Justin Sullivan/Getty Images News

Introduction

In this inflationary environment, I continue to look for businesses that are resilient to the dreaded inflation tax. My last article covered a REIT. And the ones before that covered insurance and reinsurance stocks that benefited from rising rates. Today, I look at Restaurant Brands International (NYSE:QSR), which is a leading quick service restaurant chain that operates the well-known Tim Hortons, Burger King and Popeyes and Firehouse Subs brands. QSR is an inflation-resilient play in the consumer discretionary sector as it benefits from rents and royalties, whilst a triple net agreement with its franchisees allows it to pass on cost inflation risks. On the business side, the company is undergoing a suite of modernization initiatives to vitalize growth and increase monetization of its customers. Based on my conservative DCF valuation, the stock has 15% upside and the technicals are also pointing bullish. The 3Q FY22 earnings release next week could be a catalyst for sharp price appreciation.

Business Brief

QSR is a large quick service restaurant business with four key brands:

- Tim Hortons (TH), which is a leading donut/coffee/tea restaurant in North America

- Burger King (BK), which is the world’s second-largest fast food hamburger restaurant

- Popeyes (PLK), which is the world’s largest quick-service chicken restaurant

- Firehouse Subs (FHS), which is a leading player in the QSR sandwich category in North America

The company runs on a franchise model with 96%, 88% and 70% of total revenues from the BK, PLK and FHS businesses coming from franchise and property revenues in Q2 FY22. The TH business is an exception; this segment has backward integration in manufacturing, warehousing and distribution activities, selling mostly to TH franchisees. In Q2 FY22 the TH business saw 68% of revenues came from these supply-chain related activities and 32% from franchise and property royalties and rents.

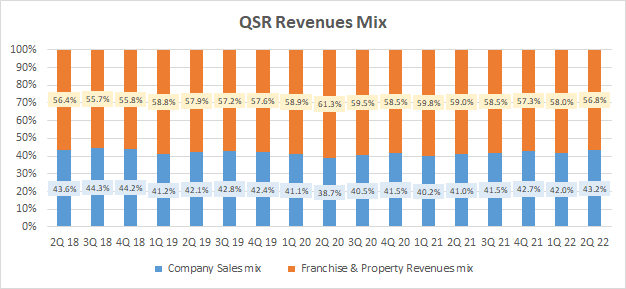

Overall, 57% of QSR’s revenue mix comes from royalties and rents from franchises:

QSR Revenues Mix (Company Filings, Own Analysis)

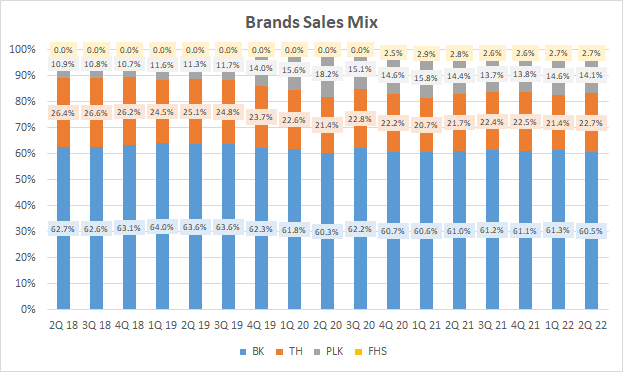

And while BK restaurants punch in the highest sales:

Brand Sales Mix (Company Filings, Own Analysis)

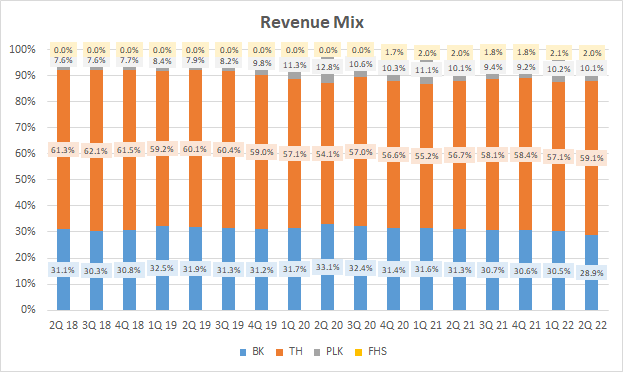

The supply chain operations of TH make it a larger revenue contributor for the company. Almost 60% of the top-line comes from the TH brand:

Revenue Mix (Company Filings, Own Analysis)

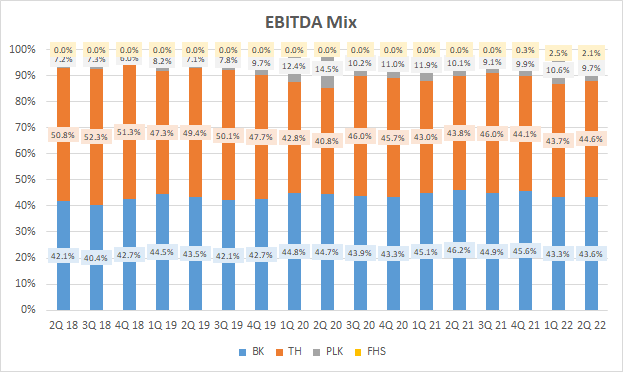

However, the purely franchise based operations of BK is a higher margin business overall with 56.9% EBITDA margins compared to TH’s 28.4% EBITDA margins. This is because TH’s supply chain business clocks in operating margins lower than what is typical for the franchised restaurant operations. Hence on aggregate, BK and TH are roughly equally important contributors at the operating earnings level:

EBITDA Mix (Company Filings, Own Analysis)

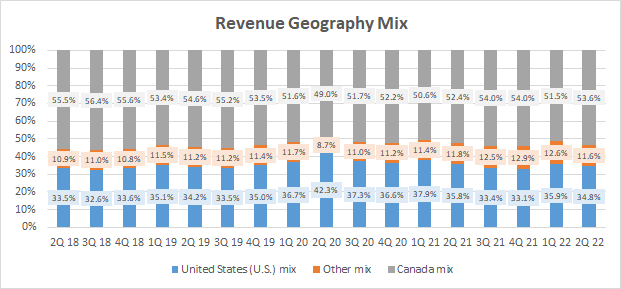

Almost 90% of QSR’s revenues comes from Canada and the US:

Revenue Geography Mix (Company Filings, Own Analysis)

Over the years, QSR has established leading positions in its markets. Going forward, the company is placed to capture greater share of customers’ spend by expanding its offerings and driving higher engagement with customers.

Why Buy QSR Now?

I believe QSR is a good buy now for 2 key reasons:

- QSR’s franchise model is resilient to inflation

- Modernization initiatives will boost growth across brands

Here’s how I see these factors playing out:

QSR’s franchise model is resilient to inflation

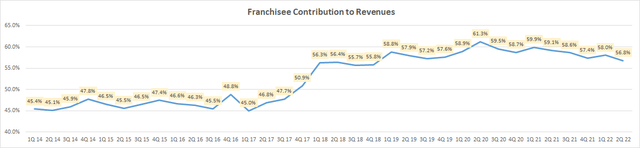

As of Q2 FY22, the majority (56.8%) of QSR’s revenues come from franchises. Furthermore, over the last 8 years, this mix has increased from 45% in 2014:

Franchisee Contribution to Revenues (Company Filings, Own Analysis)

The franchise business model is very resilient to inflation. This is because royalties are charged as a percentage of the franchisee’s sales, which over time, tracks the CPI inflation index as noted in the Q2 FY22 earnings call. Rent charges to franchisees also keeps in tandem with CPI.

However, on the costs side, QSR is not as exposed to inflationary effects. Operations is under the complete purview of the franchisees’ management teams. Even the rent agreements with franchisees is on a triple net lease structure. Under such a structure, all costs, including property taxes, repairs, maintenance and insurance are borne by the franchisee.

Thus, most of QSR automatically receives inflation-linked price hikes without experiencing cost inflation pressures.

In the current environment of high inflation environment with the CPI print at 8.2% as of September 2022, after decades of sub-4%, inflation resilient businesses are of ever-increasing importance in an investments portfolio. QSR fits the bill quite well here.

Modernization initiatives will boost growth across brands

QSR is revamping its portfolio across brands to better align to modern consumer preferences.

Tim Hortons

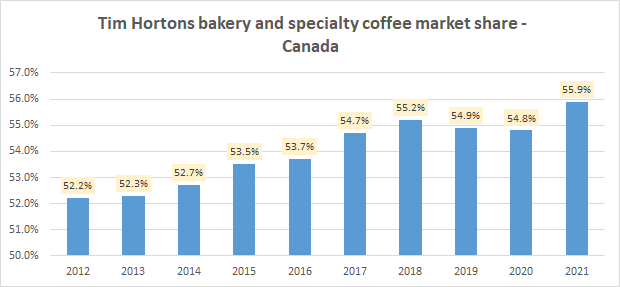

For the TH brand, in 2019, the company conducted surveys to understand reasons for lower visitation. The findings highlighted weaknesses in quality perception, which was addressed with improved product offerings, resulting in market share increases in Canada, its main geography:

Tim Hortons Market Share (Euromonitor, Own Analysis)

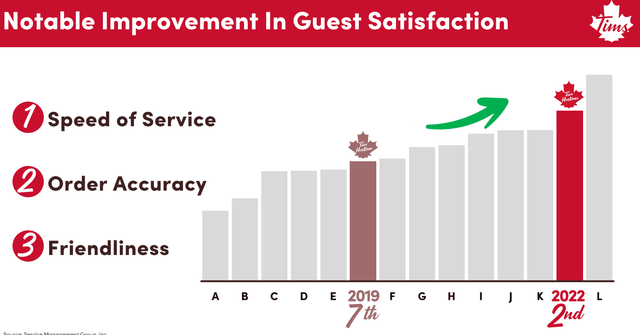

Consumers also indicated an aging brand perception with Tim Hortons in the same survey. To rectify this, the company is currently undergoing growth acceleration initiatives by increasing consumer convenience and engagement. This is being driven by investments in digitalization, which are yielding substantial returns in guest satisfaction scores:

TH Guest Satisfaction Improvements (Tim Hortons Investor Day 2022)

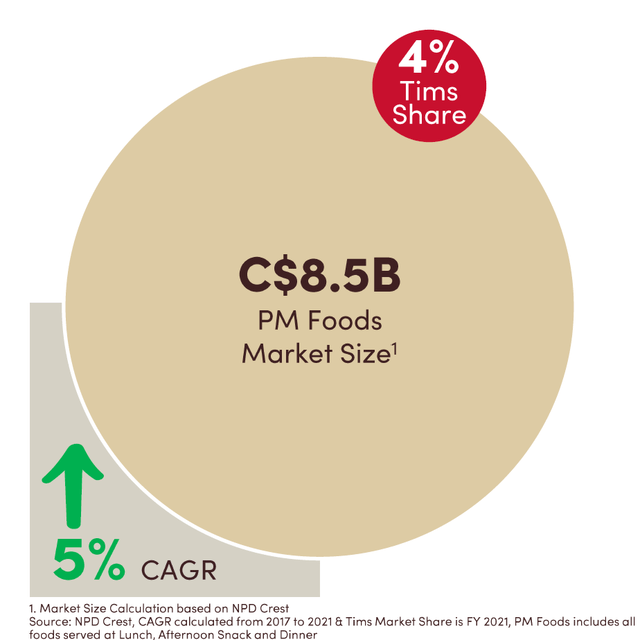

Incrementally, TH in Canada is expanding its offering beyond the AM-time meals such as breakfast and brunch to PM-time meals such as lunch, evening snack and dinner. Currently, TH holds a 4% market share in PM foods:

PM Foods Market Size and Share (Tim Hortons Investor Day 2022)

Management has not specified a numerical target market share but in the Q2 FY22 earnings call, CEO Jose E. Cil commented that they have:

…big aspirations for our lunch and dinner business, and we’re just getting started.

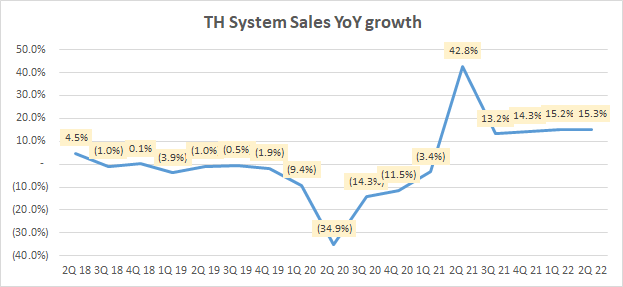

Operationally, the TH business is growing significantly faster than pre-pandemic levels at a sustained 15% YoY:

Tim Hortons System Sales YoY Growth (Company Filings, Own Analysis)

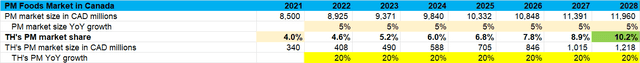

I’m assuming the PM segment grows faster at a 20% CAGR. Then the math shows that TH can easily get to double-digit market share in the current 2020s decade:

PM Foods Market Size and Shares (Company Filings, Own Analysis)

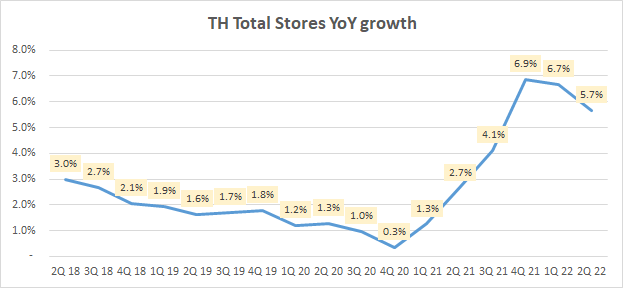

Note that the overall TH sales growth is driven by an increase in the number of stores:

Tim Hortons Total Stores YoY Growth (Company Filings, Own Analysis)

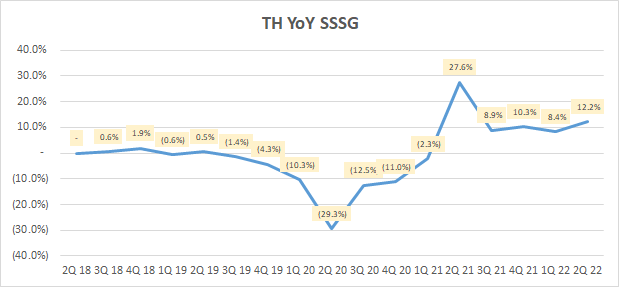

But also an extremely strong up-tick in same store sales (SSG) growth:

Tim Hortons YoY SSSG (Company Filings, Own Analysis)

This suggests that the modernization initiatives are indeed working to improve monetization levels at each restaurant.

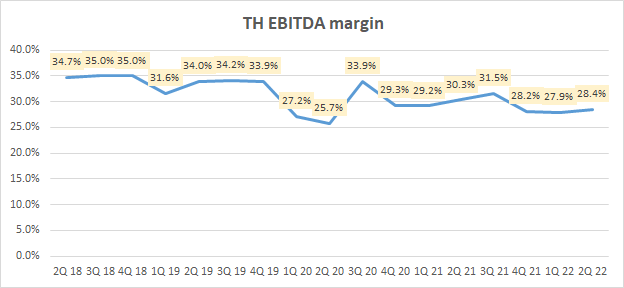

The increased investments to revitalize growth in TH has naturally led to a dip in EBITDA margins to 28.4%, about 600bps lower than pre-pandemic levels:

Tim Hortons EBITDA Margin (Company Filings, Own Analysis)

However, I think margins can return or even go higher than historical levels after the current investment cycle. This would be driven by operating leverage, improved market leadership and brand position leading to some marginal pricing power.

Burger King

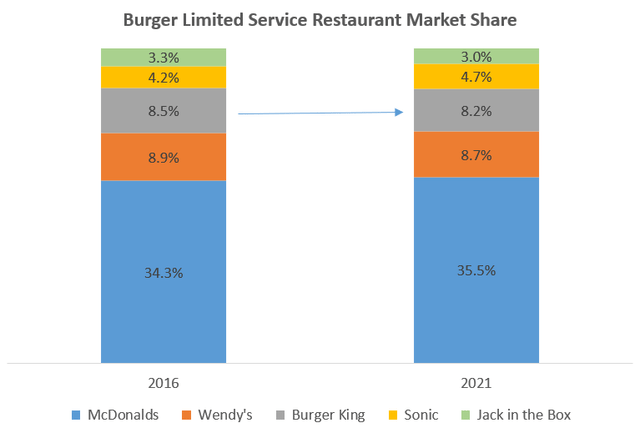

In the burger limited service restaurant (LSR) category, BK’s market share is estimated to be at 8.2%. This is stagnant to slightly falling since 2016:

Burger Limited Service Restaurant Market Share (Euromonitor, Own Analysis)

From a customer connect perspective, BK has historically opted for controversial ads, many of which has not garnered favorable reactions.

Operationally, complex menus, slow operations and outdated restaurants have been highlighted as key issue areas.

To solve these issues, QSR is investing $400 million over two years into various initiatives. $150 million will be allocated to advertising and digitalization. $250 million into remodels, relocations and upgrades to boost operational efficiency.

On the brand advertising front, BK has recently veered away from being controversial and instead adopted an individual-empowering message with its “You Rule” campaign. This seems in-line with modern cultural sentiments. Other consumer-focused companies I am bullish on such as Pinterest (PINS) is also aligning toward self-empowerment and expression in their marketing.

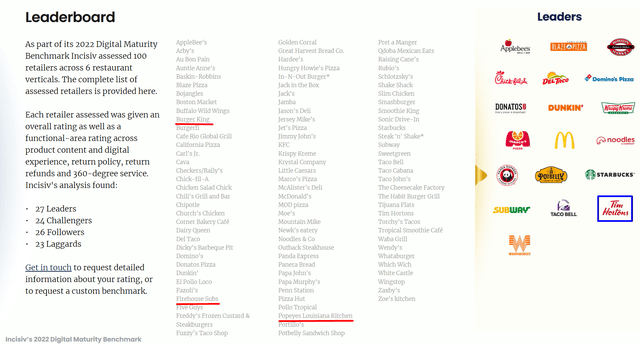

QSR’s Tim Horton’s brand is already considered a digital leader in Incisiv’s Digital Maturity Benchmark 2022 study. Given the planned investments for Burger King, I believe there is great scope to dramatically improve its operational performance and monetization.

Digital Leaders in Restaurants Industry (Incisiv Digital Maturity Benchmark 2022 Study)

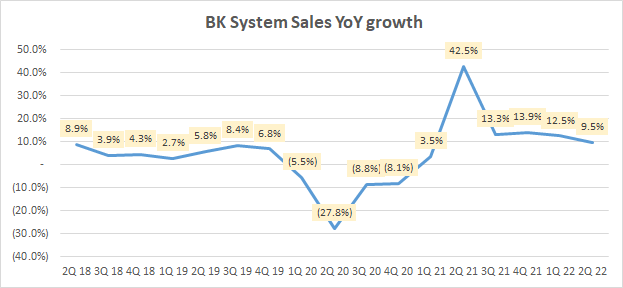

BK’s business is now growing faster than pre-pandemic levels with 9.5% YoY growth as of Q2 FY22:

Burger King System Sales YoY Growth (Company Filings, Own Analysis)

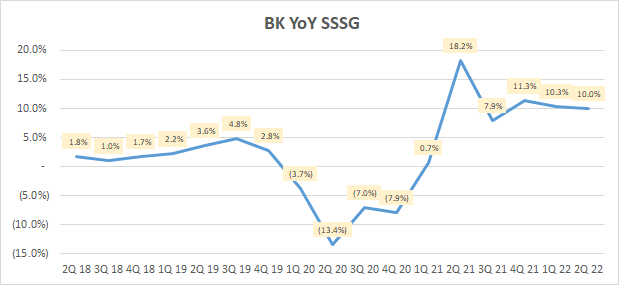

SSSG metrics are also above pre-pandemic levels with 10.0% YoY growth as of the latest Q2 FY22:

Burger King YoY SSSG (Company Filings, Own Analysis)

I expect these early green shoots of positive momentum to continue as the modernization initiatives yield fruitful outcomes.

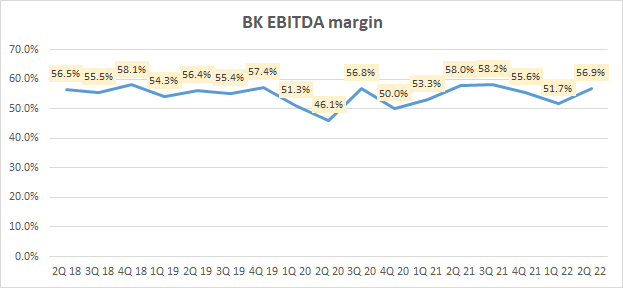

On the margins front, BK is clocking in 57% EBITDA margins as of Q2 FY22:

Burger King EBITDA Margin (Company Filings, Own Analysis)

I anticipate the next few quarters to remain in this range as S&M and G&A investments ramp up. Post digitization initiatives, leaner operations can result in a margins uptick.

Overall

TH and BK make up almost 90% of QSR’s revenue and margins mix. The PLK and FHS businesses are not major needle-movers for the stock. I believe with the planned modernization initiatives, QSR is well-poised to continue increasing customer engagement and improving operational efficiencies. This is likely to fuel strong sales growth and eventual structural margin improvement.

Valuation

These are my key assumptions for a simple DCF valuation for QSR:

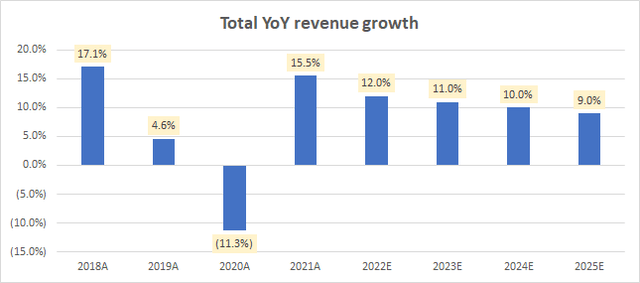

Total YoY Revenue Growth (Company Filings, Own Analysis)

My FY22 revenue growth estimate of 12.0% is mostly in line with consensus, followed by a gradual reduction down in the growth rate as I expect most of the digital initiatives to boost the revenue base initially when deployed. I believe my assumptions here are conservative.

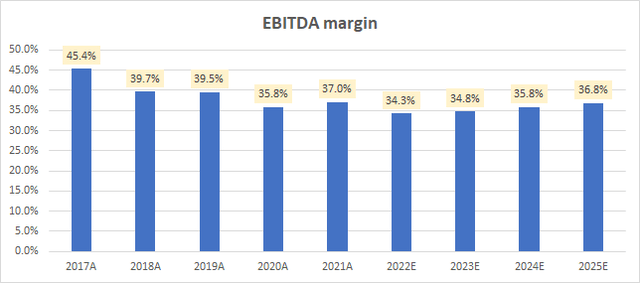

EBITDA Margin (Company Filings, Own Analysis)

Due to investments in SG&A, EBITDA margins are expected to not see meaningful uptick for a few years. However, I expect it to normalize back to historical levels. It may very well stabilize at a higher level but I have conservatively not built in such optimism at this stage.

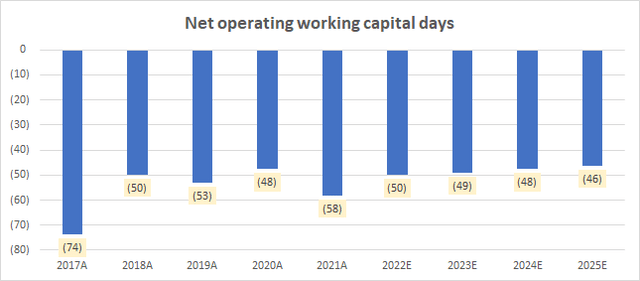

Net Operating Working Capital Days (Company Filings, Own Analysis)

There is no meaningful shift in the net operating working capital profile for QSR. Hence, it is assumed to hover around historical levels.

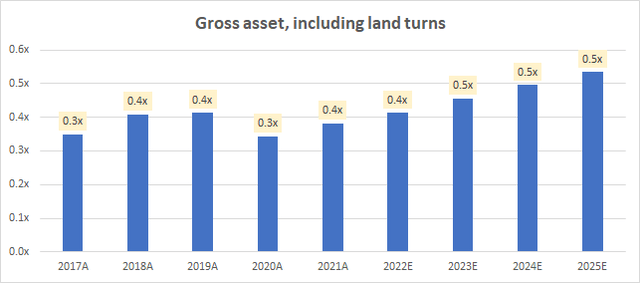

Gross Asset Turns (Company Filings, Own Analysis)

Gross asset turns are seeing an up-tick as I expect higher engagement and hence monetization resulting from the modernization initiatives.

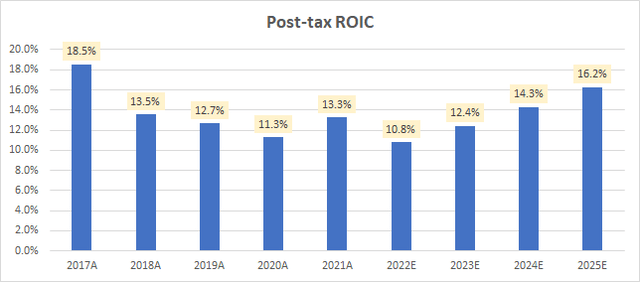

Post-tax ROIC (Company Filings, Own Analysis)

Using a US marginal corporate tax rate of 27% assumption, post-tax ROIC is expected to trend upwards to 16.2% by FY25. Again, this is mainly driven by higher monetization in the businesses.

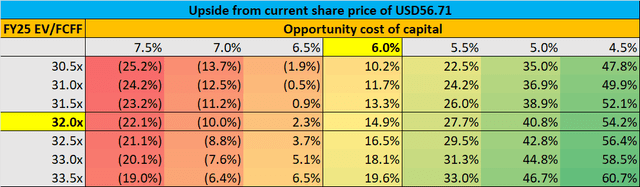

My opportunity cost of capital for my valuations is equal to my expectations of annual returns for the S&P 500 over the long run. I have assumed this figure to be 6%. This is close to the U.S. cost of equity that the “Dean of Valuation” Professor Aswath Damodaran, has in his latest datasets, accounting for the fact that QSR’s beta of 0.94 is close to the market beta of 1.

I use enterprise value to free cash flow to firm (EV/FCFF) terminal value multiples as this allows for explicit input of my terminal year (2025) operating assumption views. This Twitter thread on valuation multiples explains how to use and interpret EV/FCFF multiples.

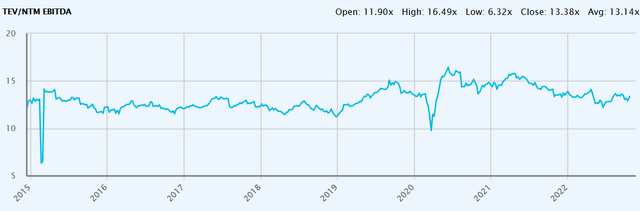

In this case, a 32.0x FY25 EV/FCFF multiple corresponds to a 15.9x FY25 EV/EBITDA multiple. The stock is currently trading at a 1-yr forward EV/EBITDA of 13.4x:

QSR 1-yr forward EV/EBITDA (Capital IQ)

I believe the modernization initiatives will elevate the quality of the business profile, warranting a multiple upgrade. For this reason, I posit that my implied FY25 EV/EBITDA exit multiple of 15.9x is reasonable.

Overall, with the conservative operating assumptions, an opportunity cost of capital of 7.0% and FY25 EV/FCFF of 32.0x, I see 14.9% upside in the stock, corresponding to an intrinsic value per share of $65.16. The Q3 FY22 earnings release next week on November 3 2022 may be a catalyst for the stock.

Technical Analysis

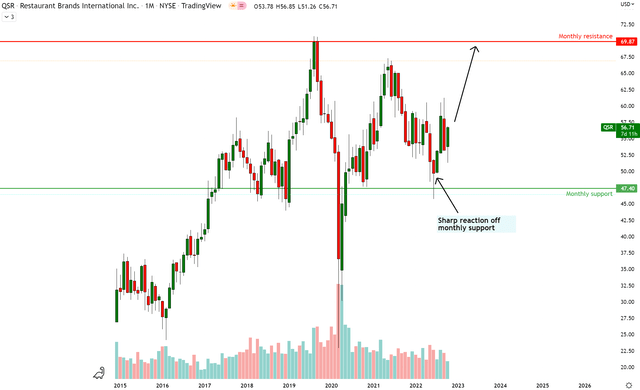

QSR Technical Analysis (Own Analysis using TradingView)

QSR has reacted sharply off monthly support at $47.40. Price is now consolidating and I expect it to continue its launch up toward the monthly resistance area at $69.87.

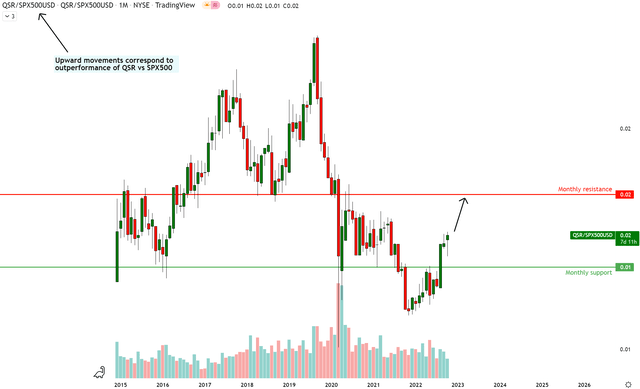

QSR vs S&P 500 Technical Analysis (Own Analysis using TradingView)

On the relative QSR vs SPX chart, price has broken past a key resistance area turned monthly support. I see it moving sharply toward the monthly resistance area after a brief period of consolidation, generating alpha vs the S&P 500.

All in all, the charts, which depict the footprints of aggregate crowd behavior in the markets, are also showing bullish signs.

Key Monitorables

The performance of Tim Hortons and Burger King is what drives QSR’s stock. The company has its Q3 FY22 earnings release coming out next week on November 3 2022. I will be paying close attention to key metrics such as SSSG and stores growth in the release.

Positioning

In conclusion, I think the QSR has robust foundations and a clear growth path. The franchise model protects more than 50% of the top-line from falling behind inflation and the modernization initiatives are expected to continue improving key business metrics. Given the proximity of the company’s earnings call next week, more conservative investors may want to wait for the earnings release before building a position. I am more young and impatient though, so I have bought already as I believe it is ready to fly anytime soon.

Be the first to comment