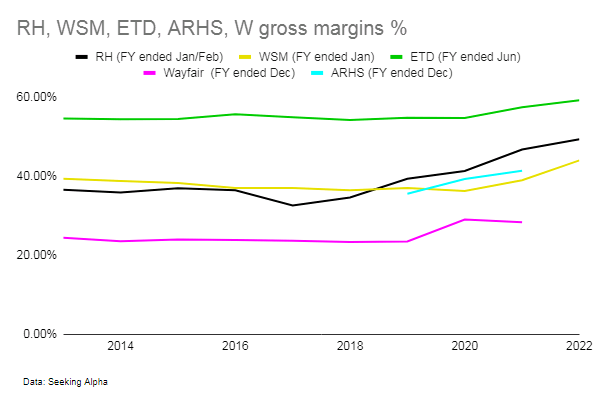

Margins however remained strong, notably in contrast to rivals such as Williams-Sonoma, whose margins have been under pressure as a result of inflation.

|

Gross margins % |

Q1 |

Q2 |

Q3 |

|

RH (quarters ended April, July, September ) |

52.1% |

52.7% |

Not released |

|

Arhaus (quarters ended March, June, September) |

46.3% |

49.2% |

48.4% |

|

Williams-Sonoma (quarters ended May, July, October) |

43.8% |

43.5% |

41.5% |

|

Ethan Allen (quarters ended March, June, September 2022) |

60.4% |

58.2% |

60.4% |

|

Wayfair (quarters ended March, June, September 2022) |

26.8% |

27.3% |

29% |

Looking ahead, the company’s strategy of focusing on long term brand equity rather than short term profits is sound. RH’s target market (households earning USD 200,000 or more) are less likely to be affected by recession and even if so, are likely to recover considerably better than households in lower income brackets putting RH in a good position as one of the very few truly luxury furniture retailers to capture their spending when housing activity picks up. Research reports from real estate consultancy firms anticipate a long (about five years) runway of growth for luxury housing in the U.S.

RH’s margins have grown over the past decade and is already among the highest among rivals. Their continued focus on building and elevating their brand could give them potentially greater pricing power enabling them to maintain and perhaps further expand margins in the long run.

Author

Not just a furniture retailer but an entire ecosystem of spaces, dining, travel, and hospitality for the ultra-wealthy

Although RH is most known for furniture, the company continues to evolve, and have been venturing into new areas from restaurants and guesthouses to travel experiences (such as yachts) to elevate the brand and create a one-of-a-kind ecosystem of “Products, Places, Services and Spaces” aimed at the ultra wealthy. This is a very unique market positioning, a competitive strength that so far no premium furniture retailer be it Arhaus, Williams-Sonoma, or Ethan Allen enjoys.

RH’s growing ecosystem opens cross-selling opportunities for their affluent members, potentially helps build brand loyalty, while diversifying revenue streams (furniture currently accounts for about 69% of RH’s total revenues) and increasing their addressable market. Their new guesthouse, opened in September this year, positions the company to carve a share of the luxury hospitality space which is fast changing and growing at a rapid clip as luxury travelers seek new experiences, while their new luxury yachts expands their design expertise, positioning them to capitalize on the luxury yacht market which is poised to grow in the high single digits in the coming years. RH Contemporary, a new brand launched this year featuring collaborations with global designers further expands their ecosystem and product offering. With prices on average a third higher than RH’s core products, RH Contemporary is expected to be a USD 1 billion business going forward, and given their higher average price points, could potentially be margin accretive as well.

International expansion

RH’s international ambitions could further drive growth in the coming years. The launch of RH’s first international gallery, RH England, has been pushed to 2023, and more international locations have been planned with locations already secured or in the process of being secured in Paris, Milan, Munich and Dusseldorf among other locations. The global luxury furniture market is a multi-billion dollar market, with growth expected in the mid single digits long term. RH’s unique, one-of-a-kind brand identity and market positioning should help it capture a share.

Risks

Apart from possible execution risks, RH is heavily dependent on CEO Gary Friedman (much like Tesla is heavily dependent on CEO Elon Musk).

Summary

RH’s stock has dropped considerably over the past year driven by a housing market slowdown, rising interest rates and a weakening economy. RH’s resistance to promotions have resulted in market share erosion which may continue near term, however long term, this strategy could bear fruit in terms of higher brand equity and pricing power, helping support margins which are already among the highest in the industry.

RH continues to evolve, expanding from a luxury furniture retailer into an ecosystem of products and services that increase RH’s addressable market and potentially brand loyalty as well. Their growing ecosystem also stands out, with no high-end furniture rivals enjoying a similar ecosystem aimed at the ultra-wealthy demographic. RH’s international expansion and new business launches such as RH Contemporary are promising and could drive top line growth and potentially margins as well.

With a P/E of 11.53, RH is quite cheap, and is just slightly more expensive than Arhaus (10.8) and Williams-Sonoma (7.4). All have relatively high short interest (14.2% for Arhaus, 14.8% for RH, and 16% for Williams-Sonoma). However, considering RH’s growing brand equity and unrivaled ecosystem, the company’s P/E being only slightly more expensive than high-end pure-play furniture rivals suggests a long term opportunity worth looking at.

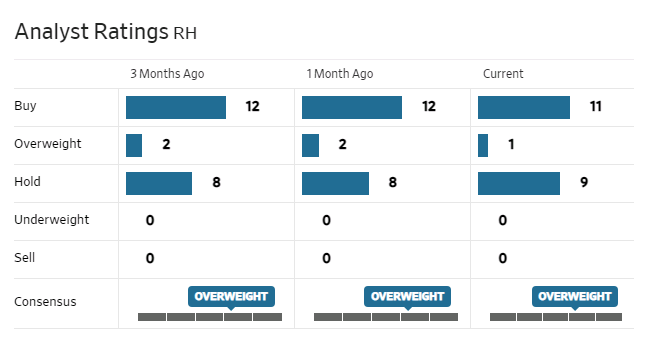

Analysts are generally bullish on the stock.

WSJ

Be the first to comment