ADragan/iStock via Getty Images

This dividend ETF article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and their weights change over time, updated reviews are posted when necessary.

KNG strategy and portfolio

The FT CBOE Vest S&P 500 Dividend Aristocrats Target Income ETF (BATS:KNG) has been tracking the Cboe S&P 500 Dividend Aristocrats Target Income Index since 3/26/2018. It has 64 stock holdings (plus options and cash equivalents), a distribution yield of 4.40% and a total expense ratio of 0.75%. KNG seeks income from holding dividend stocks and selling covered call options on these stocks.

As described by First Trust,

The Index is composed of two parts: (1) an equal-weighted portfolio of the stocks contained in the S&P 500 Dividend Aristocrats Index (the “Aristocrat Stocks”) that have options that trade on a national securities exchange and (2) a rolling series of short (written) call options on each of the Aristocrat Stocks (the “Covered Calls”). The S&P 500 Dividend Aristocrats Index generally includes companies in the S&P 500 Index that have increased dividend payments each year for at least 25 consecutive years and meet certain market capitalization and liquidity requirements.

Some important points of the strategy:

- The stock portfolio is reconstituted annually and rebalanced quarterly.

- Covered Calls are written on no more than 20% of the position in each stock.

- Covered Calls are written each month to expire the following month at a strike price close to the last daily closing price.

About 95% of asset is invested in the U.S., mostly in large cap companies (59%) and to a lesser extent in the mid-cap segment (41%).

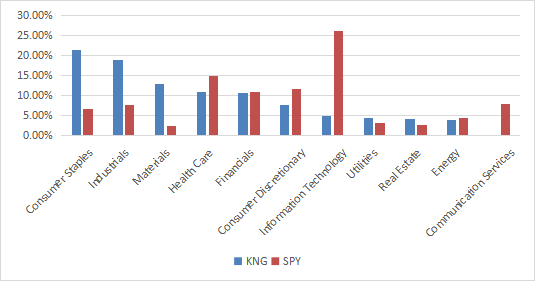

The heaviest sectors are consumer staples (21.5%) and industrials (18.8%). Compared to the S&P 500 (SPY), the fund massively overweights these two sectors, along with materials, and to a lesser extent utilities and real estate. It significantly underweights technology, consumer discretionary, healthcare and ignores communication services.

KNG vs. SPY sector breakdown (Chart: author; data: First Trust, Fidelity)

The top 10 holdings, listed in the next table with some fundamental ratios, represent 19.2% of asset value. The largest holding weighs 2.09%, so risks related to individual companies are low.

|

Ticker |

Name |

Weight% |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

Cardinal Health, Inc. |

2.09% |

-266.44 |

N/A |

13.98 |

4.96 |

|

|

Albemarle Corp. |

1.99% |

-64.04 |

121.73 |

12.77 |

0.25 |

|

|

Exxon Mobil Corp. |

1.99% |

393.29 |

11.56 |

8.17 |

0.28 |

|

|

Archer-Daniels-Midland Co. |

1.98% |

54.69 |

14.14 |

12.86 |

2.05 |

|

|

Chevron Corp. |

1.96% |

703.62 |

11.57 |

9.52 |

0.56 |

|

|

W.W. Grainger, Inc. |

1.87% |

55.62 |

20.39 |

18.47 |

1.40 |

|

|

Nucor Corp. |

1.85% |

90.25 |

4.26 |

4.67 |

N/A |

|

|

Genuine Parts Co. |

1.84% |

47.94 |

19.50 |

19.94 |

1.61 |

|

|

General Dynamics Corp. |

1.83% |

2.84 |

20.54 |

19.93 |

1.51 |

|

|

Aflac, Inc. |

1.80% |

-19.99 |

9.20 |

11.53 |

N/A |

Historical performance

Since April 2018, KNG has underperformed SPY by 1.8 percentage points in annualized return, with a similar risk measured in drawdown and volatility (standard deviation of monthly returns). KNG has also lagged the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) and popular dividend-oriented ETFs with lower yields: the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard Dividend Appreciation Index Fund (VIG).

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

KNG |

44.71% |

8.45% |

-32.57% |

0.44 |

17.19% |

|

SPY |

56.13% |

10.27% |

-32.05% |

0.5 |

18.24% |

|

NOBL |

51.47% |

9.54% |

-32.87% |

0.5 |

16.85% |

|

VIG |

55.27% |

10.13% |

-29.58% |

0.56 |

15.88% |

|

SCHD |

69.07% |

12.21% |

-32.29% |

0.62 |

17.56% |

Data calculated with Portfolio123

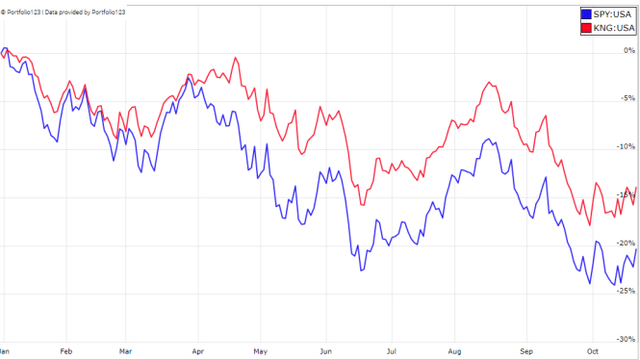

However, KNG has beaten SPY in 2022 as of writing.

KNG vs. SPY in 2022 to date (Portfolio123)

Scanning the current portfolio

KNG is cheaper than the S&P 500 regarding the price/sales ratio. However, it is slightly more expensive in other usual metrics (see next table).

|

KNG |

SPY |

|

|

Price / Earnings TTM |

19.08 |

17.98 |

|

Price / Book |

3.59 |

3.38 |

|

Price / Sales |

1.4 |

2.18 |

|

Price / Cash Flow |

15.64 |

13.63 |

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, Altman Z-score. My core portfolio holds 14 stocks selected using these metrics (more info at the end of this post). I have scanned KNG holdings with these quality metrics. I consider that risky stocks are those with at least 2 red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate (where these metrics are less relevant). With these assumptions, only 3 stocks out of 64 are risky and they weigh 4.5% of asset value, which is a good point.

Based on my calculation, aggregate Altman Z-score and return on assets are slightly above SPY’s values. The Piotroski F-score is very close to the benchmark. These metrics point to a quality similar to the U.S. stock market average.

|

KNG |

SPY |

|

|

Altman Z-score |

3.79 |

3.36 |

|

Piotroski F-score |

5.93 |

5.98 |

|

ROA% TTM |

8.67 |

7.50 |

Takeaway

KNG holds the 64 dividend aristocrats of the S&P 500. They are rebalanced in equal weight on a quarterly basis. It also implements a short-term covered calls strategy to generate additional income. A maximum of 20% of each stock position is hedged by options. Aggregate quality and valuation metrics are close to the S&P 500 index. Total return since inception is disappointing compared to the S&P 500 and other dividend ETFs, including NOBL, which tracks the S&P 500 Dividend Aristocrats Index. However, KNG has outperformed SPY in 2022 to date. For transparency, my equity investments are split between a passive ETF allocation (KNG is not part of it) and an actively managed stock portfolio, whose positions and trades are disclosed in Quantitative Risk & Value.

Be the first to comment