sutthirat sutthisumdang/iStock via Getty Images

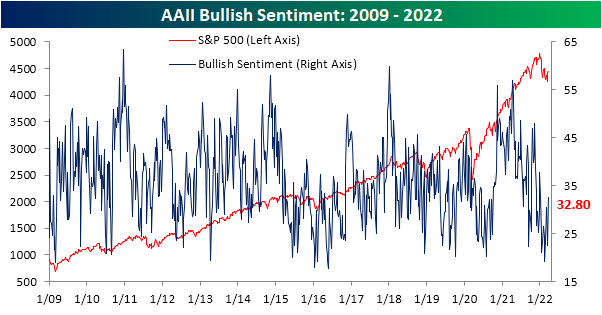

There’s nothing like higher prices to cure investor blues, and the last week has been a perfect example of that. AAII’s weekly sentiment survey saw a double-digit increase in the percentage of respondents reporting as bullish this week, with that reading rising from 22.5% up to 32.8% and matching the highest level of optimism in 2022.

AAII Bullish Sentiment 2009-2022 (Author)

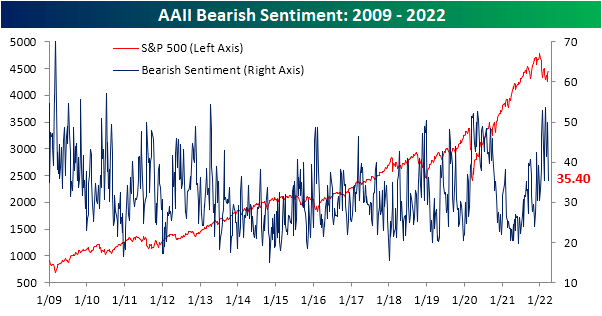

Those gains to bullish sentiment borrowed entirely from bears, as the percentage of respondents reporting as pessimistic fell from nearly 50% of respondents down to 35.4%. The 14.4 percentage point decline marked the largest weekly decline in bearish sentiment since July 2010, when the reading had fallen by 19.27 percentage points. More recently, however, there have been a couple of other double-digit drops in bearish sentiment, including a 12.3 percentage point decline in the first week of March and an 11.9 percentage point drop in December.

AAII Bearish Sentiment 2009-2022 (Author)

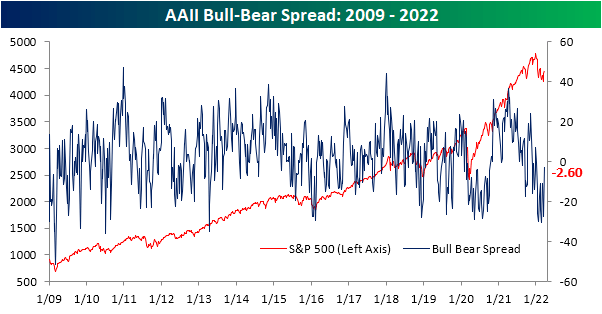

Bears continue to outnumber bulls, but the margin has narrowed to the smallest degree since the first week of the year. The bull-bear spread has risen to -2.6 after leaping higher by 24.7 points week over week – the largest one-week increase in the number since October 2019.

AAII Bull-Bear Spread 2009-2022 (Author)

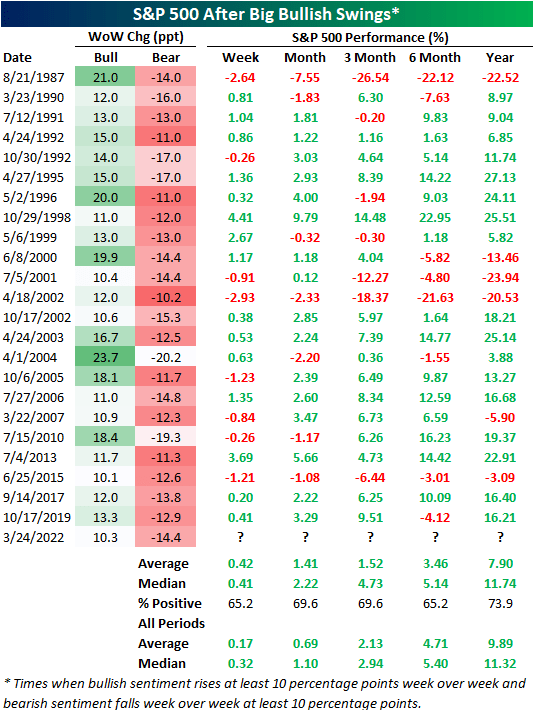

Looking at it another way, this week marked the first time since October 2019 that bullish sentiment rose by at least 10 percentage points while bearish sentiment fell by at least 10 percentage points in the same week. In the table below, we show each prior instance of simultaneous double-digit swings in bullish and bearish sentiment without another occurrence in the previous six months. As for how price action has responded to such swings in sentiment, the S&P 500 has generally seen consistently positive performance in the months ahead, but only one-week and one-month performance has been significantly stronger on an average or median basis than what has been the norm.

S&P 500 After Big Bullish Swings (Author)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment